<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: Zakat is more than just an alms, it's an economic lever that combats hoarding by imposing an annual rate of 2.5% on dormant assets. By encouraging investment and redistribution, it stimulates growth and reduces inequality. A divine mechanism for fair finance, where wealth circulates for the benefit of all rather than stagnating.

Tired of seeing fortunes lying idle while millions lack the necessities of life? Zakat, often reduced to a mere ritual duty, is in fact a divine mechanism against hoarding, redistributing stagnant wealth and reawakening the economy. By imposing a 2.5% tax on idle assets, it punishes stagnation and stimulates ethical investment, transforming frozen money into a tool for social justice. Unlike capitalism, which concentrates wealth, zakat creates a beneficial circular flow, reducing inequality and instilling collective serenity. Discover how this Islamic pillar combines sustainable growth and sharing values, realigning finance with people.

Contents

Zakat: more than almsgiving, it's an economic pillar

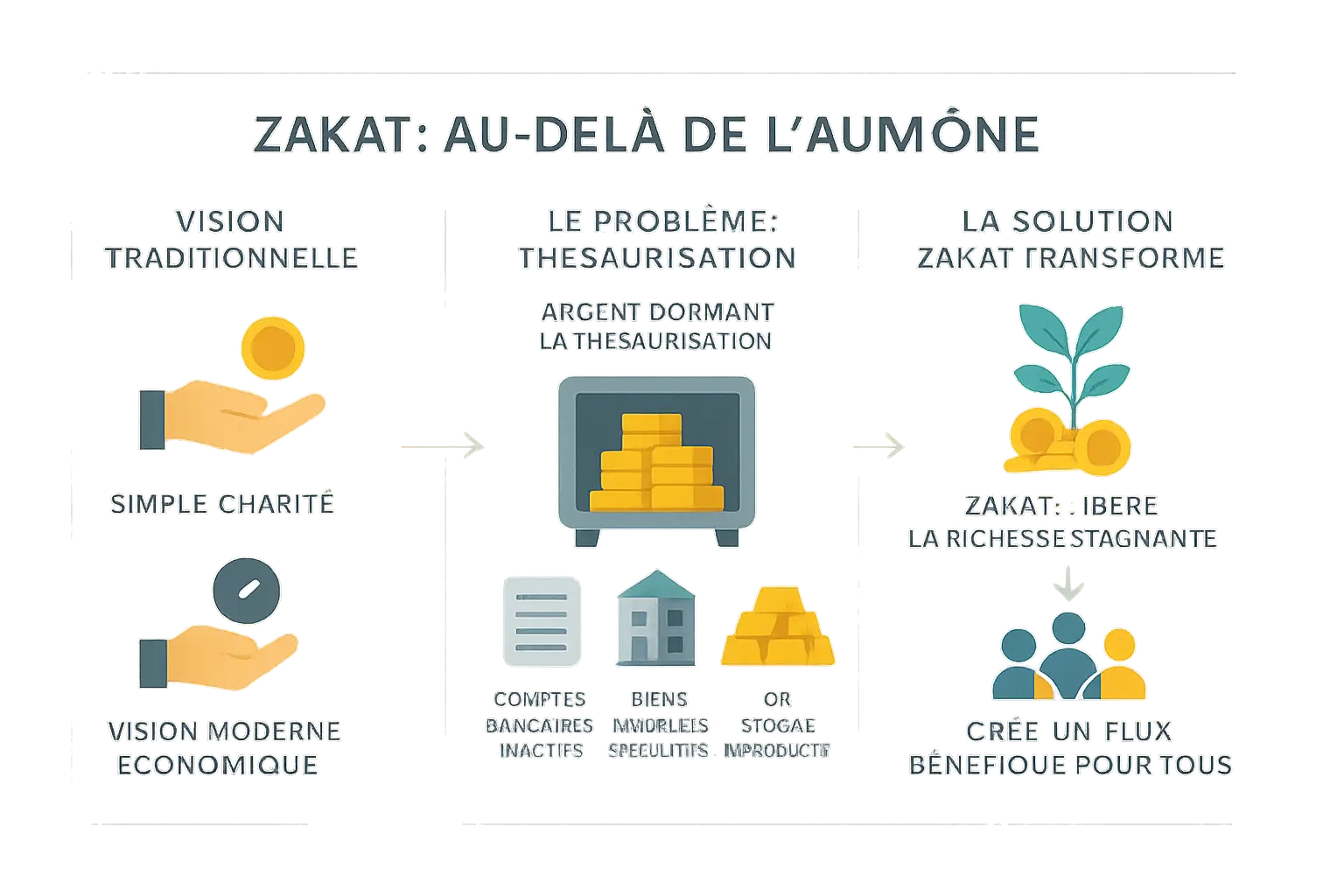

Going beyond the traditional vision of zakat

When it comes to Zakat, many people think of it as a simple religious obligation. Yet this practice is much more than an act of charity: it's an economic mechanism designed to fluidify wealth and avoid its concentration. By requiring an annual deduction of 2.5% on dormant assets, Zakat encourages people to get away from the logic of sleeping money, and put it into motion for the benefit of all.

