<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

In a nutshell? Dubai 2025 marks the end of unbridled speculation in favor ofa mature market offering average rental yields of 6.9%, higher than London or New York. For Muslim investors, riba-free solutions, such as interest-free payment plans, combine high returns with Islamic compliance, with an entry ticket starting at €160,000 for an apartment.

Dubai immobilier en 2025 : entre maturité et opportunités halal cache-t-il des pièges pour l’investisseur musulman ? Alors que le marché offre un rendement locatif de 6,9 %, bien au-delà de Londres ou New York, comment concilier croissance patrimoniale et éthique islamique ? Villas (+20 % en un an), appartements dès 160 000 €, projets « off-plan » avec paiement échelonné : explorez des stratégies sans riba. Découvrez comment Muslimimmobilier rend accessibles ces opportunités, en évitant pièges comme la sur-offre ou frais annexes, pour un investissement aligné sur vos valeurs et l’avenir de Dubaï.

Contents

Dubai 2025: the end of speculation, the beginning of mature investment

Dubai's real estate market is entering a new era. Gone is the euphoria of the post-pandemic years, marked by dizzying price rises. By 2025, the figures speak of a mature, balanced market: AED 51.1 billion in sales in February, with prices stabilizing after 27.5% growth in 2024. An evolution that opens up real opportunities, provided we understand the rules of the game.

Why is this maturity a unique opportunity? Because it rewards investors looking for security and practicality. Ready-to-live-in properties are skyrocketing, developers are adapting their offers, and rental yields remain among the highest in the world. But for Muslims, a crucial question is how to take advantage of this dynamic without falling into the riba trap.

This guide will help you make the transition. You'll discover :

- How real opportunities lie in the right zones and segments

- Why riba-free alternatives exist and are emerging

- How smart investors navigate villas, apartments and off-plan to maximize their capital

In 2025, investing in Dubai means choosing the right balance between yield and value. Ready to seize this opportunity?

