<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

In a nutshell? Fear of missing out (FOMO) traps investors in emotional choices, but the certainty of divine rizq offers lasting peace. By immersing oneself in Muslim spirituality, every financial act becomes an act of faith, aligned with ethical principles. A study by OpenEdition reveals that 78% of rash decisions in finance stem from sterile social comparisons, underlining the importance of this calming approach.

Does the fear of missing out (FOMO) gnaw at you when you see other people's financial successes on social networks? This psychological stress, fuelled by toxic comparisons and the frantic race to make a quick buck, hides a modern illusion: the belief that happiness and security lie in material accumulation. Behind this anxiety lie emotional and spiritual mechanisms that need to be deconstructed to restore halal balance to your investments. Discover how the certainty of Divine Rizq and Tawakkul transform fear into serenity, and why true financial opportunities are those aligned with your values.

Contents

Introduction: Fear of missing out (FOMO), the illusion of a never-ending race

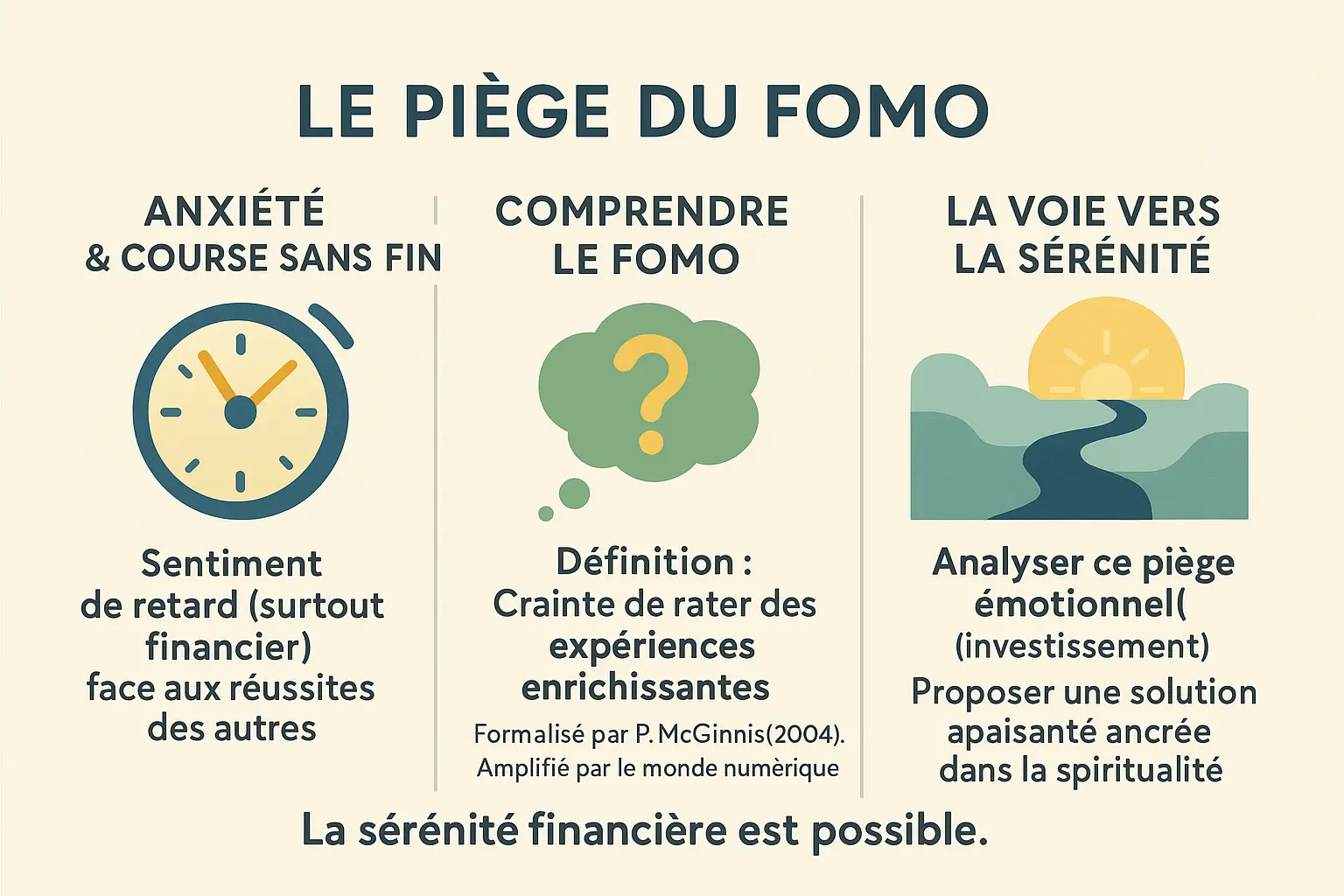

As you scroll through your news feed, have you ever felt a twinge of anxiety when you see photos of villas, luxury cars or entrepreneurs flaunting their financial success? This dull anxiety, this feeling of being out of step with your own reality, is what psychologists call the fear of missing out (FOMO). Formalized by Patrick McGinnis in 2004, this notion refers to "a pervasive fear that others may have enriching experiences from which we would be absent". In our ultra-connected digital world, this phenomenon distorts our relationship with money, driving impulsive decisions such as buying overvalued assets or risky investments.