The problem of sleeping money

Hoarding - the passive accumulation of wealth - is poisonous to the economy. A saturated bank account, vacant real estate or precious metals locked away in a safe: these practices deprive society of vital resources. While modern capitalism values accumulation, zakat hoarding tackles this stagnation by imposing a gentle but steady loss on non-productive assets. The result? Money circulates, stimulating employment, consumption and solidarity.

Announcing the plan

This article explores how Zakat revolutionizes our relationship with money. We'll see how it disincentivizes hoarding, redistributes wealth fairly, and opposes a system that values financial concentration. In short, Zakat is not just a spiritual duty: it's a lever for a more inclusive economy, where wealth feeds society rather than anonymous accounts.

Hoarding: a social injustice and an economic hindrance

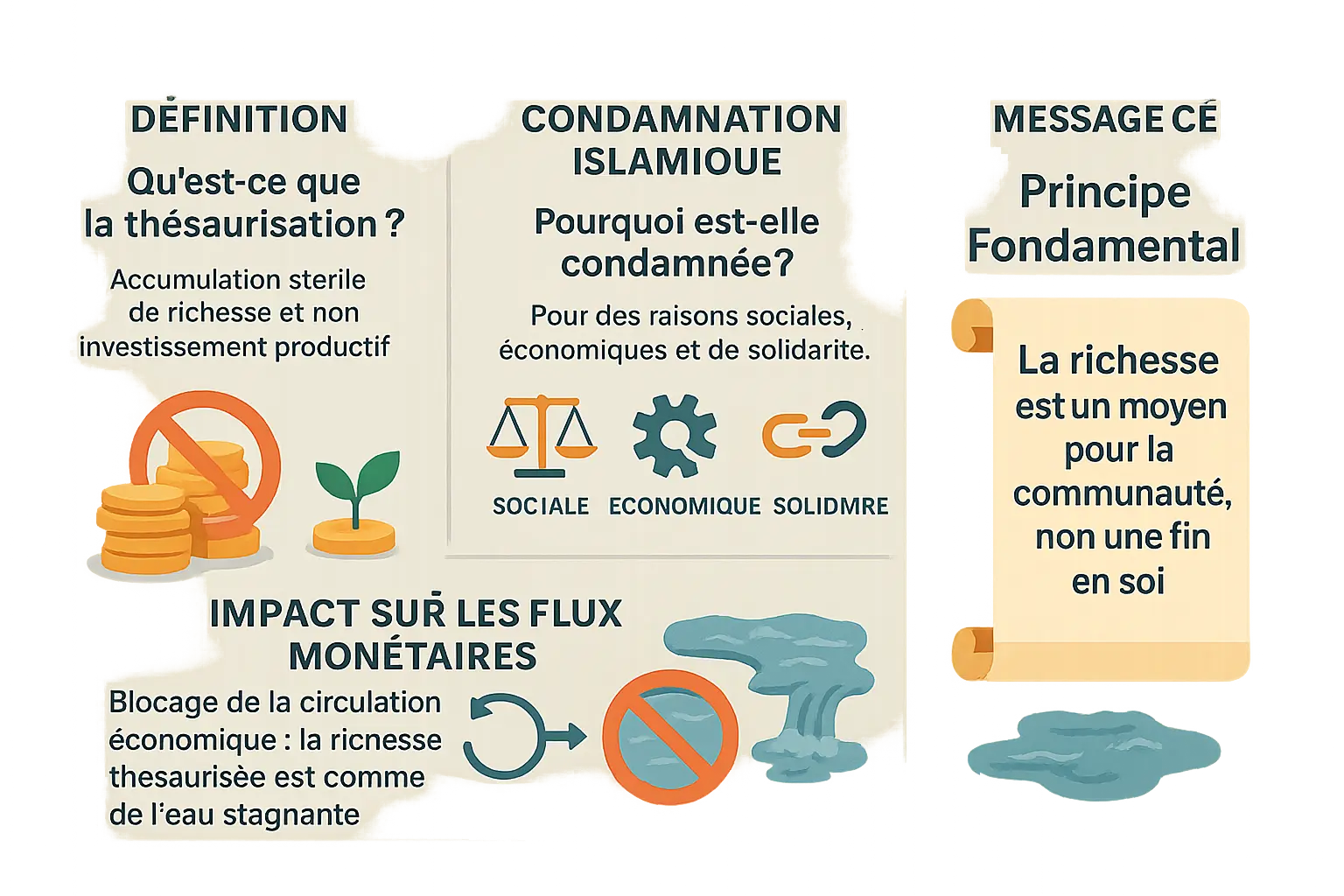

What is hoarding in Islamic finance?

