<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: Waqf embodies an ethical and sustainable investment model derived from the Islamic economy. By immobilizing a halal asset to generate perpetual income for the benefit of the community, it transforms wealth into social and spiritual leverage. A precursor of impact funds, it combines material sustainability with spiritual reward, like medieval universities or the wells of Othman Ibn Affan.

Tired of seeing the modern economy plagued by speculation and debt? The waqf ethical economy embodies an age-old alternative, where capital serves people and sustainability rather than short-term profitability. Rooted in real finance and Islamic values, this model transforms an asset into an inexhaustible source of social benefits - eternal schools like Al-Azhar, free hospitals, accessible housing - like a generous tree whose fruits benefit everyone, today and tomorrow. Beyond the material, it cultivates the Sadaqa Jariya, the alms that continue to bring eternal reward, while preserving the essentials: trust, justice and sustainability.

Contents

The waqf, a foundation of heart and mind for an ethical economy

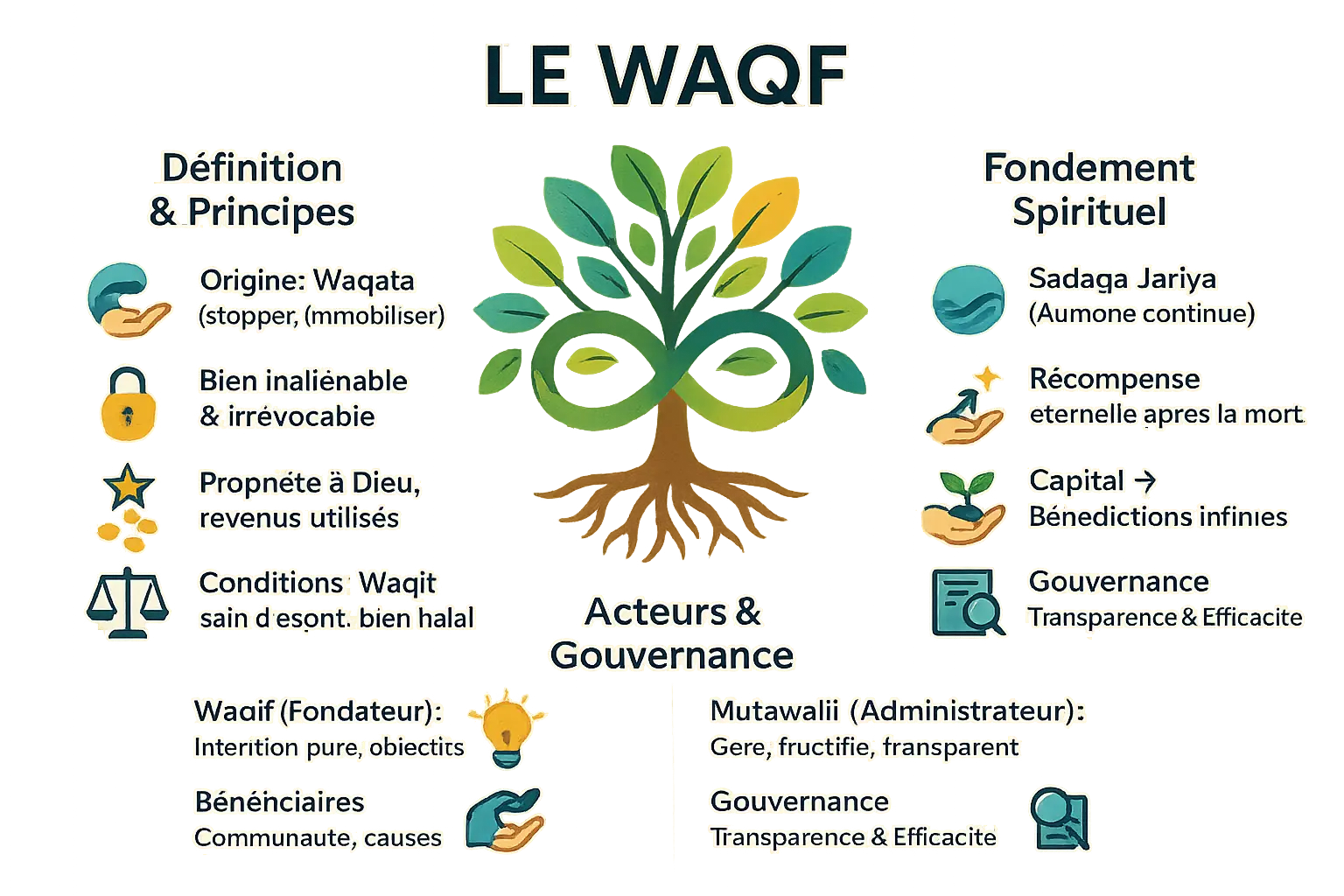

Definition and principles: a property dedicated to charity for all eternity

The word Waqf (وقف) comes from the Arabic root waqafa, meaning "to immobilize". According to AAOIFI standard n°33, it is an irrevocable contract immobilizing a halal asset in order to devote the profits to social or religious causes. The capital remains inalienable, symbolically transferred to God, while its fruits serve the designated beneficiaries. To be valid, the Waqif (founder) must be of full age, of sound mind, and the owner of the asset, which must be tangible and lawful.

