<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: Islamic finance transforms our relationship with money by combining faith and ethics. By rejecting riba, a source of inequality, and cultivating Tawakkul, it frees us from material anxiety for sustainable prosperity. A long-term vision (5-10 years) and clear principles (5% tolerance of illicit income according to AAOIFI) enable us to invest with serenity while strengthening the community.

Does Islamic finance seem utopian to you in a world dominated by riba and inflation? Behind the numbers and the crises, a financial system based on Tawakkul and Baraka redefines wealth as a divine blessing, not as material accumulation. While inflation, the "poor man's tax", dilutes the value of your savings, frameworks like AAOIFI offer a pragmatic way forward: invest in companies with less than 30% debt and less than 5% illicit income, while purifying dubious gains via Tazkiyah. Discover here how to combine faith and investment, by transforming your financial choices into acts of trust in Ar-Razaq, He who provides.

Contents

Beyond conventional finance: why a debt-based system is problematic

Riba: a form of inequality at the heart of the system

Riba, forbidden by the Koran (2:275), goes far beyond usury. It refers to any fixed and unjustified gain on a loan, even a moderate one. This practice, likened to "a declaration of war against Allah and His Messenger", creates an unequal system where the rich get richer effortlessly while the poor get poorer. Take a peasant borrowing to sow his crops: his failure to repay means he loses his land, illustrating this systemic impoverishment.

The debt economy, fuelled by riba, drives governments to print money, generating inflation. Known as the "poor man's tax", this dilution of monetary value erodes the savings of the middle classes. According to this legal analysis, the prohibition of riba remains fundamental to ethical finance. Repeated banking crises show how this model benefits financial institutions to the detriment of citizens.

Anxiety and stress: the human costs of the growth paradigm

Today's system generates ever-increasing psychological stress. The fear of missing out, social comparison and the frantic race for performance create a constant state of alert. This stress disrupts concentration, reduces productivity and depletes vital energy. Studies show that 40% of working people suffer from debt-related anxiety, with symptoms such as insomnia.

Fear of missing an opportunity (FOMO) leads to risky emotional investments. Islam advocates calm financial management, based on a balance between effort and trust in God. Tawakkul (trust in Allah) is not inaction, but energy channeled into sustainable projects, like a farmer who sows knowing that the rain comes from Allah. This model, far removed from modern greed, puts people and spirituality back at the heart of the economy.

Faced with this system, the Islamic solution is based on ethical investments and tools such as Al Baraka Group's halal funds. These initiatives, based on risk-sharing and transparency, show that it is possible to reconcile profitability and values. In 2023, the Islamic sector financed 12% more socially responsible projects than traditional finance, proving the relevance of this approach.

