<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

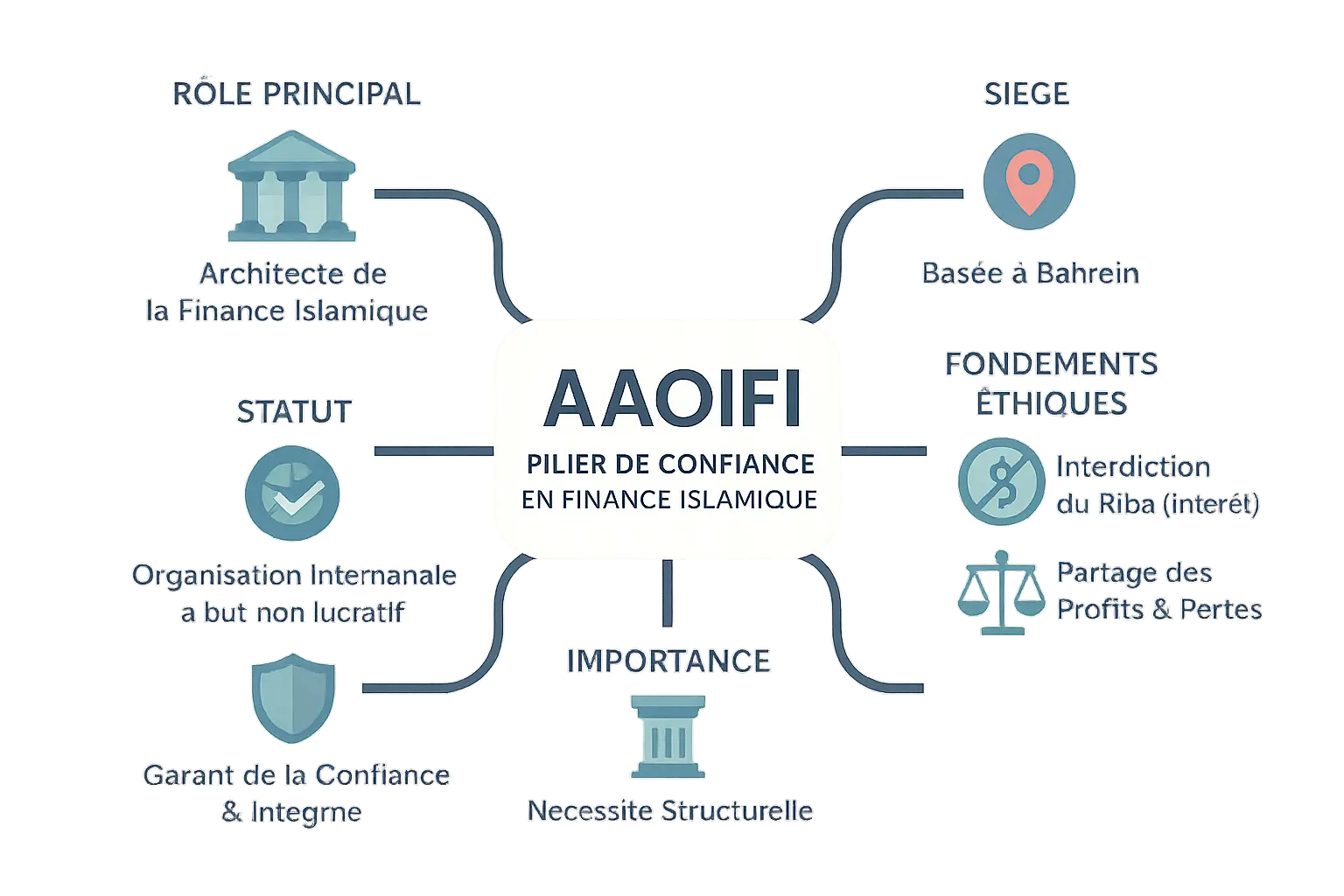

Key points to remember: AAOIFI, based in Bahrain, guarantees that Islamic finance complies with its ethical principles (prohibition of riba, risk sharing). Its standards, adopted in 40 jurisdictions, reinforce transparency and investor confidence. It represents an essential ethical compass for the global harmonization of responsible finance.

Are you wondering about trust in Islamic finance? AAOIFI, the guardian of the industry's ethical and legal standards, embodies a concrete response to a major challenge: how to guarantee the transparency of institutions based on profit-sharing and the prohibition of riba. This report looks at how this organization, much more than an alternative to IFRS, is building a financial architecture aligned with Shariah precepts, while adapting to modern challenges such as Sukuk or FinTech. Discover here the keys to a global harmonization that combines faith, rigor and the future.

Contents

AAOIFI, the pillar of trust in Islamic finance

Like an architect designing a solid edifice, AAOIFI lays the foundations for Islamic finance. Based in Bahrain, this international non-profit organization is much more than just a technical body: it is a structural necessity for preserving an ethical financial system.

