<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

The bottom line: choosing between banks and private safes means weighing up security, confidentiality and risk. Opt for a bank (such as Société Générale, with €30,500 insurance included) if you prefer stability, or a private provider for discretion, but check rigorously its durability. In 2025, protecting your assets away from home becomes an art of reconciling prudence and compliance.

You think your assets are safe in a bank safe-deposit box? Behind the reassuring reputation of the big banks lie opaque pricing, rigid procedures and even high-profile scandals. This independent report compares safe deposit box offerings in France, revealing a market divided between traditional players and private providers with sometimes misleading promises. Discover the hidden flaws, the counterparty risks in the private sector, and how to choose a solution aligned with your values of prudence and discretion, whether you want to protect precious metals or sensitive documents.

Contents

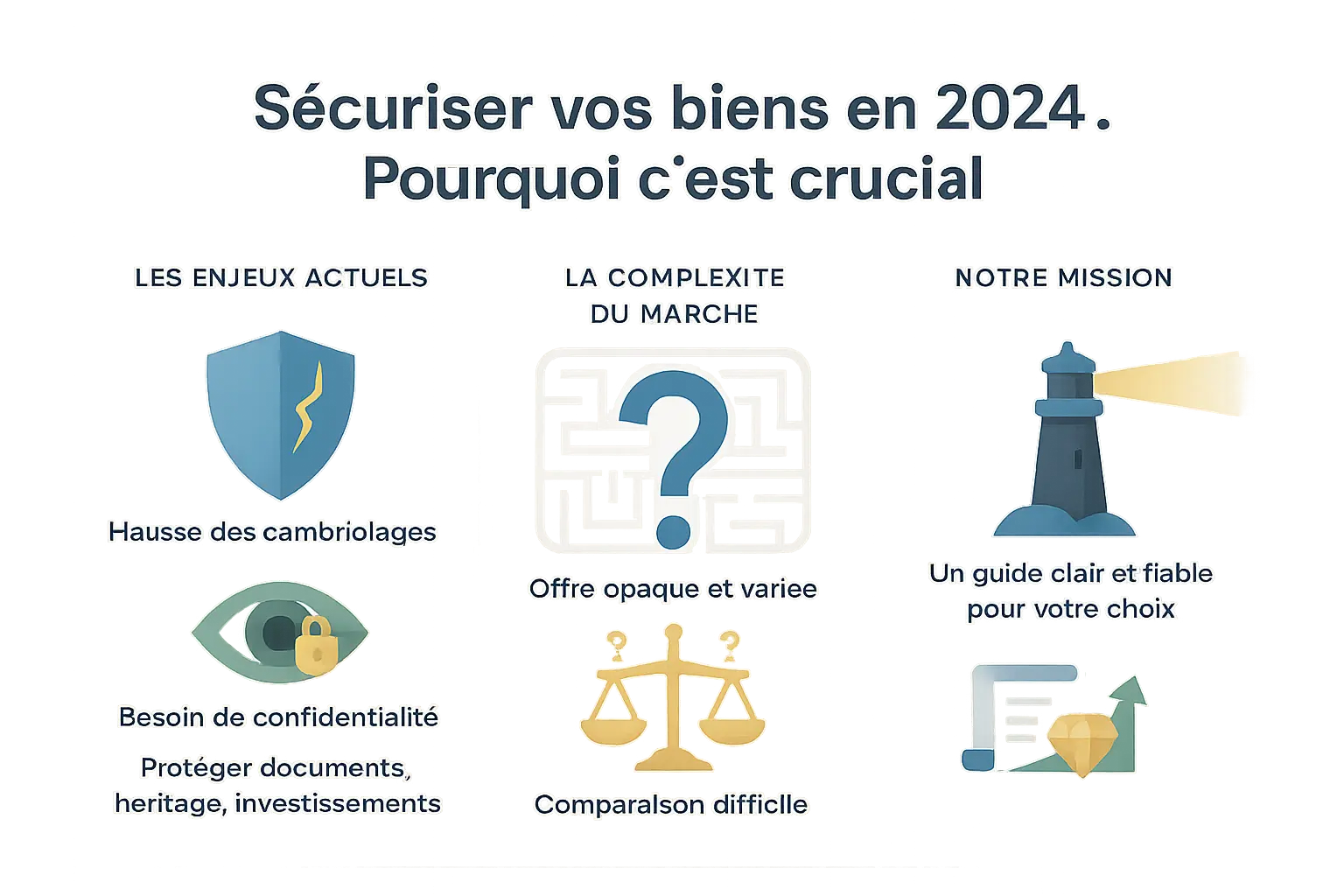

Why renting a safe is a crucial decision

In 2024, protecting your valuables is no longer just a matter of prudence. With 218,000 burglaries in France (+3% vs. 2023), your sensitive documents, inheritances and investments are under threat. The confidentiality of bank vaults, broken by the obligation to declare them to FICOBA since 2020, limits your discretion. How can you reconcile physical security, anonymity and peace of mind?

The market contrasts two models: banks, which are stable but opaque on costs, and private players, which are flexible but offer variable guarantees. CoffrePrivé, for example, offers competitive rates, but cases of receivership involving similar names (e.g. CoffreFortPlus.com) reveal weaknesses. This choice reflects your values. Namlora, an Islamic investment ecosystem, embodies ethics by placing trust and responsibility at the heart of your asset management, in line with your halal principles.