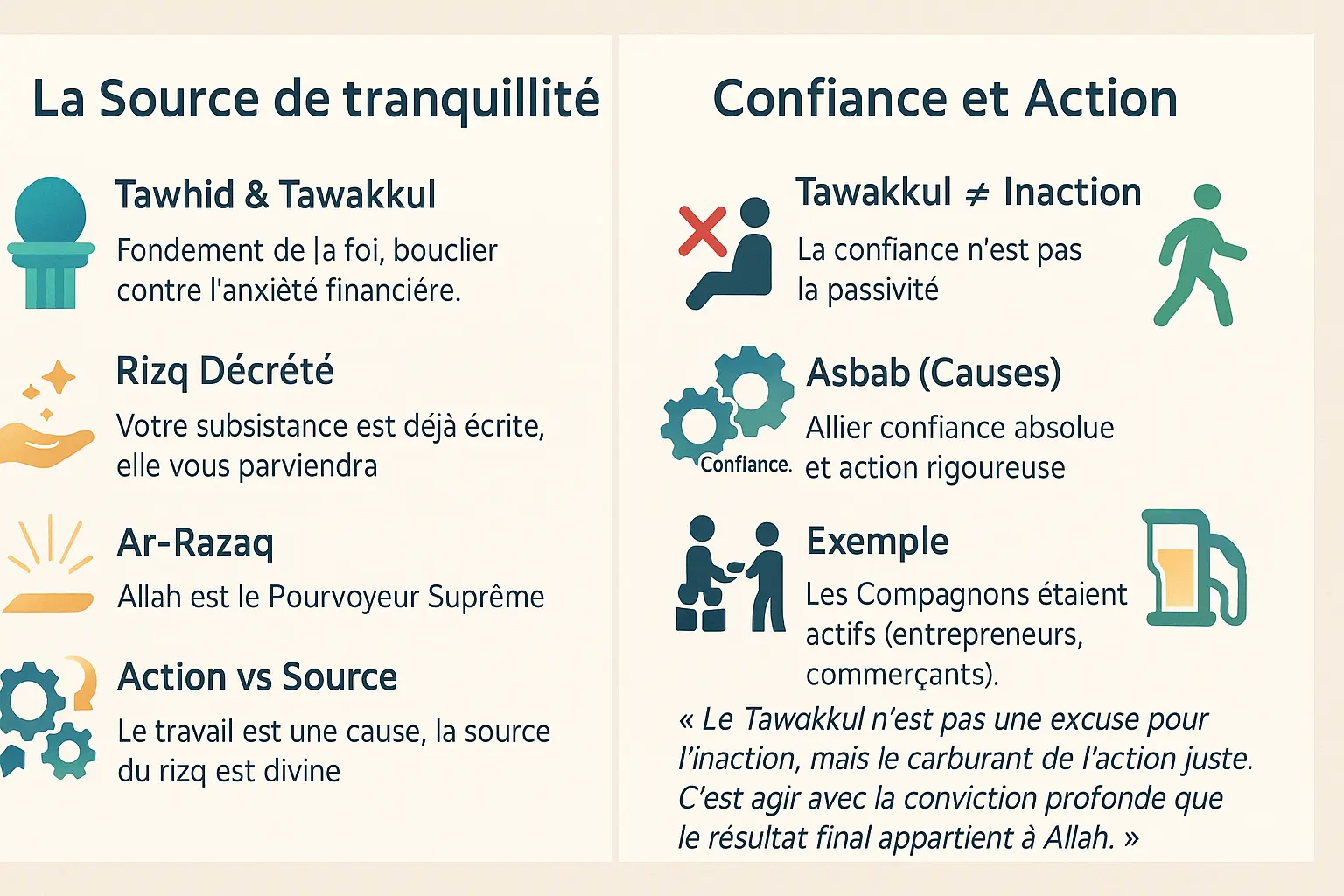

Tawakkul: the spiritual key to financial serenity

Your sustenance (rizq) has already been decreed: the source of tranquility

In Islamic finance, Tawakkul symbolizes more than a spiritual notion: it's an emancipating pillar in the face of material anxieties. The Koran (51:58) reminds us: "Verily, it is Allah who is the Great Provider, the Possessor of strength, the Unshakable One", embodying the concept of Ar-Razaq, the One who provides according to a divine plan.

The certainty that your rizq is decreed before you are born (hadith Al-Bukhari 6594) mentally frees you from the fear of lack. The Prophet (ﷺ) illustrated this by evoking birds that find their food through their effort combined with divine trust. This serenity encourages ethical financial choices, breaking with the modern anxiety linked to FOMO and social comparisons. For Namlora investors, this translates into Sharia-compliant decisions, without compromising their spiritual future.

The golden mean: combining absolute confidence and rigorous action

"Tawakkul is not an excuse for inaction, but the fuel for right action. It is acting with the deep conviction that the final outcome belongs to Allah."

Tawakkul does not mean passivity. The Prophet (ﷺ) clarified it: "Tie up your camel and trust in Allah" (Jami At Tirmidhi 2517), emphasizing the balance between trust and responsibility. The Companions, though believers, were seasoned economic players, confirming that effort remains an obligation. This happy medium, reinforced by Sabr (patience), offers an alternative to the current system centered on riba and inflation.

The Koran (65:3) reminds us: "Whoever puts his trust in Allah, He is sufficient for him", a divine promise reconciled with competent action. Within the Islamic investment ecosystem, this principle guides investors towards sustainable projects. As the Al Baraka Group points out, this ethical and spiritual approach restores meaning to economic exchanges, by aligning material objectives with Islamic values.