Islamic finance is based on two pillars: the prohibition of riba and profit/loss sharing. These principles form a fair model, in which each party assumes risks. AAOIFI guarantees the consistency of this model.

The existence of AAOIFI is not an alternative, but a necessity if Islamic finance is to remain true to its ethical values.

Why does Islamic finance need its own rules?

In contrast to traditional interest-based systems, Islam requires models such as Mudaraba and Musharaka, based on the sharing of results. IFRS standards (economic substance vs. legal form) pose a problem here: in Islamic finance, the legal form of a contract determines its compliance with Sharia law.

Without the appropriate standards, profit-sharing could be interpreted as debt, misleading investors. AAOIFI standards ensure a true and fair view of transactions, enabling savings to comply with Sharia law.

The origins of AAOIFI: a response to a fundamental need

In December 1989, heads of financial institutions gathered in Algiers to launch a visionary project. One year later, on February 26 1990, AAOIFI was born with the signing of a founding agreement.

The organization was finally established in Manama, Bahrain, on March 27, 1991. Behind its technical name - Accounting and Auditing Organization for Islamic Financial Institutions - lay a clear mission: to establish universal standards for a rapidly expanding sector.

The founding members - Islamic Development Bank, Dallah Al-Baraka, Faysal Group, Al Rajhi Banking & Investment Corporation, Kuwait Finance House and Al-Bukhary Foundation - shared a common vision: to create a normative language to standardize and harmonize Islamic finance practices.

Today, this project has resulted in 117 standards covering five areas. Over and above technical standards, this isa confidence-building tool for a booming sector.

A structure designed for compliance and collaboration

AAOIFI embodies a collaborative ecosystem. The General Meeting brings together all members, while three technical councils guide the action: the Accounting Council, the Governance and Ethics Council, and above all, the Sharia Council.

The latter is the spiritual heart of the organization. As the ultimate guarantor of compliance, it ensures that every standard reflects Islamic principles. More than a technical body, it embodies the soul of Islamic finance.

AAOIFI's strength also lies in its diversity: central banks, regulators and experts from over 45 countries form a network that reinforces its international legitimacy and its role as a global harmonizer.

To explore its interactions with other bodies, such as the Majmaʿ al-Fiqh, dialogue remains open on the future of Islamic finance.