A record market entering a phase of stabilization

Figures that speak for themselves: healthy growth in 2025

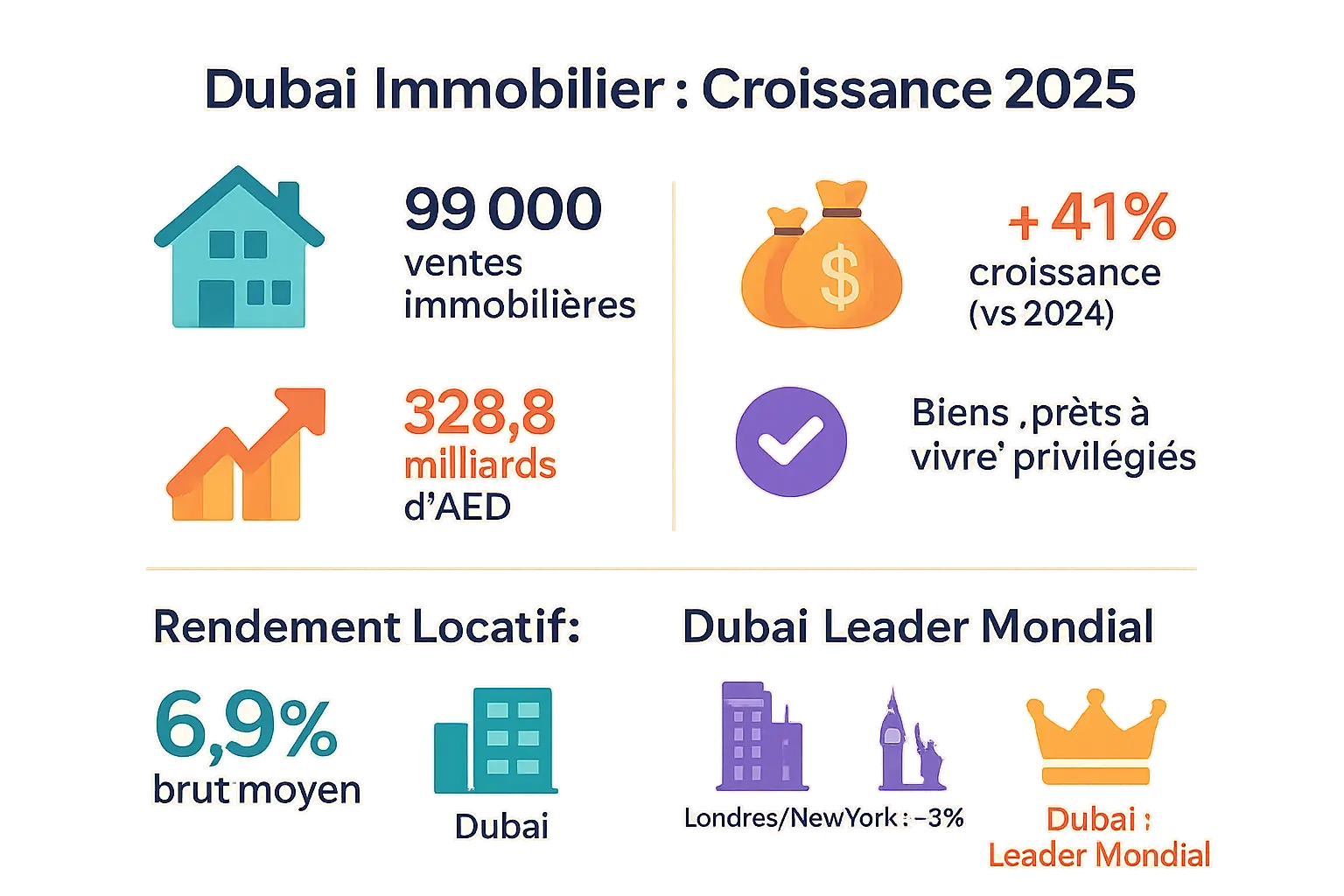

Dubai set new records in 2025, confirming its status as a leading investment destination. The first half of the year saw almost 99,000 real estate sales for a total value of AED 328.8 billion, an increase of +41% on 2024.

This dynamism does not reflect a speculative bubble, but a maturing market. The proportion of "ready-to-live-in" properties has soared to over 70% of transactions, a sign that investors now prefer investments that are immediately operational and generate stable income, rather than betting on short-term capital gains.

The median price per square foot was AED 1,563, up +4%. This measured increase contrasts with past speculative booms, reflecting a market that is becoming more structured and adapting to global economic realities. Developers are now offering more affordable housing to meet a more diversified demand.

A rental yield that outperforms the world's capitals

The average gross rental yield in Dubai is 6.9%, an impressive figure compared with 3% in cities like London or New York.

With an average rental yield approaching 7%, Dubai is not only playing in the big league, it's redefining the rules of international real estate investment.

Apartments are rising at up to 7% and more, attracting in particular investors seeking passive income in line with Islamic ethics. This attractiveness is due to a unique combination of sustained international demand, an advantageous tax system with no income tax, and an annual rent prepayment scheme that is very reassuring for owners.

Neighborhoods such as Dubai Marina and Business Bay offer above-average yields thanks to their strong rental demand. Even in more affordable areas such as Jumeirah Village Circle, yields remain competitive at between 5.5% and 6.5%, demonstrating that Dubai remains accessible to investors of all profiles.