Sadaqa jariya, the spiritual foundation of eternal investment

Waqf transforms capital into a source of infinite blessings, both for the community and for the donor. It's a transaction in which social well-being feeds individual salvation.

Il incarne la Sadaqa Jariya (aumône continue), dont la récompense persiste après la mort. Un hadith rapporté par Muslim (1631) souligne que seules trois actions rapportent après le décès : la Sadaqa Jariya, la science bénéfique et les enfants pieux. Contrairement aux donations ponctuelles, le Waqf crée un héritage spirituel éternel par des actifs productifs. Cette double récompense – terrestre par l’impact social et céleste par la rétribution divine – en fait un investissement spirituel unique.

Players and governance: a pact of trust

The Waqf's governance is based on a clear and accountable structure. Each player is bound by a sacred commitment to transparency and efficiency. Here are the key roles:

- Waqif (founder): The initiator, who commits his property with the pure intention of serving the community.

- Mutawalli (administrator): The rightful custodian, responsible for preserving the assets and optimizing their impact in accordance with the founder's wishes.

- Beneficiaries: The community or defined causes, which receive the fruits of the Waqf according to established objectives.

This system is based on modern transparency and accountability mechanisms, guaranteeing the sustainability of the work and the confidence of stakeholders. AAOIFI standards reinforce this governance through rigorous accounting and ethical frameworks.

