<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

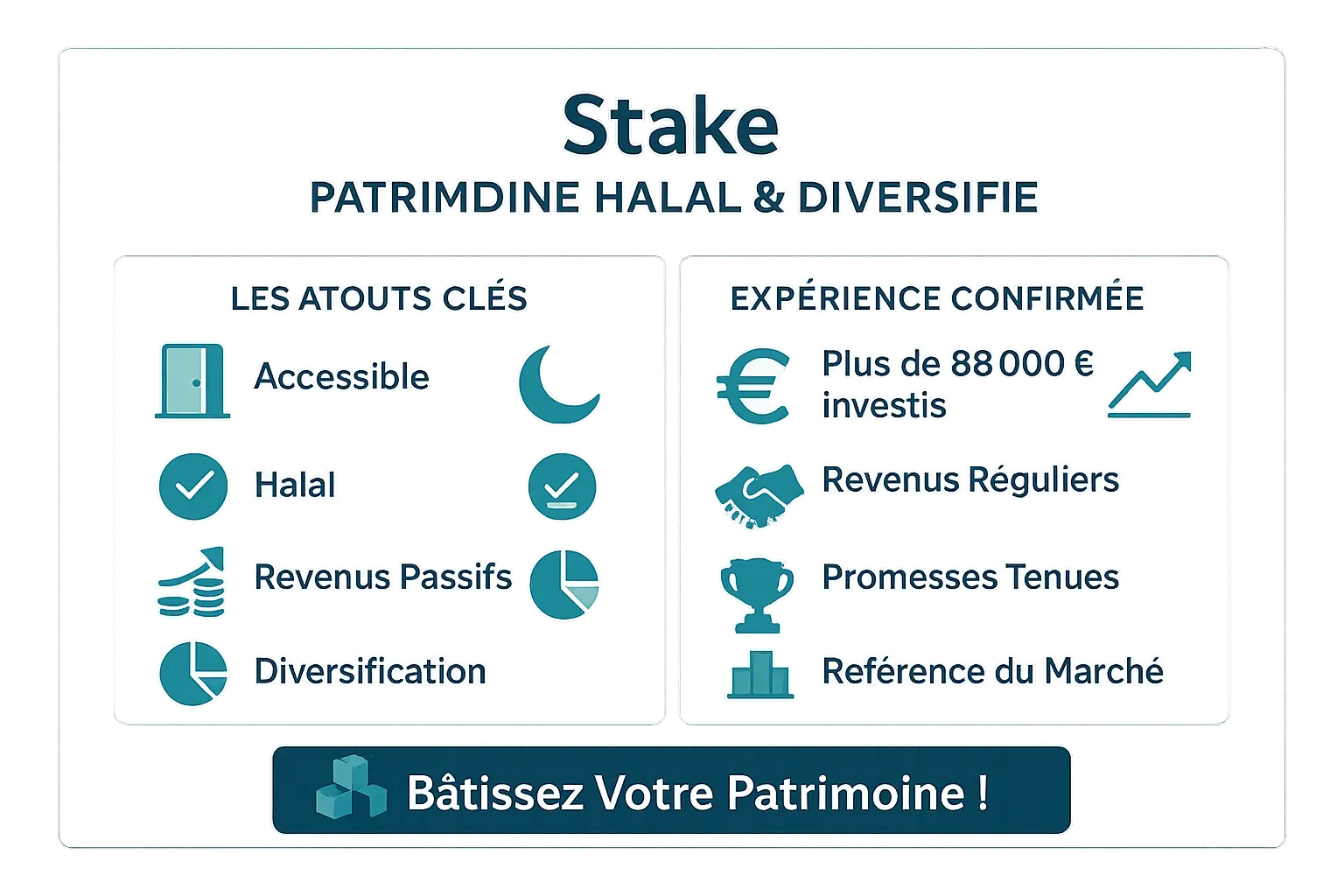

Key facts: Stake offers simple, ethical access to halal real estate in Dubai and Saudi Arabia, from as little as $150. Thanks to DFSA/CMA regulation and the total absence of riba, you generate monthly rents (5.40% yield in 2024) and benefit from market growth. My investment of €88,000 is testimony to the reliability of a platform that combines yield, security and Sharia compliance.