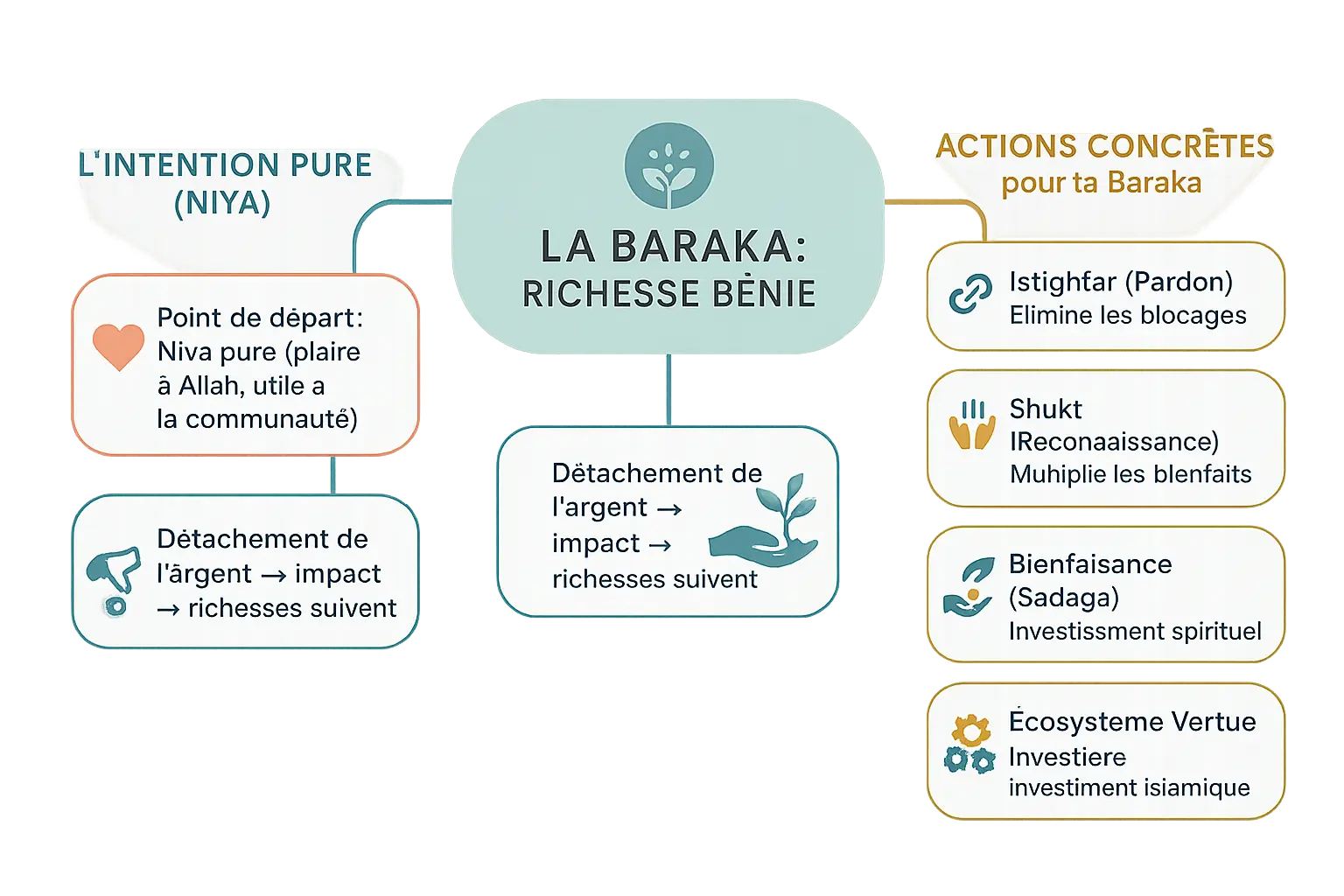

The quest for Baraka: redefining wealth beyond the material

Pure intention (Niya): the starting point of all blessed wealth

Baraka embodies true wealth in Islamic finance. It is measured not by accumulation, but by the divine blessing that makes a little matter bear fruit. Unlike great wealth without a blessing, which remains sterile.

Niya, pure intention, is the key. Aiming to please Allah and serve the community transforms the financial act into a spiritual investment. This orientation of the heart frees us from monetary obsession: by seeking impact, material wealth naturally follows.

As illustrated in Sura Nooh (71:10-12), asking Allah's forgiveness opens the floodgates of sustenance. The metaphor is clear: by detaching oneself from the cult of gold, we gain access to a spiritual abundance that has concrete repercussions.