A development model steeped in history

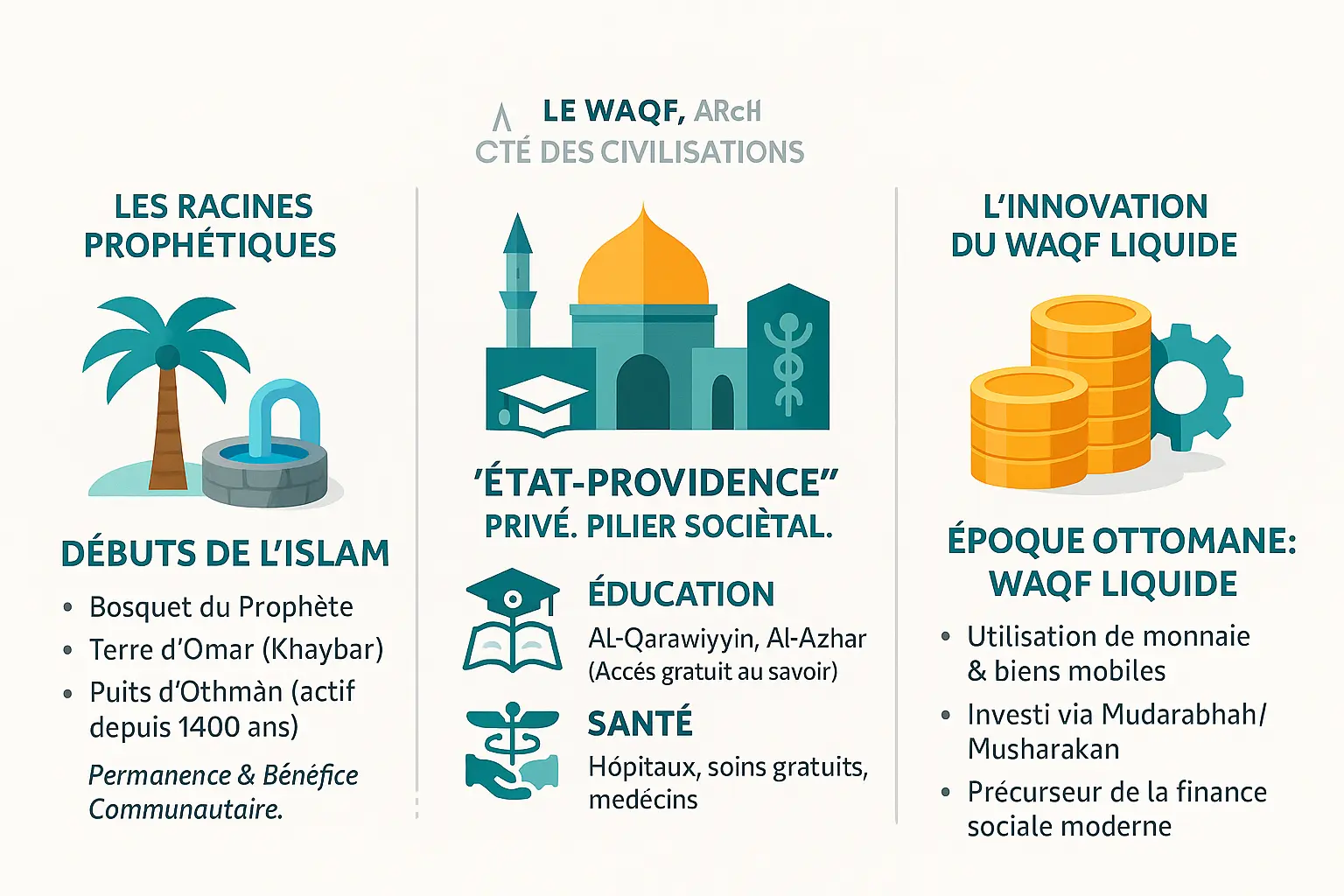

Prophetic roots: Islam's first waqfs

Il est ancré dès l’ère prophétique grâce à Othman ibn Affan (RA), qui a acquis le puits de Rumâh à Médine pour le rendre accessible à tous. Ce Waqf, actif aujourd’hui encore, génère des revenus redistribués via l’agriculture, soutenant les orphelins et les démunis.

Omar ibn al-Khattab (RA) established another pillar by dedicating fertile land in Khaybar as an eternal Waqf. This model, inalienable, feeds the poor and travelers, inspiring the companions to generalize this practice, as Jabir ibn Abdullah points out.

The waqf, architect of Muslim civilizations

This institution has shaped Islamic societies as a private "welfare state", with a major impact in three areas:

- Education: Al-Qarawiyyin University (Morocco, 859 A.D.) and Al-Azhar University (Egypt) were funded by Waqfs, opening access to knowledge to all.

- Health: The Bimaristan (hospitals) of the Umayyad and Abbasid caliphates, such as the Al-Muqtadir hospital in Baghdad, offered free healthcare, paid for by Waqf revenues.

- Infrastructures: the Waqf-financed Haseki Sultan complex in Istanbul brought together a mosque, soup kitchen and public baths, revealing a community urbanism. In Zanzibar, Waqfs have sculpted the urban landscape.

L’innovation du waqf liquide

The Ottoman era saw the birth of the liquid Waqf, capturing funds via the Mudarabah. In Bursa, these funds boosted the economy by financing mills and businesses. Although marginalized by the modern state, their legacy still inspires Islamic economics, as witnessed by Turkey's Vakıflar Bankası.