Fatigué de chercher un investissement immobilier rentable et halal sans tomber dans les pièges du riba ou les frais opaques ? Découvrez mon expérience et avis Stake, la plateforme qui permet d’investir dès 50 € dans des biens à Dubaï, avec un retour sur investissement tangible et des loyers versés chaque mois. Avec plus de 88 000 € investis et un portefeuille diversifié, explorez comment cette solution innovante ouvre les marchés stratégiques de Dubaï et de l’Arabie Saoudite, en alignant profit et valeurs. Profitez de la transparence des frais et des nouvelles opportunités comme la rénovation pour maximiser la plus-value, tout en bénéficiant d’une gestion simplifiée et sécurisée.

Contents

My story: why I invested over €88,000 in Stake

There was a time when halal real estate seemed out of reach. Finding a profitable investment, in line with my Islamic values and without complex administrative management, was a challenge. Conventional options involved opaque fees, high risks or prohibitive amounts. That's when I discovered Stake, a platform that transformed my vision of investment.

Stake immediately impressed me with its ethical rigor. Based in the United Arab Emirates, the platform is regulated by the DFSA, guaranteeing a solid legal structure. Most importantly, there is no riba. In a sector where interest is commonplace, this detail was decisive. Fees are transparent - 1.5% on acquisition, 0.5% annually - and ownership documents are verifiable, reinforcing confidence.

Today, my Stake portfolio exceeds €88,000. Every month, I receive my rents effortlessly, and the appreciation of the assets strengthens my capital. In 2024, the average rental yield was 5.40%, with an overall rate of 10.1% including asset appreciation. These figures are not promises, but concrete results that I have seen become reality.

This experience proved to me that participative real estate investment can be profitable, secure and halal, perfectly aligning my financial objectives and my personal convictions.

For those hesitating to take the plunge, here's a concrete opportunity: 👉 Invest now and receive 150 AED free thanks to this link. The platform also offers purchase-renovation-resale or rental strategies, with a gradual expansion into Saudi Arabia, a fast-growing strategic market.

For those looking to build a sustainable legacy, I'm sharing this video where I explain 👉 You can find a video where I invest live on Telegram. Real estate in Dubai has never been so accessible, and Stake proves that it's possible to combine profit and ethics in a world where transparency remains rare.

Résumé de notre avis Stake

Stake offers halal participatory real estate investment accessible from as little as 150 USD, with shares in properties in Dubai and Saudi Arabia. Regulated by the DFSA and CMA, the platform guarantees Sharia compliance, monthly rental income and transparency. Ideal for combining ethical values with potential returns in dynamic markets.

👉 Invest now and receive 150 AED free with this link.

| Benefits | Disadvantages |

|---|---|

| ✅ 100% Sharia-compliant investment | ❌ Limited liquidity (exit windows) |

| ✅ Access from 150 USD | ❌ Risk of real estate fluctuations |

| ✅ DFSA/CMA regulation | ❌ Dependence on Stake management |

| ✅ Monthly passive rental income |

Returns emphasize the reliability and regularity of rents, but yields depend on the market. To align savings and convictions, Stake offers a structured and ethical framework.

👉 Discover a live investment video on Telegram.

What exactly is Stake? Participatory real estate investment for everyone

Stake reinvents real estate investment through a collaborative model. Imagine buying a brick in a building: instead of acquiring a complete property, you become the owner of a fraction with other investors. This approach democratizes access to luxury real estate in Dubai and Saudi Arabia, removing traditional barriers to entry.

The platform acts as a trusted intermediary. It selects high-yield properties, manages rentals and renovations, then redistributes the monthly rents. The equivalent of a modern real estate fund, accessible from as little as 500 AED (around €130). Each operation strictly adheres to the principles of Islamic finance, eliminating any risk of riba. Ownership documents, such as DIFC certificates in Dubai or DLD titles, guarantee absolute transparency.

"You solve that problem of not having to explore too many different investment opportunities, while still having the ability to invest with just a few clicks."

