<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: Beyond gold, silver, platinum and palladium offer unique opportunities to diversify wealth. Silver, the driving force behind the energy transition, and the platinum-palladium duo, pivots of the automotive and innovation sectors, complement gold as pillars of stability. A moderate allocation (5-10%) balances yield, resilience and ethical values, in line with a sustainable economy.

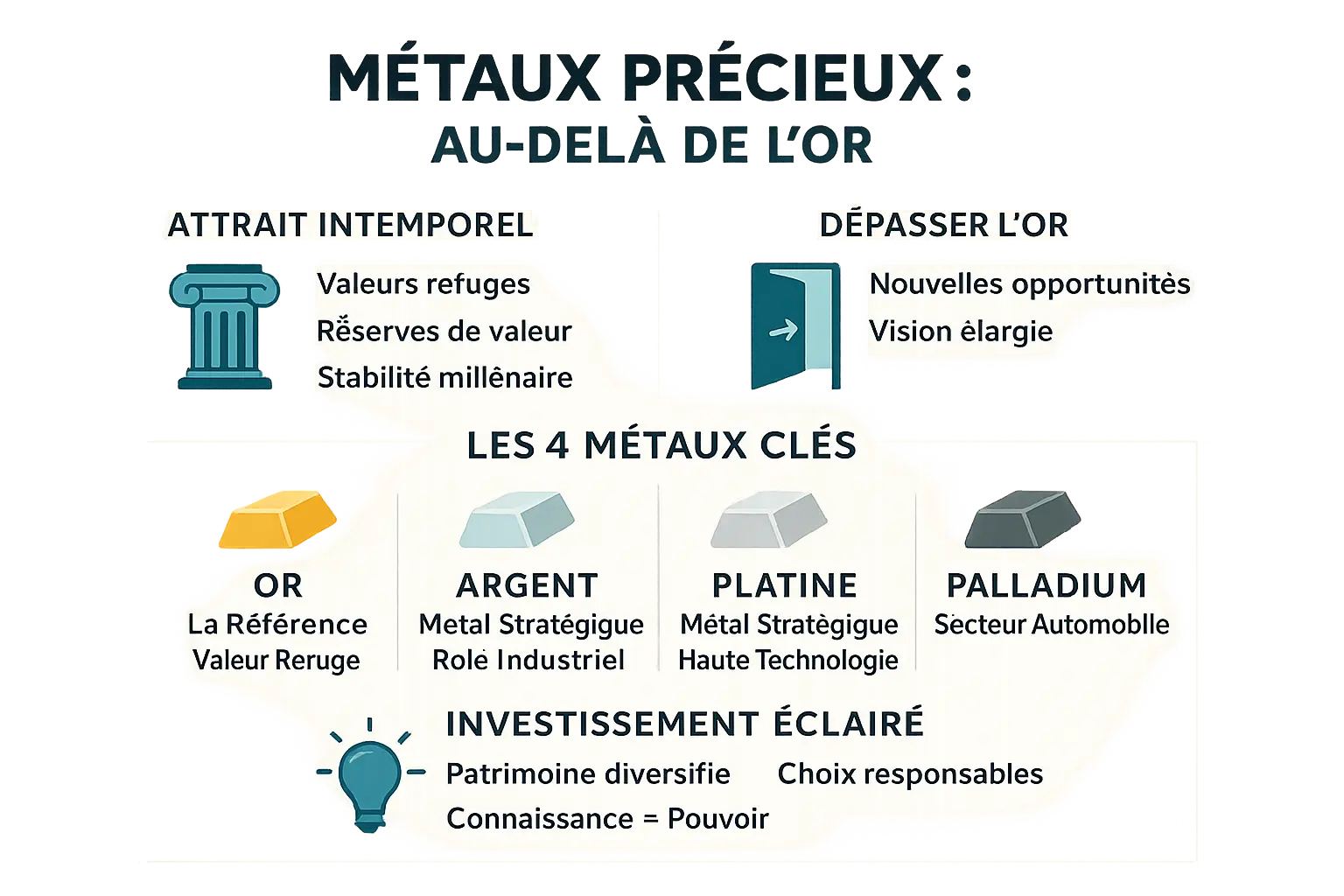

Are you limiting your investment strategy to gold, missing out on little-known opportunities? Discover the 4 precious metals - gold, silver, platinum and palladium - and their strategic role in the global economy. Beyond the historical fascination with these assets, each metal hides a unique dynamic: monetary stability for gold, industrial potential for silver, geopolitical scarcity for platinum, and risky speculation for palladium. By understanding their strengths and risks, you can avoid the pitfalls of a simplistic approach and reveal hidden wealth, between safe haven and sustainable growth.