How are AAOIFI standards created? A transparent and rigorous process

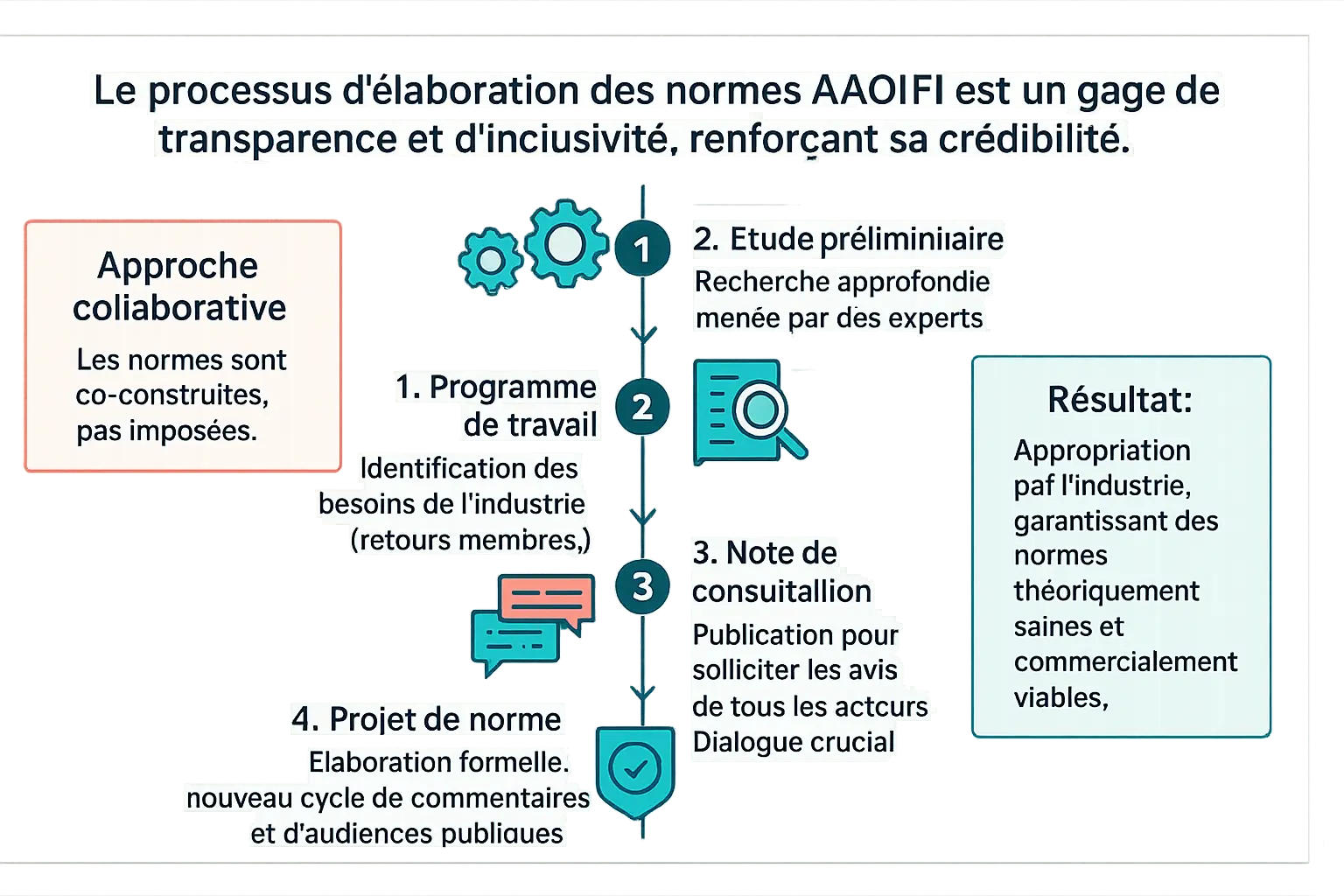

Behind each AAOIFI standard lies a process as methodical as the growth of a tree: carefully prepared soil, solid roots, structured branches. This rigor reflects the core values of Islamic finance - transparency, inclusivity, Sharia compliance - and relies on dialogue with industry players to build shared legitimacy.

The development of a standard follows five clear stages:

- Work program: Priorities emerge from feedback from members (banks, regulators, academics), forming a map of urgent challenges.

- Preliminary study: experts from within or outside the Secretariat take a closer look at the subject, in particular by analyzing the religious foundations for Sharia issues.

- Consultation note: A document summarizing the proposals is submitted to a diverse panel (banks, regulators, academics) for feedback.

- Draft standard: After analysis of the comments received, a draft is published for a further round of comments, comparing theoretical ideas with realities in the field.

- Final standard: Once the feedback has been integrated, the standard is adopted by the relevant council and published as an industry reference.

This collaborative process ensures that standards reflect both theoretical soundness and practical relevance. Professionals see them as tools that are co-constructed, not imposed, encouraging their appropriation. The example of the FAS 3 standard illustrates this dynamic: designed to meet the challenges of the pandemic, it benefited from a specific working group, integrating lessons from the field before being finalized.

By structuring its work in this way, AAOIFI strengthens investor confidence while adapting the ecosystem to contemporary challenges. This ability to unite tradition and innovation enables the organization to guide a growing sector, like a lighthouse guiding ships through modern storms.