The process takes place in 3 simple steps: secure registration, selection of a property from available opportunities, and instant investment. Your rental income automatically accumulates in your Stake account. Regulation by the DFSA (Emirates) and the CMA (Saudi Arabia) guarantees the solidity of the system. Liquidity windows every six months enable you to resell your shares to other investors, adding a flexible dimension to this investment.

Investing in Stake now offers access to a dynamic real estate market, with an average yield of 10.1% in 2024. This solution combines ethics and profitability, in line with the values of Namlora, the Islamic investment ecosystem that places spirituality at the heart of economic exchanges while valuing responsibility.

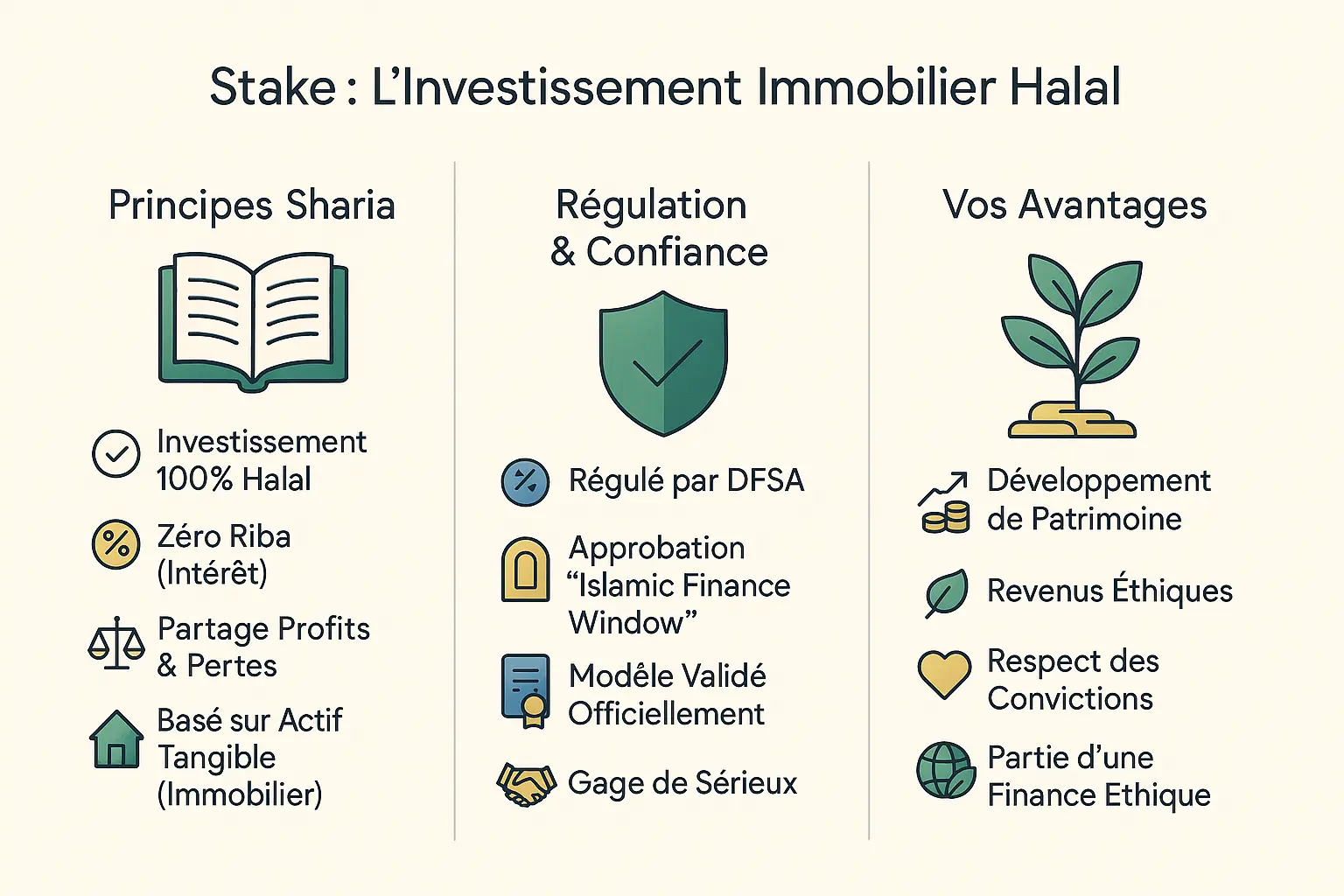

Halal compliance: the cornerstone of Stake investment

Investing with Stake means choosing a certified halal investment platform. Each transaction rigorously excludes riba (usurious interest), favoring models based on the sharing of profits and losses linked to tangible assets. This approach reflects the principles of Islamic finance: transparency, fairness and ethics. For Muslims, it's the guarantee of an investment aligned with their values, whether it's an apartment in Dubai or a project in Saudi Arabia, a strategic market recently opened up by the platform.

Stake's solidity is underpinned by a demanding regulatory framework. The platform is supervised by the Dubai Financial Services Authority (DFSA) and holds Islamic Finance Window certification, proof of validation by a recognized financial authority. This dual guarantee - legal expertise and religious compliance - reassures investors that our processes are rigorous. As one user puts it: "Liquidity in real estate can be difficult, but Stake makes it easier". For my part, I have invested over €88,000 via Stake, and my regular monthly rents testify to the reliability of the model.

For the Muslim community, Stake embodies a revolution: investing without compromise. It's a tool for building wealth in line with one's convictions, while generating regular rental income. This vision is in line with the ambition of an ethical financial ecosystem, like the one promoted by Namlora, which places justice and transparency at the heart of the economy. From acquisition-resale with renovation to renovated acquisition-rental, Stake offers concrete solutions to enhance your capital. By choosing Stake, you become part of a model where faith, responsibility and growth come together.