Contents

Why take an interest in precious metals beyond gold?

For thousands of years, precious metals have been a safe haven and a store of value. Symbols of wealth and stability, they have stood the test of time, adapting to the needs of society. Like a century-old tree that withstands storms, each of them bears a unique history, a precise function in the global economy.

Gold remains the undisputed universal benchmark. However, to limit our gaze to this metal alone is to ignore distinct opportunities and dynamics. Silver, platinum and palladium are strategic metals with varied profiles. While gold shines for its stability, these less obvious allies reveal exceptional industrial potential, key roles in the energy transition, and less linear but sometimes more promising paths.

Understanding these four metals opens the door to an enlightened investment, in line with your values and objectives. At Namlora, we believe in building a diversified portfolio, combining security and innovation. Each metal tells an economic, technological and ecological story. Understanding its subtleties means choosing to cultivate your wealth wisely, in harmony with your faith and convictions. Because investing is not speculating: it's sowing today to reap tomorrow, with confidence and responsibility.

Gold (🟡): the essential pillar of your estate

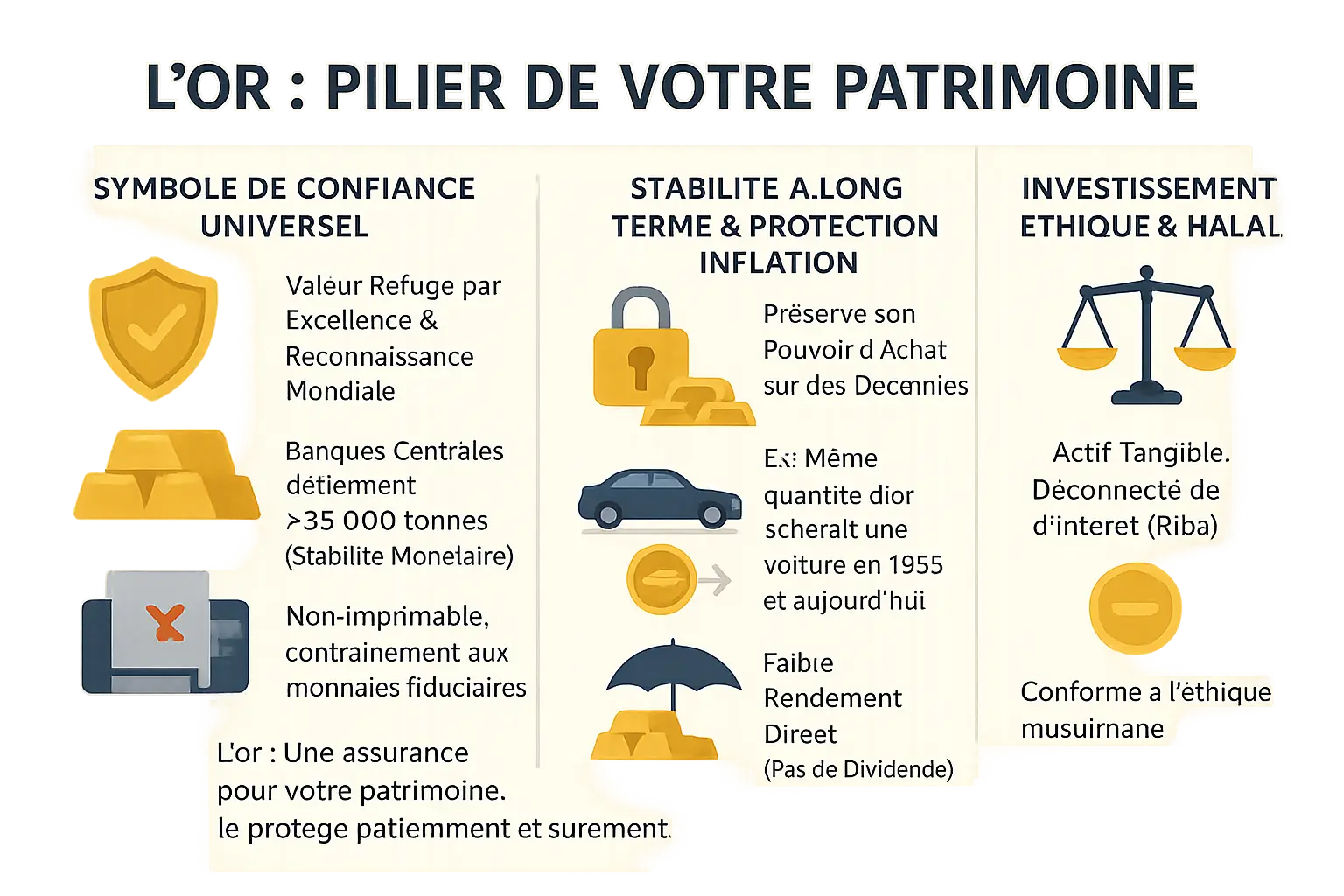

A universal symbol of trust