This article explores a modern-day trap for Muslim investors: how the unbridled quest for profit, fueled by tales of dazzling fortunes, becomes an emotional trap. Discover how Islamic spirituality offers a path to appeasement by putting the certainty of Rizq (decreed sustenance) and trust in Allah (Tawakkul) back at the heart of your financial strategy, while respecting the ethical principles of Islamic finance.

Fomo in investment: when emotion becomes your worst enemy

Toxic comparison and short-sightedness

FOMO often stems from unhealthy comparisons with those around us. Seeing your neighbor buy a property or your cousin succeed financially creates a sense of urgency. Social networks, veritable distorting mirrors, exacerbate this phenomenon by displaying spectacular but rarely representative success stories. These situations generate permanent anxiety.

Behind every triumphalist Instagram story or LinkedIn post lies a complex, often invisible reality. The young entrepreneur who flaunts his dazzling success may have gone through financial hardship or benefited from hidden privileges. Imitating these journeys without understanding their context is like reproducing a recipe without knowing all the ingredients.

The envy that follows is poisonous. Jealousy of a destiny that isn't yours forgets that material wealth is ephemeral. Who could be rich for a year and then lose it all in a few months? Those who chase exponential gains (x100, x1000) base their choices on elusive opportunities rather than on a sustainable strategy. This short-term vision leads to risky decisions.