Stake's key features for capital growth

Classic rental investment in Dubai

With Stake, you can acquire shares in residential real estate in Dubai from as little as AED 500. This classic model guarantees two tangible benefits: regular monthly rents and capital appreciation linked to growth in the local real estate market. In 2024, the average rental yield was 5.40%, with an overall return on investment of 10.1%. An investment of €88,000, like mine, generates passive income while benefiting from rising prices, supported by flagship projects such as Dubai Creek Harbour and Expo City.

New diversification strategies: renovation and added value

Stake expands its opportunities with innovative strategies. Here are the available options:

- Buying, renovating and reselling: Buying a property to renovate for rapid added value through targeted work.

- Buying, renovating and letting: Transforming an old property to increase its rental value through energy or aesthetic improvements.

These approaches multiply sources of income. For example, an energy-efficiency renovation can improve the building's EPD rating and justify a higher rent, while reducing long-term costs. This meets the expectations of modern tenants and maximizes profitability.

Geographic expansion: the Saudi market and beyond

Stake expands into Saudi Arabia, a strategic market regulated by the Capital Markets Authority (CMA). This opening enables Stake to diversify its portfolio geographically, taking advantage of the Saudi real estate recovery. In 2024, sales in Riyadh jumped by 77%, and tax incentives (30-year exemptions) are attracting investors. To see these opportunities in action, 👉 you can watch a video of me investing live on Telegram.

Advantages and disadvantages of Stake

| Benefits | Disadvantages |

|---|---|

| Compliance with Islamic principles (absence of riba). | No fixed return guarantee. |

| Access from 500 AED, ideal for small budgets. | Dependence on local real estate fluctuations. |

| Full transparency on costs and ownership documents. | Withdrawals only possible via bi-annual exit windows. |

To get started, 👉 invest now and receive 150 AED free through this link. Stake combines ethics and performance, putting trust and sustainability back at the heart of every transaction.