AAOIFI vs IFRS: two visions for the same financial world

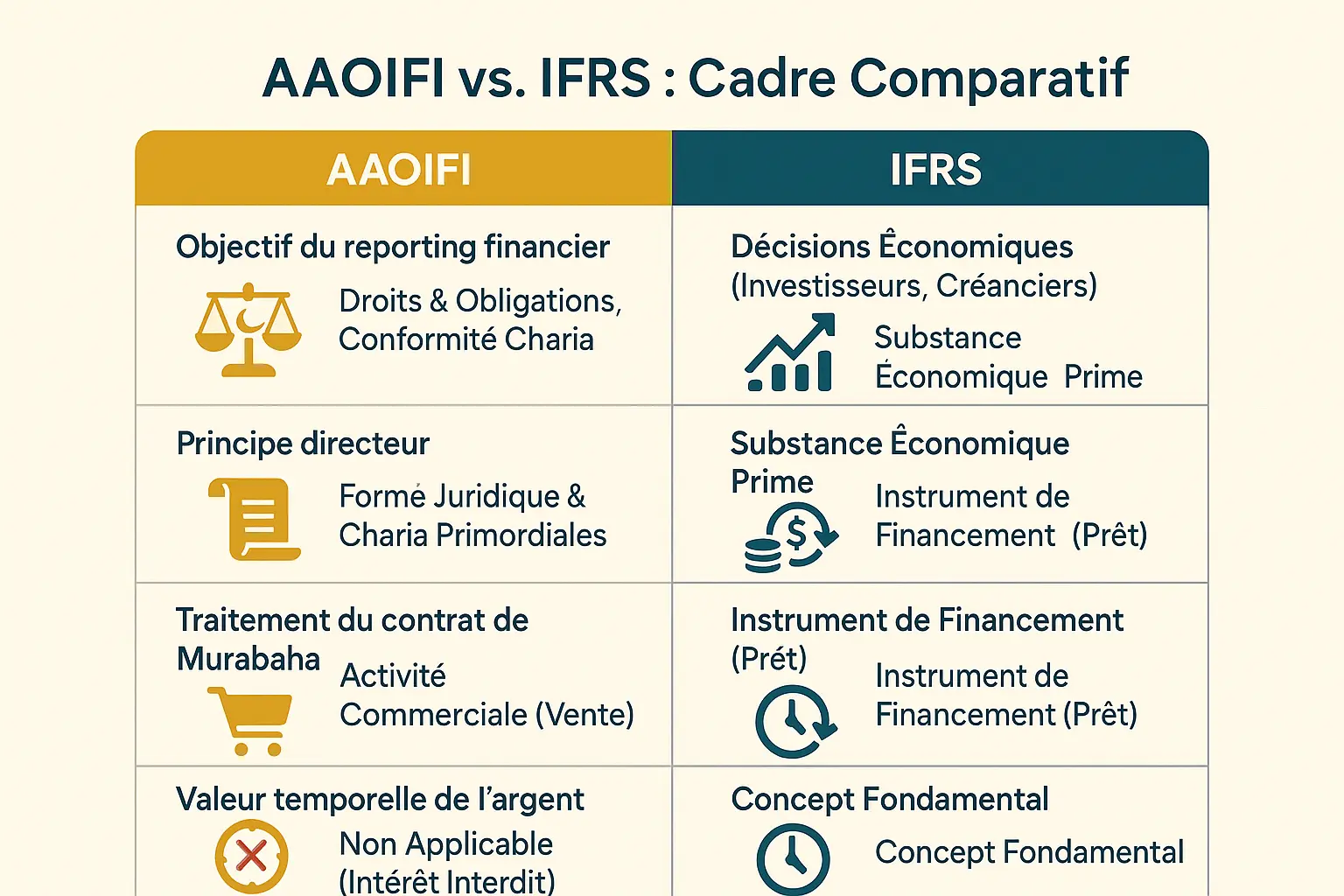

Behind the technical differences between AAOIFI and IFRS lies a fundamental conflict: how to report on financial reality in an ethical manner. As one academic study points out, AAOIFI focuses on the rights and obligations of all stakeholders in compliance with Sharia law, while IFRS aims to inform investors' economic decisions.

Murabaha, the common credit sales contract in Islamic finance, illustrates this divergence. IFRS considers it to be a simple financing instrument, based on its economic essence. AAOIFI, on the other hand, considers this contract to be a commercial activity in its own right, its legal form determining its halal nature.

| Comparison dimension | AAOIFI | IFRS |

|---|---|---|

| Purpose of financial reporting | Provide information on the rights and obligations of all parties, in compliance with Sharia law. | Provide investors and creditors with useful information for economic decision-making. |

| Guiding principle | Legal form and Sharia precepts are paramount. | Economic substance takes precedence over legal form. |

| Time value of money | Not applicable. Discounting and interest rates are prohibited. | Fundamental concept for valuing assets and liabilities. |

| Murabaha contract processing | Considered as a commercial activity (sales). | Recognized as a financing instrument (loan). |

The time value of money marks another divide. IFRS take this into account through the discounting of future cash flows, the cornerstone of their approach. For AAOIFI, this concept is prohibited: making money grow by the mere passage of time violates the prohibition of riba.

These contrasts explain why Islamic banks are fundamentally different. Their ethical mission requires a unique accounting framework, where every transaction reflects concrete values.