Waqf, an ethical alternative to the current financial system

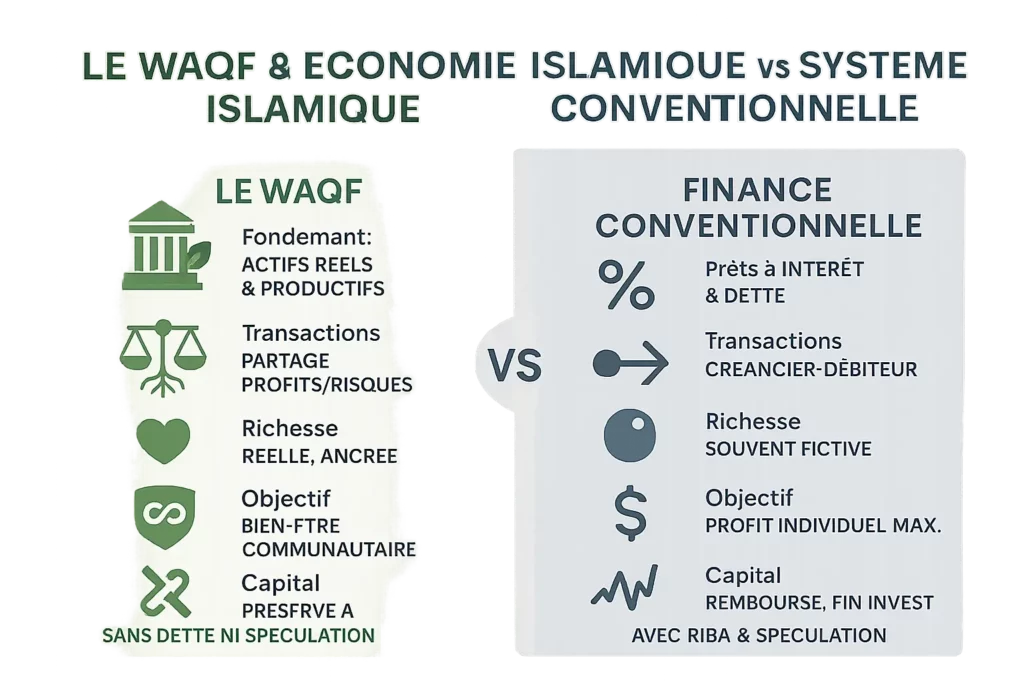

A model free of debt and speculation

Le système financier mondial repose sur le riba, un mode de financement basé sur l’intérêt. En islam, cette pratique est prohibée car elle génère de la richesse sans création de valeur réelle, comme le souligne la BCEAO qui le qualifie d’« enrichissement sans cause ».

Contrairement à ce modèle, le waqf incarne les principes de la finance islamique : partage des profits et des pertes (Moudaraba, Mousharaka) et adossement à des actifs tangibles (immobilier, entreprises éthiques). Ce système élimine le risque de dépendance à la dette tout en ancrant la richesse dans l’économie réelle. Par exemple, celui de l’université Al-Azhar au Caire, créé au Xe siècle, a permis de financer l’éducation gratuite de générations d’étudiants grâce à des revenus fonciers stables. Pour en savoir plus sur les limites de la spéculation, découvrez les principes qui encadrent la spéculation en islam.

Waqf, a pillar of a tangible, resilient economy

Il tire sa force de la productivité de ses actifs réels : un immeuble, une terre agricole ou une entreprise durable. Contrairement aux systèmes fondés sur la dette, ce modèle préserve le capital et génère des revenus récurrents pour la communauté. C’est un « investissement à impact social » avant l’heure, comme le décrit une étude de OpenEdition.

En se basant sur des biens productifs, le waqf échappe aux bulles spéculatives et offre une stabilité rare dans un monde marqué par les crises répétées. Par exemple, le Waqf familial (Dhurri) permet à une lignée de préserver un patrimoine tout en redistribuant les profits au profit de la communauté, comme le montre l’exemple de fermes agricoles gérées collectivement en Afrique de l’Ouest. Ce modèle illustre comment une économie ancrée dans le concret peut résister aux aléas financiers modernes.