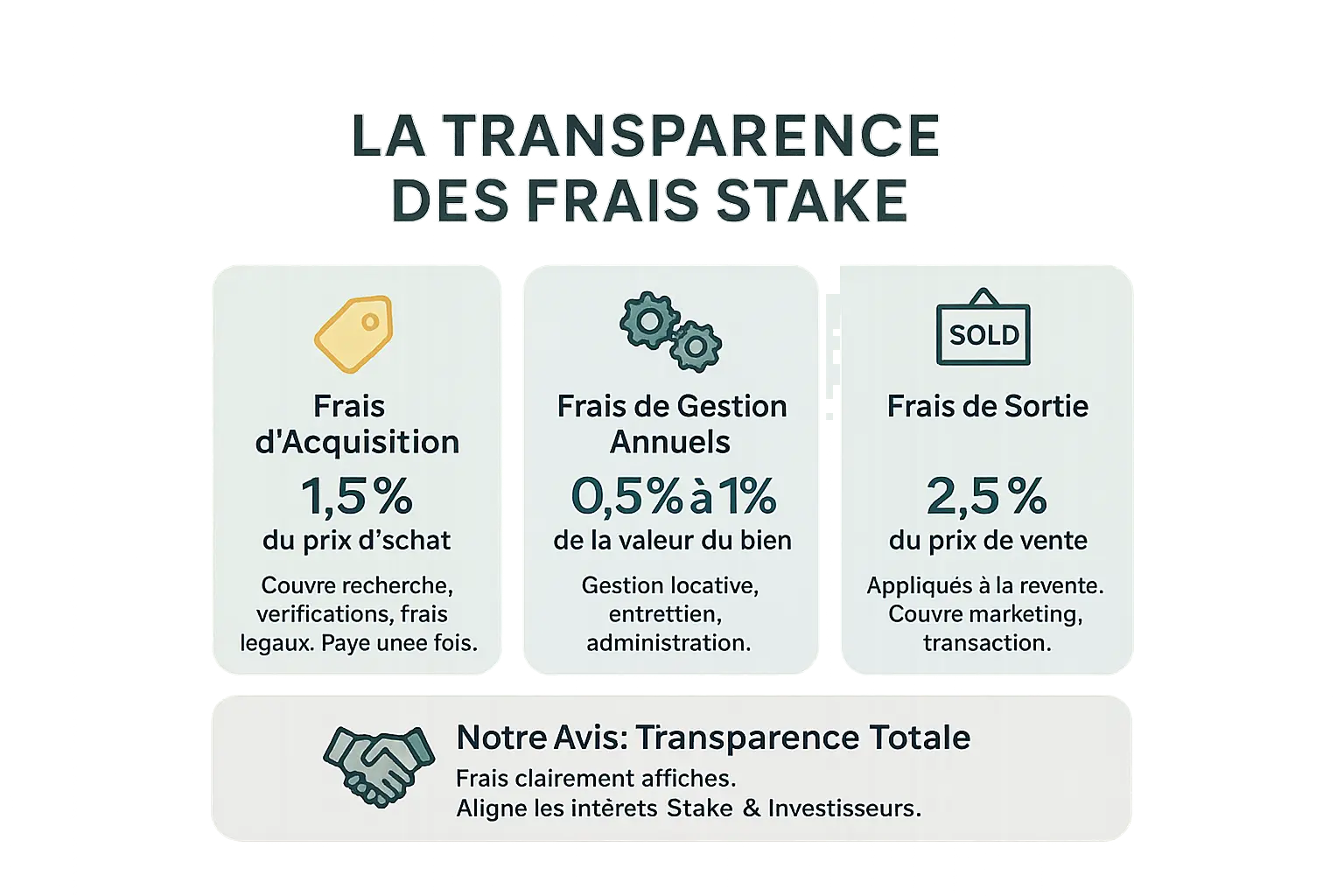

Rates and fees on Stake: appreciable transparency

Stake offers a model with no recurring fees. The platform is remunerated solely on transactions carried out, aligning its interests with those of investors. A detailed, predictable structure for assessing the profitability of each investment.

| Type of charge | Percentage (indicative) | Description |

|---|---|---|

| Acquisition costs | 1.5% of purchase price | Covers property search, legal verification, notary fees and structuring. Paid only once. |

| Annual management fee | 0.5 to 1% of property value | Rental management, maintenance, tenant communication and administrative tasks. |

| Exit fees | 2.5% of sales price | Marketing and resale transaction costs. |

👉 Investis dès maintenant et reçois 150 AED offerts grâce à ce lien.

Our opinion on Stake's fees

Transparency is a major asset. Every fee is clearly displayed prior to investment, with no hidden commissions. This model favors responsible management: Stake thrives if the properties increase in value and generate rental income.

👉 Check out my live investment video on Telegram to understand these fees in a halal strategy.