Concrete actions to attract Baraka to your finances

Baraka is cultivated through concrete actions rooted in Islamic ethics. These practices form a virtuous financial ecosystem, where every gesture resonates in the tangible and intangible.

- Istighfar (asking for forgiveness): This practice unblocks spiritual barriers. As Sura Nooh points out, it triggers a shower of blessings, opening the doors to sustenance.

- Shukr (gratitude): Appreciating what we have activates the divine promise of multiplied blessings. Gratitude nourishes trust (tawakkul) in Allah's providence.

- Sadaqa (charity): Giving alms to loved ones and the needy acts as a spiritual investment. The Prophet (pbuh) said that "charity does not diminish wealth" (Surat Al-Baqarah 2:261).

- Zakat al maal (compulsory almsgiving): by purifying 2.5% of your assets, you contribute to a virtuous circle. Organizations like Namlora reinvest these funds in educational and economic projects to build a sustainable Islamic investment ecosystem.

These actions form a golden triangle: pure intention, spiritual practice, community involvement. While the worldly system reduces wealth to its material form, Islamic finance reveals its blessed dimension. A paradigm where every dirham circulates for the common good, in alignment with the teachings of the Koran and Sunnah.

As the experience of Al Baraka Group demonstrates, this approach is not utopian. Indonesian Islamic banks have seen their profitability increase thanks to Zakat, providing scientific confirmation that God's blessing acts on assets and economic growth.

