<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key facts: Inaia Finance offers a reliable halal solution for investing in physical gold, with an average Trustpilot rating of 4.9/5. Its Wakala model guarantees strict Shari'ah compliance, while allowing diversification into silver, platinum or palladium. Customer reviews highlight responsive customer service and proven liquidity through rapid resales. Despite high purchase fees (5.95%), gold's historical growth (8% annually according to Morningstar) offsets these costs over the long term, for sustainable savings in line with one's convictions.

⚠️ Disclaimer: The information shared by Namlora is provided for educational purposes only. It does not constitute financial advice or investment recommendations.

Does investing in halal gold online seem complicated? Between doubts about Islamic conformity and the security of investments, many people give up on this age-old pillar of savings. Yet Inaia Finance, acclaimed by its users (4.9/5 on Trustpilot), offers a transparent solution for investing in physical gold, silver or platinum, as well as palladium, while respecting the principles of ethical finance. Discover how this platform combines simplicity, profitability and value, by revealing the concrete benefits and feedback from those who have already taken the plunge.

Contents

Why be interested in gold as a halal investment in 2025?

In the year 2025, marked by geopolitical tensions and persistent inflation, many Muslims are looking to protect their savings while remaining true to their principles. Gold, the cornerstone of ethical investments, offers an ancestral solution adapted to our modern challenges.

Ce métal précieux, reconnu comme valeur refuge par l’Autorité des Marchés Financiers, a démontré sa résilience en 2024 avec une hausse de 29,7 %. Selon les experts, sa stabilité en fait un actif clé pour l’épargne de long terme, notamment dans un contexte de taux élevés et d’incertitudes monétaires.

Gold embodies the ideal Islamic savings vehicle: a tangible asset with no riba, it meets Shari'a criteria provided it is acquired hand-to-hand and without excessive speculation. The detailed methods emphasize the importance of avoiding delivery delays and favoring AAOIFI-certified platforms such as Inaia.

- Protects your savings by rising with inflation

- Offers secure diversification, uncorrelated with speculative markets

- Remains tradable worldwide, guaranteeing immediate liquidity

To get your halal investment off the ground, talk to an expert. Inaia, rated 4.9/5 on Trustpilot, combines expertise and religious conformity, complying with AAOIFI Sharia Standard 57. Customers praise Inaia's responsiveness and the ability to track assets via an intuitive (but not yet modern) application.