AAOIFI's global impact: harmonization on the move

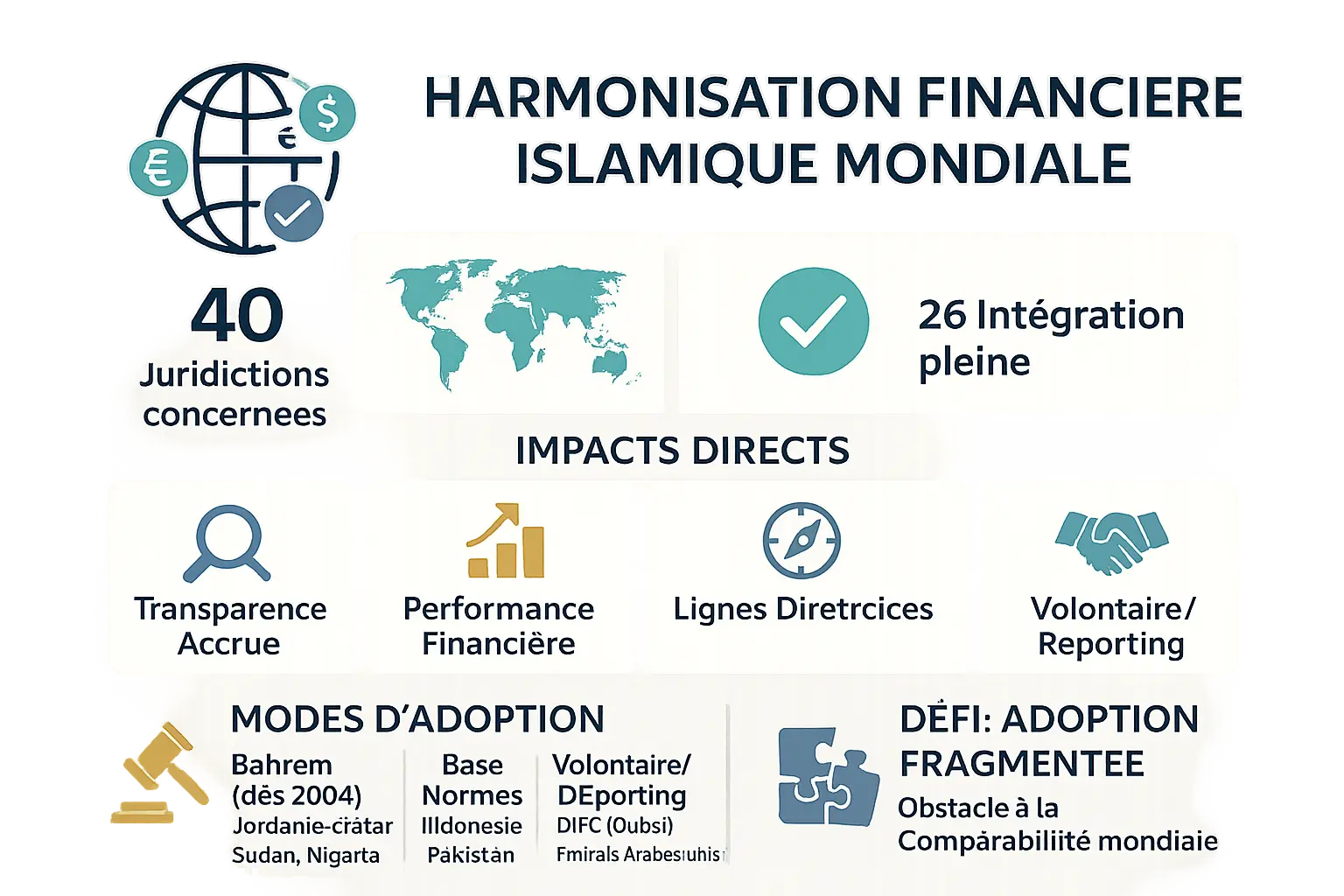

AAOIFI has established an essential reference framework for Islamic finance. Its standards have been adopted, in full or in part, in 40 jurisdictions worldwide, 26 of which apply them on a mandatory basis. This increased dissemination strengthens the transparency of Islamic financial institutions (IFIs) and their financial performance, further enhancing investor loyalty. In Jordan, the strict integration of AAOIFI standards has led to a 15% increase in the number of foreign investments in the Islamic banking sector between 2018 and 2022, illustrating the concrete effect of this regulation.

The adoption spectrum reflects a nuanced reality:

- Mandatory adoption: Bahrain, Jordan, Qatar, Sudan, Nigeria and others. These countries are incorporating AAOIFI standards into their regulations, such as a model made compulsory in Bahrain in 2004 by the Monetary Authority. In Mauritania, this adoption has standardized the calculation of profits in Mudaraba contracts, reducing disputes between partners.

- Basis for national standards: Indonesia and Pakistan, where AAOIFI standards inspire local frameworks. In Indonesia, the National Sharia Council has adapted AAOIFI principles to structure the certification of halal products in the banking sector, guaranteeing 8% annual market growth since 2020.

- Recommended as guidelines: Kuwait, where their application remains voluntary but influential. Major local banks such as Al-Ahli Bank use these standards to attract international investors, particularly Gulf pension funds.

- Voluntary or secondary adoption: DIFC (Dubai) and United Arab Emirates, where they complement existing standards. Sukuk issuers in the DIFC are now required to include a sharia compliance audit to AAOIFI standards, reinforcing the credibility of Islamic financial products.

This heterogeneity raises a major challenge: fragmented adoption. An IFI operating in several countries has to reconcile divergent requirements, complicating the comparability of financial data. For example, an Islamic banking group operating in both Malaysia (where AAOIFI standards guide the guidelines) and the United Arab Emirates (where they are optional) must produce two separate financial reports, increasing compliance costs by 20-30%. This imbalance between global harmonization and national sovereignty illustrates the challenge of universal regulation in an expanding sector.

