<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: The Majma' al-Fiqh al-Islami guides Muslims in a complex world by translating the Sharia into practical rules through a collective Ijtihad. Thanks to key decisions such as the validation of Takaful (1985) or equity investment (1992), it offers an ethical and secure framework for reconciling faith and modern finance.

Lost in the myriad of contradictory fatwas in a changing world? The majma al-fiqh, this assembly of multidisciplinary scholars and experts under the aegis of the OIC, embodies the collective response to modern challenges, from Islamic finance to bioethical issues. Discover how this body, born in 1984, uses collective ijtihad to reconcile tradition and innovation. Explore its landmark decisions, such as framing cryptocurrencies or allowing organ donation, while discovering its challenges: slow decision-making, tension with national sovereignty, and adapting to AI. An ethical guide to investing, deciding and living in line with your convictions in a globalized world.

Contents

Majma' al-Fiqh al-Islami: a guide to ethical investment in the modern age

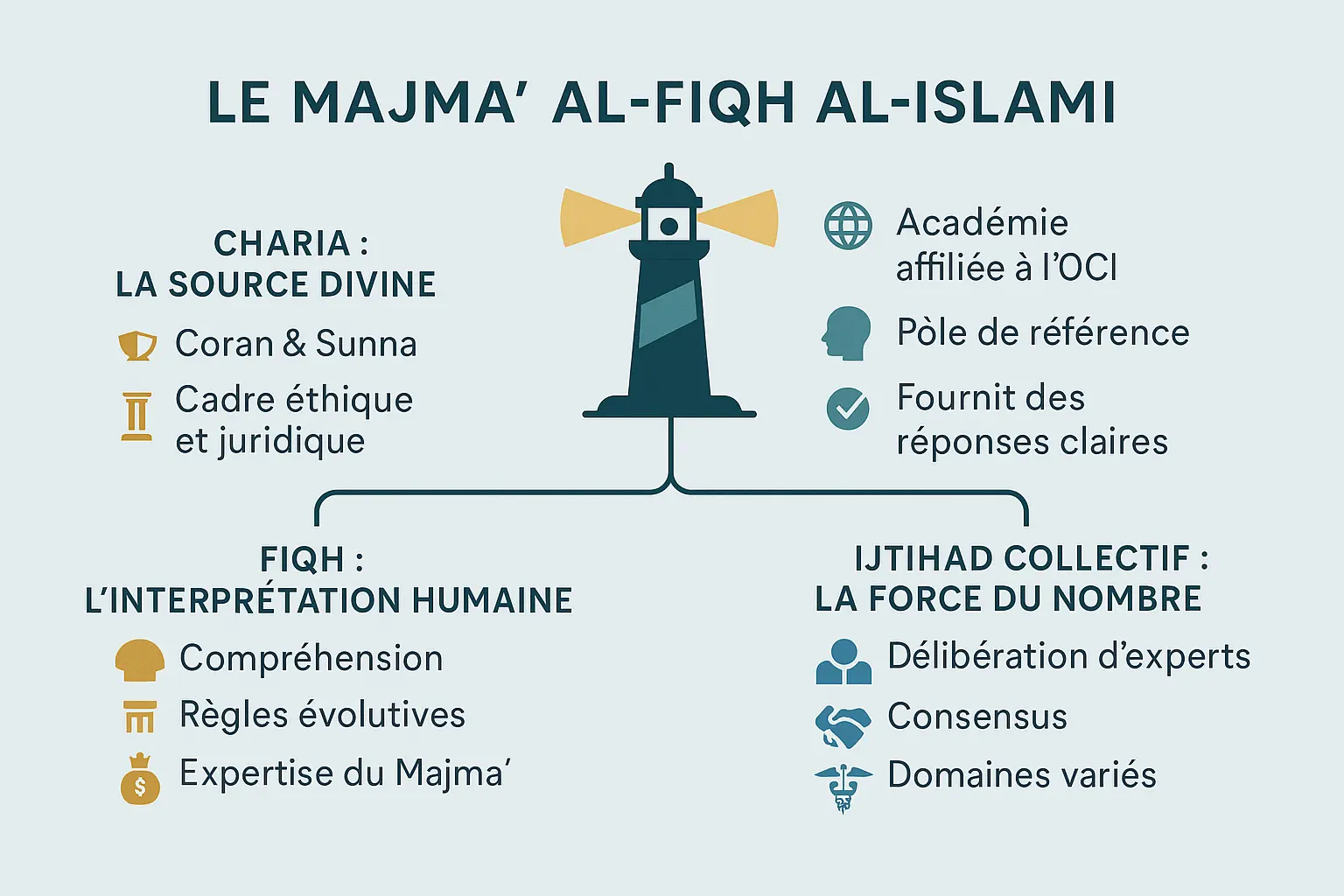

Imagine a lighthouse illuminating rough waters for ships in distress. The Majma' al-Fiqh al-Islami plays this role in the modern Muslim world, guiding believers through the complex challenges of finance, technology and medicine. As an institution of the Organization of Islamic Cooperation (OIC), this International Academy of Islamic Fiqh offers collective and reliable answers, essential for aligning investments with Islamic values.