In Islamic finance, useful savings are encouraged, but hoarding, or "al-kanz", is the excessive accumulation of wealth - silver, gold, cash - beyond real needs, without investing it or paying Zakat. This sterile hoarding runs counter to Islamic ethics, paralyzing the economy and preventing resources from serving the community. In concrete terms, hoarding means leaving assets to sleep in a safe or an account, without using them for productive projects, commercial exchanges or acts of solidarity.

Why does Islam condemn this practice?

Hoarding concentrates wealth in a few hands, depriving the economy of vital liquidity. It holds back economic justice and collective fulfillment. Behind this condemnation lies a profound vision: wealth must circulate to serve the community, never accumulate. By hoarding, an individual not only contravenes a spiritual duty, but also acts against the general interest. This creates an imbalance that weakens social bonds and distances society from the Islamic model of sharing and mutual responsibility.

Wealth is not an end in itself, but a means to the service of the community. To let it lie dormant is to deprive society of its potential for growth and justice.

Negative impact on cash flow

Immobilized money stifles the economy. When large sums are hoarded, money flows slow down, accentuating inequalities. Zakat encourages the movement of wealth: money must create, exchange and redistribute. Like a river that irrigates the land, wealth circulates and nourishes the economic ecosystem. When it stops, it dries up opportunities for those who need them.

This dynamic is confirmed by the negative impact on the economy. When it circulates, it feeds employment and shared prosperity. When it sleeps, it stifles collective development. Without movement, wealth becomes useless, inequalities take root, and growth runs out.