AAOIFI's momentum lies in its ability to strike a subtle balance between theological rigor and economic adaptability. Malaysia, a pioneer in the integration of AAOIFI standards, has seen its Islamic financial market grow by 12% by 2023, thanks to clear regulations and auditable practices. Similarly, Kazakhstan, which incorporated AAOIFI principles into its banking law in 2021, has attracted $400 million in foreign investment in the halal sector, proving the relevance of the model beyond Muslim borders.

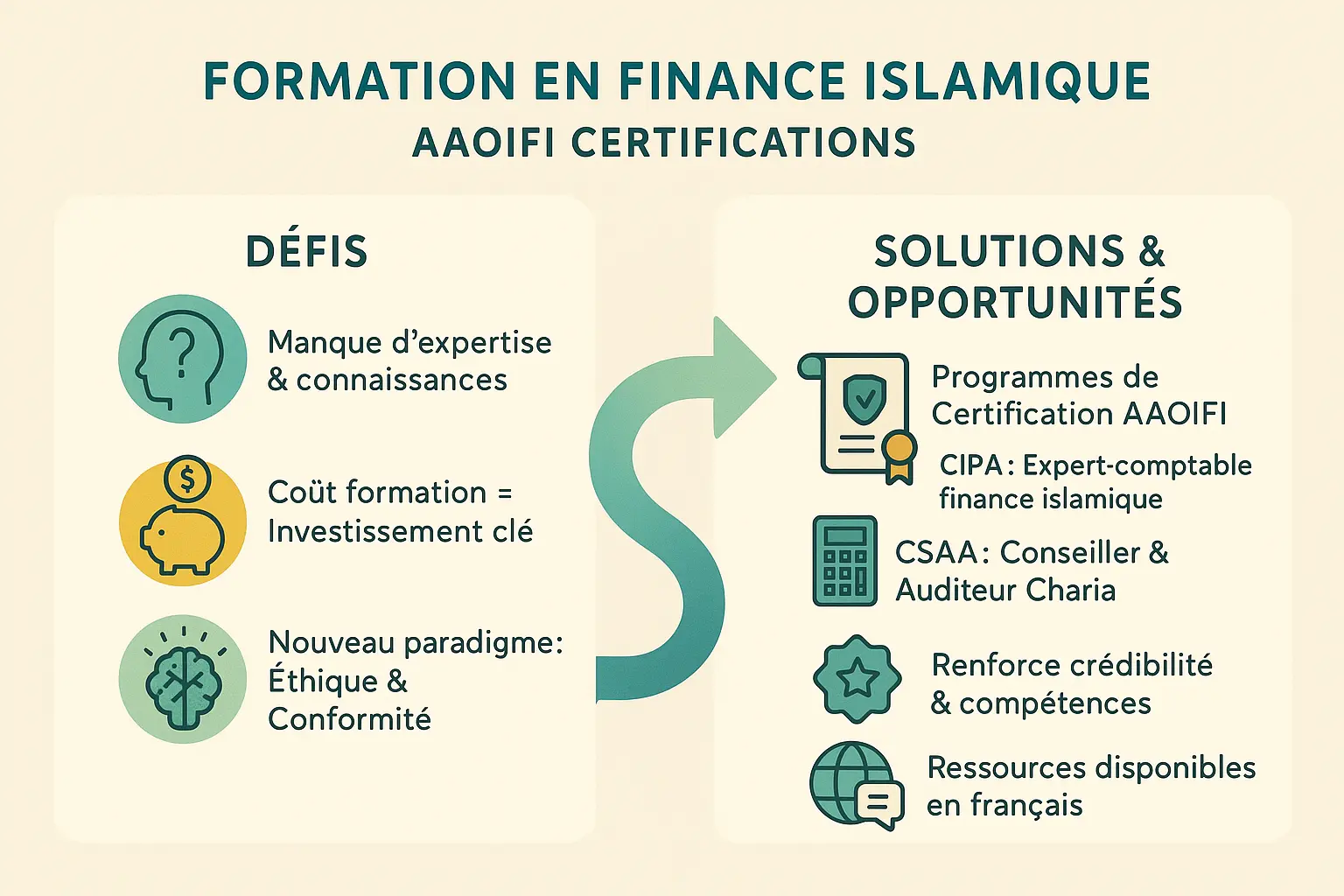

Challenges and opportunities: training in Islamic finance

The lack of knowledge and expertise in Islamic accounting is a major obstacle to the adoption of AAOIFI standards. Professionals must not only learn new rules, but adopt a new paradigm of thinking, rooted in ethics and Shariah compliance. This change, while demanding, represents a unique opportunity for organizations and individuals alike.

To meet this challenge, AAOIFI offers internationally recognized certifications:

- Certified Islamic Professional Accountant (CIPA): Program requiring four modules (accounting, auditing, regulation, Shari'a standards) and practical experience. Ideal for specialized accountants.

- Certified Shari'ah Adviser and Auditor (CSAA ): Certification for Shari'ah advisers and auditors, with an exam in English or Arabic.