Villas, apartments, luxury: understanding Dubai's two-speed market

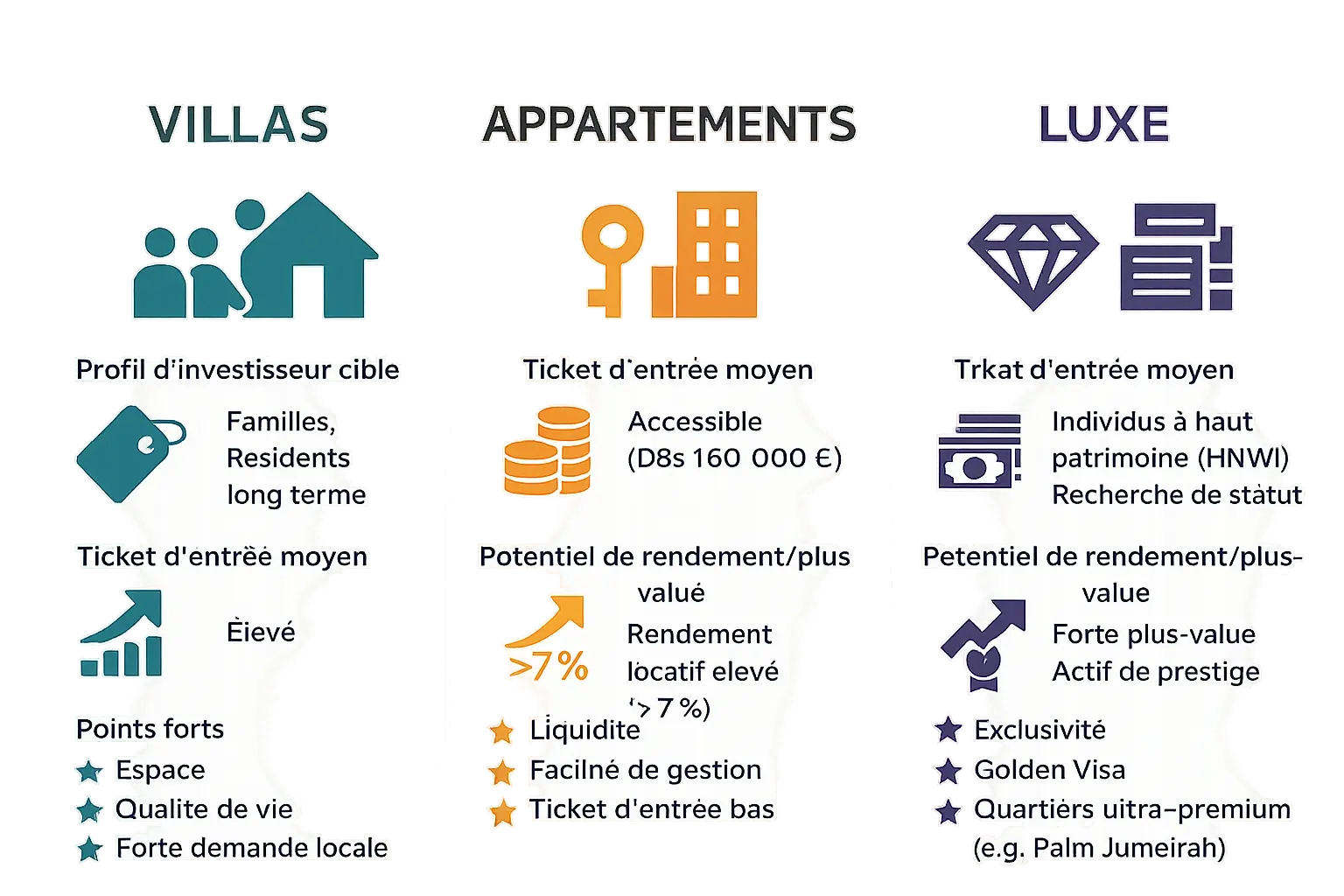

| Segment | Target investor profile | Average entry ticket | Potential return/increase in value | Highlights |

|---|---|---|---|---|

| Villas | Families, long-term residents | 2 to 5 million AED (high-end suburbs) | +20% annual capital gain | Space, quality of life, strong local demand |

| Apartments | Rental investors, first-time investors | 160,000 € minimum | Rental yield >7 | Liquidity, ease of management, low entry ticket |

| Luxury | High net worth individuals (HNWI) | Several million euros | High capital gains, prestigious asset | Exclusivity, Golden Visa, premium neighbourhoods |

The Dubai real estate market is divided into three segments with distinct profiles. Villas, prized for their spaciousness and quality of life, attract families and permanent residents. With prices ranging from AED 2 to 5 million in the suburbs, they offer an average appreciation of 20% over one year. Neighborhoods such as Arabian Ranches and Dubai Hills Estate offer the best opportunities.

Apartments are the most affordable option, with an entry ticket starting at €160,000. They appeal to rental investors thanks to an average yield of 7%, combined with increased liquidity. Zones such as Jumeirah Village Circle offer affordable apartments with long-term growth potential.

The luxury segment, meanwhile, is driven by the influx of foreign millionaires. Villas from AED 8 million to AED 100 million on Palm Jumeirah or Emirates Hills attract a discerning clientele. The Golden Visa program plays a key role: it enables non-resident investors to obtain residential status by purchasing property, boosting demand in this premium segment.

Each segment responds to different priorities: asset security for villas, immediate yield for apartments, prestige and status for luxury. For Muslims, the most important thing is to check that transactions comply with Islamic principles, notably via platforms such as Namlora, which offers riba-free solutions for investing in these different segments.