Since ancient times, gold has embodied stability and value. Unlike fiat currencies, its intrinsic rarity prevents uncontrolled issuance. Why do central banks hold over 35,000 tonnes of gold? Because this yellow metal is the foundation of confidence in monetary systems.

Its universal recognition transcends borders and cultures. In times of geopolitical or monetary uncertainty, gold acts as an anchor for government reserves. It is a tangible asset, with no dependence on cyclical economic policies.

Long-term stability and protection against inflation

Imagine this paradox: in 1935, 14 ounces of gold bought a basic car. Today, those same ounces still allow that purchase, despite 90 years of inflation. This relative constancy proves its power to preserve value.

Yet gold does not generate direct income like bonds or equities. Its short-term volatility may give cause for concern, but its strategic role is to stabilize a portfolio. It's a silent insurance that asserts itself in financial storms.

Gold from a halal investment perspective

Why is physical gold Sharia-compliant? Because it embodies a tangible asset, with no link to the interest system (Riba). It's an ethical investment, based on the real possession of a precious asset.

Gold is not just an investment, it's an insurance policy for your wealth. It won't make you rich quickly, but it will protect your wealth patiently and surely.

Halal gold financial products require verifiable physical reserves. Discover how to invest in gold in IslamThe Halal system combines tradition and modernity. This transparency reassures Muslim investors wishing to reconcile faith and wealth growth.