Stake: for what type of investor?

Muslims wishing to invest in compliance with Sharia law will find a suitable solution in Stake. The platform offers interest-free(riba) investors, with "Islamic Window" approval from the DFSA. Every transaction is backed by real assets, ruling out excessive speculation(gharar). Prohibited sectors (alcohol, gambling, etc.) are systematically avoided, reinforcing Islamic ethics. 👉 Invest now and receive 150 AED free thanks to this link.

Beginners or cautious investors will appreciate thesimplified access to real estate. From as little as AED 500 (approx. USD 150), you can own shares in Dubai properties. Management is delegated to the Stake team, avoiding the constraints of direct rental. As one user points out, "the application makes it possible to own a share of property in just a few clicks". This simplicity appeals to those looking to diversify without prior expertise.

For those already invested, Stake offers a gateway into international real estate. Units in Dubai or Saudi Arabia generate monthly passive income. With an average yield of 10.1% in 2024 (5.40% rental income and 5.48% appreciation), this strategy appeals to expatriates. Dubai's dynamic market, combined with strict regulations (DFSA and CMA), ensures a secure framework. 👉 You can find a video of me investing live on Telegram.

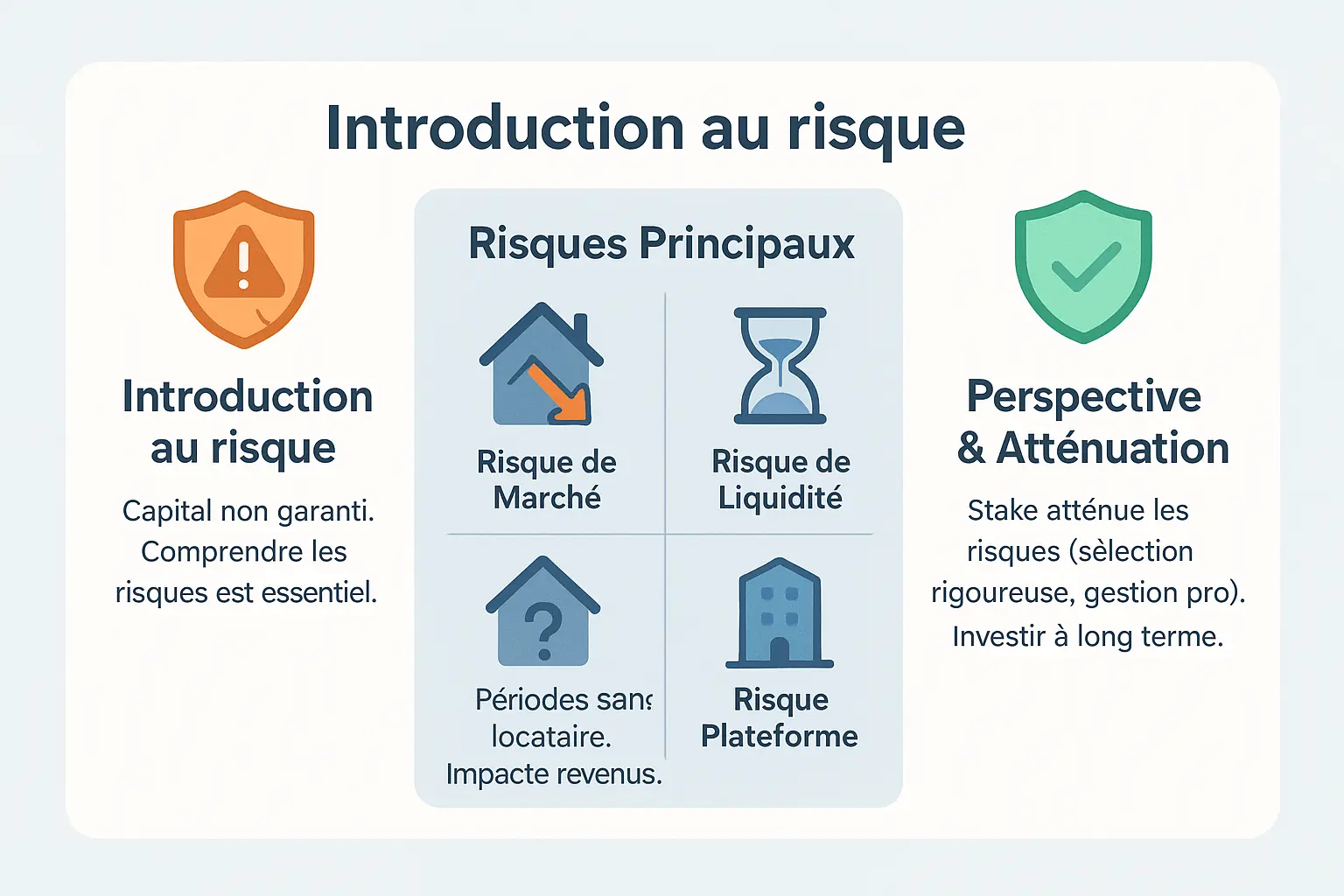

Risks and drawbacks to be aware of before investing

Like all investments, Stake is not without risk. The capital invested is not guaranteed, and it is essential to understand the potential challenges before taking the plunge. Real estate in Dubai or Saudi Arabia, while dynamic, is still influenced by external factors that can affect profitability.

- Market risk: Fluctuations in Dubai real estate prices can lead to a fall in the value of your units on resale. An unfavorable economic climate or a drop in rental demand has a direct impact on your capital.

- Liquidity risk: Unlike shares, your Stake units are not immediately liquid. Resale takes place via "exit windows" organized every six months, which can tie up your funds for several years.

- Vacancy: A property can remain unoccupied for months, temporarily reducing your income. This is often due to a poorly calibrated rent or a less attractive location.

- Platform dependency: Your investment depends on Stake's sustainability and management. Poor governance or legal difficulties could jeopardize your gains.

To mitigate these risks, Stake rigorously selects its properties and offers professional management. Properties are chosen for their rental potential and stability. However, it is crucial to invest onlymoney that you can let work over the long term. Diversification also remains a lever for reducing the impact of any failure.