Zakat: a divine mechanism for the circulation of wealth

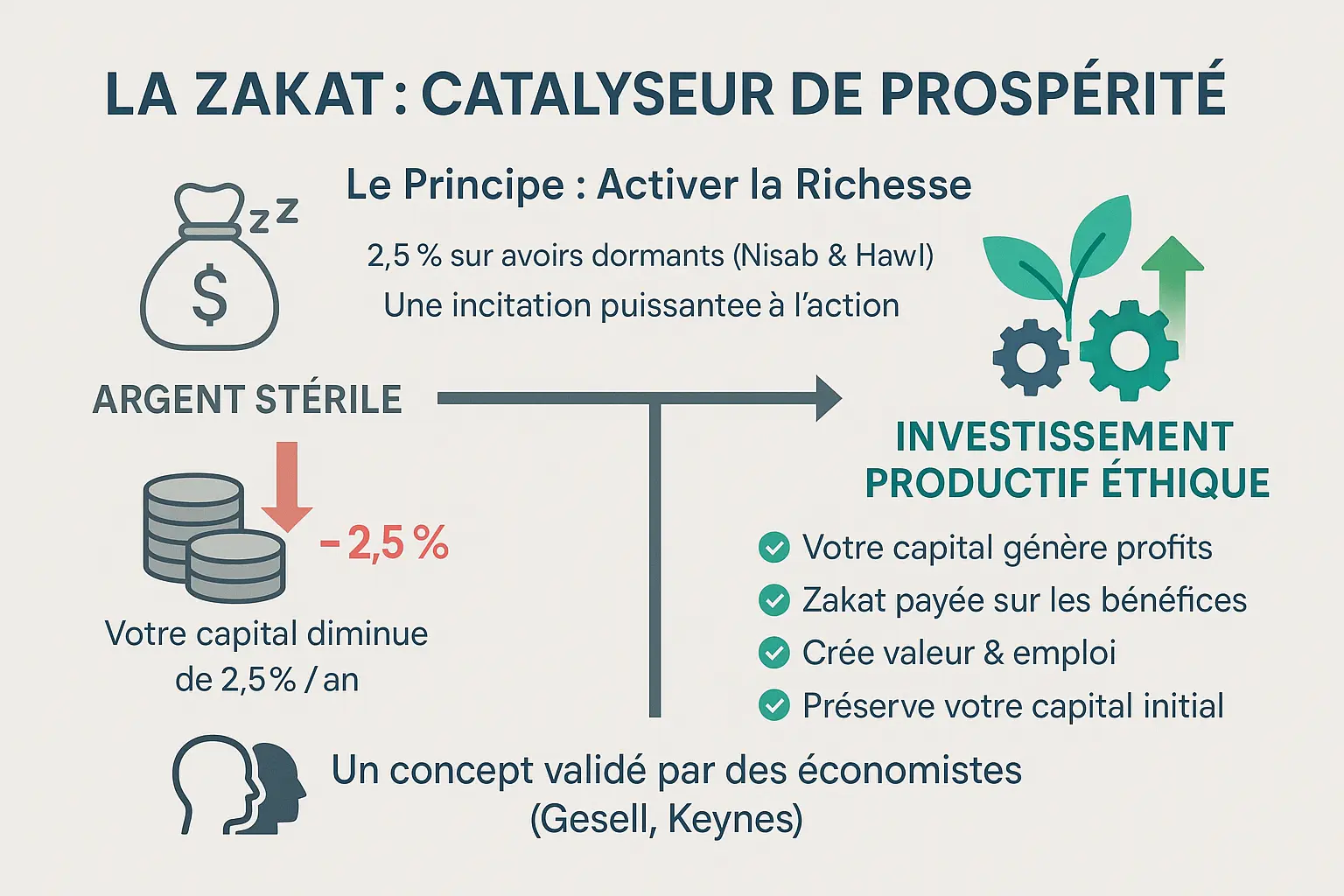

The principle: a spiritual tax on stagnation

Behind its spiritual dimension, zakat acts as a unique economic lever. By requiring an annual levy of 2.5% on assets exceeding a minimum threshold (the Nisab) and held for a lunar year (the Hawl), it embodies a clear rule: money that does not circulate is mechanically reduced. It's not a punishment, but a benevolent reminder that wealth is a tool of social justice, not an individual trophy. It cultivates the habit of action, like a gardener pruning dead branches for the health of the tree.

From stagnation to productive investment

Faced with this rule, two paths become clear:

- Inaction: Your money loses 2.5% every year, a natural brake on inaction.

- Ethical action: By investing in halal projects-such as a sewing workshop or an agroecological micro-farm-you pay zakat on profits, not capital. This protects your funds while generating employment and local autonomy.

This mechanism feeds an ecosystem of solidarity. A person who finances a halal artisan doesn't just redistribute 2.5%: he or she activates a cycle of value, dignity and trust. This is the very DNA of Namlora, which promotes these principles.

A concept validated by economists

The logic of zakat resonates with universal economic visions. Silvio Gesell, a forerunner of the XXᵉ century, imagined a "melting currency" to discourage hoarding. John Maynard Keynes, the father of modern economics, described this idea as "irreproachable". Read the idea behind it: a fluid economy where money serves, not shackles.

In short, zakat embodies a rare balance. It prevents the concentration of wealth by putting it back into motion, while anchoring faith in the real economy. It's an invitation to build a world where prosperity and equity reinforce each other, like the roots and branches of the same tree.

How does zakat apply to hoarded goods?

The case of dormant gold and silver

Keeping cash or precious metals without using them exposes you to Zakat. As soon as your assets exceed the Nisab threshold (85g of gold or 595g of silver), you must pay 2.5% of their value each year. This rule is an incentive to bring these assets out of their economic inertia.

Un coffre-fort rempli d’or inactif devient un levier économique via la Zakat. Soit vous le réinvestissez dans des projets productifs, soit vous redistribuez sa valeur. Cette obligation annuelle transforme l’épargne stérile en capital circulant. Pour ceux qui souhaitent faire fructifier leur or de manière éthique, il existe des méthodes d’investissement conformes aux principes islamiques.

What about non-productive real estate?

The main residence is spared, but property acquired for speculation or left empty is included in the calculation. An apartment declared as a speculative asset is subject to a 2.5% Zakat on its market value.

Dwellings that are vacant for no legitimate reason become zakatable to encourage them to be rented out. This combats sterile property accumulation and boosts the market. An owner who leaves a property unoccupied not only pays Zakat on its potential value, but also deprives households of vital resources. This logic is part of a broader vision of ethical real estate financing, far removed from speculative practices.