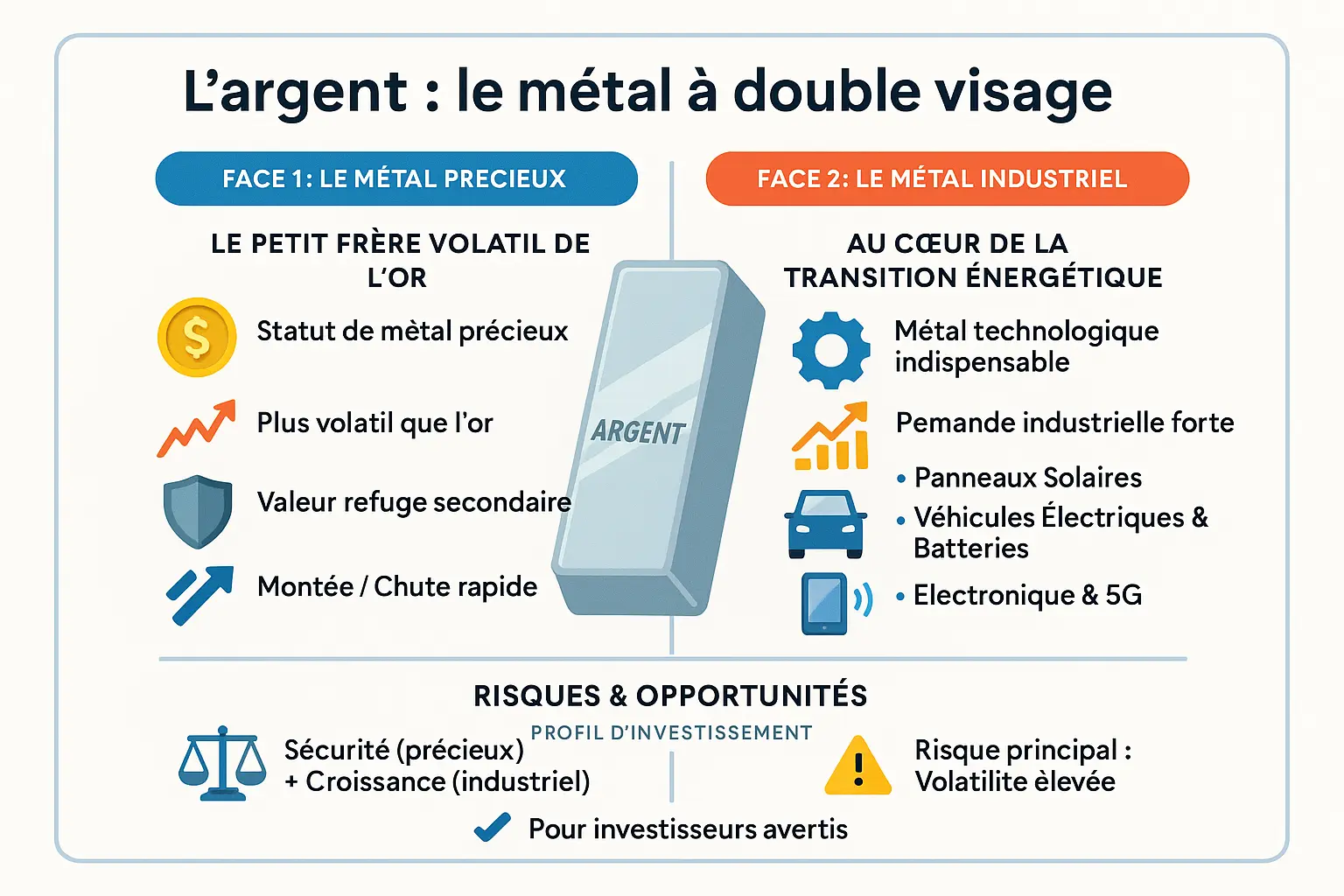

Silver (⚪): the metal with two faces, between refuge and industry

Gold's more volatile "little brother

Silver shares precious metal status with gold, but its nature is more nervous. Its volatility is explained by its dual function as a monetary refuge and an industrial raw material. When the market rises, it soars faster than gold; when it falls, it falls more sharply.

The gold/silver ratio, once 15:1, now sometimes exceeds 80:1. This divergence suggests a potential catch-up if industrial demand accelerates. For sophisticated investors, it represents a secondary safe-haven asset with an atypical profile.

The real advantage: a metal at the heart of the energy transition

Its exceptional electrical conductivity makes it a strategic ally for renewable energies and modern technologies:

- Solar panels ☀️: essential for harnessing the sun's energy

- Electric vehicles 🔋: used in recharging systems (25 to 50g per car)

- Electronics 📡: present in printed circuits, accelerating digital technology

The World Bank classifies silver as a critical metal. Its industrial demand is set to quadruple by 2050, driven by the electrification of transport and clean energies.

Risks and opportunities

Its higher volatility than gold makes it an asset for balanced portfolios. Fluctuations in the technology and automotive sectors have a direct impact on its value. This atypical investment is ideal for those wishing to capitalize on the energy transition while maintaining a base of security.

Namlora offers Islamic-compliant solutions, integrating precious metals in a responsible and sustainable approach.

Platinum (⚫) and palladium (🚗): strategic metals for the automotive industry

Platinum: the rare and undervalued giant

With less than 190 tonnes mined annually, platinum is the embodiment of scarcity. 85% of its production comes from South Africa and Russia, areas of proven geopolitical risk. Used up to 40% in diesel catalysts, this noble metal resists corrosion and high temperatures, but its value remains lower than that of gold despite being 15 times rarer.

Its future lies in the hydrogen transition. European projects to produce carbon-free hydrogen depend on platinum. However, research into alternatives raises questions about its future industrial dominance.

Palladium: the speculative star at a turning point

Palladium surpassed the price of gold in 2020, driven by automotive demand (80%). Its extreme volatility makes it a strategic but risky metal. Geopolitical tensions have pushed up its price, illustrating its sensitivity. The rise of electric vehicles threatens its dominance, making its industrial future uncertain.

For an ethical Islamic investment, understanding how it fits into halal diversification diversification is essential. It symbolizes every investor's challenge: capturing opportunities while assessing long-term risks.