At a time when burglary is evolving through technology, and cities such as Marseille and Lille are accumulating thefts, a bank safe does not protect against all risks. BNP Paribas Fortis customers who were not compensated after a robbery show that security goes beyond armored walls. This guide will help you to combine prudence and conviction. Because securing your assets also means promoting a fair, sustainable business model in line with your values of faith and social commitment.

Safe deposit box services: two opposing worlds in France

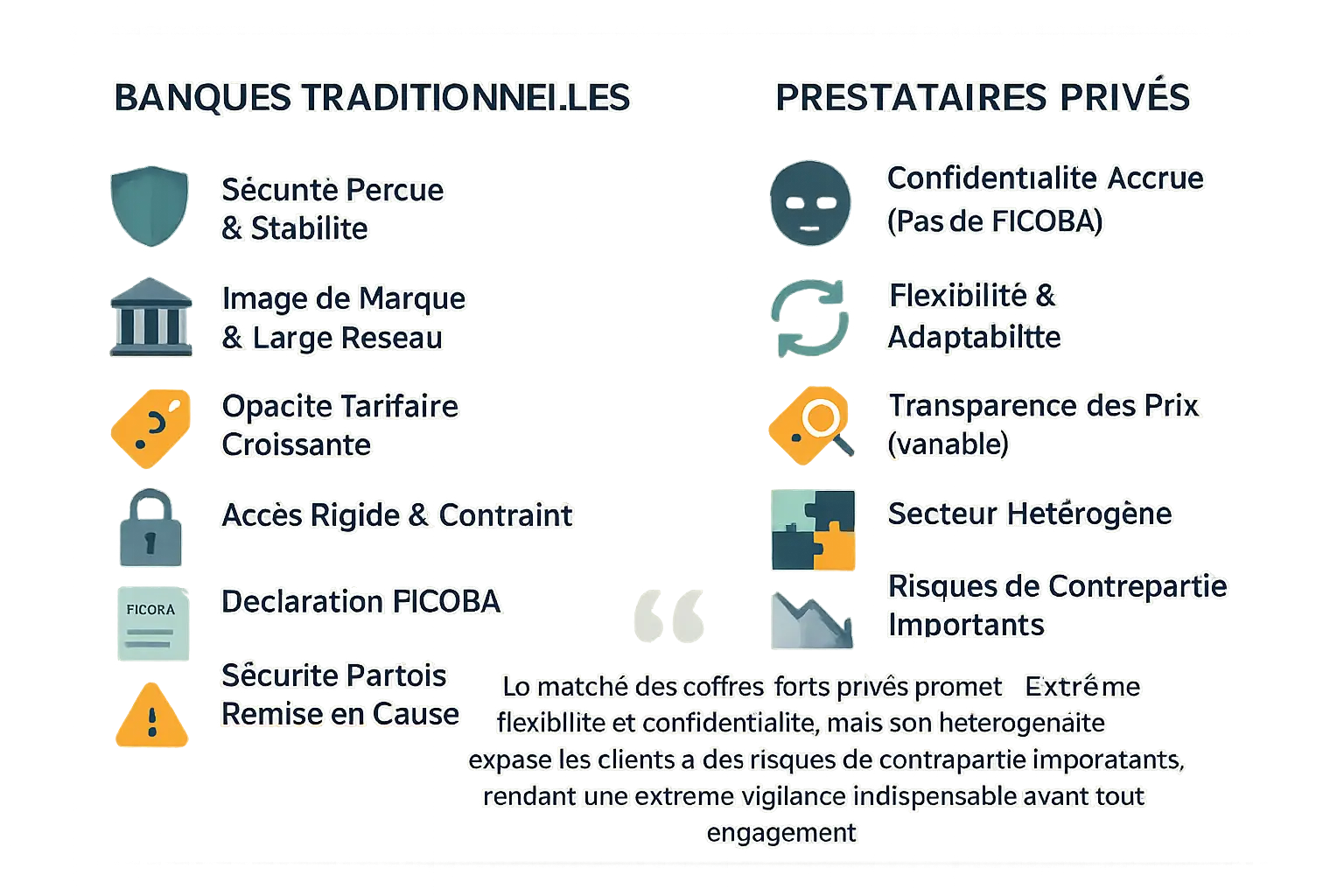

Traditional banks: perceived security

Banks have long been the benchmark for secure storage. Their reputation is based on a solid brand image, a dense branch network and long-standing expertise in the management of valuable assets.

However, this blind trust is now being called into question. Customers are gradually discovering a less reassuring reality: declining pricing transparency, rigid access procedures, and the obligation since 2020 to register safe deposit box rentals in the Bank Account File (FICOBA). This last point erodes the expected discretion, as the data is accessible to the tax authorities.

Real-life cases have tarnished this reassuring image: customers of BNP Paribas Fortis are still waiting for compensation six years after a theft, while an octogenarian was left for 23 hours in a safe-deposit box in Rennes. These incidents call for a critical reading of the banking promise.

Private service providers: the quest for flexibility and confidentiality

The private vault market is asserting itself as the alternative to banking limits. It offers a number of attractive features: zero FICOBA declarations, simplified access and, in some cases, clear pricing. For investors in precious metals or demanding collectors, this administrative independence is a decisive advantage.