Off-plan or resale: two strategies for the same goal

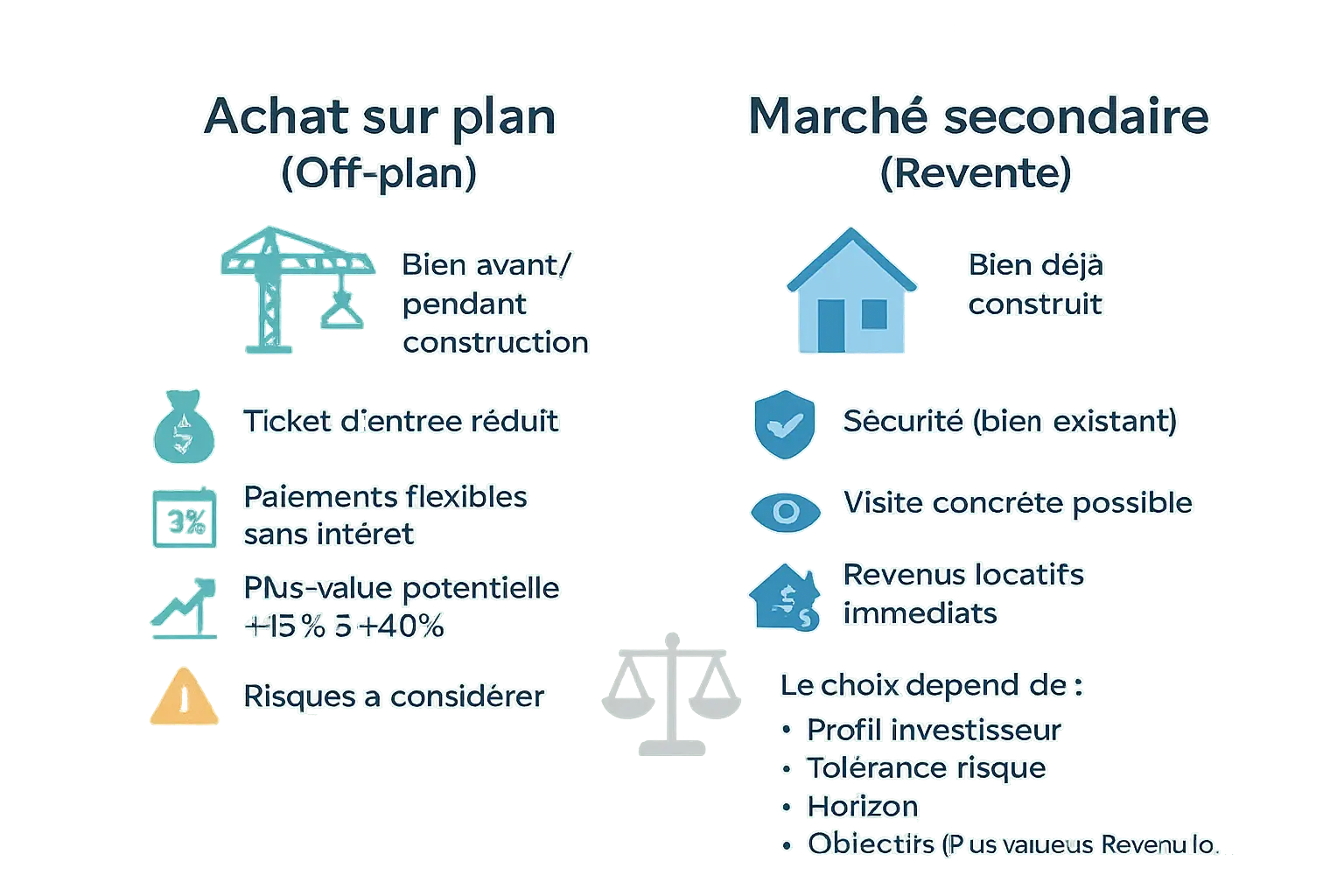

Off-plan purchasing: a bet on the future

Investing in a pre-construction property in Dubai offers unique advantages. Developers often offer interest-free payment plans, in line with Islamic principles. With a down payment of 5-10%, you spread the remainder over 2-5 years.

Prices are up to 20% lower than for completed properties, with a potential capital gain of +15% to +40%. According to the Dubai Land Department, studio apartments could gain 12% to 18% in value by 2025. The ability to customize finishes is a bonus.

To secure your investment, give priority to RERA-registered developers. Regulated escrow accounts protect your funds, despite possible delays in delivery.

The secondary market (resale): the security card

The secondary market attracts Muslim investors. Buying a built property offers immediate rental income of between 5% and 8%, with rents expected to rise by 15% by 2024.

Resales rose by 17.7% in July 2024 compared with 2023, accounting for 34% of transactions. Unlike current projects, these properties generate immediate profitability.

The choice depends on your profile. For rapid capitalization, opt for secondary investments. For long-term investment with added value, off-plan remains relevant, with flexible payouts.

Whatever your choice, due diligence is crucial. Check fees (4%) and Islamic compliance. Dubai offers opportunities, but every decision deserves careful consideration.