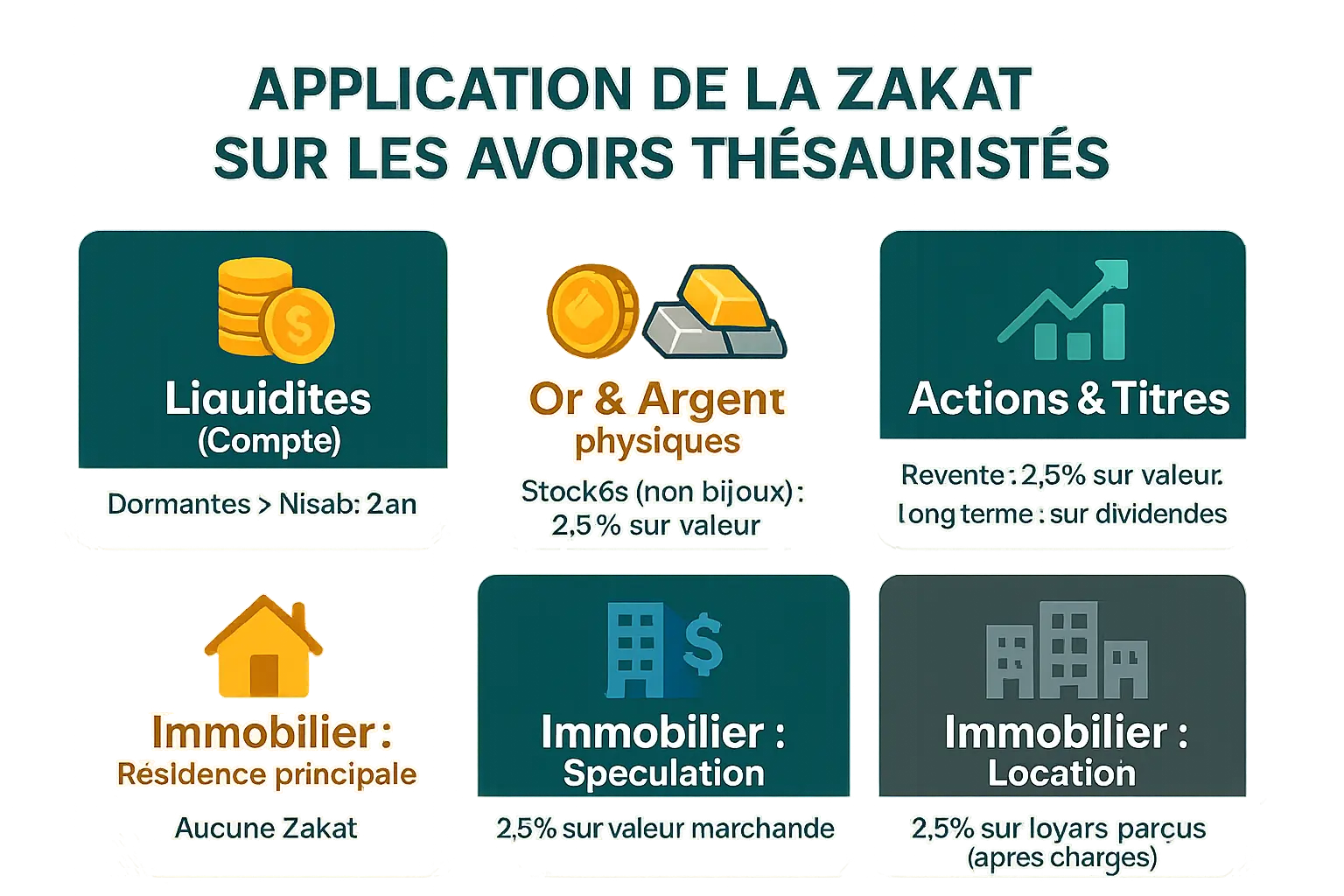

Summary table: zakat on assets

| Credit type | Equity position | Principle of Zakat application |

|---|---|---|

| Cash (Bank account) | Money lying dormant beyond the Nisab | 2.5% on the total amount after one year. |

| Physical gold and silver | Stored as a value reserve (excluding worn jewelry) | 2.5% on current market value. |

| Equities and securities | Invested in halal businesses | 2.5% on the value of shares if intended for resale, or on dividends if held for the long term (depending on the school). |

| Real estate | Main residence | No Zakat. |

| Real estate | Bought for speculation (resale) | 2.5% on the market value of the property. |

| Real estate | For rent | 2.5% on rents received (after deduction of expenses). |

Zakat transcends financial obligation. It encourages reinvestment in the real economy by taxing idle assets. This mechanism guarantees a virtuous rotation of wealth, promotes access to housing and stimulates entrepreneurship. By maintaining this dynamic, Zakat acts as a remedy against economic and social imbalances linked to the passive accumulation of capital.