Mais cette liberté a un prix. Ce secteur, en pleine émergence, reste hétérogène. La confusion entre des acteurs aux noms proches, comme coffrefortplus.com et coffre-prive.fr, illustre les risques. Des témoignages sur des plateformes d’avis signalent des liquidations judiciaires et des livraisons non honorées, rappelant que la pérennité d’un prestataire est aussi cruciale que la solidité de ses murs.

The private safe market promises flexibility and confidentiality, but its heterogeneity exposes customers to significant counterparty risks, making extreme vigilance essential before any commitment is made.

Security and access: uncertified robustness

BNP Paribas and Société Générale safes use a double-key system (customer + bank), but the absence of EN 1143-1 or A2P certification for vaults remains problematic. These standards define levels of resistance to professional burglary tools, up to €250,000 insurable in class 5 according to Gruber. BNP Paribas provides no information on these guarantees, a critical shortcoming for valuable assets. Société Générale, although more transparent in 2020, has not updated its data.

Access remains rigid: BNP Paribas requires a systematic appointment, with strict verification of identity. Société Générale allows more direct access in some branches, but opening hours remain limited. Their location in city centers (Paris, Marseille) exposes property to the risk of flooding, according to the Observatoire des Risques Urbains 2023, a parameter rarely mentioned.

Pricing and insurance: the great transparency gap

BNP Paribas hides its rates behind vague statements such as "variable according to volume". A document from 2022 revealed €235/year for an average safe deposit box (36-70 dm³), with no clear insurance. Société Générale, a pioneer in 2020, offered €125/year for a small safe deposit box (≤ 31 dm³) with €30,500 cover, an amount extendable to €1 million for large volumes. This data franchise makes SG more predictable, despite dated rates.

BNP Paribas Fortis doubled its prices in Belgium in 2024, a sign of disengagement confirmed by the increase in management fees in France. Société Générale formally prohibits the storage of IT media (crypto keys, hard drives), a clause absent from BNP's general terms and conditions. A contradiction to keep an eye on for investors in digital assets.

Confidentiality and reputation: the myth of infallibility

Since September 2020, FICOBA declarations have made safe deposit boxes traceable. This legal obligation, imposed by article 1649 A of the French General Tax Code, exposes lessees to tax audits. In the event of suspicions, the tax authorities can demand that the safe deposit box be opened by means of a judicial warrant, as in 2023 in the case of an entrepreneur suspected of concealing income.

High-profile cases shake reputations. BNP Paribas delayed settling 12 cases of theft in 2019, while Société Générale saw bullion disappear without compensation in 2022. These incidents show that physical security cannot compensate for poor contractual management. The loss of a key, like that of a customer left for 23 hours in Rennes in 2013, also reveals human failings in protocols.