What is fiqh and sharia? The basics to understand

Sharia represents the divine, unchanging way, derived from the Koran and the Sunna. It is the source of living water that nourishes faith, defining the eternal principles of halal and haram. Fiqh, for its part, is the human interpretation of this source, like the canals that distribute water to the fields. It translates divine commandments into practical rules for changing realities, from prayer to financial contracts. This key distinction shows how Islam remains alive, thanks to Fiqh, while respecting the integrity of the Sharia.

Collective ijtihad: strength in numbers in the service of faith

Ijtihad is the effort of scholars to answer new questions. Ijtihad Jama'i (collective) revolutionizes this practice by bringing together experts from various fields - law, economics, medicine - to debate collectively. The Majma' al-Fiqh embodies this approach, transforming fragmented opinions into solid consensus. This strength in numbers reassures the Ummah in the face of modern challenges, such as cryptocurrencies or artificial intelligence, by guaranteeing profound and legitimate legal decisions.

History and founding of Majma' al-Fiqh: a response to fragmentation

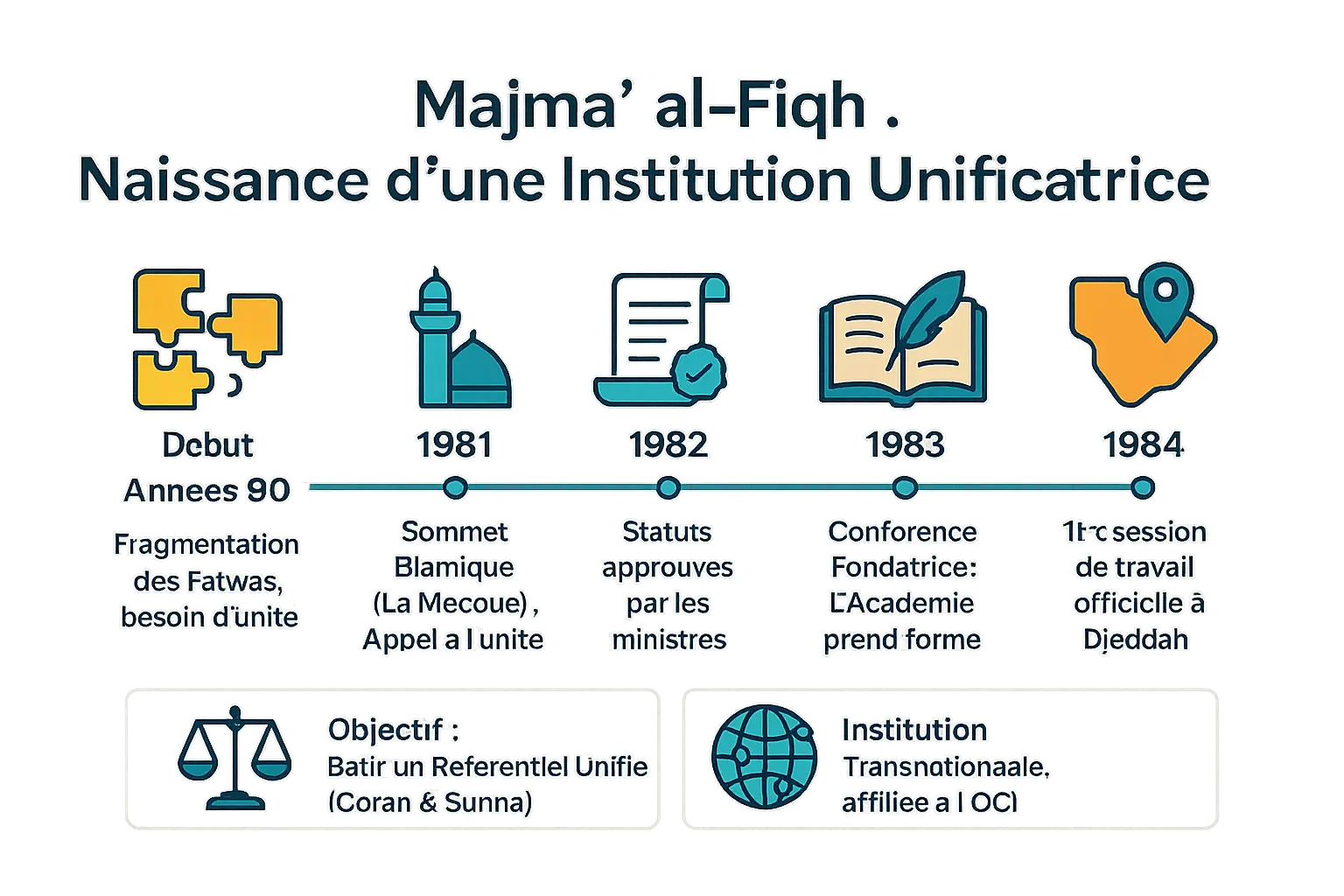

The 1980s marked a turning point for the Muslim Ummah. Faced with a proliferation of contradictory fatwas and the urgent need to respond to modern challenges, the call for a unified legal authority became imperative. Divergences between schools of thought (madhahib) and the absence of a collective framework for tackling complex issues such as Islamic finance or bioethics created a cacophony that undermined the cohesion of the global Muslim community.