Model comparison: waqf vs. conventional finance

| Criteria | The Waqf and the Islamic economy | The conventional financial system |

|---|---|---|

| Foundation | Tangible and productive assets | Interest-bearing loans and debt |

| Nature of transactions | Sharing profits and risks | Creditor-debtor relationship |

| Wealth generated | Real and based on productivity | Often fictitious and debt-based |

| Final objective | Social and community well-being | Maximizing individual profit |

| Capital sustainability | Capital preserved in perpetuity | Capital repaid, end of investment |

Revitalizing the waqf: concrete solutions for the 21st century

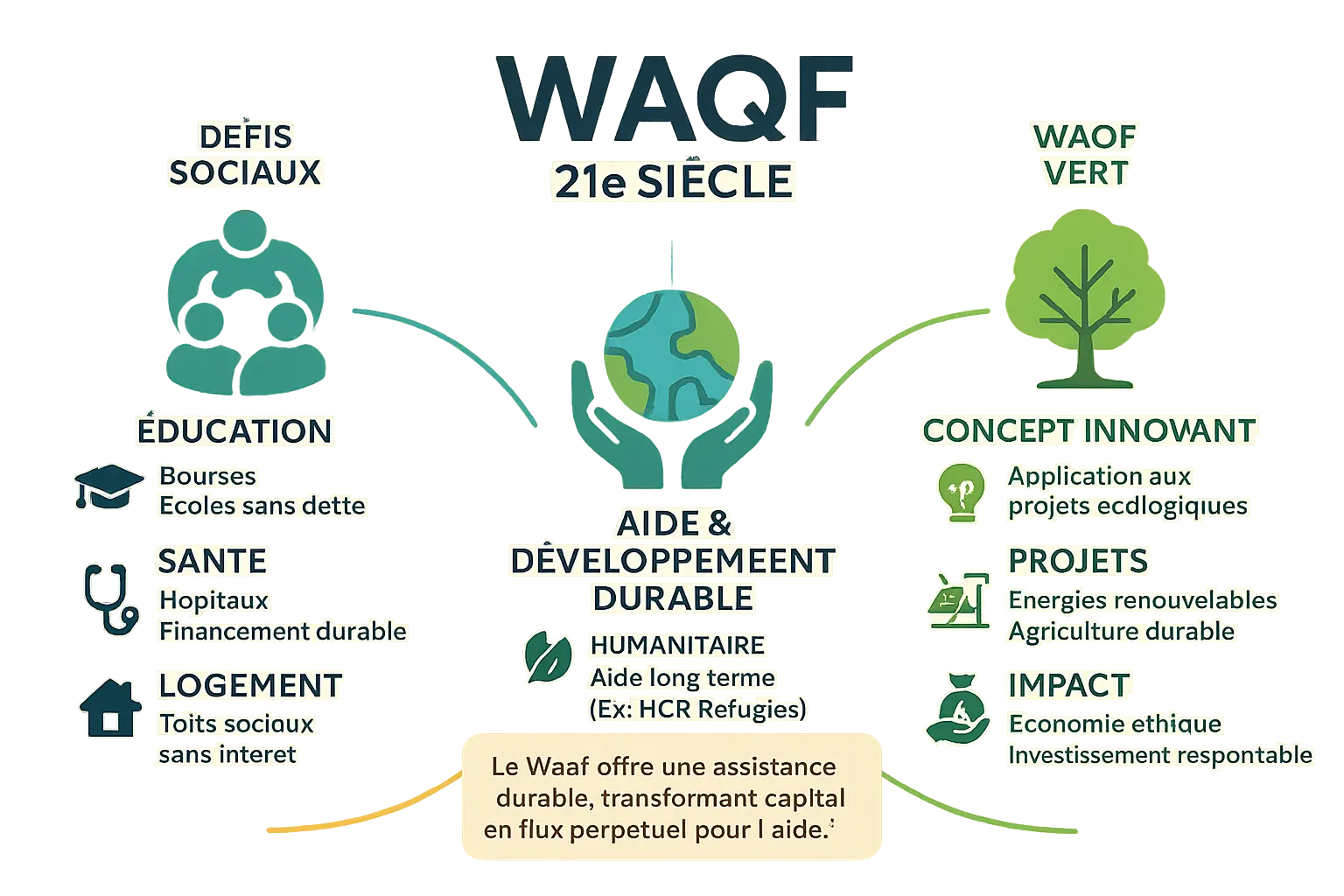

Meeting social challenges: education, health and housing

Le Waqf moderne répond aux besoins actuels en éducation, santé et logement. En éducation, des institutions comme l’université Al-Azhar en Égypte ou l’IIUM en Malaisie bénéficient depuis des siècles de revenus pérennes pour financer l’enseignement. À Istanbul, le Complexe Süleymaniye, construit au XVIe siècle, continue de financer des écoles et des logements étudiants grâce à ses revenus fonciers.