Private safes: an alternative to be examined with caution

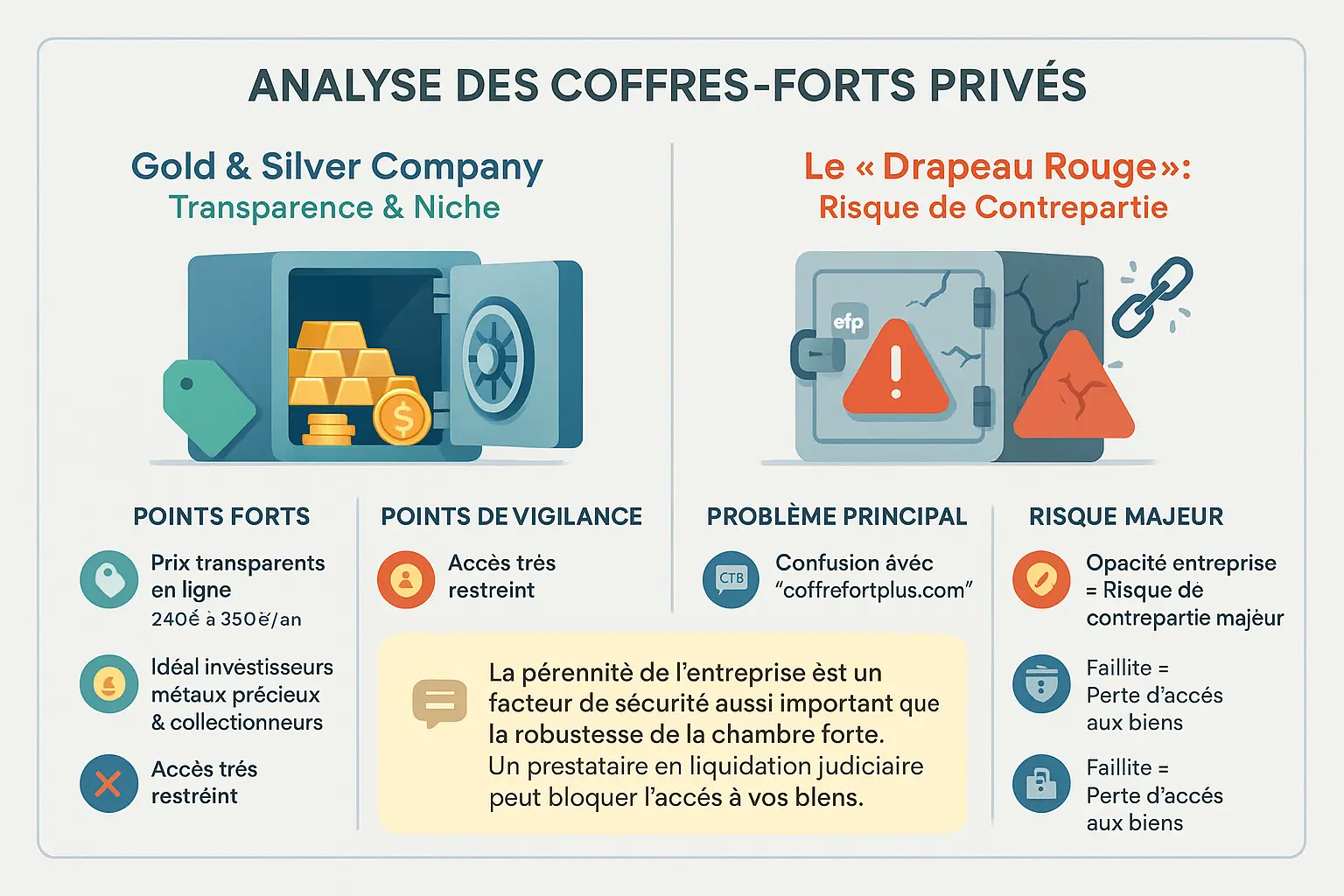

Gold & Silver Company: transparency for investors

Gold & Silver Company stands out for its clear, accessible offering for those wishing to invest in gold in line with its values. Unlike most players in the sector, this company publishes its prices online: from €240 per year for a small safe-deposit box (16.5 dm³) to €350 for the largest models.

Ideal for investors in precious metals, this service provider is particularly attractive to those seeking discreet management of their assets. The security features are impressive on paper: facial recognition at entry, 24-hour surveillance, intrusion detection system. However, the absence of any officially communicated EN 1143-1 certification should draw attention.

Physical access to the safes remains one of the drawbacks of this service. The very limited opening hours (only 10am-1pm on Mondays, Fridays and Saturdays) make it difficult to gain urgent access to one's possessions. This model is therefore better suited to investors wishing to store their precious metals on a long-term basis.

The "red flag": beware of counterparty risk

The case of Coffre Privé is a perfect illustration of the perils of the private sector. Although the official website features BRINK's vaults and "declared value" insurance, further investigation reveals some worrying red flags. Companies with similar names, such as coffrefortplus.com, are facing reports of receivership.

The durability of the company is just as important a security factor as the sturdiness of the vault. A company in receivership can block access to your assets.

This major counterparty risk is confirmed by concrete facts. Several companies in the Label Habitat group (which operates coffrefortplus.com) went into receivership in December 2024, leaving many customers stranded. The DGCCRF (Direction Générale de la Concurrence et Répression des Fraudes) alerted the public to this situation, underlining the importance of checking the solvency of a private service provider before committing to a contract.

For those wishing to secure their precious and strategic metals, this reality calls for heightened vigilance. The total lack of transparency regarding the financial health of certain private service providers, combined with the absence of legal guarantees, makes these solutions risky choices without thorough verification. A prudent strategy would be to give preference to players with a solid reputation, such as Gold & Silver Company which, despite its limited access, offers visibility on its pricing structure.