The pillars of solidity: why Dubai remains a haven for investors

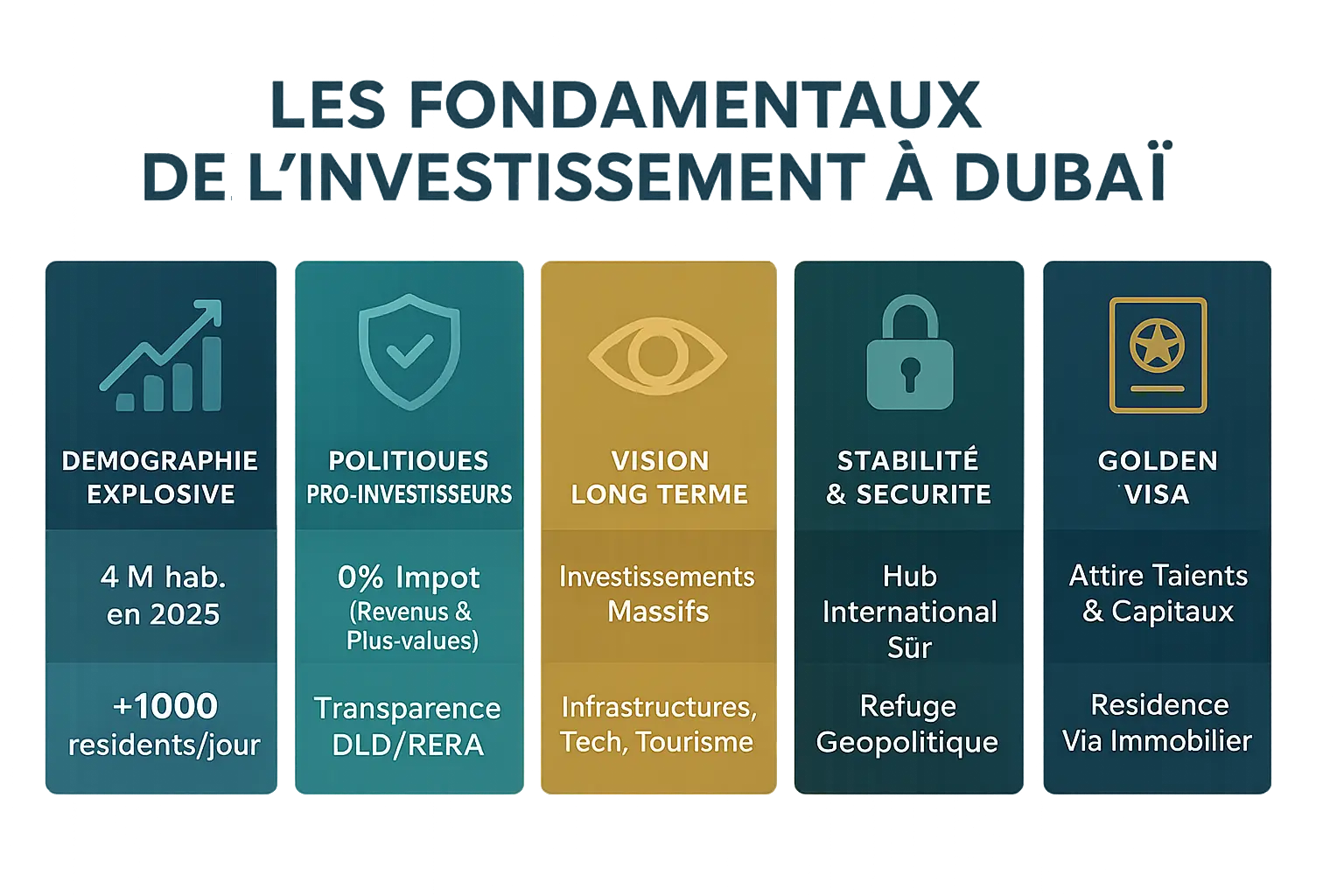

Dubai's real estate market is not based on speculative winds, but on solid fundamentals. In 2025, these structural pillars will justify the confidence of investors, including those wishing to align their capital with Islamic principles.

Dubai's real estate market is not based on speculative winds, but on solid fundamentals. In 2025, these structural pillars will justify the confidence of investors, including those wishing to align their capital with Islamic principles.

- Explosive demographic growth: with 4 million inhabitants by 2025 and an influx of 1,000 new residents a day, rental demand remains buoyant. This dynamic is fuelled by qualified professionals and families attracted by the emirate's stability.

- Unique pro-investment policies: Dubai is an unrivalled destination thanks to the absence of income and capital gains tax. Organizations such as the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) guarantee exemplary transparency.

- A long-term vision: the government is reinvesting massively in sustainable infrastructure (transport, renewable energies), such as the Dubai Urban Tech District project, a zero-carbon district dedicated to innovation.

- Stability and security: Despite global turbulence, Dubai maintains its status as a safe haven. According to the World Bank report, the emirate ranks among the 10 safest cities for foreign investment.

Le Golden Visa incarne cette stratégie accueillante. En investissant au moins 2 millions d’AED dans un bien en freehold, les étrangers obtiennent un visa de 5 ans renouvelable. Avantage clé : il permet de parrainer toute la famille, sans obligation de résidence permanente. Pour les musulmans, ce dispositif s’aligne avec l’éthique islamique si l’acquisition s’effectue sans riba, via des plans de paiement échelonnés proposés par des plateformes comme Muslimimmobilier. Cette combinaison de stabilité, de croissance démographique et de régulation transparente transforme Dubaï en destination stratégique. En 2025, les investisseurs avisés y trouvent non seulement des rendements attractifs (6,9 % en moyenne), mais aussi un écosystème où leurs valeurs peuvent guider leurs décisions.