Des centres comme l’Association marocaine d’économie islamique offrent un accompagnement structuré. En 2025, les examens auront lieu en juin et décembre.

For French-speaking audiences, 20 Shari'a standards were translated into French in 2011, with a project to translate all 54 standards underway. Accessible via the official website, these resources facilitate access for players in the Maghreb and sub-Saharan Africa.

By overcoming these obstacles, AAOIFI not only regulates, it also builds a solid ecosystem. Its certifications are becoming levers of confidence for a booming sector, as evidenced by its adoption in 40 jurisdictions. Training here is neither a cost nor an obligation, but an investment in the ethical future of global finance.

AAOIFI faces the future: between innovation and integrity

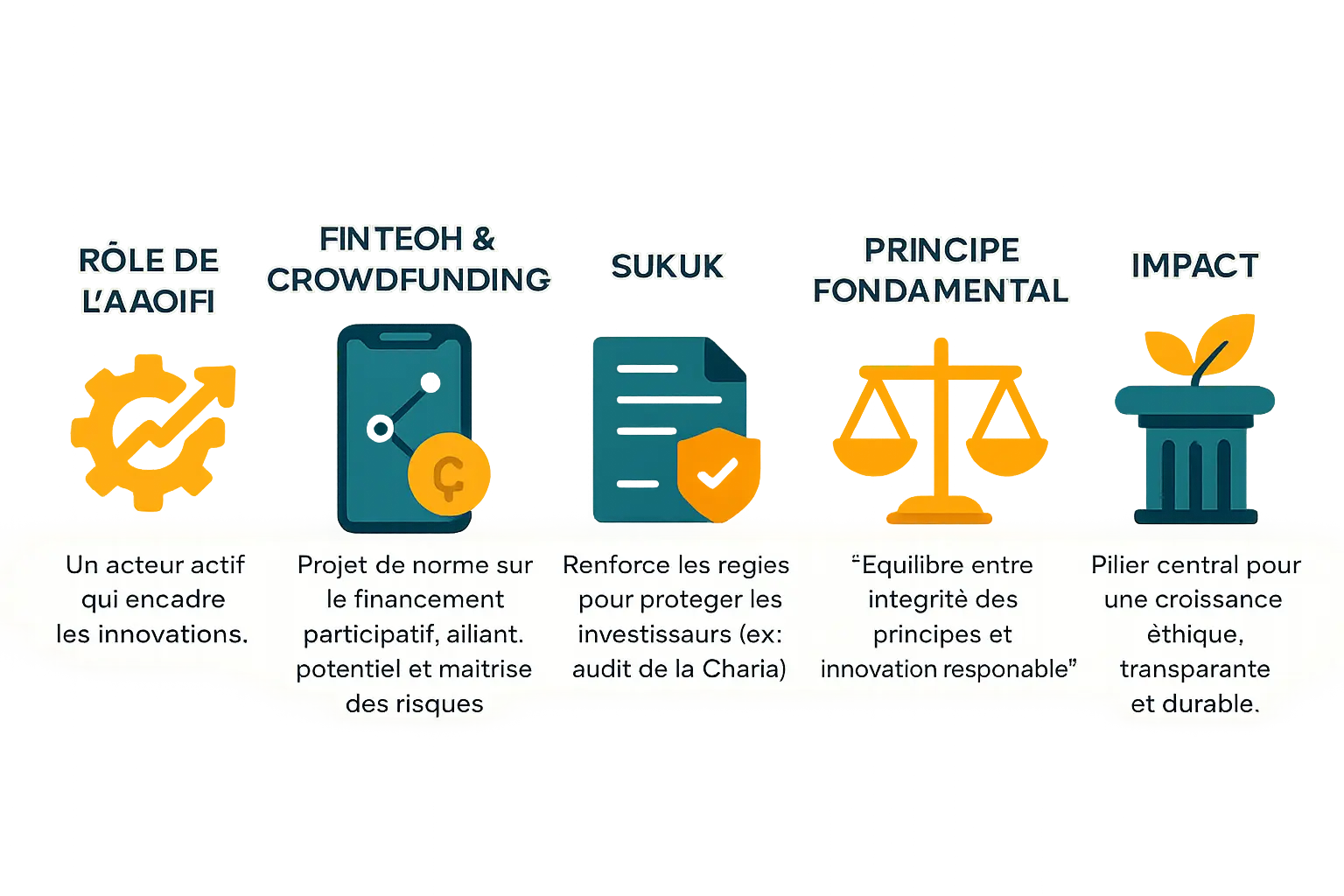

The AAOIFI not only observes developments in Islamic finance, but also takes an active role in guiding innovations while preserving the essence of Islamic principles. This commitment is reflected in concrete initiatives that combine modernity and Sharia compliance.