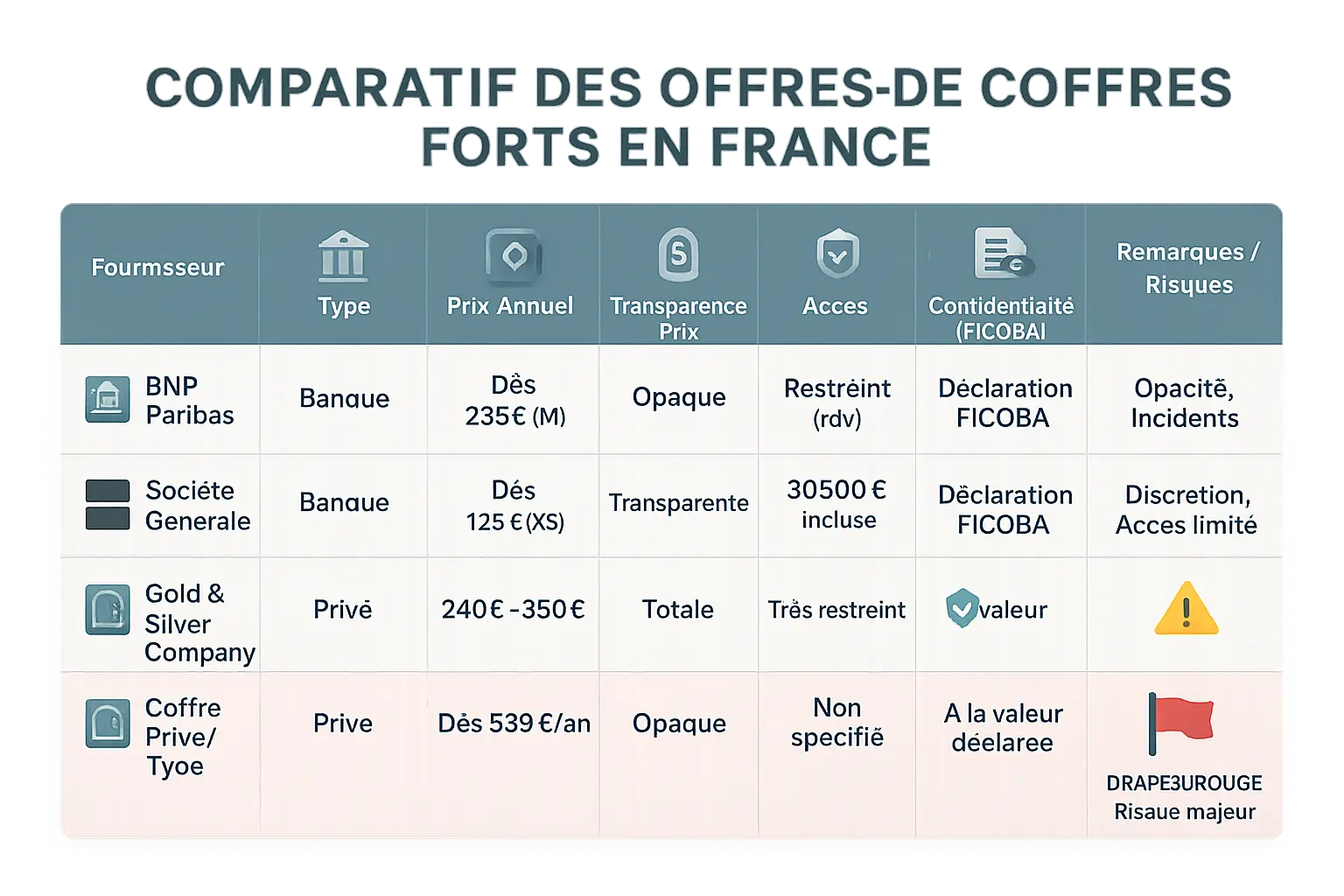

Comparison Table Of Safes In France

Compare safes in France: type, cost, transparency, access, insurance and confidentiality.

| Supplier | Type | Annual price | Transparency | Access | Insurance | FICOBA | Risks / Highlights |

|---|---|---|---|---|---|---|---|

| BNP Paribas | Bank | 235 € (M) | Opacity | Appointments | Not specified | Yes | Risk: High-profile incidents |

| Société Générale | Bank | 125 € (XS) | 2020 data | Restricted | 30 500 € | Yes | Advantage: partial transparency. Risk: disappearance of ingots |

| Gold & Silver | Private | 240-350 € | Clairs en ligne | Limited opening hours | Optional (0.45%) | No | Ideal for investors. Risk: restricted access |

| Private Safe | Private | 599 €/year | Opacity | Not specified | Declared value | No | RED FLAG: Risk of liquidation |

The 3 pillars of your decision: security, contract and insurance

Understanding safety levels and certifications

Standard EN 1143-1 classifies safes according to their resistance to burglary, from class 0 (30 units of resistance, insurance up to €8,000) to class V (270 units, up to €200,000). The absence of this certification, as at BNP Paribas, should be a cause for alarm. A2P certification applies to locks (A2P* to A2P**), guaranteeing 5 to 15 minutes of resistance. Always check the engraving on the lock: an A2P lock on a fragile door is insufficient.

The contract and insurance: read the fine print

Bank or private contracts conceal critical details. Société Générale prohibits digital media (hard disks, USB keys), penalizing cryptocurrency investors. The loss of a key generates break-in costs (€200-300 for a small safe deposit box), to be borne by the customer. Ask for details of the coverage included (€30,500 with SG) and exclusions (such as computer media).

- Guarantee included: Société Générale offers a basic €30,500 for safe-deposit boxes under 31 dm³. BNP Paribas does not specify the amount.

- Excluded items: Digital media and dangerous substances (explosives, toxic substances) are prohibited, especially in banks. Private individuals sometimes authorize such deposits, but the responsibility lies with the customer.

- Insurance extensions: Gold & Silver Company offers optional insurance at 0.45% of the declared value. Coffre Privé remains vague on the amounts.

- Lost keys: Break-in charges apply, as in the case of a BNP Paribas Fortis customer who was locked out for 23 hours in 2013.

Since 2020, FICOBA has been registering your tax data, reducing confidentiality. For total discretion, choose private companies such as Gold & Silver Company, which are not subject to this obligation. However, be sure to check their sustainability: some competitors, such as CoffreFortPlus.com, are facing receivership in 2024.

Before signing, ask for EN 1143-1/A2P certificates, read insurance exclusions, check break-in costs and validate the financial health of the service provider. Banks reassure the faithful (such as BNP Paribas), while private companies seduce those who prefer discretion (Gold & Silver Company), but require heightened vigilance.