Investing in accordance with your values: the framework of Islamic finance

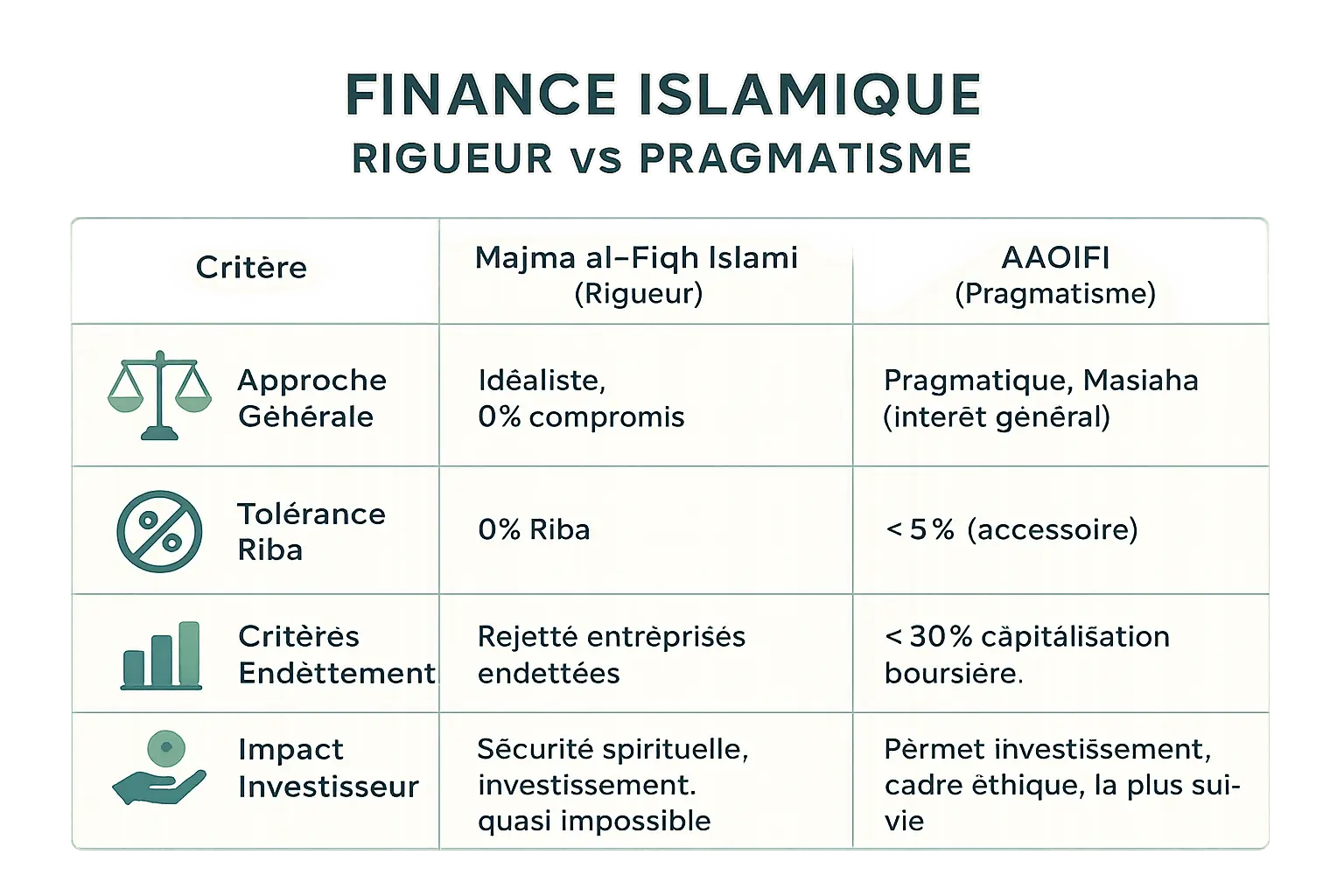

Two approaches for the same objective: how to navigate between rigor and pragmatism

The challenge of eliminating riba (interest) in the modern world has led to the emergence of two major schools of thought in Islamic finance. These approaches, while sharing a common goal, differ in their practical application.

| Criteria | Majma al-Fiqh Islami (Strict approach) | AAOIFI (Pragmatic approach) |

|---|---|---|

| General approach | Idealist and very rigorous. Aims for 0% compromise. | Pragmatic, based on the general interest (maslaha) of the community. |

| Riba tolerance | 0% riba tolerated in investments. | Tolerance for incidental illicit income, generally less than 5%. |

| Debt criteria | No numerical criteria, but rejects virtually any company with conventional debt. | Debt ratio of less than 30% of market capitalization. |

| Impact for the investor | Very reassuring spiritually, but makes investment virtually impossible (99.9% of shares considered haram). | Allows you to invest and not become impoverished, while maintaining a strict ethical framework. It's the most popular approach worldwide. |

Faced with the complexity of the global financial system, Majma al-Fiqh Islami and AAOIFI offer solutions tailored to the needs of Muslim investors. Institutions such as AAOIFI play a key role in the development of international standards. Majma, with its ideal but unrealistic approach, limits market access. AAOIFI, on the other hand, strikes a balance between ethics and practicality.

The Majma al-Fiqh approach, while spiritually reassuring, makes investment virtually impossible in today's environment. Indeed, 99.9% of listed stocks are considered not to meet its exacting criteria. This extreme rigor, while admirable in its quest for the absolute, does not respond to contemporary economic realities where technical compromises are necessary to preserve the purchasing power of Muslims.

AAOIFI proposes a more accessible path by authorizing threshold limits for indebtedness (less than 30% of market capitalization) and non-conforming income (less than 5% of sales). This pragmatic approach enables Muslims to invest without betraying their principles, while preserving their purchasing power. Structured around technical councils (accounting, governance, ethics), AAOIFI draws up detailed standards to guide professionals in the creation of interest-free products.

Whatever the framework chosen, the purification of doubtful income (Tazkiyah) remains a fundamental pillar. This practice involves identifying non-compliant incidental income (such as bank interest) and redistributing it to charitable causes, without deriving any personal benefit from it. This approach doubles legal compliance with spiritual purification, ensuring that wealth remains a tool of justice and not a source of defilement.