In 1981, the Third Islamic Summit Conference, held in Mecca, responded to this call. Resolution no. 8/3-T/S-I formalized the creation of the Majma' al-Fiqh al-Islami. This project, supported by King Khalid bin Abdulaziz of Saudi Arabia, aims to mobilize scholars and experts to update Shariah principles in a changing world. The aim is clear: to establish a unified frame of reference, combining traditional rigor and adaptation to contemporary realities.

The implementation process was gradual. In 1982, the statutes of the Academy were approved by the Ministers of Foreign Affairs meeting in Niamey. The founding conference in 1983, under the patronage of King Fahd, gave concrete form to the institution in Jeddah. In 1984, the first working session launched the work, marking the beginning of a new era for Islamic jurisprudence.

It is essential to distinguish the Majma' al-Fiqh al-Islami from other entities with similar names, such as the Majma' al-Islami of Sheikh Ahmed Yasin. Unlike the latter, the Jeddah Academy enjoys transnational recognition through its affiliation with the OIC, which comprises 57 member states. This legitimacy enables it to assert itself as the global jurisprudential reference for Muslims.

- 1981: Founding resolution at the Islamic Summit in Mecca.

- 1982: Approval of the Articles of Association by the Ministers of Foreign Affairs.

- 1983: Founding conference in Jeddah.

- 1984: First official working session.