To find out more about the basics of investment, including ethical and halal principles, you can read this detailed article.

What do our users think? Customer reviews on Stake

On Trustpilot, Stake has an average rating of 3.9 stars, with over 12,620 reviews. Feedback particularly highlights the application's ease of use, transparency of operations - including compliance with Islamic principles - and the platform's reliability, backed by strict regulation (DFSA in the Emirates, CMA in Saudi Arabia).

Here are a few concrete testimonials:

- "I really enjoyed using the application! Being able to acquire a share of property with a simple button is an innovative concept." - Venus

- "Thanks to Stake, I receive my rental income every month. It's accessible, clear and secure." - Muhammad Waqas Ahmad

- "Mohammed Burhan helped me with precise answers. It's reassuring." - Dakota Woods

- "Stake is the best real estate investment platform. Starting from AED 500, it's simple and rewarding with minimal effort." - Christopher Madtha

For Dan, an investor, liquidity in real estate is no longer an obstacle:

"Liquidity in real estate is sometimes difficult, but with Stake's exit windows, life is so much easier if you want to sell some shares. These windows, organized every six months, allow you to resell your shares to other investors, without an intermediary."

👉 Invest now and receive 150 AED free with this link.

Final opinion: Stake, the right choice for a diversified halal real estate portfolio?

Stake redefinesreal estate investment for followers of Islamic finance. Regulated by the authorities of the Emirates and Saudi Arabia, the platform offers property shares from as little as AED 500, with no riba. Returns combine rental income (5.40% in 2024) and capital appreciation (10.1% in 2024), with liquidity facilitated by half-yearly exit windows. "These windows simplify liquidity," confirms investor Dan. On Trustpilot, the platform is praised for its transparency and responsiveness.

Having invested more than €88,000 via Stake, I can vouch for its reliability. My rents are accumulating monthly, and the expansion into Saudi Arabia is opening up opportunities in strategic markets. Unlike volatile investments, Stake combines stability and ethics, with verifiable assets (DIFC/DLD certificates). For the Muslim community, it's a benchmark: "The simplest, most reliable platform," sums up Mohammed Alkanderi. Explanatory videos on my Telegram channel show how to get started in just a few clicks.