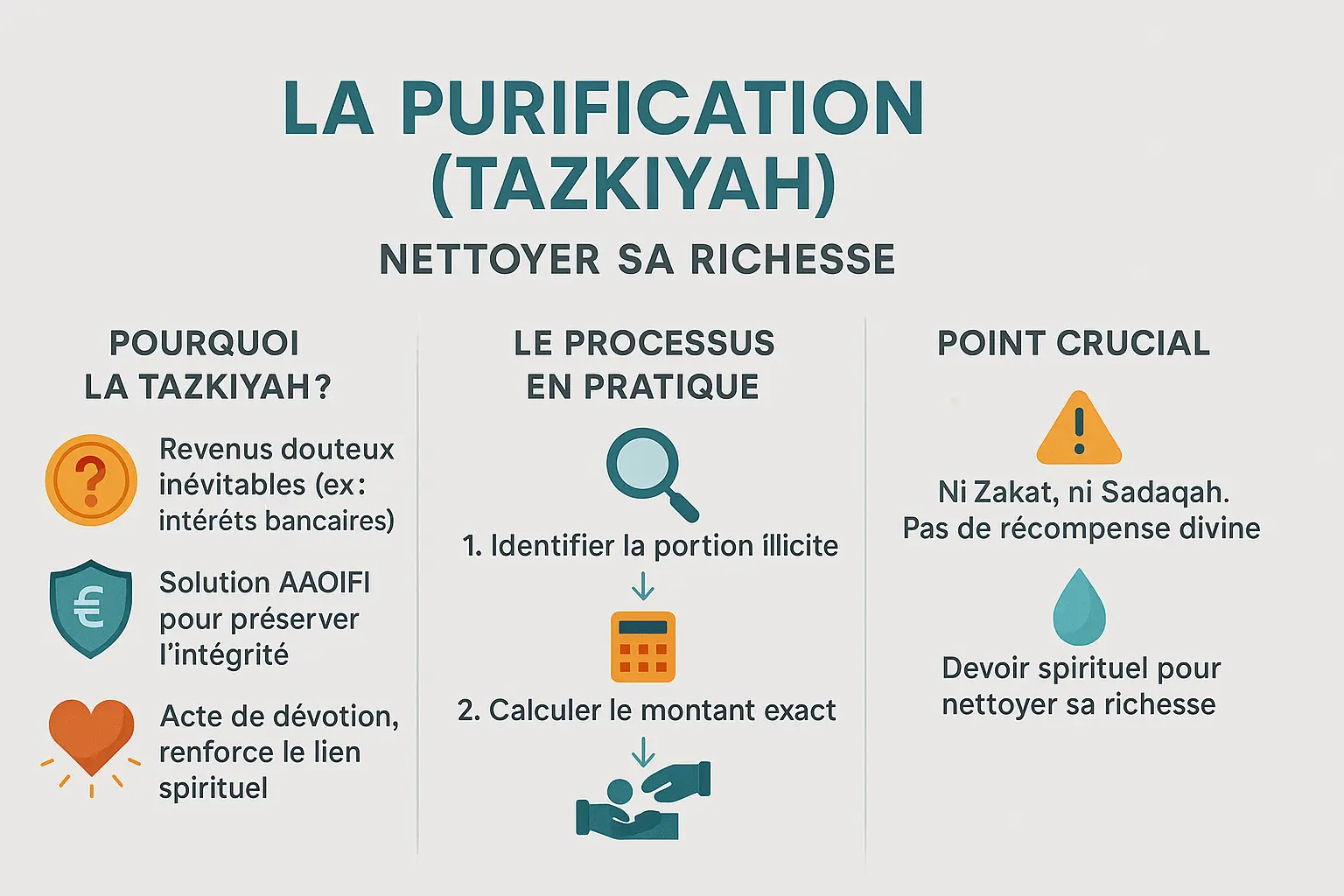

Purification (Tazkiyah): how to deal with unavoidable doubtful income?

What is purification and why is it necessary?

Investing in a predominantly halal business does not always protect against non-Sharia-compliant incidental income. Even a lawful business can earn interest by placing its cash in a conventional bank. Purification (Tazkiyah) offers a clear and benevolent solution for investors concerned about their faith.

Cleansing is not a simple transaction, it's an act of devotion that preserves the integrity of your wealth and strengthens your spiritual bond with your investors.

Contrary to popular belief, this practice is not a punishment, but an open door to responsible engagement. It is a way of integrating oneself economically while respecting Islamic principles, particularly in a system where the strict approach of the Majma al-Fiqh would prohibit 99.9% of the world's equities. With Tazkiyah, investors preserve their baraka while contributing to the real economy.

The purification process in practice

The mechanism consists of three simple steps:

- Identification: Analyze income to isolate the portion generated by non-compliant sources (e.g. bank interest). Specialized teams do this automatically for Islamic funds.

- Calculation: Determine the percentage to be purified, often less than 5% according to AAOIFI standards for halal companies. AAOIFI sets these thresholds to authorize investment in shares that strictly comply with Sharia criteria.

- Redirection: Donate this sum to charity, without expecting any spiritual reward or tax advantage. This donation differs from Zakat or Sadaqah in that its aim is to eliminate impurity rather than accumulate merit. By doing so, you turn a spiritual risk into a charitable opportunity.