Majma' methodology: a rigorous, multidisciplinary process

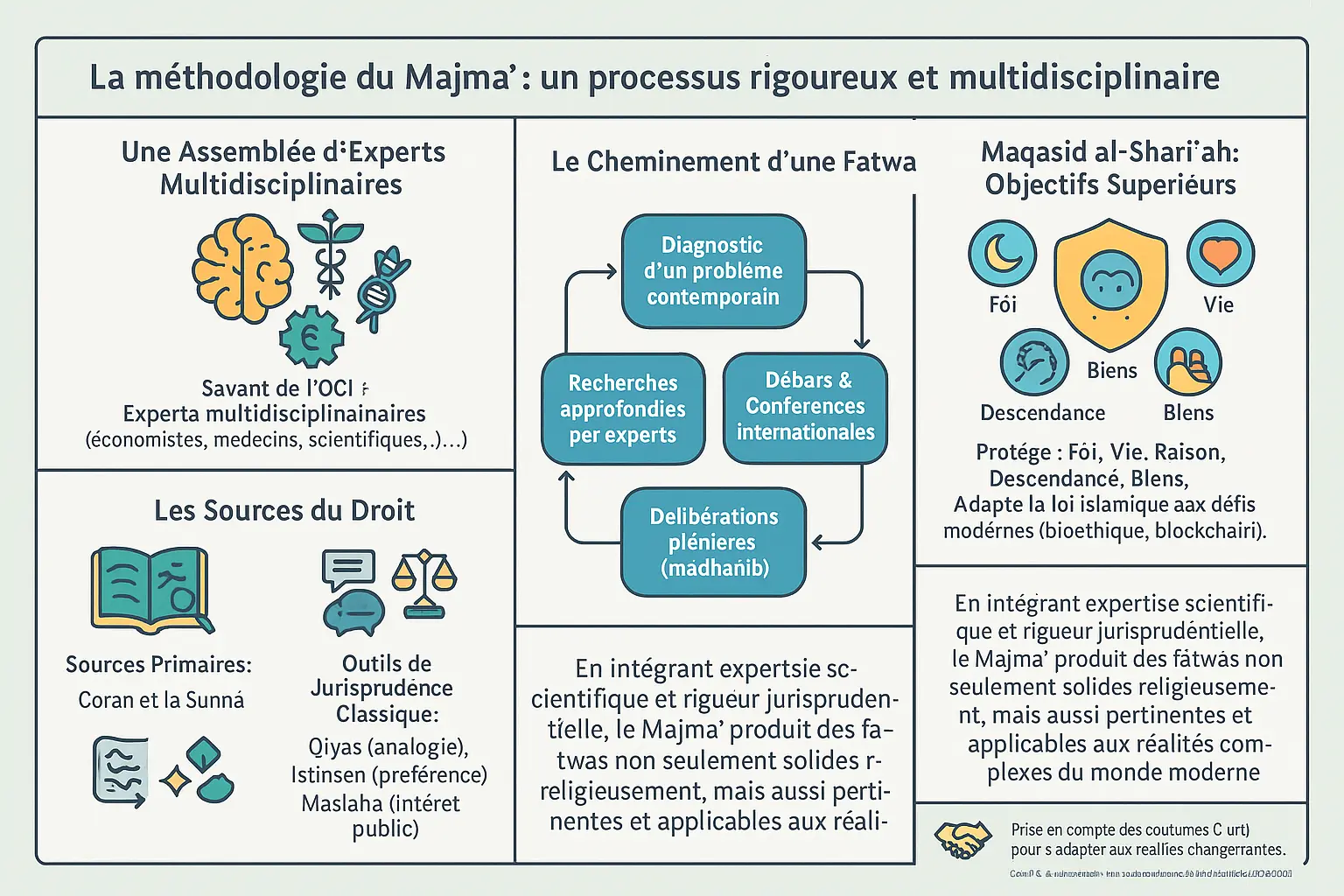

Behind each decision of the Majma' al-Fiqh al-Islami lies a structured process, the fruit of exchanges between scholars, experts and various disciplines. This rigor guarantees fatwas rooted in tradition, while adapting to contemporary challenges.

An assembly of multidisciplinary experts

The Council brings together one representative per OIC member state, chosen from among the most eminent scholars. In addition to jurists and ulama, experts in economics, medicine, technology and the social sciences also participate. This multidisciplinary expertise makes it possible to tackle subjects such as artificial intelligence and ecological issues. For cryptocurrencies, economists collaborate with scholars to assess the risks of speculation (maisir) while preserving wealth (hifdh al-maal), a higher Shariah objective.

By integrating scientific expertise and jurisprudential rigor, the Majma' produces religiously sound fatwas adapted to modern realities.

The path of a fatwa: from identification to resolution

The process begins with the identification of a problem, often raised by a state or institution. Experts carry out in-depth research, debate at international seminars, and then formalize their conclusions at plenary sessions. Once adopted, these collective resolutions become official. The 1988 resolution on organ transplants illustrates this synergy between doctors and theologians in defining the criteria for brain death.

The foundations of Islamic law: between tradition and adaptation

Decisions are based on the Koran and Sunna, supplemented by qiyas (analogy), istihsan (legal preference), and maslaha (public interest). The Academy also incorporates local customs (ʿurf) if they conform to Sharia law, as a study on their role in the decision-making process highlights.

The higher aims of Sharia: a strategic vision

The Academy focuses on Maqasid al-Shari'ah (protection of life, faith, reason, descent and wealth). This approach makes it possible to interpret ancient texts for new issues, such as smart contracts. In environmental matters, the principle of damage prevention (sadd al-dharar) justifies the prohibition of toxic waste dumping, embodying the notion of khilafah (stewardship of the Earth). In this way, the Majma' proposes unified solutions, demonstrating the flexibility of fiqh in the face of the challenges of the 21st century.

Majma''s major resolutions: concrete responses to modern challenges

The Majma' al-Fiqh al-Islami transcends the theoretical framework to offer practical guidance to Muslims. Its decisions, born of Collective Ijtihad, illustrate a capacity for adaptation in the face of economic, medical and societal challenges.