Ethical and geopolitical issues

Concentrated in unstable zones, platinum production remains vulnerable: a South African strike can push up its price by 10%. The circular economy offers a response through the recycling of automotive catalytic converters (8 grams on average per unit). This process reduces environmental impact and supply risks, while promoting ethical practices.

The future of these metals will depend as much on the automotive industry as on innovation. As with any Sharia-compliant investment, transparency of the supply chain and prudent risk management remain fundamental. Their role in the ecological transition reinforces their relevance, provided that scarcity, ethics and geopolitical stability are reconciled.

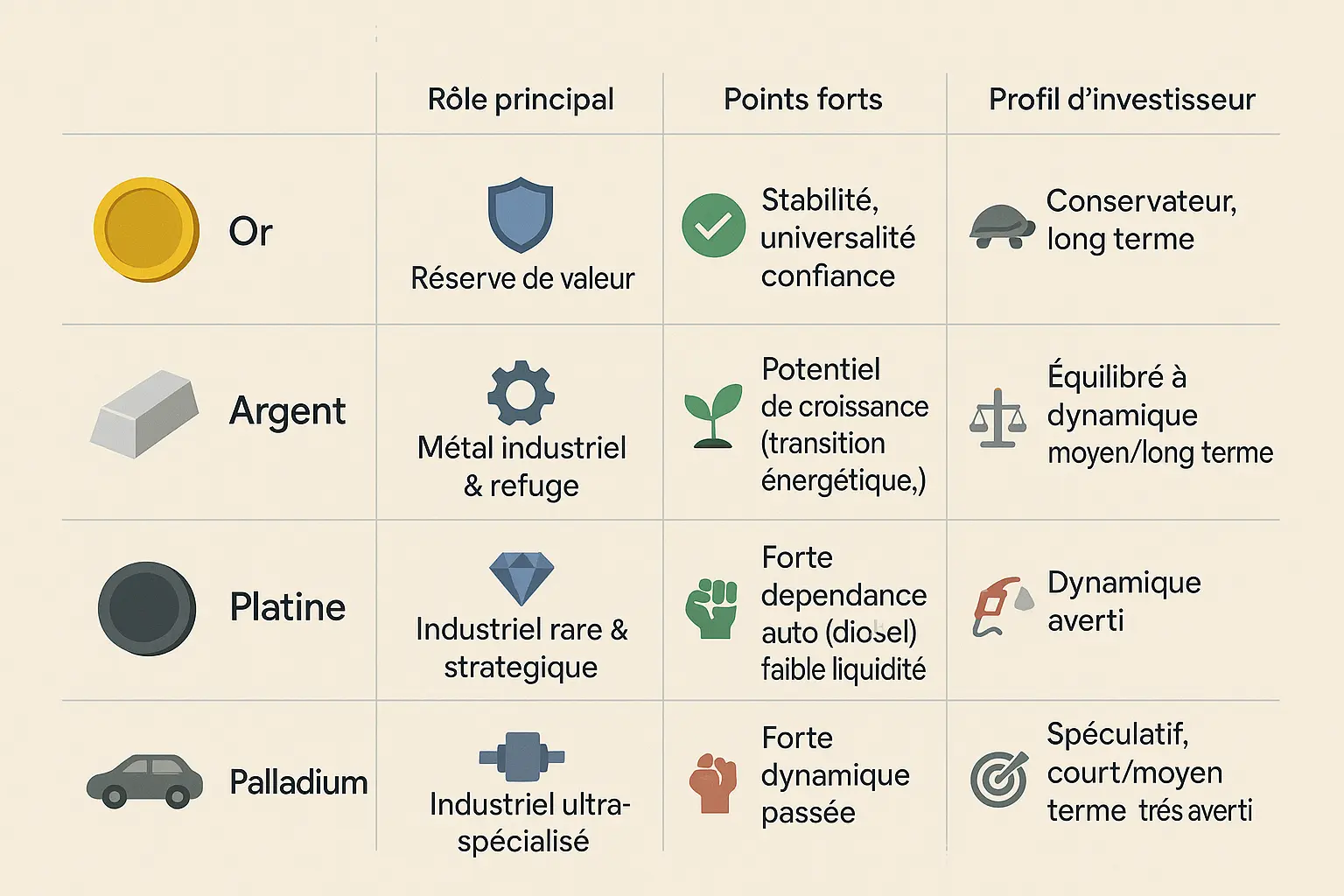

| Metal | Main role | Highlights | Main risks | Investor profile |

|---|---|---|---|---|

| Or 🟡 | Value reserve | Stability, universality, state confidence | Low direct yield | Conservative, long term |