Halal investment in Dubai: the riba-free way is possible and accessible

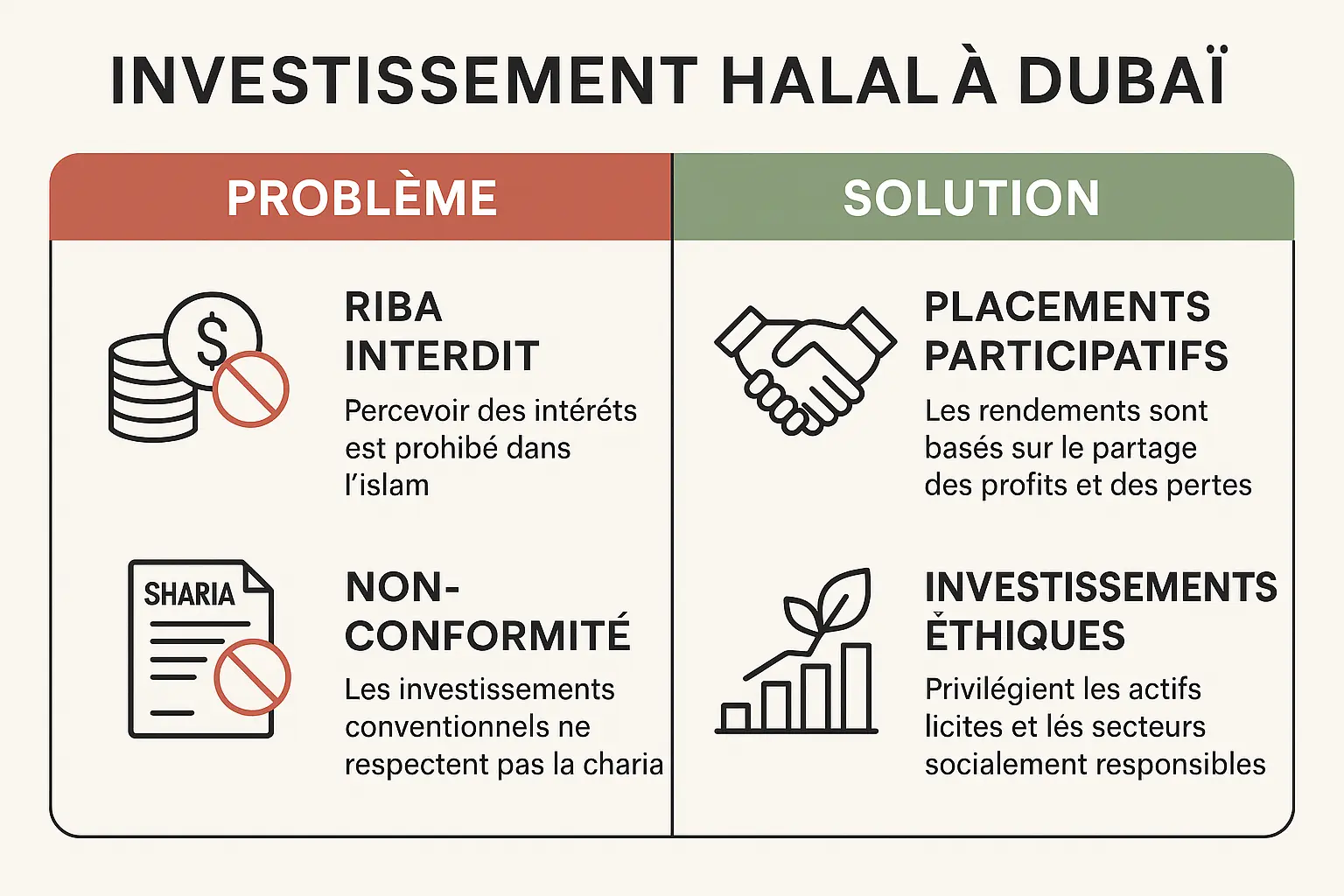

Riba: the main pitfall for Muslim investors

Riba, the Arabic word for interest, is categorically prohibited in Islam. Prophetic tradition compares it to seven deadly sins, so harmful is its impact on social justice considered to be.

Despite this clear prohibition, many Muslims in Dubai still take out conventional mortgages. Why do they do this? Sometimes because they don't know what the alternatives are, often because they lack the support they need. It's a paradox: a city where 20% of the population is Muslim, but where the halal offer remains undervalued.

Imagine investing in a rental property in Palm Jumeirah, knowing that your monthly payments include forbidden interest. Isn't that a contradiction in terms? The good news is that solutions do exist, and they're thriving.

Compliant alternatives: how to acquire property without usurious credit

In Dubai, the market offers three main types of halal financing: cash purchases, staggered sales contracts (Murabaha) and lease-purchases (Ijara). These methods, validated by scholars, make it possible to acquire a studio from €160,000 or a villa in the Emirates Hills.

Developers like Namlora offer interest-free payment plans for up to 10 years. Imagine: you buy an apartment in Dubai Hills, pay 10% on reservation, then 50% during construction, and the balance on delivery. No riba, just a natural progression towards home ownership.

Investing with respect for your values is not a sacrifice of performance. On the contrary, it's a guarantee of serenity and a baraka for your assets.

Islamic banks such as Dubai Islamic Bank and Emirates NBD also offer compliant products. Their Ijara model transforms rents into down payments on property. A smart solution for families looking for housing while becoming homeowners.

What are the advantages of these solutions?

- Total transparency: the final price is set at the time of acquisition

- Fairness: money is used to buy a real asset, not to generate interest

- Accessibility: some plans require as little as 10% down payment

These systems avoid the pitfalls of conventional loans: variable rates, late payment penalties or perpetual debt. They reinforce your financial autonomy, while respecting your convictions.