Islamic finance: laying the foundations for an ethical system

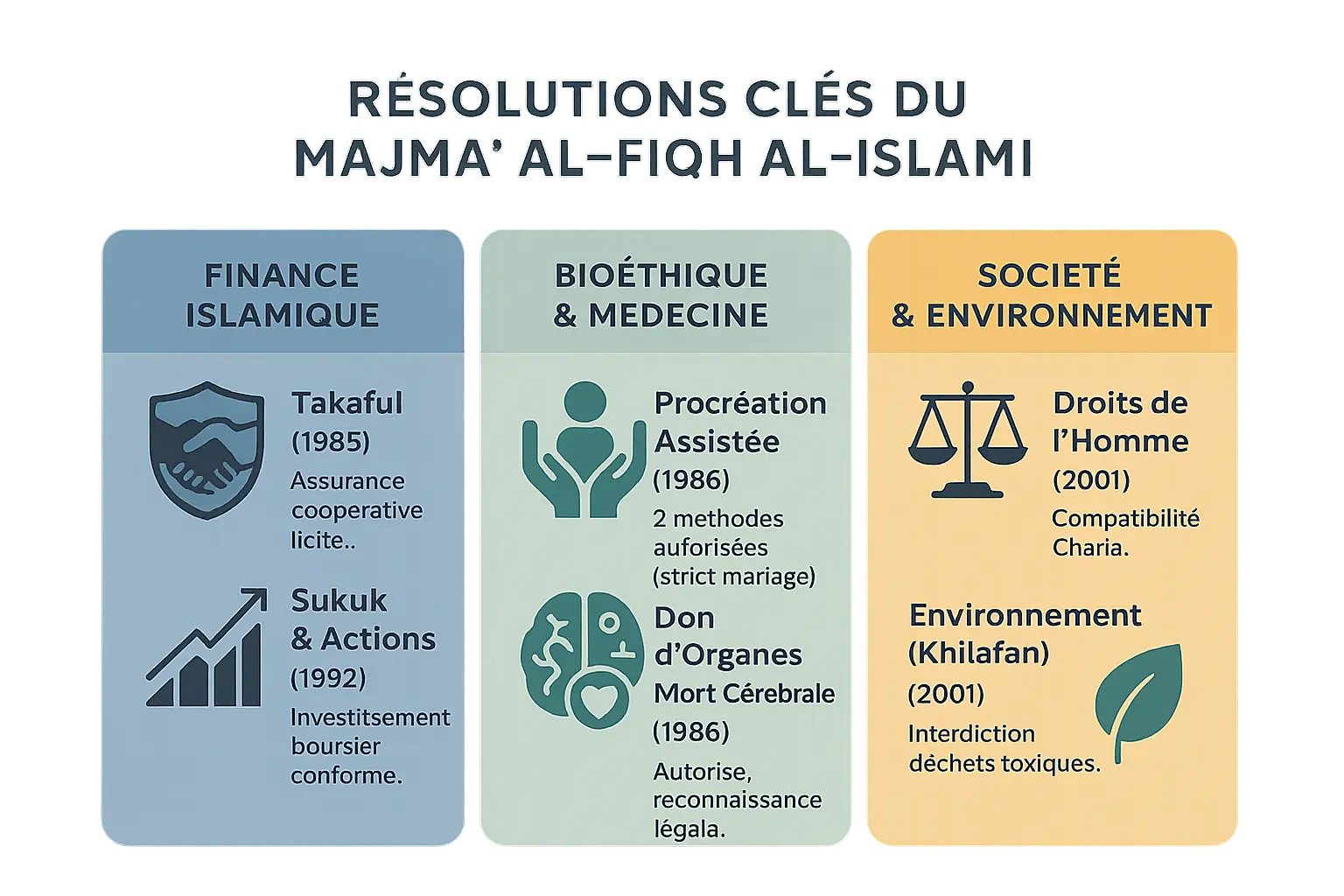

In 1985, the Majma' revolutionized Islamic finance by validating Takaful, an insurance model based on solidarity. This decision eliminated prohibited elements such as Riba (interest) and Gharar (uncertainty), while aligning itself with Koranic teachings: "Help one another in righteousness and piety" (Koran 5:2). Namlora follows this logic by facilitating Sharia-compliant investments, such asIslamic stock market investments.

The 1992 resolution opened up the financial markets to Shariah-compliant companies, enabling Muslims to combine profitability and values. In 2019, faced with cryptocurrencies, the Academy validated Bitcoin as "essentially ḥalāl", while highlighting the risks associated with its volatility.

Bioethics and medicine: guiding science with a conscience

In 1986, the resolution on assisted reproduction (n°16) struck a balance between innovation and ethics. Of the seven methods analyzed, five were prohibited to avoid confusion of filiation, while two, limited to the context of marriage, were authorized.

The 1988 resolution on organ transplantation left its mark on Islamic bioethics. By recognizing brain death as a criterion of death, the Academy enabled access to life-saving transplants while prohibiting the commodification of organs.

Society and environment: a global vision

In 2001, the Majma' affirmed the compatibility of human rights with Sharia law. On the environmental front, it banned the dumping of toxic waste, relying on the concept of khilafah (stewardship) to promote responsible resource management.

| Domain | Resolution Key | Year | Main conclusion |

|---|---|---|---|

| Finance | Takaful validation | 1985 | Deemed legal as a cooperative alternative to conventional insurance |

| Medicine | Brain death & Organ transplants | 1987-1988 | Recognition of brain death and authorization of organ transplants with consent |

| Finance | Stock partnerships | 1992 | Authorization to invest in shares of Sharia-compliant companies |

| Company | Human rights | 2001 | Affirmation of the compatibility of human rights with Sharia law |

| Finance | Smart Contracts | 2019 | Final decision deferred for further study, showing a cautious approach |