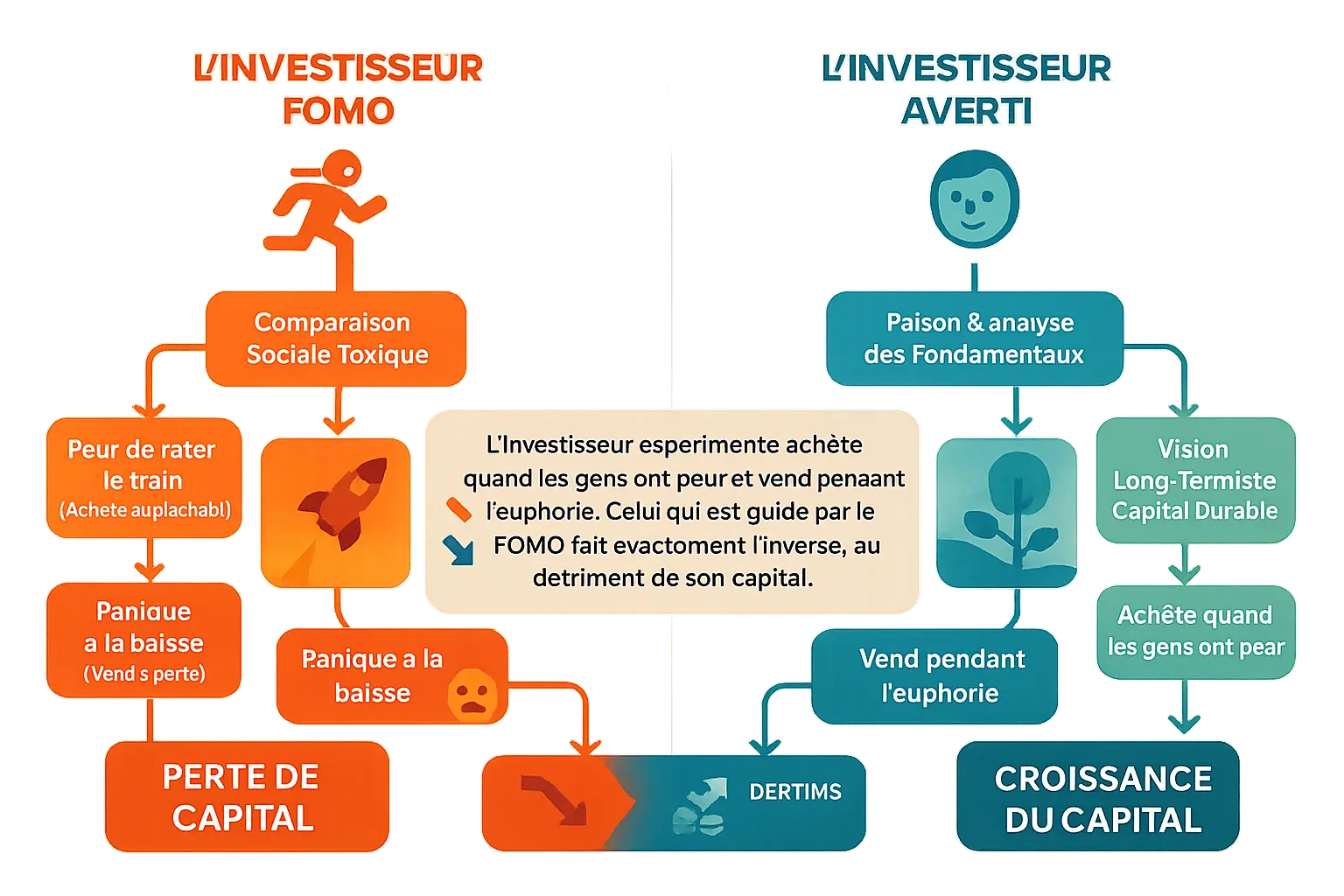

Les décisions irrationnelles dictées par la peur et l’euphorie

L’investisseur expérimenté achète quand les gens ont peur et vend pendant l’euphorie. Celui qui est guidé par le FOMO fait exactement l’inverse, au détriment de son capital.

Face à la baisse d’un actif, la panique pousse à vendre à perte. Or, un investisseur solide voit cette baisse comme une opportunité d’achat à prix réduit. Le FOMO pousse à l’achat frénétique d’actifs en pleine euphorie, au moment même où leur valeur culmine. Cette course effrénée à la performance reproduit le comportement de la foule, sans analyse objective.

Ce phénomène s’observe clairement sur les marchés de cryptomonnaies. Combien ont acheté du Dogecoin à son pic en 2021, poussés par les memes et les tweets d’Elon Musk ? Peu ont anticipé son effondrement brutal. Cette dynamique de « pump and dump » profite aux initiateurs qui revendent à perte aux derniers arrivés.

Paradoxalement, quand une véritable opportunité se présente, le blocage mental s’installe. Les doutes envahissent l’esprit, alimentés par le « wasswas ». Ce conflit intérieur entre le désir d’agir et la peur de se tromper paralyse. La solution réside dans le retour à la raison, en s’appuyant sur l’analyse rationnelle plutôt que sur l’émotion du moment.

The certainty of rizq: the spiritual remedy for financial stress

Understanding that your sustenance (rizq) has already been decreed

Financial serenity is rooted in Tawhid, the oneness of Allah. Ar-Razzaq, the Ultimate Provider, inscribed your rizq - health, relationships, inner peace - before you were born. A hadith (Bukhari) confirms that the angel records your sustenance from the womb. This certainty frees you from earthly anxieties: you won't miss out on what's destined for you, nor obtain the forbidden.

Working 15 hours a day for a material good is minor shirk: a dependence on human beings rather than on Allah. True security comes from Tawakkul, that absolute trust compared by the Prophet (pbuh) to birds leaving on an empty stomach, certain to return in the evening with a full belly.

When it comes to real estate, give priority to halal: a legally acquired property feeds your faith and your wallet.