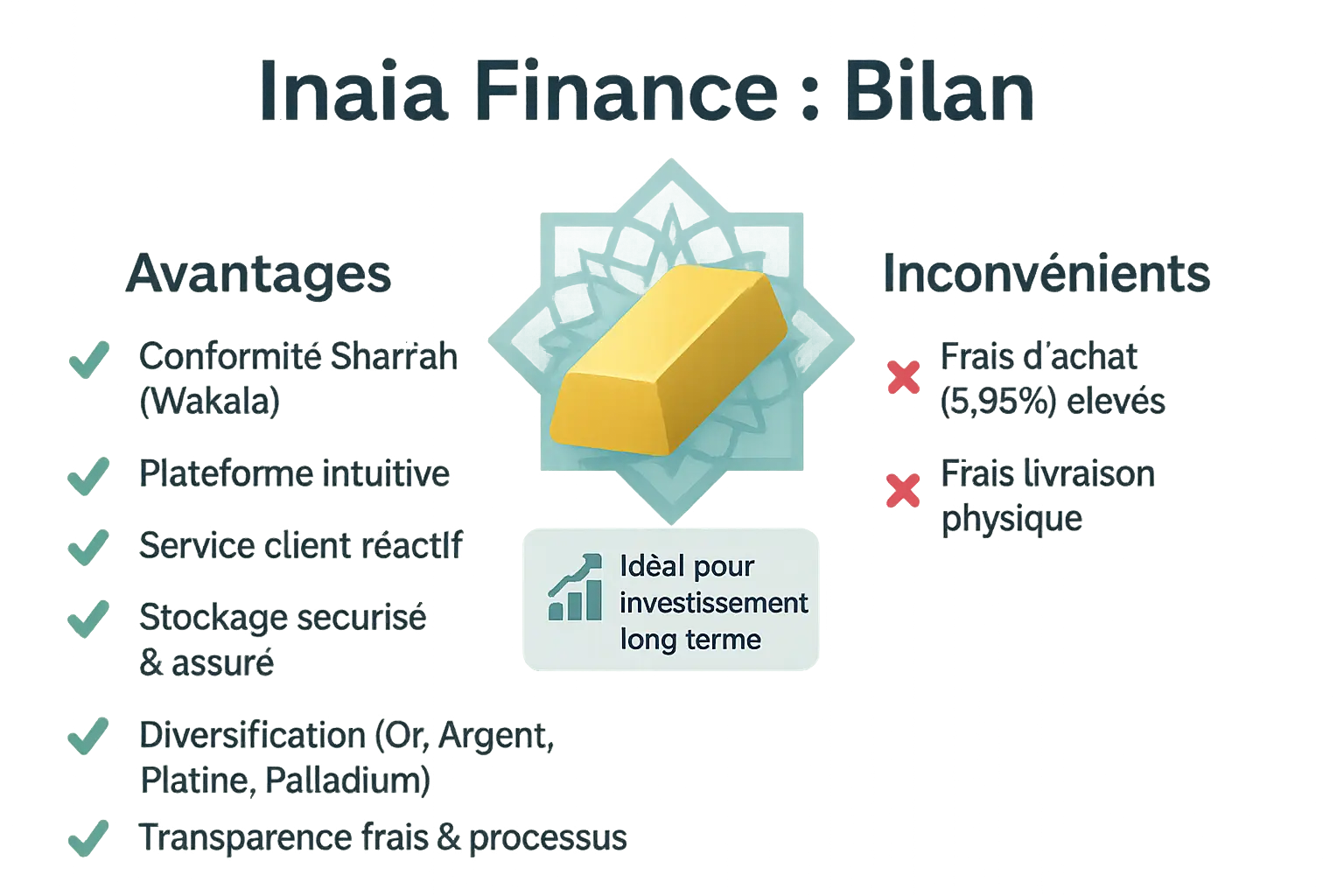

Summary of our opinion on Inaia Finance

Inaia Finance scores 8.5/10. This platform offers investment in Shari'ah-compliant "Green Gold" certified gold (999.9‰ purity). Strengths lie in its ease of use, transparency on fees and responsive customer service. Disadvantages include a purchase fee (5.95%) and physical delivery costs.

| Benefits | Disadvantages |

|---|---|

|

|

Why choose Inaia

Inaia is ideal for investing in halal gold thanks to its certified wakala model. Physical gold is stored in secure vaults (€12/year) and resellable online. The 167 reviews on Trustpilot (4.9/5⭐) praise its reliability and team. However, avoid physical delivery except for large quantities.

Preparing your investment

Take a call with a GOLD expert to get started. This free consultation will guide you in building an ethical and sustainable wealth.

The costs of investing in Inaia Finance

Inaia's cost structure

Inaia uses a "pay as you go" model without subscription. Charges apply only to actions taken. On my first purchase (20g ingot), I belatedly discovered the storage and shipping costs. Better to anticipate these costs before investing. This model offers great flexibility, ideal for beginners wishing to invest without a regular commitment.

Summary table of charges

| Type of charge | Cost | Important details |

|---|---|---|

| Purchase costs | 5,95% | Deducted from every purchase of precious metals. |

| Storage costs | 12 € per year | For secure storage in Germany. |

| Delivery charges | Variable (e.g. €57.77 for 20g of gold) | For secure transport and compulsory insurance in Europe. |

| Resale costs | 1% | On the total amount at the time of resale. |

Our opinion on Inaia Finance fees

The purchase fee (5.95%) pays for halal compliance (Wakala contract) and the platform's simplicity. The 12€/year storage fee is competitive. Delivery charges (57.77€ for 20g of gold) are necessary to be sure of receiving your bullion, reflecting the security required in Europe.

This model is suitable for long-term investors. Over 7 years, the increase in gold value will offset these costs. To avoid storage costs, you can collect your gold some time after purchase, but this is only profitable for large quantities. Sharia compliance, supervised by a Sharia Board, adds a valuable ethical guarantee for Muslim investors.

Take a call with a GOLD expert to check whether this model fits your strategy and clarify the religious aspects of your investment.

Inaia Finance: for whom is it the right solution?