Impact and influence of the Majma': a moral and normative authority

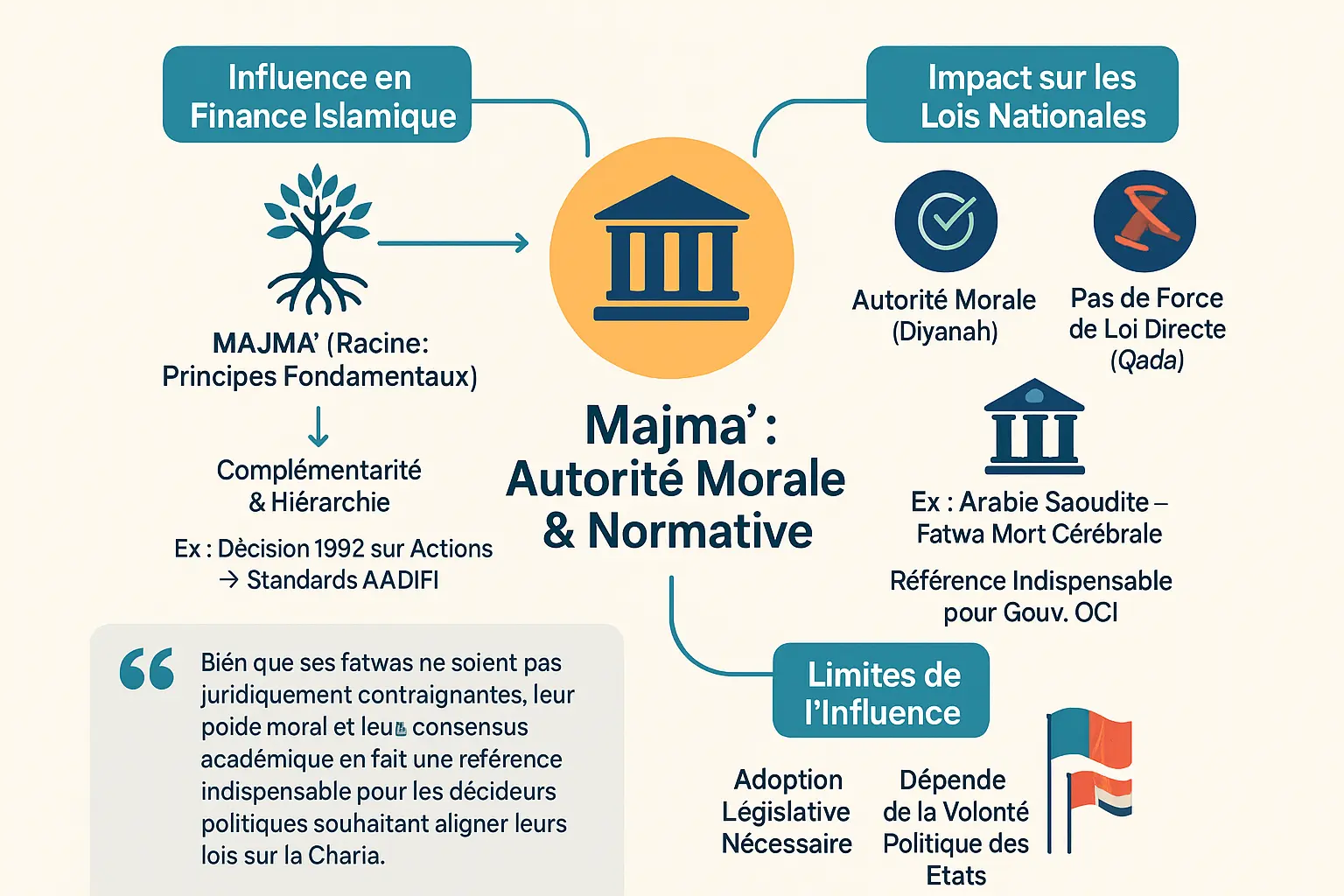

Le Majma’ al-Fiqh al-Islami ne se contente pas d’émettre des avis théoriques : son influence irrigue l’économie islamique comme une racine nourrissante. En finance, il agit en architecte des principes fondamentaux tandis que des organismes comme l’AAOIFI façonnent les normes techniques. Cette complémentarité entre Majma’ et AAOIFI rappelle celle d’une racine solide et de branches vigoureuses. Ainsi, la résolution de 1992 autorisant l’investissement en actions conformes à la Charia a permis à l’AAOIFI de structurer des critères précis, comme le seuil de 5% de revenus non conformes ou de 30% d’endettement.

"Although its fatwas are not legally binding, their moral weight and academic consensus make them an indispensable reference for policymakers wishing to align their laws with Sharia law."

This moral authority (diyanah) is reflected in national legislation. Saudi Arabia, for example, incorporated the recognition of brain death into its law thanks to the fatwa of the Majma' in 1988. While legal force (qada) remains in the hands of governments, the legitimacy of the Majma' makes its opinions inescapable. However, state sovereignty imposes limits: a fatwa requires a local legislative process to become law, creating disparities in application from country to country. Nigeria, for example, has incorporated Majma' recommendations into its Islamic finance framework.

To further illustrate this dynamic, the relationship between the Majma' and AAOIFI illustrates how a strategic vision translates into operational practices. While the Majma' sets the fundamentals, AAOIFI develops the compliance tools, proving that collaboration between institutions strengthens the credibility of the Islamic financial system. This synergy shows how the Islamic ecosystem balances innovation and fidelity to principles, even if the Majma' adopts a cautious stance on emerging subjects such as smart contracts, preferring in-depth studies before any definitive resolution.