L’immobilier halal à Dubaï est désormais accessible. Investir sur Stake dès maintenant vous permet de démarrer avec un bonus de 150 AED. Avec un marché immobilier de Dubaï en hausse de 18 % en 2024, Stake allie rendement, conformité et simplicité pour un investissement éthique et pérenne.

Stake incarne une révolution dans l’investissement immobilier halal, alliant accessibilité, transparence et respect des valeurs islamiques. Avec ses rendements passifs, sa régulation solide et son ouverture à des marchés dynamiques, elle offre une opportunité unique de construire un patrimoine éthique. Pour un démarrage immédiat, saisissez votre chance via ce lien et alliez rentabilité financière et convictions personnelles.

FAQ

Is participatory real estate financing halal?

Participatory real estate investment can be fully halal when it follows the principles of Islamic finance. On Stake, for example, investments are structured to avoid riba (interest) and respect Sharia compliance, validated by DFSA regulation. When you buy shares in tangible assets in Dubai or Saudi Arabia, you share profits and risks as in an ethical partnership, with no prohibited clauses.

What's the best investment in Dubai?

For the value-conscious Muslim, participatory real estate via Stake stands out. With a minimum capital of 500 AED, you become the owner of shares in residential or commercial properties, generating monthly rents and long-term value enhancement. Dubai offers a dynamic market, reinforced by expansion into Saudi Arabia, combining regulatory security (DFSA/CMA) and profitability. It's a choice in line with your convictions and wealth objectives.

How profitable is real estate investment in Dubai?

Returns on Stake combine two levers: regular rents (5.4% average rental yield in 2024) and potential capital gains linked to property appreciation. In 2024, the average overall yield was 10.1%. Added to this is the possibility of capturing rapid gains through purchase-renovation-resale. Of course, results vary according to location and management, but the double effect of rents + appreciation provides a solid base.

How can I invest in real estate in a halal way?

The key is to ensure that the investment is riba-free and based on tangible assets. Stake offers a turnkey solution: buy shares in property in Dubai or Saudi Arabia, without bank interest. The DFSA/CMA-regulated platform simplifies the process. It's like building your wealth brick by brick, with the serenity of following the Sunna of ethical investment. And with a modest sum, you can start to grow your capital.

What are the disadvantages of equity crowdfunding?

Like any investment, real estate crowdfunding has its limits. Liquidity is lower: the resale of your shares depends on exit windows, not immediate liquidation. You're also dependent on the platform's management - a poor strategy or unforeseen event on the property can affect your gains. Finally, the real estate market remains sensitive to economic fluctuations. But on Stake, these risks are mitigated by rigorous property selection and solid regulation.

What are the risks of investing in participative financing?

The major risks are market risk (falling prices), temporary rental vacancy, and the length of the holding period (2 to 5 years on average). For example, if a property remains unoccupied for several months, your income will be reduced. The sustainability of the platform itself is another factor to consider. However, Stake limits these risks by locating properties in profitable areas and by proactive management, like a gardener pruning dead branches to preserve growth.

Is it a good idea to invest in Dubai?

Dubai remains one of the world's most dynamic real estate markets. Thanks to its extensive infrastructure, economic diversification and open-door policy, the city is attracting investors and residents alike. By choosing Stake, you can benefit from this growth without the hassle of rental management. My own investment of €88,000 testifies to the reliability of the model: stable monthly rents and growing capital. It's a rare opportunity to align your finances with your values.

What is the ideal monthly budget for living in Dubai?

This question is more relevant to residents than investors. As a remote owner via Stake, you don't have to worry about the local cost of living. Your budget depends on your ability to save for your investment, with USD150 enough to get you started. It's an ideal lever for those who want to earn rent from the Gulf without moving, like planting a tree and reaping the rewards remotely.

How can I find an investor in Dubai?

Stake eliminates the need to look for a partner: the platform acts as an intermediary, linking investors from all over the world around a common asset. It's like pooling your savings with others to buy a building, without the legal complications. If you're looking to invest yourself, Muslim networks or co-investment platforms are good places to start. But Stake offers a clear and secure solution, avoiding complex negotiations.