Zakat vs capitalism: two opposing visions of wealth

Distribution versus concentration

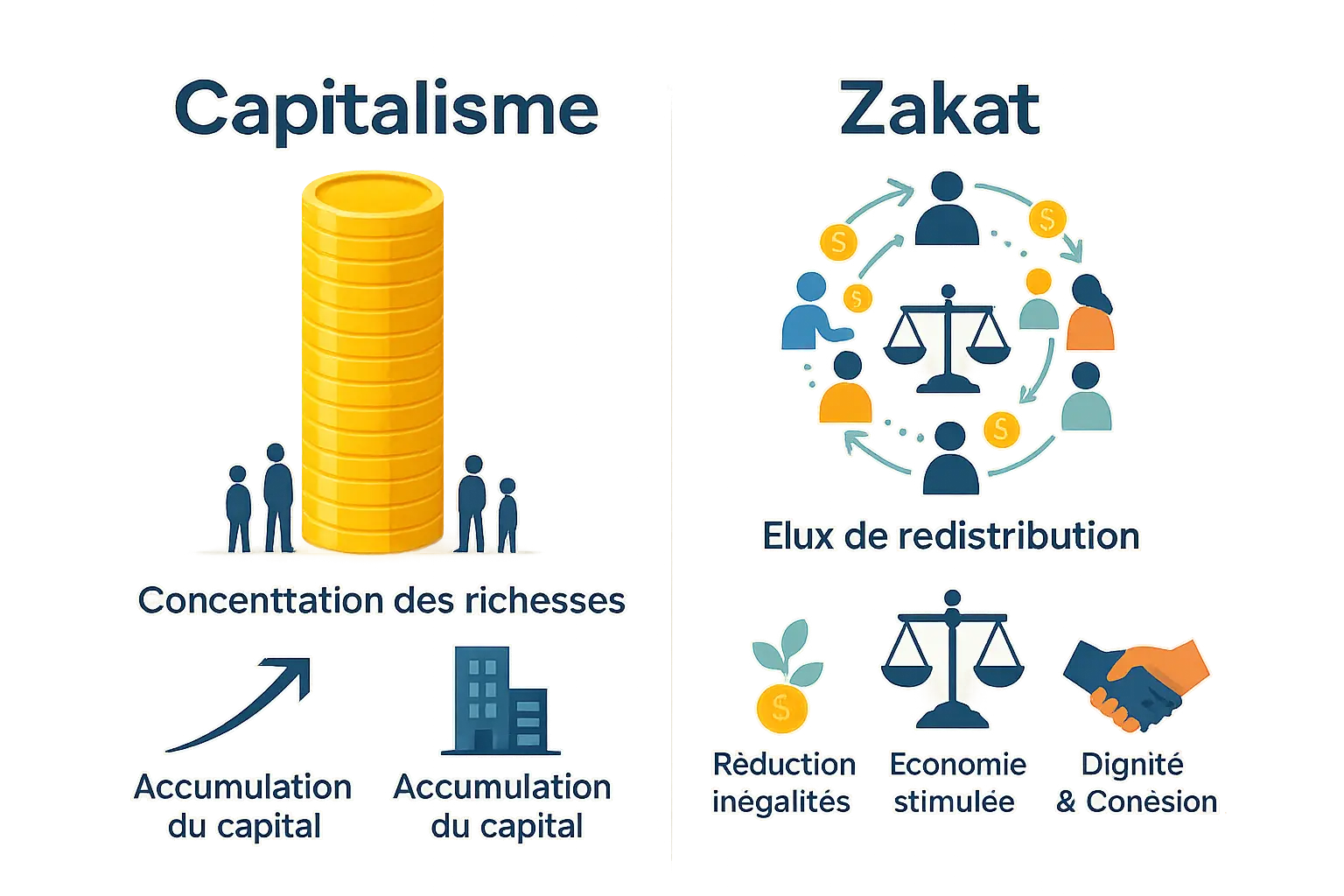

Modern capitalism favors the concentration of wealth in a few hands, creating a structural imbalance. Zakat, on the other hand, imposes a constant flow of redistribution, guaranteeing a healthier social and economic balance.

Where modern capitalism favors the concentration of capital, Zakat imposes a constant flow of redistribution, guaranteeing a healthier social and economic balance.

By requiring an annual levy of 2.5% on dormant assets, Zakat encourages investment in the real economy rather than hoarding. This threshold is not arbitrary: it avoids discouraging savings while encouraging action. For example, a Muslim saver would rather invest his money in a solidarity fund than let it stagnate, generating both an ethical return and a social impact. In the long term, this mechanism cultivates a balance between saving and sharing.

The benefits of a solidarity-based economy

Zakat is more than a religious act: it's an economic pillar that reinvents social relationships. Its impact can be measured by :

- Reducing inequalities: By transferring resources from the most affluent to the most vulnerable, Zakat strengthens cohesion. Find out more about its ability to reduce socio-economic inequalities. This mechanism rebalances inherited disparities and prevents chronic impoverishment.