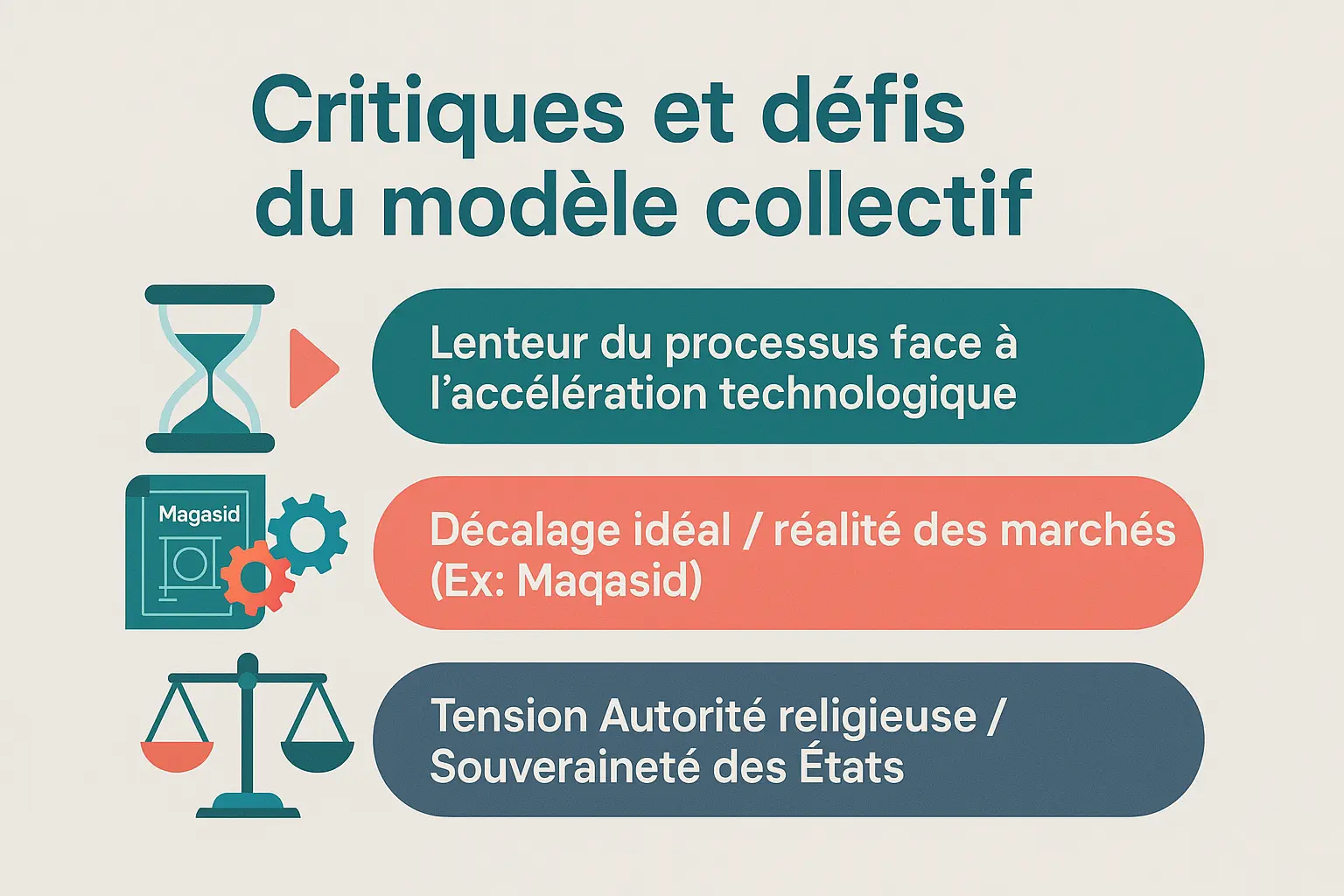

The slowness of the deliberative process in the face of technological acceleration

Le modèle collectif du Majma‘ al-Fiqh al-Islami, bien que rigoureux, peine à suivre le rythme des innovations rapides. Son approche consensuelle nécessite des débats entre experts de différentes écoles, un processus long. Par exemple, les avis individuels sur les cryptomonnaies ont émergé avant que l’Académie ne se prononce, illustrant ce décalage temporel. Cette lenteur, bien que garantissant une analyse approfondie, peut laisser un vide en matière de guidance religieuse dans des domaines émergents.

The gap between ideal resolutions and economic reality

Majma' fatwas, though legally sound, face practical obstacles. In Islamic finance, the Academy advocates profit and loss sharing (PLS) structures for their fairness. However, the market often opts for debt mechanisms, more suited to conventional frameworks. This discrepancy reveals a tension between the theoretical ideal (Shariah Maqasid) and pragmatic constraints, underlining the limits of a fixed approach despite its moral relevance.