En santé, des hôpitaux comme le Rumah Sehat Terpadu en Indonésie assurent des soins gratuits via des revenus de Waqf, combinant modernité et pérennité. Pour le logement, des biens immobiliers transformés en Waqf offrent des solutions abordables, évitant la dépendance aux prêts à intérêt. Le Fonds National du Royaume-Uni illustre cette innovation en gérant des logements sociaux tout en maintenant les bâtiments à long terme. Découvrir des projets immobiliers éthiques.

A lever for humanitarian aid and sustainable development

Il transforme un capital initial en un flux de revenus perpétuel pour l’aide humanitaire.

The Global Islamic Refugee Fund (GIFR), launched in 2022 by the UNHCR and the Islamic Development Bank, illustrates this power. With a target of $500 million, it invests according to Sharia law to finance programs in 31 countries: education (scholarships for 872,000 people by 2024), health (drinking water and hygiene), and housing (23,600 shelters repaired in Chad). According to a UN report, Islamic tools remain under-utilized despite their potential for achieving the SDGs. Already, GIFR has supported 8.9 million beneficiaries since 2017, proving that this model combines urgency and sustainability.

The emergence of "green waqf": investing for the planet

The Green Waqf directs assets towards ecological causes: reforestation, renewable energies, sustainable agriculture. In Syria, arid lands are becoming productive olive farms, combining food security and soil preservation. The Green Waqf framework, documented by experts, proposes projects such as solar power plants and water-saving irrigation networks. These initiatives support the climate and life on earth MDGs, aligning respect for God's creation with modern challenges. Here, preserving the environment becomes an act of faith, where every tree planted or solar panel installed generates an eternal spiritual reward.

De la volonté à l’action : comment participer son économie

Setting up your own waqf: the key stages

Transforming an asset into a lever for spiritual and social impact begins with a sincere intention. Here are the simplified steps to make your waqf project a reality:

- Intention (Niyya): Set a clear objective in line with your values. Do you want to support education, health, or strengthen family solidarity? This intention guides every subsequent decision.

- The Waqf deed (Waqfiyya): Formalize your commitment in a document detailing the property chosen, its beneficiaries and the management procedures. This spiritual and legal contract guarantees the continuity of your gift.

- Appointment of the property manager (Mutawalli): Choose a person or institution you can trust to preserve and optimize the property. This manager acts as a guarantor of your intentions, with rigorous accounting and ethical concerns.

The family waqf (dhurri), a tool for ethical foresight

The family waqf (dhurri) combines protection of assets with intergenerational solidarity. Unlike the public waqf (khairi) dedicated to universal causes, the dhurri gives priority to the founder's descendants.

Take the example of a sheep farm: the capital (the animals) remains inalienable, but the profits (sale of wool, lambs) can support family needs. However, this structure requires an ultimate charitable purpose. If the line dies out, assets can be redirected to public causes, ensuring a lasting social impact.

Participate in modern, accessible waqf funds

The digital revolution has democratized waqf. Now, even modest contributions can fund collective projects thanks to Islamic crowdfunding. This model, tried and tested in agricultural initiatives, gives small farmers access to debt-free financing.

For novices, modern Islamic financial institutions offer turnkey support. They ensure Shari'a compliance, account transparency and optimized returns. Whether financing a well in Africa or an educational program in Asia, these platforms transform every donation, however modest, into a seed of change.

The waqf embodies a vision where faith feeds action. It reminds us that the economy can be a lever for unity, not division. By preserving capital and redistributing its fruits, this model foresees a fairer society, where baraka replaces speculation, and every financial act becomes a form of worship.