| Silver ⚪ | Industrial metal & refuge | Growth potential (energy transition), more accessible | Very high volatility | Balanced to dynamic, medium/long term |

| Turntable ⚫ | Rare & strategic industrial | Rarity, rebound potential, diversification | Dependence on automobiles (diesel), low liquidity | Dynamic, knowledgeable |

| Palladium 🚗 | Ultra-specialized industrialist | Strong momentum in the past, tension over supply | Risk of bubble, extreme dependence on cars | Speculative, short/medium term, very informed |

The choice between gold, silver, platinum and palladium depends entirely on your investor profile, time horizon and risk tolerance. Each metal meets specific needs: gold ensures stability, silver benefits from the energy transition, platinum offers strategic rarity, while palladium remains speculative. None is "better" than the others, but each has its place in a diversified strategy.

How to invest in precious metals in a practical and responsible way

The various gateways to precious metals

Investing in gold, silver, platinum or palladium comes in a variety of forms. Each has its own advantages, risks and degree of control. Here are the three main options:

- Physical purchases (coins and bullion): Acquiring gold, silver or palladium bullion or coins offers the advantage of a tangible asset. Direct possession is reassuring, especially in times of crisis, but secure storage is essential. Consider using a bank vault or specialized companies.

- Financial products (ETF/ETC): These funds replicate the price of metals without actually owning them. Practical for active investors, but beware of recurring management fees. You don't own the metal, which exposes you to counterparty risk if the issuer defaults.

- Shares in mining companies: Buying shares in mining companies offers indirect exposure. The price depends as much on the metal as on the company's financial health. This choice suits investors willing to study both the metal and the company's management.

The principles of prudent investment in line with your values

Precious metals are not risk-free investments. Gold, a symbol of stability, can lose 40% of its value in just a few months. Silver, more volatile, reacts strongly to economic cycles. Platinum and palladium, linked to the automotive industry, depend on technological developments.

In France, physical gold is exempt from VAT on purchase, but subject to a flat-rate tax of 11.5% on resale. To best protect your savings, limit your allocation to 5-10% of your total assets. Precious metals complement, but do not replace, a diversified portfolio.

The financial authorities classify these assets as "atypical". Before taking the plunge, consult the AMF's warnings. A crucial warning: the capital invested is never guaranteed.

A successful investment is not the one that yields the highest return, but the one that is best understood. Take the time to educate yourself before entrusting your savings.

Building your strategy: precious metals as the foundation of your financial future

There's more to precious metals than their brilliance. Gold embodies stability, preserving value in the face of monetary inflation, as evidenced by its long-term hold despite crises. Silver, less expensive to buy, is anchored in technological innovation: it is indispensable for solar panels and electric batteries, the key sectors of tomorrow. Platinum and palladium, although more volatile, offer targeted opportunities for experts, notably in the automotive industry, where their catalytic properties limit pollutant emissions.

Diversification remains your shield against the unexpected. By spreading your investments across these metals, you limit the shocks associated with market fluctuations. At Namlora, this logic is part of an ethical vision: every financial decision must serve mankind and preserve natural resources. For example, recycled or Fairmined-certified gold guarantees extraction that respects human rights and the environment, aligning your earnings with universal values.

En choisissant consciemment vos actifs, vous devenez un pilier d’une économie plus juste. Investir de manière responsable, c’est non seulement sécuriser votre patrimoine, mais aussi œuvrer pour un avenir où la finance reflète vos convictions. Avec Namlora, chaque transaction participe à un réseau solidaire, où transparence et croissance durable guident chaque choix. L’épargne devient un acte de foi et de confiance, pour soi, sa famille et la société.

L’or, pilier de stabilité et réserve universelle. L’argent, moteur de croissance grâce à son rôle dans la transition énergétique. Platine et palladium, choix stratégiques liés à l’automobile, menacés par les évolutions tech. Diversifier, c’est préparer l’avenir avec sagesse. Chez Namlora, chaque investissement allie connaissance, éthique et confiance pour construire un patrimoine résilient et sur des valeurs claires.