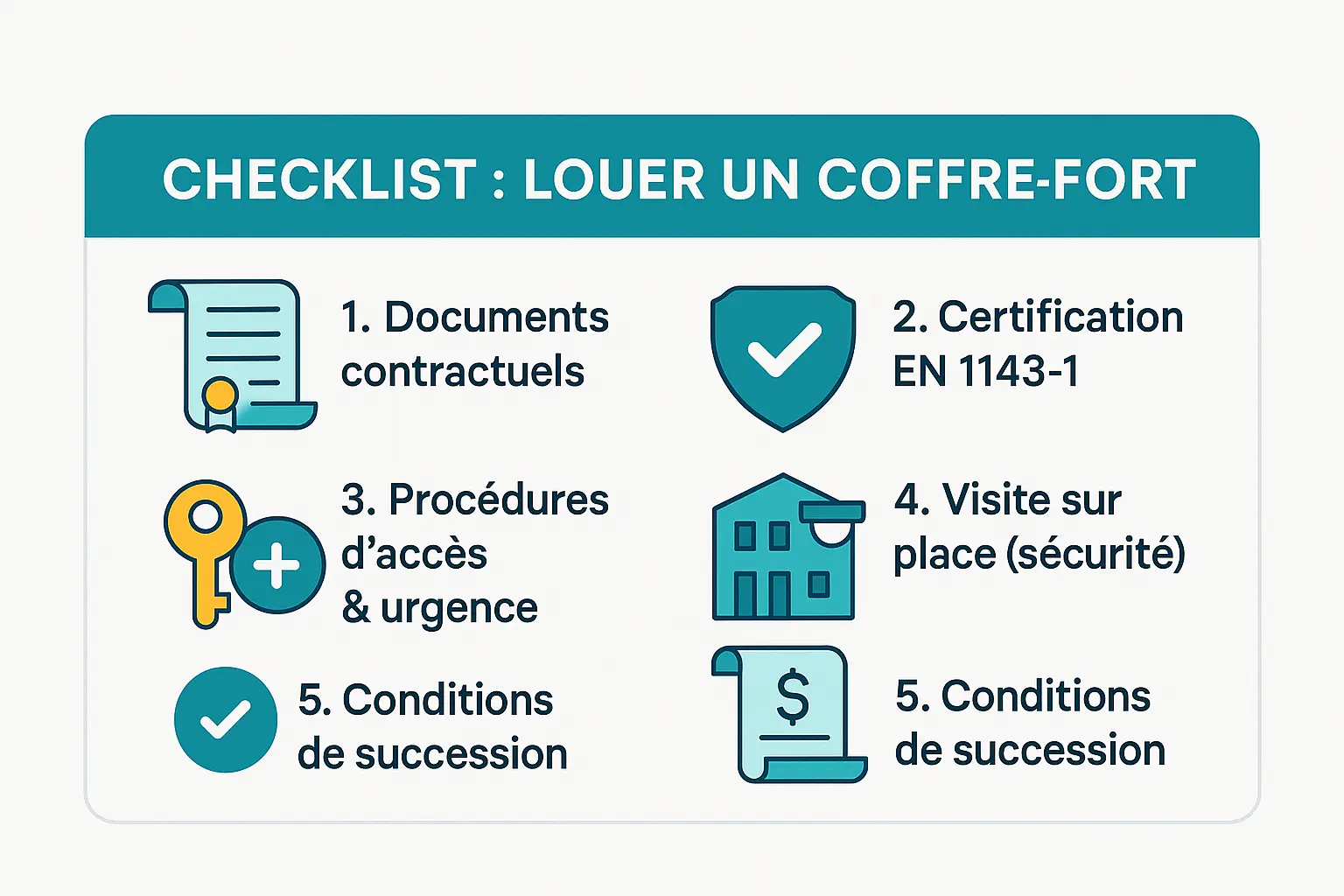

The ultimate checklist before renting your safe

Before signing a safe rental contract, it's crucial to carry out a series of checks to secure your decision. This checklist guides you step by step through the essential stages, protecting you from unpleasant surprises.

- Exiger les documents contractuels : Demandez systématiquement les conditions général et particulières du contrat, ainsi que l’attestation d’assurance. Lisez attentivement les montants de garantie, les exclusions (comme le refus de couvrir les données informatiques dans les coffres bancaires) et les clauses liées à la perte de clé ou au non-paiement des loyers.

- Check certification: Ask about the vault's class according to EN 1143-1, which defines burglary resistance. The absence of official certification (A2P, EN 1143-1) or a clear answer on this point should raise a red flag. An uncertified vault can expose your assets to major risks.

- Understand access and emergency procedures: Find out about access procedures if you forget your key or code, break-in fees (which can exceed €300 for a small safe) and emergency response times. Banks like BNP Paribas require a double key to open the safe deposit box, which can slow down access in an emergency.

- Evaluate the on-site experience: If possible, visit the site to judge the physical security (presence of an airlock, 24/7 surveillance system, secure neighborhood) and the professionalism of the reception. Banks with branches in areas at risk of flooding (such as Paris or Marseille) or towns with a high incidence of burglaries (e.g. Tournefeuille) deserve special attention.

- Clarify inheritance conditions: check that heirs will be able to access the contents in the event of death, with a clear procedure. Bank safe-deposit boxes require a deed of notoriety, while some private providers such as Gold & Silver Company offer no guarantee on this point. A poorly drafted clause could block access for heirs for months.

So which safe solution is right for you?