Inaia Finance is aimed primarily at Muslim investors concerned with Islamic compliance, long-term savers and those seeking to diversify their portfolios with precious metals.

The value-conscious Muslim investor

For Muslims requiring compliance with Sharia law, Inaia offers a model certified by MINHAJ Advisory to AAOIFI standards (to be checked if their contract with them has been renewed). Namlora shares this vision of an ethical economy. Here, no riba, but a purchase of physical gold via a wakala contract (delegation contract).

First-time investors and long-term savers

It's a simple solution for beginners or those wishing to build up capital for the future. The savings plan allows you to accumulate gold, silver, platinum or palladium in automatic monthly instalments, with secure storage in Germany/Switzerland for €1/month. Several families have already capitalized for their children over 20 years.

Investors seeking diversification

Pour ceux déjà investis en immobilier, dans des entreprises (private equity halal), Inaia propose des métaux précieux (or, argent, platine, palladium). L’or reste le pilier pour sa stabilité, l’argent offre une alternative abordable, tandis que le platine et le palladium s’ouvrent aux tendances industrielles du futur.

How does Inaia work? Key features explained

A 100% online buying and selling process

Investing in gold with Inaia takes just a few steps. Quick registration gives you access to an intuitive platform for tracking your investment in real time. Choose the metal (gold, silver, platinum or palladium), the desired weight and validate the transaction. Resale is seamless: for my part, I recovered part of my savings within a few days in the form of bullion, proof of the reliability of the service.

Take a call with a GOLD expert

Shari'ah compliance: the Wakala contract at the heart of the system

The Wakala contract allows Inaia to act as an agent to buy gold on your behalf, respecting the "hand-to-hand" exchange (qabd) required by Shari'ah. This avoids prohibited interest. This framework guarantees that the gold belongs to you from the moment of purchase, with no risk of ownership by a third party.

The Wakala contract guarantees a purchase made on behalf of the customer without delay, an essential condition of Shari'ah compliance.

Secure storage or physical delivery: the choice is yours

Two options: store your gold in Inaia's vaults (€12/year) or have it delivered to your home. 98% of customers prefer secure storage in Germany. Delivery costs around €57.77 for 20 g, including insurance. Green Gold" ingots, upgraded in 2024, combine ethics and sustainable production. Prefer selling directly on the app to avoid fees