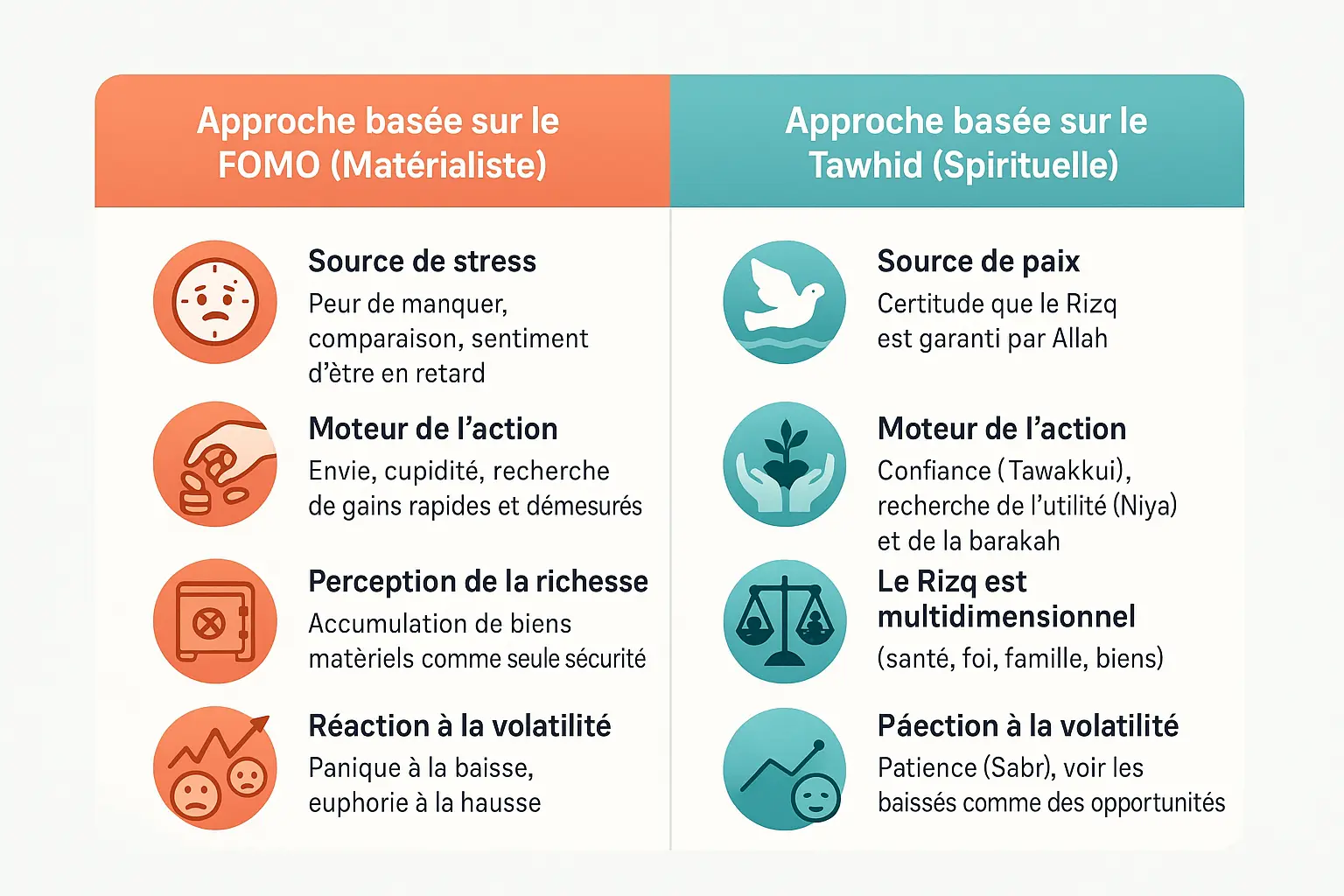

Material FOMO versus spiritual serenity

| FOMO-based approach (Materialistic) | Tawhid (Spiritual) approach |

|---|---|

| Source of stress: Fear of missing out, comparison, feeling late | Source of peace: The certainty that Rizq is guaranteed by Allah |

| Driving force: Envy, greed, the quest for quick and excessive gains | Driving force behind action: Trust (Tawakkul), search for usefulness (Niya) and barakah |

| Perception of wealth: Accumulation of material goods as sole security | Perception of wealth: Rizq is multidimensional (health, faith, family, possessions) |

| Reaction to volatility: Panic on the downside, euphoria on the upside | Reaction to volatility: Patience (Sabr), see downturns as opportunities |

FOMO pushes you to invest for fear of missing out. The spiritual approach is based on Yaqeen: if Allah has written this gain, you will have it. Downturns become sales, not disasters.