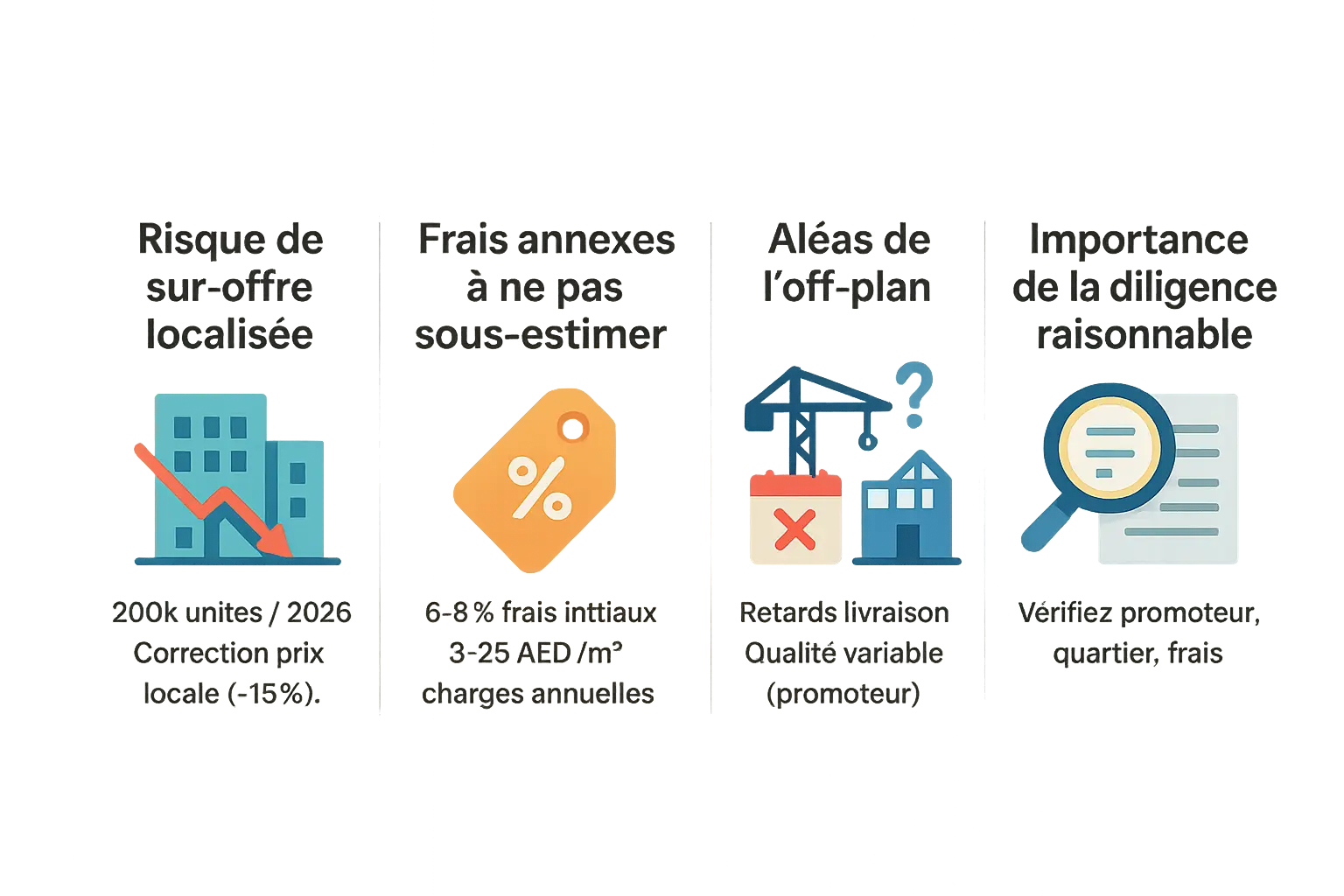

Risks to be aware of for an informed investment

Investing in Dubai combines potential and complexity. But behind the promise of returns, there are very real risks. For a Muslim investor, these challenges are matched by the need to ensure Islamic compliance in every decision. Fortunately, clear rules and due diligence transform these obstacles into controlled opportunities.

- The risk of localized oversupply: By 2026, nearly 200,000 new units could flood the market. While not all projects will see the light of day, this massive supply could trigger price declines of up to -15% in certain neighborhoods. A phenomenon to be watched closely, especially for projects in developing areas.

- Don't underestimate ancillary costs: The purchase price is just the tip of the iceberg. Allow for 6-8% up-front costs, including a 4% transfer fee from the Dubai Land Department (DLD), NOC (No Objection Certificate) fees and agency fees. And don't forget the annual charges, ranging from 3 to 25 AED/m², for upkeep of the common areas.

- The hazards of off-plan: New-builds are attractive for their flexible payment plans and attractive prices. But the risk of delays is very real. On some projects launched in 2024-2025, deliveries are spread over 24 to 36 months, with lead times sometimes doubled. Increased vigilance with regard to the developer, its track record and its partners is therefore crucial.

The key to a sustainable investment is due diligence. Checking the solvency of the developer, analyzing future rental flows and budgeting for all hidden costs are essential steps. In this respect, Namlora's approach is unique: combining transparency with Islamic ethics. By eliminating riba and favoring certified partners, this bridge between values and returns offers a secure framework for investing with a clear conscience. Because a good investor doesn't run away from risks - he converts them into levers for responsible growth.

Building wealth in Dubai 2025: between vigilance and conviction

Dubai's real estate market embodies maturity in 2025. After a spectacular expansion, prices are up 4%, with average rental yields at 6.9%, among the highest globally. This stability is due to sustained demand and pro-investment policies.