FAQ

Which precious metals to invest in for a balanced strategy?

To build a resilient portfolio, balance is essential. Gold, a pillar of stability, protects your savings over the long term. Silver, more volatile, offers powerful leverage thanks to its industrial demand linked to the energy transition. Platinum, undervalued despite its scarcity, remains strategic for those anticipating innovations. Palladium, a short-lived star, attracts bold investors thanks to its automotive demand, but its future depends on developments in the electrical market. Diversification between these metals, according to your profile, creates a solid foundation.

Which precious metal should I invest in according to my profile?

The choice depends on your objectives and risk tolerance. Conservative investors will opt for gold, a universal safe-haven, ideal for preserving their wealth. Those looking to combine stability and moderate growth will lean towards silver, supported by green technologies. Discerning profiles, ready to accept greater volatility, will explore platinum (strategic rarity) or palladium (short-term opportunities). Like a gardener planting various species for a sustainable harvest, a balanced allocation between these metals offers protection against economic storms.

What is the most profitable metal for investment in 2025?

"Profitable" depends on your horizon. In the short term, palladium has shown impressive peaks, but its dependence on automobiles remains a risk. Silver, buoyed by industrial demand, could overtake gold if historical ratios recover. In the long term, gold remains king for its proven stability, like an oak tree that withstands hurricanes. The answer lies in the right mix: a solid portion in gold, a dynamic complement in silver, and daring touches in platinum/palladium for the more enterprising.

Is it profitable to invest in gold in 2025?

If "profitable" means "protecting your capital", gold remains unrivalled. Its price fluctuates in the short term, but over 50 years, it has preserved its purchasing power, like an anchor in a monetary storm. Central banks hold massive reserves, testifying to its eternal confidence. For those seeking a refuge from inflation or instability, its "lack of direct yield" is a false flaw: its true value lies in its ability to weather crises without burning up.

Is it profitable to invest in gold in 2025?

If "profitable" means "protecting your capital", gold remains unrivalled. Its price fluctuates in the short term, but over 50 years, it has preserved its purchasing power, like an anchor in a monetary storm. Central banks hold massive reserves, testifying to its eternal confidence. For those seeking a refuge from inflation or instability, its "lack of direct yield" is a false flaw: its true value lies in its ability to weather crises without burning up.

What precious metals prices are forecast for 2025?

Predicting markets is perilous, but trends are emerging. Industrial demand for silver is set to grow with solar panels and electric vehicles. Undervalued platinum may benefit from the green hydrogen that requires its properties. Palladium, closely linked to automotive standards, could see its value fluctuate with the rise of electric vehicles. Gold, less sensitive to industrial cycles, will remain a barometer of confidence in fiat currencies. As with the weather, be prepared rather than predict.

What is the 10-year price of platinum and its place in the gold portfolio?

Over the past decade, platinum has lost ground to gold, a victim of its dependence on the declining diesel automobile. Yet its scarcity (less than 190 tonnes mined annually) and its applications in hydrogen and medicine offer potential. Like a diamond in the rough, it requires patience and discernment: its brilliance is revealed to investors capable of waiting for new technologies to enhance its uniqueness.

Which metal pays off best in the short term? And in the long term?

In the short term, palladium has broken records, boosted by anti-pollution standards, but its speculative bubble may burst. In the long term, gold and silver remain the real winners: gold for its durability, silver for its dual industrial role. As in a long-distance race, consistency pays off. Rare metals like platinum and palladium are like sprints: fast, but risky.

Which metal will attract investors' money in 2025?

Silver is attracting attention for its dual role as a safe-haven and technology metal. Hedge funds are betting on its demand for 5G and solar energy. Palladium continues to be favoured by traders for its tight supply, while gold appeals to stability-minded savers. Discreet platinum may surprise if the green transition gathers pace. Like bees and honey, silver flows with the flowers of growth.

Which metal is worth more than gold today, and why?

In 2020, palladium surpassed gold in value per ounce, driven by its scarcity and automotive demand. This record illustrates how temporary scarcity can surpass tradition. Yet this hierarchy is fickle: tomorrow, silver, undervalued in gold/silver ratio, could reclaim its crown. Platinum, heavier but less expensive, reminds us that a rough diamond is worth less than a cut diamond... until it's cut.