- Stimulation of the real economy: Redistributed funds boost consumption and entrepreneurship. Zakat recipients spend immediately on their basic needs, activating local markets. In West Africa, initiatives such as the "Zakat for Entrepreneurs" program in Senegal transform these funds into productive micro-credits.

- Spiritual protection and dignity: for the giver, Zakat frees the soul from the temptation of accumulation. For the recipient, it is a right that restores dignity without humiliation. This dual material and moral dimension strengthens trust within communities.

By acting on these levers, Zakat builds an ecosystem where wealth circulates, nourishes activity and prevents crises. It embodies a vision where prosperity and justice harmonize, anchoring stability through equity. Unlike the speculative cycles of capitalism, it establishes a model of balance between ethics, economics and solidarity.

Towards a fairer, more humane financial ecosystem

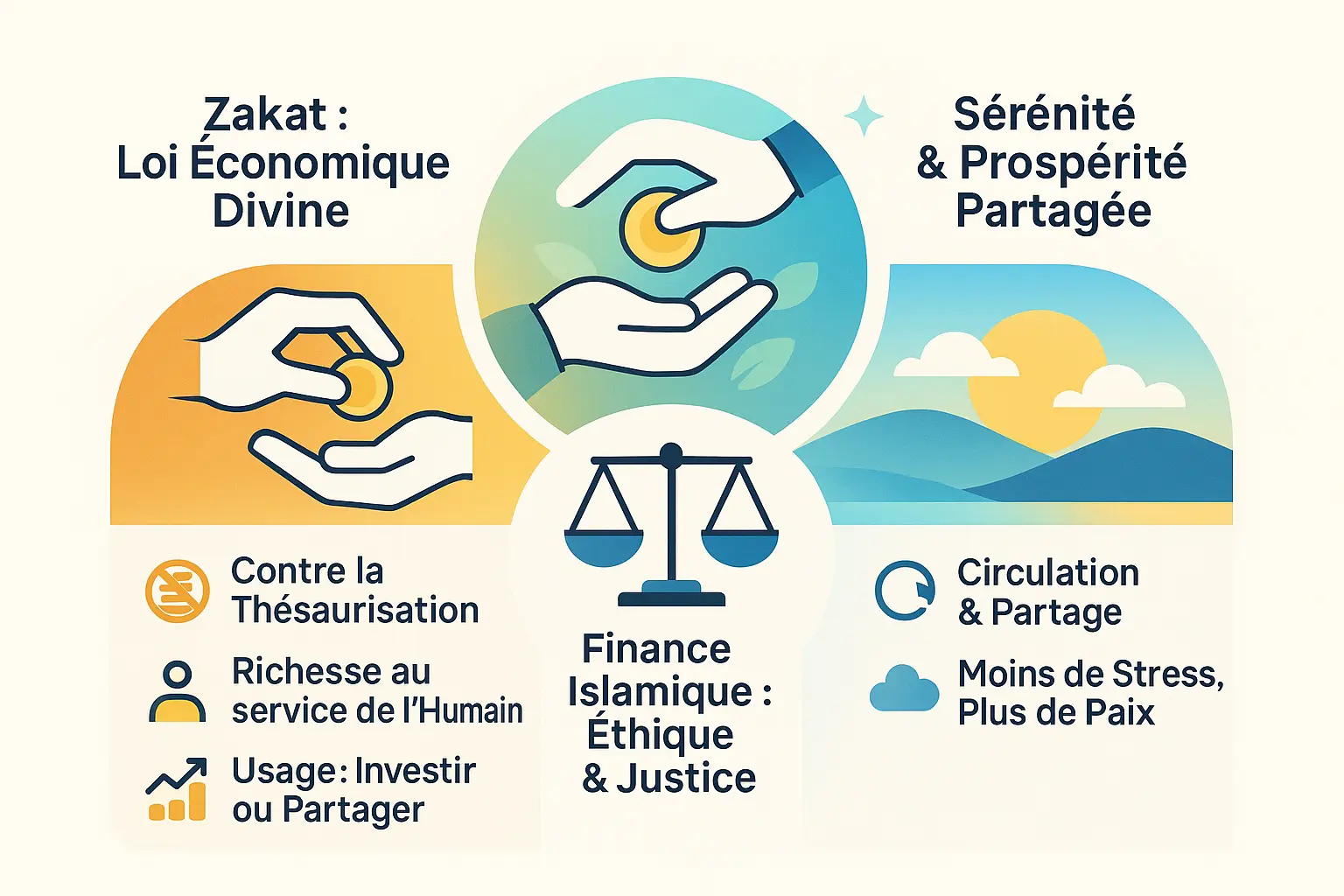

Zakat, an economic and spiritual law

Zakat is both a religious duty and an intelligent economic mechanism: by taxing 2.5% of idle wealth, it prevents hoarding. Unlike modern capitalism, which values accumulation, it requires that money circulates to serve the community.