The prosperous marry Sabr with action. They know that trials strengthen faith. Inequalities in wealth are tests: the rich are tested in their gratitude, the poor in their patience.

To increase your rizq, prioritize Dua, Istighfar, Sadaqa and family ties. A hadith asserts that charity attracts wealth as a shadow follows one who turns his back on it.

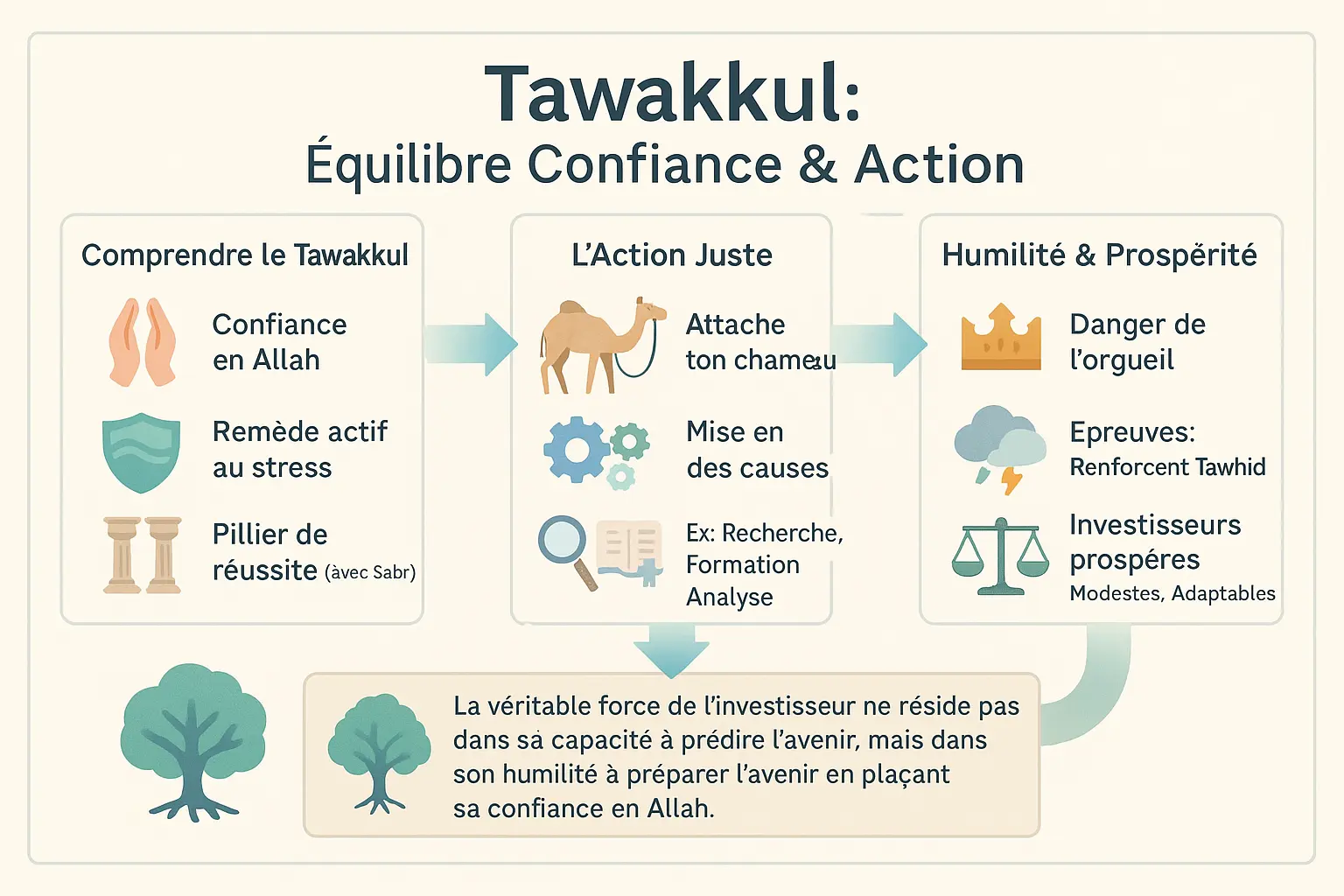

Tawakkul: the perfect balance between trust in Allah and righteous action

Tie up your camel and place your hope in Allah

Tawakkul, total trust in Allah, is not an invitation to inaction. It is a subtle balance between effort and faith, as illustrated by the Prophet (pbuh) in the famous hadith of the camel: "Tie up your camel and trust in Allah". This metaphor applies directly to the modern investor.