Would you like to put these principles into practice? The purification of stock market earnings is a practical example of this ethical approach, enabling you to grow your assets without compromising your spiritual integrity. This process reflects the balance between economic pragmatism and spiritual rigor at the heart of Namlora's vision.

Towards serene prosperity: the pillars of sustainable and ethical investment

True financial freedom comes from Tawhid

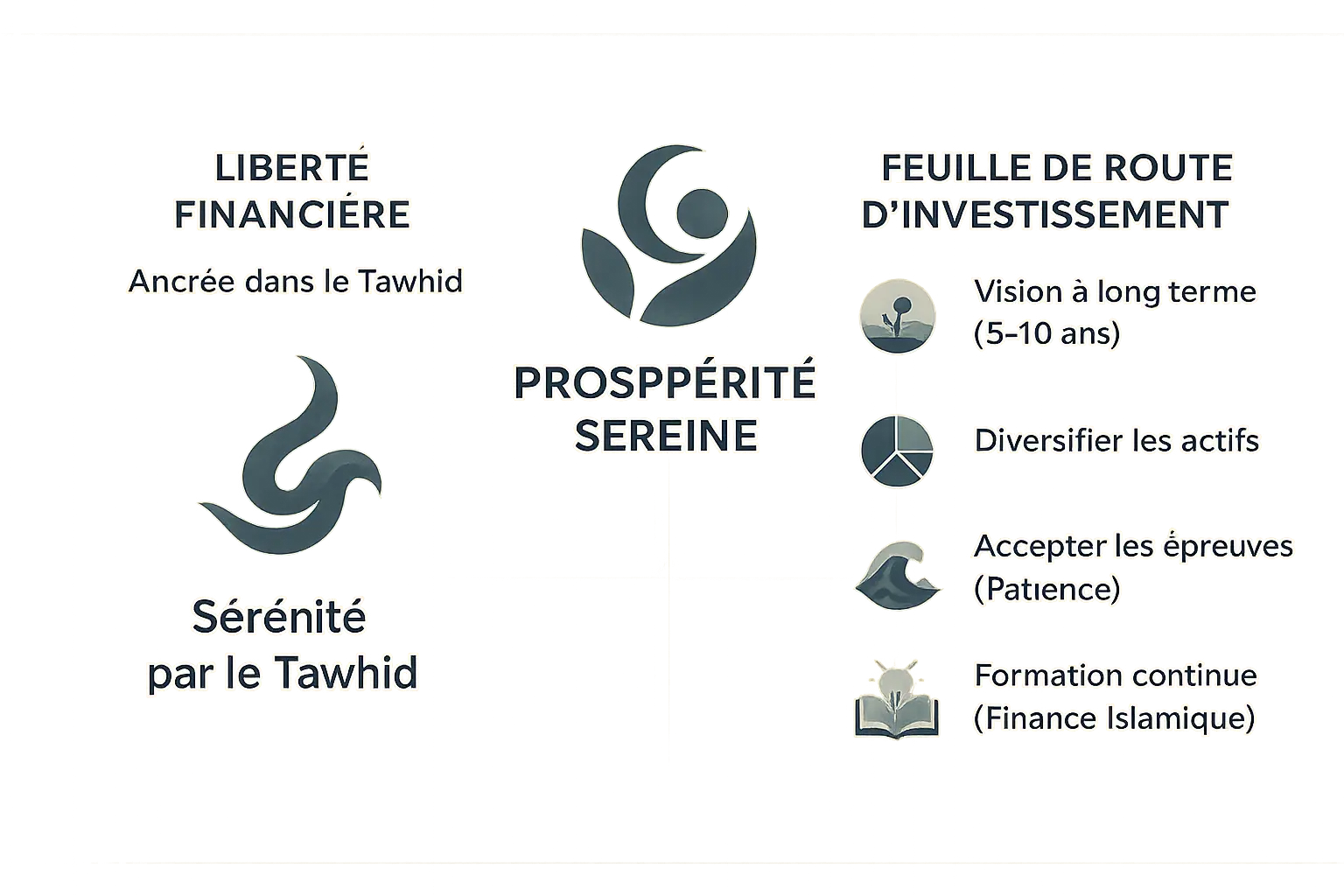

Financial serenity is rooted in Tawhid, recognizing that Allah is Ar-Razaq. By embracing this belief, you transcend material anxiety. Unlike the riba-based system, Islamic investment values the sharing of profits and losses. By accepting that your livelihood is decreed, you act with discernment, checking a company's compliance before buying its shares rather than speculating on rumors.