This system protects society by encouraging investment in the real world or redistribution to the most disadvantaged. Stagnant capital is gradually eroded, whileinvested capital generates profits and solidarity.

Building a new investment model

Namlora embodies this vision with anethical investment ecosystemwhere profitability and Islamic compliance guide every decision, valuing transparency, profit-sharing and the exclusion of illicit activities.

Our platform connects entrepreneurs and committed investors. Namlora guides towards responsible opportunities where growth benefits all without betraying values.

A choice for a peaceful future

Choosing Zakat means opting for collective serenity: this system creates a living economy where everyone finds their place, freeing the rich from excessive attachment and restoring dignity to the most vulnerable.

Turn your money into a lever for social transformation. Discover our halal investment solutions to align your finances with your convictions and contribute to a fairer world, one dirham at a time.

Zakat is not a ritual obligation, but a divine economic law that combats hoarding by redistributing wealth. It stimulates the economy and social cohesion. Islamic finance embodies a fair and ethical model. Namlora offers halal investment solutions. Together, let's transform wealth into shared progress.

FAQ

What's the difference between hoarding and saving?

Hoarding consists of accumulating wealth (gold, silver, real estate) without using or investing it, leaving it to stagnate when it could be of use to society. Saving, on the other hand, is a reserve intended for future needs (such as a project or precaution), often temporary and aligned with productive goals. Islam encourages useful savings, but condemns sterile hoarding, as it deprives the economy of vital liquidity and deepens social inequalities.

What is the zakat achoura amount for 2025?

The term "zakat achoura" seems to be a confusion with Zakat Al-Maal (zakat on goods). In 2025, the threshold (Nisab) is set at around €530 (silver base, 595 g) or €7,595 (gold base, 85 g). If your assets have exceeded this threshold for one year (Hawl), Zakat amounts to 2.5% of the market value of your eligible assets (cash, gold, speculative investments, etc.).

What is hoarding?

Hoarding refers to the accumulation of wealth beyond personal needs, without investing it, using it or paying Zakat. It is an act of sterile avarice, condemned by the Koran (Sura At-Tawba, v.34), which deprives the economy of flow and concentrates wealth. Conversely, Islam values ethical investment and sharing, as emphasized by Zakat, which encourages the "fructification" of goods.

What if I have gold but no money to pay zakat?

If you have gold reaching the Nisab threshold (85 g, around €7,595 in 2025) but no cash, you must convert part of it into money to pay Zakat (2.5% of its value). For example, for 100 g of gold, sell around 2.5 g to redistribute it. This obligation is a reminder that wealth must circulate, even if it means parting with a material possession.

What are the advantages of hoarding?

According to Islamic finance, hoarding brings no benefits. It is even seen as a social injustice, as it freezes wealth and fuels speculation. Islam prefers a dynamic economy where every asset generates value or feeds solidarity. Zakat, by taxing inaction, encourages this circular and just vision, unlike capitalism, which values accumulation.

What are the disadvantages of hoarding?

Hoarding has two major impacts:

- Economic: It stifles the flow of money, curbing consumption, investment and job creation.

- Social: It concentrates wealth, leaving the majority without the means to live. Spiritually, it feeds material attachment. Zakat combats these effects by transforming idle money into a lever for justice and growth.

What is the zakat amount for zakat Al Maal 2025?

For 2025, the threshold (Nisab) is based on gold or silver:

- Gold: 85 g (approx. €7,595).

- Silver: 595 g (approx. €530).

If your assets (cash, gold, speculative investments) have exceeded this threshold for one year (Hawl), apply a rate of 2.5% on their total value after deduction of eligible debts.

Can we give zakat to the family?

Zakat may not be given to direct ascendants (parents, grandparents), descendants (children, grandchildren) or spouses. However, a great aunt, a cousin or a distant relative of your family may benefit from it, provided they do not have sufficient resources. The aim is to strengthen social ties without neglecting normal family obligations.

How much is zakat per person in France?

In France, the amount varies according to the Nisab and the value of each individual's capital. If your assets (cash, gold, investments) are worth more than €7,595 (gold) or €530 (silver) and have exceeded this threshold for one year, you pay 2.5% of their value. This calculation also includes deductible debts, such as property expenses or future taxes.