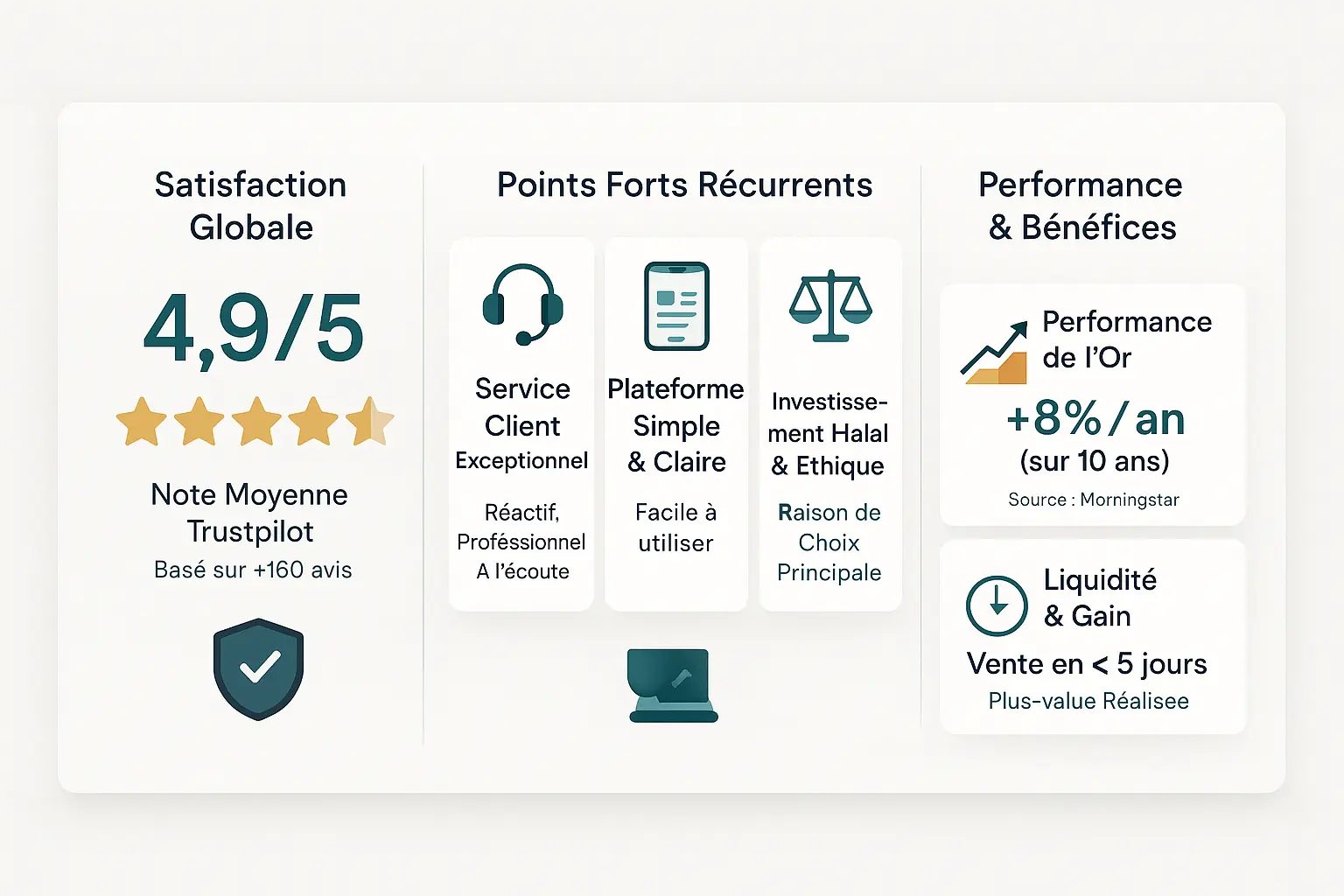

What do customers think of Inaia Finance?

Inaia Finance has an average rating of 4.9 out of 5 on Trustpilot (160+ reviews), reflecting its reliability. Users highlight its ethical commitment (halal), responsive customer service and intuitive platform. A few critics point to high initial fees, but gold's appreciation offsets these costs over the long term.

Recurring strengths

- Human support: Recognized responsiveness and professionalism, with advisors available to provide clear answers.

- Accessible interface: An easy-to-use mobile application, suitable for beginners, with real-time tracking of investments.

- Ethics and compliance: Finance aligned with Islamic values, avoiding riba and promoting responsibility.

Customer testimonial

"An Inaia customer since 2018, I am satisfied with their gold savings. The service is competent, and I sold my gold in less than 5 days with a capital gain."

Opinions point to rapid liquidity and a performance underpinned by gold, whose price has gained +8% a year on average over 10 years. For personalized support, book a call with a gold expert.

Final opinion: Inaia, a trusted partner for your halal gold?

With a rating of 4.9/5 on Trustpilot (167 reviews), Inaia stands out as a reliable platform that complies with Islamic principles. My test purchase of a 20g ingot (€1300) confirmed the speed of transactions and transparency of fees (5.95% on purchase, €12/year in Germany/Switzerland safe-deposit box). A 7-year view is recommended to optimize capital gains.

For more details, take a call with a GOLD expert via this link offers personalized guidance on the AAOIFI-compliant Wakala contract.

This opinion is personal and does not constitute financial advice. Do your own research (DYOR).

FAQ

Is gold still an appropriate investment for securing my savings?

L’or a toujours été un pilier de la diversification patrimoniale, et ce pour de bonnes raisons. Contrairement aux actifs financiers traditionnels, il conserve sa valeur sur le long terme et sert d’assurance contre l’inflation ou les crises géopolitiques.

Chez Inaia Finance, cet avantage se double d’un engagement éthique : votre or physique est stocké en Allemagne dans des coffres sécurisés, et chaque transaction respecte les principes de la finance islamique (contrat Wakala). Bien sûr, comme tout placement, il faut garder un horizon long terme pour lisser les variations de prix, mais l’expérience des clients Inaia montre que la plus-value générée compense souvent les frais initiaux.

When is the right time to buy gold in 2025?