The Waqf embodies a timeless solution for a fair, sustainable and inclusive economy. By combining spirituality and social well-being, it **transforms capital into collective benefit, replacing debt with Baraka**. Accessible to all, it embodies an ethical investment where every act resonates for eternity, between earth and sky.

FAQ

What is the concept of waqf?

Waqf is a profoundly Islamic institution, rather like planting a tree whose fruits will nourish future generations. It involves immobilizing an asset (a plot of land, a building, or even money) in order to devote its profits to a charitable cause. The asset becomes inalienable and irrevocable - it can neither be sold nor inherited. It's a definitive gift, but not a disinterested one: your sincere intention creates an ongoing stream of benefits, for the community and for you, beyond your earthly life.

What is waqf in Islam?

For the Muslim, the Waqf is much more than a legal tool: it's a spiritual commitment. Imagine a capital frozen like a solid pillar, whose income flows like a river feeding the needs of a school, a hospital or a well. This practice has its roots in a prophetic hadith: continuous almsgiving (Sadaqa Jariya) is one of the three acts that continue after our death. By dedicating a good to God, you build an eternal legacy, where every euro generated becomes a silent prayer for your salvation.

What is green waqf?

The Green Waqf is an innovation inspired by the ecological spirit of our times. Like a garden whose roots nourish the earth, it's aboutinvesting in sustainable projects - renewable energies, responsible agriculture, reforestation. It's not just about saving water from a well, but preserving the source itself. A modern Waqf that combines faith and ecology, to cultivate a world where future generations will find shelter, food and a preserved environment.

What is waqf in the Koran?

The word "Waqf" does not appear in Arabic letters in the Koran, but its spirit permeates the entire divine message. Remember the verse: "And they ask you what they should give. Say: Give the surplus " (2:219). The Waqf is this surplus transformed into a perpetual gift. It is the concrete application of this injunction, immobilizing a good to turn it into a river of benefits, where ordinary Sadaqa is a drop of water that evaporates.

What are the rules of waqf?

The rules of Waqf are as simple as a contract of trust: you must be of legal age, of sound mind, and the owner of the property being offered - with no debts weighing on the gift. The good must be lawful (halal), tangible, and its use clearly defined (for a school, a hospital...). Once the contract has been drawn up, the property symbolically belongs to God. The Mutawalli, the designated manager, cultivates it with honesty like a gardener tends an orchard, redistributing the fruits without owning the roots.

What is the difference between waqf and sadaqah?

Sadaqa is a one-off almsgiving, a gift that ends with the deed. Waqf, on the other hand, is a gift that keeps on giving - like planting a tree whose fruits will feed the poor for centuries to come. If the Sadaqa is a candle that illuminates an evening, the Waqf is a lighthouse whose light guides generations. The difference lies in the eternal link: in the Waqf, the capital remains intact, and only the income is used for the cause, creating an uninterrupted spiritual reward.

What is waqf in Islamic finance?

In Islamic finance, the Waqf is the anti-debt par excellence. Unlike traditional interest-based systems (riba), it is based on real assets - a building, a farm - whose profits circulate in the economy without speculation. It's a way of investing without forgetting thatwell-used capital feeds society. Imagine a fund that generates ethical income, like an orchard whose harvests feed schools: this is Waqf, the premise of modern social finance.

What is the definition of Qawam?

I think you're referring to "Waqf" rather than "Qawam". The term "Qawam" in Islam refers more to the one who maintains or supports - for example, a husband's role towards his family. But when it comes to Waqf, it's the Mutawalli who "qawam" the fixed asset, preserving it and making its benefits bear fruit for the community.

How do you get rid of waswas in Islam?

Waswas is that whisper of the evil one that disturbs your faith or your good deeds. To free yourself from it, Islam recommends a spiritual hygiene: seek refuge with Allah, recite the Koran regularly, and practice the prayer of repentance. Like a breeze that disperses clouds, steadfastness in good deeds keeps these temptations at bay. If the trouble persists, consult a scholar or a spiritual adviser, because sometimes the discomfort comes froma door that we need to close together.