Your roadmap for a worry-free investment

- Take a long-term view: think in 5- to 10-year cycles. The sustainable development of legitimate businesses generates solid profits, unlike ephemeral speculation.

- Diversify your assets: Spread your investments between ethical sectors (halal food, responsible technology) and verified funds, without violating Sharia principles.

- Accepting hardship: Market fluctuations sharpen your resilience. Progressive success builds humility.

- Continuous training: Use tools like Zoya or Musaffa to filter compliant actions and calculate the purification (Tazkiyah) of impure income.

By integrating these principles, you build a portfolio aligned with your values. True wealth is measured by the Baraka, attracted by pure intention (Niya) and righteous actions. Islamic finance unites investors, entrepreneurs and consumers around an ethical model. Income purification (Tazkiyah) embodies social justice, by donating impure earnings to charitable causes. In this way, every investment becomes an act of worship, combining earthly prosperity with divine reward.

Investing according to Islamic principles transcends economic rules. It's an art of living, combining faith and wisdom, where Tawhid illuminates freedom, Tawakkul guides action, and Baraka transforms intention into lasting wealth. Together, let's build a financial legacy in line with our values.

FAQ

What are the 5 principles of Islamic finance?

Islamic finance is based on five essential pillars: the prohibition of riba (interest), the avoidance of gharar (excessive uncertainty), the rejection of maysir (speculation), the anchoring of transactions in tangible assets, and the sharing of profits and losses between parties. These principles aim to establish a fair, ethical and balanced system, where money is not a commodity but a tool for collective economic development.

How does Islamic finance work?

Unlike conventional finance, Islamic finance is based on risk sharing. For example, in an Islamic loan, the institution can become a partner in the asset financed (such as real estate) and receive profits proportional to its participation. Income is derived from real transactions (such as a purchase-resale transaction) and not from fixed interest. The aim is to create synergy between savers and investors, aligning ethics and profitability.

How do Islamic loans work?

The Islamic loan, or murabaha, for example, operates via a profit-margin sales mechanism. The bank buys an asset (such as a house), sells it to the borrower at an agreed profit and allows for staggered repayments. The bank assumes the risk of ownership until final payment. Other models, such as ijarah (hire-purchase) or musharakah (partnership), exist, always avoiding usury.

What are Islamic financial products?

Products include interest-free current accounts, Sukuk (Islamic asset-linked bonds), Shari'a-compliant mutual funds, Takaful insurance (solidarity mutuals), and participatory financing (such as mudharabah). These tools enable people to save, invest or finance projects while respecting Islamic principles, and are supervised by shariah boards.

Who invented sharia?

Shari'a is not "invented" but revealed in the Koran and the teachings of the Prophet (Sunna). It is interpreted by jurists (ulama) through ijtihad (legal reasoning) to adapt to modern contexts. Institutions such as AAOIFI and Majma al-Fiqh Islami update these principles and apply them to today's economic challenges.

What is the definition of Gharar?

Gharar refers to contracts tainted by excessive uncertainty, ambiguity or chance, such as speculative financial derivatives. It is prohibited because it creates unacceptable imbalances and risks. For example, a loan without clear collateral or an opaque insurance contract is Gharar. Islamic finance requires transparency and defined terms to protect all parties.

Is it haram to take out a bank loan?

Yes, according to the majority of scholars, because traditional bank loans include riba (interest), explicitly condemned in the Koran (2:275). However, in complex contexts, some schools tolerate limited exceptions, such as Islamic real estate financing. The important thing is to favor halal solutions such as equity loans or community funds (waqf) to avoid exploitation.

Who manages money in Islam?

In Islam, money is an asset entrusted by Allah, to be managed with responsibility. Individuals have economic freedom under Shari'a law, while institutions such as Islamic banks and compliance committees oversee major transactions. Civil society, via Zakat and Sadaqah, also plays a role in redistribution. Finally, the State has a responsibility to ensure fairness, notably through mechanisms such as price controls in the event of a crisis.