In Islamic finance, this principle takes on its full meaning. Before placing his trust in Allah, the Muslim investor must first tie up "his camel" - in other words, do his homework. For a halal investment, this means studying a project's fundamentals, understanding its business model and assessing its compliance with Sharia law.

Take the example of investing in gold in a halal way. This historic asset requires rigorous analysis before you place your trust in it, knowing that Allah is the true Provider (Ar-Razaq). The enlightened investor makes his calculations, studies the market, then places his trust in Allah.

True tawakkul is a state of mind that follows action. It enables us to weather market turbulence with serenity, knowing that Allah alone opens the doors to sustenance. This inner peace prevents emotional decisions.

Humility, the key to successful investors

The investor's true strength lies not in his ability to predict the future, but in his humility in preparing for it by placing his trust in Allah.

Rapid success without trials can be a trap. It feeds pride, that enemy of faith, by making us believe that success comes from ourselves rather than from Allah. Financial trials, on the other hand, remind investors of their vulnerability and dependence on Allah.

The most resilient investors are those who remain modest, able to question their certainties and adapt to market changes while maintaining a spiritual focus. They see every opportunity and every loss as a reminder of their total dependence on the True Provider.

Concrete keys to attracting barakah and acquiring a blessed rizq

Turning to the hereafter to receive the blessings of this world

Quick material methods such as riba are lures. The Muslim must give priority to spiritual means. Pure intention (niya) is essential: serving others opens up rizq. Wealth follows naturally, just as the shadow follows the one who turns his back on it, freeing us from the FOMO race for immediate profit. By refocusing on divine will, the Islamic investor builds an ethical portfolio, avoiding the pitfalls of excessive speculation.

Four actions to multiply your rizq

- Istighfar (request for forgiveness): Removes sins blocking rizq. The Prophet (peace be upon him) practiced istighfar daily. According to a hadith, it attracts solutions (Musnad Ahmad 2234), like an entrepreneur repenting a commercial conflict and seeing an unexpected contract materialize. This gesture purifies the heart and opens up hidden opportunities.

- Shukr (gratitude): To thank Allah for one's possessions. The Qur'an assures us that gratitude attracts more favors (14:7). It cultivates contentment and barakah in earnings, like a saver grateful for his modest returns, thus avoiding excessive risk while preserving his financial stability.

- Sadaqa (almsgiving): Giving does not diminish rizq, it multiplies it. Discreet charity attracts blessings, like a shopkeeper discreetly offering food to a needy person and seeing his business prosper. This gesture purifies wealth and attracts visible blessings in business.

- Silat al-Arham (family ties): Strengthening family relationships attracts blessings, as highlighted in this article on FOMO. Spiritual and concrete support, such as helping a loved one in need, avoids isolated decisions dictated by financial anxiety. These bonds reinforce emotional and material stability.

By integrating these practices, the Muslim investor avoids the pitfalls of materialism. This is the true Islamic strategy, uniting faith and action. By combining Tawakkul and lawful endeavors, he builds a sustainable financial future, in harmony with the values of transparency and justice of Islamic finance.