For Muslims, the stakes are twofold: halal investment and transparency. Buying without riba not only respects Sharia law, but also secures the project. Models such as Murabaha or Ijara, supported by specialized players, offer concrete alternatives.

Due diligence remains critical. Analyzing ancillary costs (6-8%), checking the creditworthiness of promoters, and ensuring that trusted partners are proficient in Islamic finance (Musharaka, interest-free financing) are essential steps.

Dubai is not a risk-free opportunity: over-supply and delivery delays persist. However, its political stability, tax advantages and segmentation (luxury, affordable) make it unique. The key? Unite foresight and ethics. According to Namlora, investing in line with one's values builds a resilient heritage. Trust, Sharia-compliance and responsibility don't hinder profitability, they reinforce it over the long term.

Dubai 2025 embodies the maturity of the real estate market, offering real opportunities without riba. By opting for halal solutions and due diligence, every investor can building a heritage aligned with our values. With Namlora, you can combine peace of mind and performance strategic vision and respect for islam.

FAQ

What are the forecasts for the Dubai real estate market in 2026?

Dubai's real estate market looks set for a transition to a more mature but still dynamic phase in 2026. As the emirate digests the current wave of construction (up to 200,000 new units expected), experts anticipate a stabilization of prices rather than a sudden collapse. Well-positioned segments, especially in urban areas and premium zones such as Dubai Marina or Palm Jumeirah, should maintain their attractiveness. For Muslims concerned about Islamic compliance, riba-free solutions such as installment plans are still available to take advantage of this mature market with peace of mind.

Will real estate collapse in 2025?

No, the idea of a sudden collapse of the Dubai real estate market in 2025 is more speculation than fact. If local adjustments are possible (-10 to -15% in certain less sought-after districts), they will be more akin to a healthy rebalancing than a crisis. With a growing population (1,000 new residents per day) and massive infrastructural investment, demand remains solid. Halal investors can see this as an opportunity to acquire with caution, thanks in particular to interest-free solutions such as those offered by Muslimimmobilier.

Why invest in Dubai real estate in 2025?

Investing in Dubai in 2025 means seizing a historic opportunity to diversify your assets in a stable and attractive environment. The city offers unrivalled rental yields (up to 7% for apartments), tax advantages (zero capital gains tax) and a buoyant population (4 million by 2025). For Muslims, it's also an opportunity to build a compliant estate, thanks to interest-free acquisition terms and riba-free installment plans. It's an investment in the future, in line with your values.

Will Dubai real estate collapse in 2025?

There's no collapse scenario as such for Dubai's real estate market in 2025. What we are seeing is rather a transition to maturity, with more moderate (+4% in 2025) but sustainable growth. The fundamentals remain solid: demographic influx, political stability, tax attractiveness. For Muslim investors, this represents an ideal window of opportunity to enter the market via halal solutions, taking advantage of zero interest rates and the market's increasing maturity.

Will 2025 be a good year for real estate?

2025 is part of a positive continuity for Dubai real estate, quite different from the years of unbridled speculation. What is changing is the nature of the investment: we are moving from speculative acquisition to well-considered investment. With rental yields still among the highest in the world (6.9% on average), a growing population and attractive policies, the year offers favorable conditions for acquisition. For Muslims, the main challenge is to choose halal solutions, such as direct payment plans with developers, without going through conventional banks.

What are the forecasts for property purchases in 2025?

When it comes to buying real estate in Dubai in 2025, the outlook is optimistic but nuanced. Prices will continue to rise moderately, with disparities between neighborhoods and property types. Apartments will remain affordable (from €160,000 for a studio), while luxury properties will attract international investors via the Golden Visa. The key for the Muslim investor is to favour acquisitions without recourse to traditional borrowing, opting for halal tools such as instalment plans, which enable ownership without compromising one's principles.

What new rules will change real estate in 2025?

2025 does not mark any major regulatory changes, but rather an acceleration of trends already underway. The market is becoming more professional, with greater transparency in transactions (via DLD and RERA) and a growing emphasis on halal products. For Muslims, access to riba-free acquisition solutions is becoming more fluid, with players like Muslimimmobilier facilitating compliant investment. At the same time, ancillary costs (6-8% of the purchase price) still need to be taken into account, as do rising construction costs (+15%), but these developments reinforce the market's maturity.

When will the next real estate crash occur?

To predict a real estate crash in Dubai would be to ignore the solid fundamentals of this market. Unlike other major global metropolises, Dubai is building its future on real demand (demographic growth, international appeal) and pro-investment policies. Any local corrections (up to -15% in some sectors) should be seen as healthy adjustments, not crashes. For the halal investor, it's even an opportunity to take advantage of quality properties on favorable terms, without usurious borrowing.

What will change for homeowners in 2025?

In 2025, Dubai's property owners live in a more balanced ecosystem, where quality prevails over quantity. Condominium fees (3 to 25 AED/m²) are becoming more predictable, as are rental yields (6.9% on average). An important new feature for Muslims is the growing offer of Sharia-compliant rental management services, enabling full rental income to be retained without ethical compromise. This is the year when halal real estate investment in Dubai moves from the exception to the norm.