A telling example is its work on FinTech. The AAOIFI has developed a draft standard specifically for Islamic crowdfunding, illustrating its commitment to supporting this alternative mode of financing. This normative framework recognizes the sector's potential, while specifying the safeguards needed to ensure its compliance with Sharia law.

Another striking illustration is the tightening of requirements around Sukuk, the Islamic financial certificates. AAOIFI has revised its FAS 29 accounting standard to require a mandatory Sharia audit, ensuring that these instruments are not disguised debts. This protects investors while ensuring market transparency.

To better understand this normative framework and its practical implications, you can explore this halal investment guidewhich illustrates how these principles translate into practice.

AAOIFI's future role is to strike the right balance between maintaining the integrity of its principles and facilitating responsible innovation in Islamic finance.

With these actions, AAOIFI is asserting itself as a central pillar of the sector, ensuring that the growth of Islamic finance remains rooted in ethical, transparent and sustainable values. AAOIFI's role goes beyond the technical: it enables the industry to develop while remaining true to its fundamentals, and meeting contemporary economic expectations.

AAOIFI, the guardian of ethical finance, unites tradition and modernity through clear standards. It guides the transparent Islamic finance. His future challenge ? Combining innovation and principles a fair, sustainable system rooted in human values.

FAQ

What are the AAOIFI standards?

AAOIFI issues 117 standards structured into five key categories: Shari'ah standards (for Islamic compliance), accounting standards (for accurate financial statements), auditing standards (to verify compliance), governance standards (for responsible management) and a code of ethics (for honest practices). These standards guide Islamic financial institutions (IFIs) in transparency, ensuring that their operations faithfully reflect Sharia principles such as profit and loss sharing, and prohibit concepts such as traditional interest rates.

What is AAOIFI?

AAOIFI, or Accounting and Auditing Organization for Islamic Financial Institutions, is an international organization based in Bahrain, founded in 1990. It serves as the architect of Islamic financial standards, harmonizing the practices of IFIs worldwide. Its role is crucial: it is not an alternative to conventional international standards (such as IFRS), but a necessary response to the specificities of Islamic finance, where the legal form of contracts takes precedence in order to comply with Sharia law. Think of it as an ethical guide, ensuring that your investments remain aligned with your values, without compromising on transparency.

What are the 4 ISO standards?

ISO (International Organization for Standardization) standards are not covered by AAOIFI. They belong to a general quality, environmental or safety management framework (such as ISO 9001 for quality or ISO 14001 for the environment). AAOIFI focuses on Shari'ah, accounting, auditing and governance standards specific to Islamic finance. If you're looking for information on ISO standards, these are based on a different, universal logic, not linked to religious principles.

What are the IFC standards?

The notion of "IFC standards" can be confusing. The AAOIFI does not specifically mention an IFC (perhaps a reference to Islamic Financial Institutions). Instead, its standards detail the so-called Shari'ah Standards and good accounting, auditing and governance practices for these institutions. These rules ensure that IFIs operate with integrity, avoiding non-compliant debt and promoting risk sharing. They have been adopted in countries such as Jordan and Pakistan, and serve as a benchmark in jurisdictions such as Dubai's DIFC.

What are the 5 pillars of Islamic finance?

Islamic finance is based on five essential pillars: 1. Prohibition of riba (interest): No fixed rate can be applied, favoring models such as Mudaraba (profit-sharing). 2. Profit and loss sharing: Risks and profits are shared between the parties. 3. Shari'ah compliance: All activities must comply with Islamic precepts, verified by Shari'ah committees. 4. Transparency: Contracts must be clear and unambiguous (Gharar forbidden). 5. Ethics and responsibility: Investments in sectors such as arms or alcohol are prohibited. These pillars form a just finance, where trust and sustainability guide every decision.

What is the IASB's role?

The IASB (International Accounting Standards Board) is the body that draws up the International Financial Reporting Standards (IFRS). These standards, used worldwide, focus on the "economic substance" of transactions, which may conflict with AAOIFI. For example, IFRS allows the discounting of future cash flows (linked to interest rates), which is prohibited in Islamic finance. The IASB targets universality, while AAOIFI adapts the rules to the specificities of Shari'ah, such as treating the Murabaha contract as a commercial activity, not as a simple loan.

What is Ifric's role?

The Ifric (Interpretations Committee) is an IASB committee tasked with resolving ambiguities in the application of IFRS. It has no direct link with the AAOIFI, but its approach contrasts with that of the latter. Ifric favors technical interpretations for global markets, whereas AAOIFI integrates an ethical and religious dimension. For example, when it comes to Sukuk (Islamic certificates), Ifric follows IFRS in seeing them as financing instruments, while AAOIFI requires a Shari'ah audit to guarantee compliance. These two bodies embody two visions: one economic, the other holistic and normative.