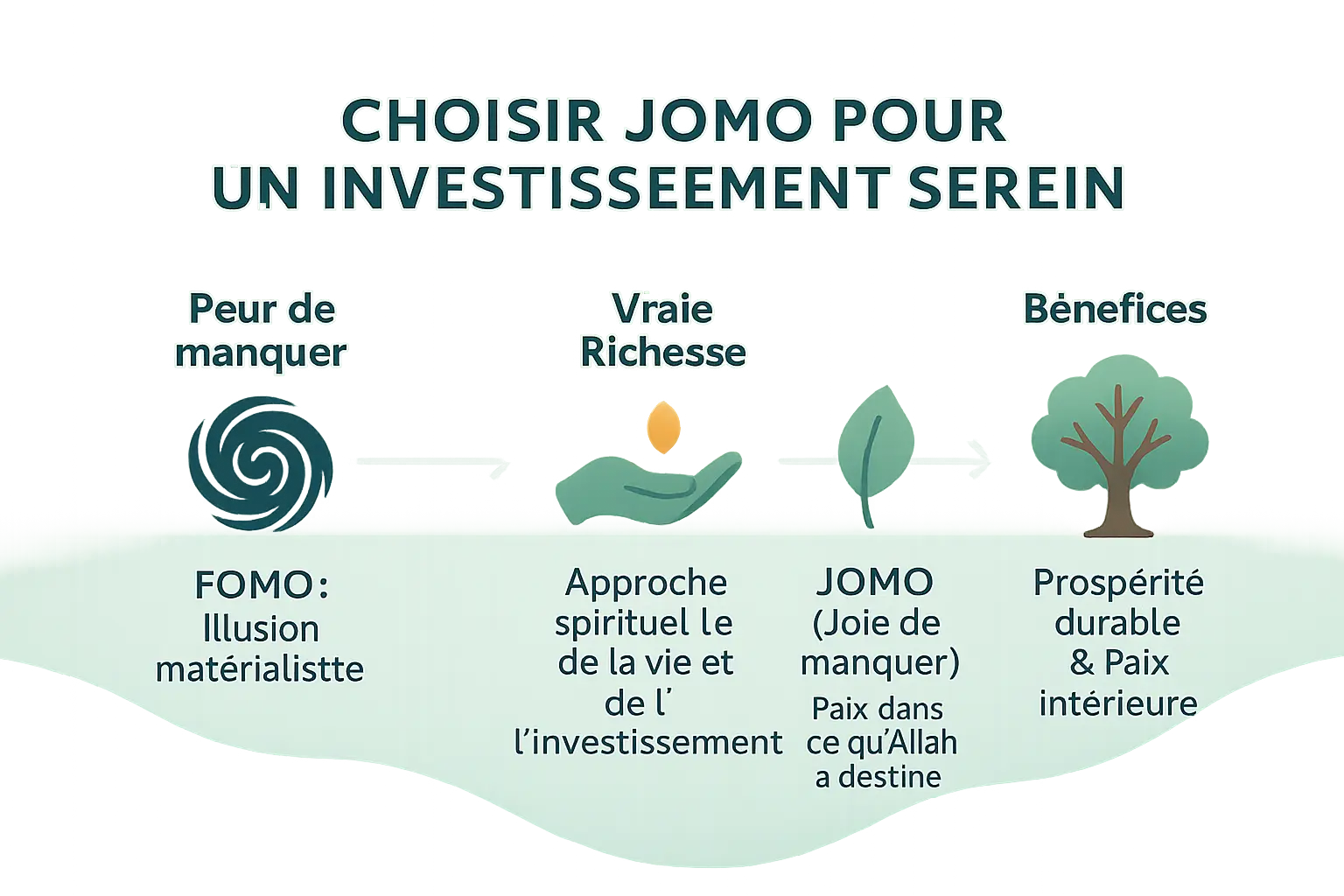

Conclusion: Choosing the Joy of Missing (JOMO) for a Safe Investment

FOMO is a modern-day illusion. This fear of missing opportunities masks the essence of Rizq: sustenance decreed by Allah. Believing that our salvation depends on a frantic race for profit reflects a misunderstanding of Tawakkul.

JOMO embodies freedom. It's the calm of refusing risky investments to focus on halal. Every dirham gained or lost is part of a divine plan. This certainty frees you from impulsive decisions.

Namlora embodies this path. The platform transforms anxiety into faith-driven action. Here, prosperity rhymes with harmony between finance and Islamic teachings. As the text says: "He who looks to the hereafter, Allah naturally provides."

Fear of missing out (FOMO) is a material illusion. By adopting JOMO - the joy of focusing on one's path, guided by the divine Rizq - the investor discovers serenity. Namlora invites you to prosper in line with your values, where trust in Allah and Islamic ethics transform stress into wisdom.

FAQ

What is the meaning of FOMO (fear of missing out)?