The "right moment" depends on your strategy. If you see gold as a pillar of your savings, rather than a speculative gamble, it's a good idea to build it up gradually through regular payments. Inaia Finance's flexible savings plan makes it possible to start with as little as €1. In 2025, gold remains a stabilizing asset in a portfolio, especially with the increased volatility of traditional markets. However, as Trustpilot reviews point out, it is better to consider this investment as an "anchor" rather than a short-term opportunity, as the fees (5.95% on purchase) require time to mature.

Is it really possible to invest 1,000 euros in physical gold?

Absolutely, and it's even a recommended approach for beginners. With €1,000, you can buy around 7-8g of gold via Inaia Finance (including purchase costs). This modest sum is enough to get you into the game, while respecting Islamic precepts: the gold is acquired in full ownership, without riba or gharar. As one Trustpilot customer testifies, "even a small amount becomes a seed that grows when you cultivate patience ". Should the need arise, resale is just a few clicks away, with only a 1% fee, for rapid liquidity if necessary.

Will gold lose its value in 2025?

Predicting the future is impossible, but recent history speaks for itself: gold has gained an average of 8% a year over the past 10 years, according to Morningstar. In 2025, persistent monetary tensions (high interest rates, global debt) and geopolitical uncertainties will reinforce its role as a "safe haven". By facilitating access to this metal, Inaia Finance enables investors to take advantage of this dynamic without compromising their convictions. It should be noted that a sudden price collapse would probably be temporary, as previous cycles have shown. That's why savvy investors, such as those who have sold their gold in less than 5 days according to opinions, prefer a gradual, reasoned approach.

What is the expected return on an investment of 10,000 euros?

Returns depend on the time of purchase and length of holding. Over 10 years, €10,000 invested in gold would have generated an average capital of €21,500, thanks to this 8% annual growth. With Inaia, you benefit from real-time monitoring via the app, enabling you to adjust your strategy. Of course, the fees (5.95% on entry, 1% on exit) slightly reduce profitability, but they guarantee a Shari'ah-compliant investment. An Inaia customer explains, "It took me 4 years to double my capital, but every year I see my savings protected from inflation, which is a relief."

What are the risks of investing in gold?

Gold is not without risk, but its weaknesses are manageable. Firstly, its price may temporarily fall during periods of strong economic growth - which is why it should not represent more than 10-15% of your portfolio. Secondly, the costs of purchase (5.95%) and physical delivery (e.g. €57.77 for 20g) require a long-term horizon. Finally, unlike equities, gold does not generate passive income. However, Inaia eliminates logistical risk (free storage in insured vaults) and ethical risk (Wakala certification). As one user reminds us, "gold is a safety savings account, not a casino".

Can gold prices fall sharply?

Yes, but these falls are often opportunities for patient savers. Gold follows cycles: it rises in times of crisis and falls when markets are optimistic. However, its intrinsic value - its industrial usefulness, its scarcity - always brings it back to its peaks. Inaia Finance incorporates this logic into its model: by storing your gold or silver in Germany, you benefit from its global liquidity without fear of permanent depreciation. A customer confides: "When the price dropped in 2020, I added cheap grams. Two years later, I was glad I'd waited. In short, the key is to stay invested without panicking.

Which gold bullion to choose for a halal investment?

At Inaia Finance, the choice is simple: you buy grams of pure gold (99.99%) in the form of certified Green Gold ingots, engraved with the Shahada. These ingots, produced in Switzerland to LBMA standards, are universally recognized, guaranteeing easy resale. No need to get lost in limited editions or historical coins, which complicate liquidity. As one user puts it: "I received my 40g ingot, and it's as reassuring as a safe. If you prefer not to deal with delivery, the safe storage option is ideal, with only €12/year to secure your metal.

Is it too late to invest in gold in 2025?

Investing in gold has no time limit, because its role is eternal: to protect your purchasing power. In 2025, gold remains attractive in the face of monetary instability and record debts. Inaia Finance allows you to start small, with regular micro-investments, to benefit from the famous "oak leaf savings" effect - modest at the root, powerful over time. As one Muslim investor points out on Muslim Expat: "I waited 4 years before selling, and the capital gain covered the costs. It's better to plant late than never. In short, if your aim is to preserve your money in alignment with your values, 2025 is a good time to start.