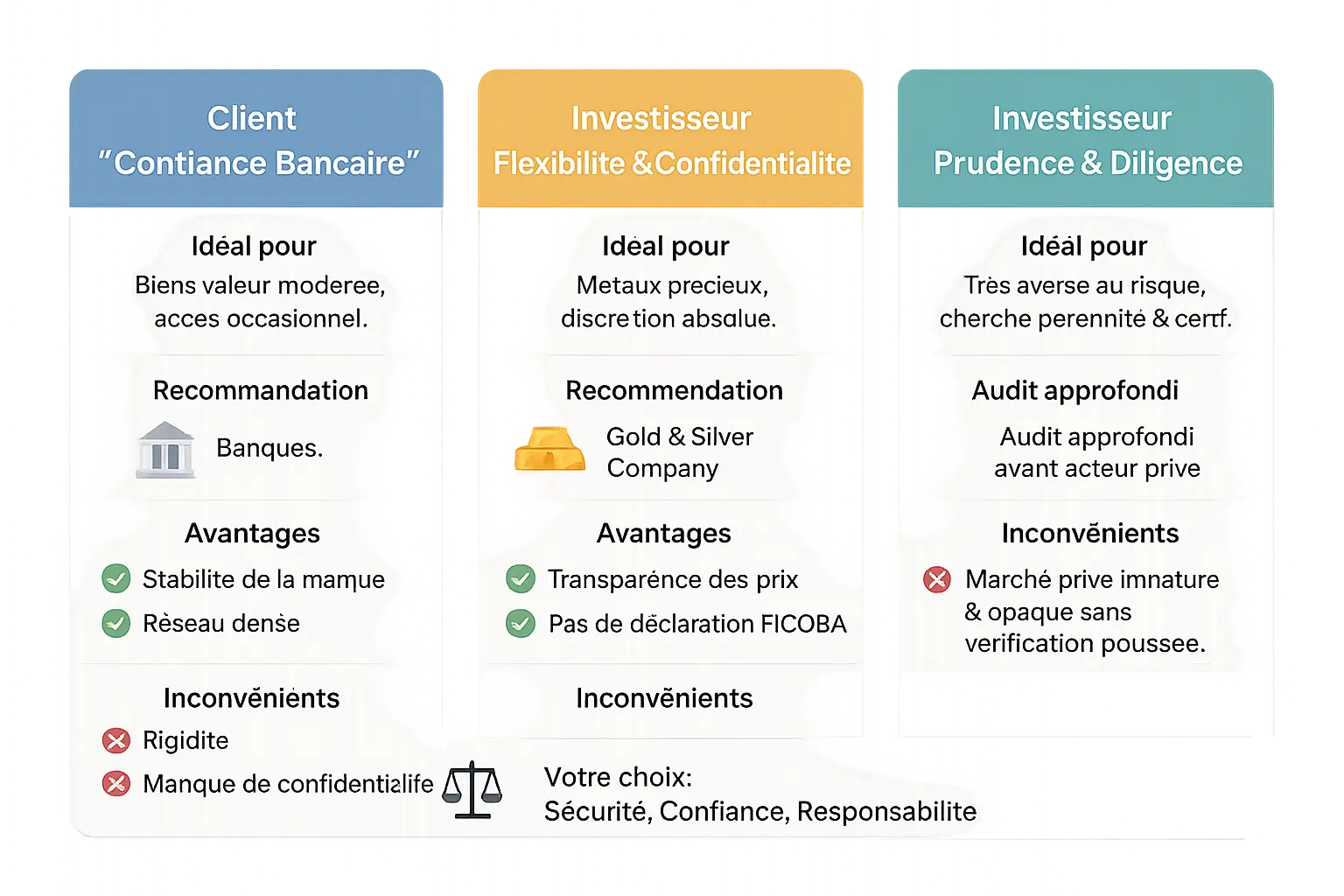

Choosing a safe means reconciling security, access and confidentiality with your priorities. Bank and private safe offers have strengths and limitations to suit every profile. Here's our summary, based on an analysis of current risks.

- Profil 1 : Le client « Confiance Bancaire ».

Les banques comme BNP Paribas ou la Société Générale offrent stabilité et réseau dense. La Société Générale se démarque par des tarifs clairs (125 €/an pour 30 dm³) et des garanties d’assurance jusqu’à 1M€. En revanche, la déclaration au FICOBA limite la discrétion, et l’accès est restreint aux horaires d’agence. Les non-indemnisations de vols dans des coffres BNP Paribas Fortis illustrent les limites de la responsabilité bancaire. - Profil 2 : L’investisseur « Flexibilité & Confidentialité ».

Gold & Silver Company, basé à Lille, propose une solution non déclarative au FICOBA. Ses tarifs (240-350 €/an) et assurance facultative (0,45 % de la valeur) attirent les adeptes de discrétion. La sécurité repose sur une surveillance 24/7, mais l’absence de certification EN 1143-1 reste un point à vérifier. L’accès est limité à des créneaux courts (lundi, vendredi, samedi de 10h à 13h). Idéal pour les investisseurs en métaux précieux exigeant la discrétion fiscale. - Profil 3 : L’investisseur « Prudence & Diligence ».

Face aux risques de liquidation (ex. CoffreFortPlus.com), la vérification est cruciale. Aucun prestataire privé n’est fiable sans audit indépendant. Exigez la certification EN 1143-1 des chambres fortes, contrôlez les bilans financiers et visitez les locaux. La pérennité de l’entreprise est aussi essentielle que la résistance du coffre. Suivez la checklist du guide pour valider contrats, certifications et procédures de succession.

Security goes beyond the walls of a safe: it requires physical certifications, provider stability and risk anticipation. An informed choice protects your assets while reflecting your values. By opting for a solution aligned with your convictions, you build a network of trust between assets and principles, transforming a simple container into a symbol of durability.

Renting a safe in 2024 is a decision guided by security, confidentiality and value. Between banks, private players and extreme vigilance, the key is rigorous analysis. Your assets deserve protection aligned with serenity, responsibility and conviction. Investing in the right solution means sowing today to reap tomorrow.

FAQ

Where to hide your home safe?