FOMO, an acronym for "Fear Of Missing Out", refers to a psychological fear of missing out on opportunities perceived as essential, whether in social, professional or financial life. In investment, this leads to hasty decisions, such as buying an asset in the midst of euphoria, for fear of "missing the boat". This anxiety is rooted in comparison with others (social networks, the success of loved ones) and a short-termist vision. In Islam, this stress is linked to a lack of Tawakkul, that trust in Allah (Ar-Razaq) which reminds us that sustenance (Rizq) has already been decreed.

Does FOMO cause anxiety?

Absolument. Le FOMO génère une anxiété chronique en alimentant la peur de regretter le passé et de manquer le futur. En investissement, cela se traduit par une course effrénée vers des gains rapides (x100, x1000), au détriment d’une stratégie durable. Cette course est toxique : elle pousse à vendre à perte en période de baisse (panique) ou à acheter à des sommets (euphorie). En Islam, cette peur matérialiste trahit un oubli de la certitude spirituelle : la sécurité véritable ne vient pas d’un bien immobilier ou d’un CDI, mais de la confiance en Allah, le véritable Pourvoyeur.

What is FOBO syndrome?

FOBO (Fear Of Better Options) is a cousin of FOMO. It corresponds to the anxiety of missing out on a better opportunity by choosing another. For example, an investor hesitates to buy a falling asset, always imagining a " better price to come". This trap paralyzes action, fuelling wasswas (doubt). The solution? Return to reason and fundamentals: if the asset is solid, act despite the uncertainty, bearing in mind that Rizq (sustenance) is already written by Allah, and not under our sole control.

How do you overcome the fear of missing out?

Overcoming FOMO requires an inner revolution. First, understand that Rizq (sustenance) is decreed by Allah before we are born: working 5 or 15 hours a day doesn't speed up what is written. Secondly, cultivate Tawakkul (trust in Allah) by acting rigorously (seeking a solid investment) while letting go of the results. Finally, refocus on the essentials: gratitude (Shukr), charity (Sadaqa), and forgiveness (Istighfar) open doors to sustenance that the material race closes.

How can FOMO be cured?

Curing FOMO requires a break with toxic comparison. Start by limiting social networks, those distorting mirrors of success. Next, practice Tawakkul: as the Prophet (pbuh) says, "Tie up your camel and put your trust in Allah" - acting wisely while handing over the outcome to Allah. Finally, cultivate usefulness (Niya) by investing not out of envy, but to bring value to others. In this way, wealth follows naturally, just as a shadow follows one who turns his back on it.

What's the name of the phobia of missing out?

Although the correct medical term is "atychiphobia" (fear of failure), in the modern context, the fear of missing out is universally referred to as FOMO (Fear Of Missing Out). In Islamic finance, this phenomenon is an emotional trap. It embodies a spiritual insecurity: doubting that Rizq (sustenance) has already been written by Allah. The solution? Remember that true security lies not in the wallet, but in divine certainty (Yaqeen).

What is the psychology behind the fear of missing out?

The fear of missing out stems from a combination of materialism and cognitive bias. Psychologically, it rests on two pillars: social comparison (envying the cousin who buys an apartment) and short-termism (seeking inordinate gains without patience). In Islam, these tendencies betray a forgetfulness of Tawhid: money is not security, Allah is. FOMO is therefore a spiritual reminder to refocus one's intention (Niya) on the hereafter, not on ephemeral goods.

What is FOMO syndrome?

FOMO syndrome is an emotional addiction to the anticipation of regret. In investment, it leads one to buy an asset after it has risen (out of fear of missing the train) or to sell when it has fallen (out of panic). This is the opposite of Islamic wisdom: the experienced investor buys when others are afraid and sells when they are euphoric. FOMO is a "minor Shirk", entrusting one's inner peace to unstable assets rather than to Allah, the sole guarantor of Rizq.

How to avoid FOMO in investing?

To avoid FOMO, three keys: 1) Spiritual certainty - As the Tawhid reminds us, Rizq is guaranteed by Allah, not by a portfolio. 2) Practical discipline - Look for halal investments (gold, ethical real estate) with solid causes (study of fundamentals). 3) Humility - Challenge yourself, like successful investors who adapt without pride. Finally, practice JOMO (Joy Of Missing Out): the joy of focusing on your own path, leaving idle comparisons to your neighbor.