To effectively conceal a home safe, the ideal location is structurally solid and inconspicuous: load-bearing walls, basements, or behind fixed decorative elements. Think of it as a deep root in the soil of a tree, invisible but solid. However, a safe that's too well hidden could become inaccessible in an emergency. The key is to strike a balance between discretion and accessibility. If you opt for a wall-mounted safe, avoid party walls or damp areas. And remember: a safe well integrated into your decor can be as discreet as a book in a library. The EN 1143-1 standard, which classifies the resistance of safes, remains your best ally in guaranteeing the security of your investment.

What are the disadvantages of using a home safe?

To effectively conceal a home safe, the ideal location is structurally solid and inconspicuous: load-bearing walls, basements, or behind fixed decorative elements. Think of it as a deep root in the soil of a tree, invisible but solid. However, a safe that's too well hidden could become inaccessible in an emergency. The key is to strike a balance between discretion and accessibility. If you opt for a wall-mounted safe, avoid party walls or damp areas. And remember: a safe well integrated into your decor can be as discreet as a book in a library. The EN 1143-1 standard, which classifies the resistance of safes, remains your best ally in guaranteeing the security of your investment.

How to open a safe without a key?

Losing a safe deposit box key is like forgetting your bank card PIN: the anxiety is real, but the solution exists. For bank safes, a double control is in place: your bank will use its emergency key in your presence. For private safes, options vary. Some biometric or electronic models offer recovery codes, but beware: unofficial methods, such as DIY by an uncertified locksmith, are akin to a wild electrical connection - risky and potentially punishable by insurance. Best practice? Read the conditions for breaking and entering in the event of loss, as a class 5 safe (EN 1143-1) is resistant to professional tools for 20 minutes, but not to negligence in security formalities.

Which is the most secure safe?

Le coffre le plus sécurisé est celui qui combine trois vertus : une certification EN 1143-1 adaptée à la valeur protégée, une installation irréprochable, et une gestion responsable. Un coffre de classe 6, capable de résister à 45 minutes d’assauts professionnels, offre la même solidité qu’un mur de béton armé.

Mais même le plus robuste des coffres reste vulnérable s’il est mal ancré ou si son accès est négligé. Les banques utilisent souvent des systèmes à double clé, tandis que Gold & Silver Company mise sur la reconnaissance faciale et la surveillance 24/7. Cependant, la certification seule ne suffit pas : un coffre certifié mais appartenant à une entreprise en difficulté financière (comme certains acteurs privés en liquidation) pourrait devenir un coffre-fort de sable – solide en apparence, mais instable à long terme.

How to choose a home safe?

Choosing a safe is like selecting a ship's safe: it has to stand up to the storm while fitting into your skiff. Three criteria guide your decision. First, the value to be protected: a class 0 safe (€8,000 insurable) will suffice for documents, but a collector of precious metals will aim for class 5 (€200,000). Next, the balance between security and accessibility: a biometric safe offers rapid access, but requires regular maintenance. Finally, certification: prefer EN 1143-1 or A2P 3 stars, like a medical certificate for a treasure. And don't forget insurance: it's the lining of your safe, transforming a simple box into a veritable legal and financial fortress.

How to install a small safe in a house?

Fixing a safe, even a small one, is a question of anchoring and foresight. Ideally, it should be integrated into a load-bearing wall or concrete floor, like planting a tree in deep soil. Use chemical dowels and expansion screws, and check that the whole assembly can withstand being pulled out - a poorly secured box is a promise of failure. Anticipate future maintenance too: a sealed safe without access to the fixing screws will become a sealed safe, including for you. Finally, if you choose an electronic safe, be sure to include a back-up system in case of power failure, as even the most modern technology can suffer an unexpected "blackout".

Is it possible to install a safe in a plasterboard wall?

Installer un coffre-fort dans un mur en plâtre (placo) est possible, mais avec des réserves. C’est comme planter un clou dans un mur de carton : la solidité dépendra des renforts. Commencez par vérifier si le mur cache un ossature métallique ou boisée. Si oui, fixez le coffre aux montants structurels avec des vis longues et robustes.

Si non, renforcez le panneau avec une plaque d’acier ou une ossature secondaire avant d’encocher le coffre. Mais attention : un coffre mal fixé dans un placo devient un leurre, aussi efficace qu’un verrou sur une porte fragile. Et pour les amateurs de discrétion, un coffre intégré dans un mur de plâtre doit rester accessible pour l’entretien, sous peine de devenir une boîte mystère à ouvrir avec un détecteur de fumée !

How can I open a safe in my home?

Opening a home safe is like unlocking a bank safe door: the procedure depends on the type of opening. For a mechanical safe, a key and combination remain the norm, but an electronic safe can respond to a code, a fingerprint or even a retinal scan. However, even the most sophisticated system has its flaws: a biometric safe without a back-up key is a double-risk safe in the event of a breakdown. And for older safes, beware of forgotten combinations - a class 3 safe (resistant for 15 minutes to professional tools) may require the intervention of a certified professional. Remember: ease of access must never take precedence over security.

Where to install a home safe?

The location of a safe in the home deserves strategic consideration. Firstly, structural security: favour load-bearing walls or concrete floors, as these elements are the foundations of your security. Secondly, discretion: a visible safe is a challenge to thieves, so hide it behind a picture, under a floor, or integrate it into a solid piece of furniture. Finally, think accessibility: a safe stored in a damp garage or cellar that's difficult to access could become a forgotten item. And for collectors of gold or works of art, an EN 1047-1-certified air-conditioned or fireproof safe is a guarantee of durability, preserving your treasure like a museum preserves its masterpieces.