Persistent differences despite unification

Even with its collective model, the Academy cannot eliminate disagreements. Institutions or scholars, as on financial issues, sometimes defend divergent positions. These differences reflect the complexity of unifying historical interpretations in a diverse world. State sovereignty, meanwhile, remains an obstacle to the universal adoption of its resolutions, illustrating the tensions between transnational religious authority and political realities.

- The slowness of the deliberative process in the face of technological acceleration.

- The gap between ideal resolutions and pragmatic market reality.

- The inherent tension between its transnational religious authority and state sovereignty.

The future of Majma' al-Fiqh: guiding the Ummah in the 21st century

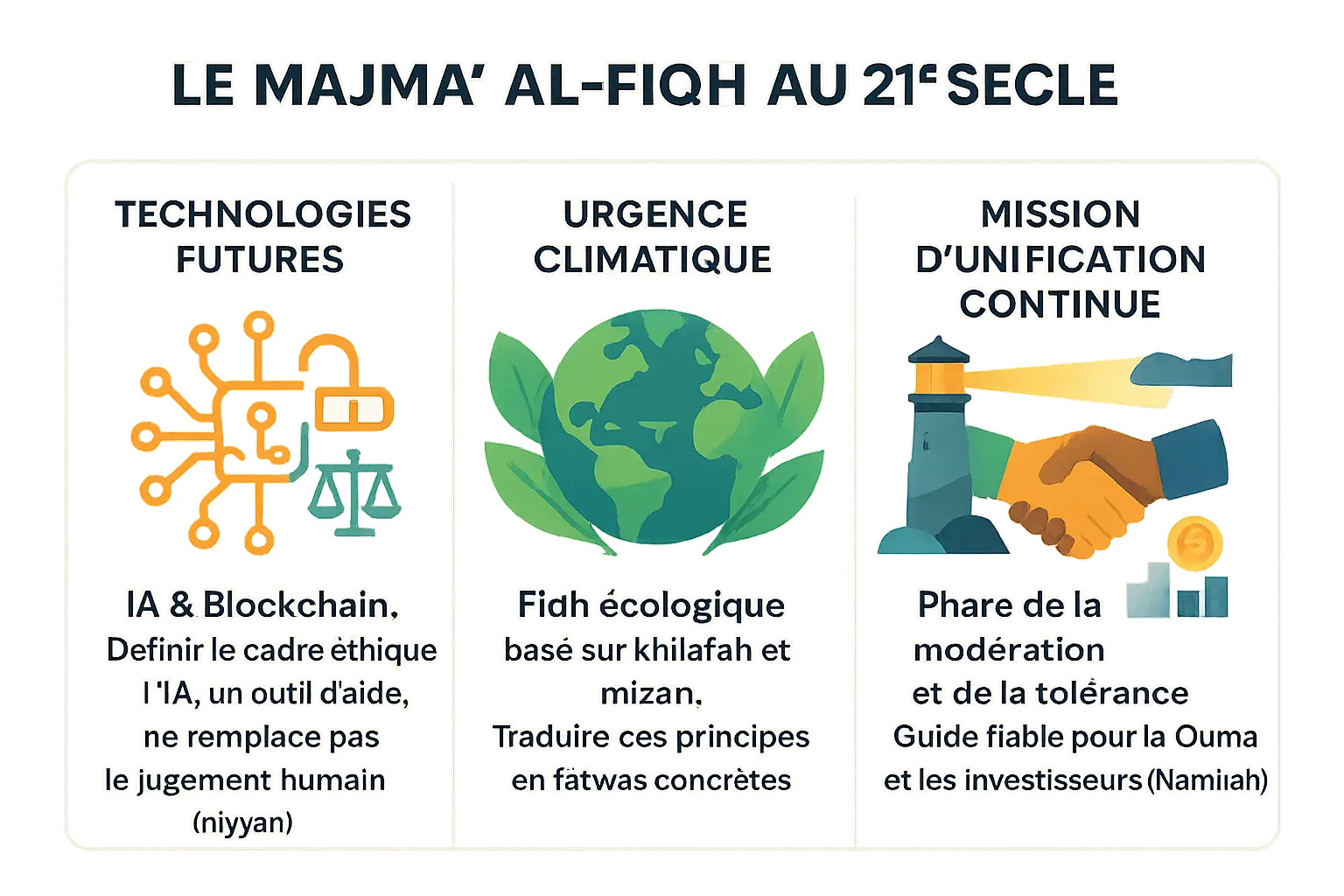

In an age of technological and environmental transformation, Majma' al-Fiqh al-Islami positions itself as a beacon of moderation, ready to frame emerging challenges. Its Collective Ijtihad model, combining religious expertise and multidisciplinary perspectives, offers a solid foundation for navigating the uncharted waters of the 21st century.

AI and blockchain: an ethical framework for innovation

Faced with the emergence of AI, the Majma' must define ethical benchmarks without sacrificing the requirements of niyyah (intention) and Maqasid al-Shari'ah. Although the Academy has not yet ruled directly on AI, its rigorous approach to electronic contracts (resolution no. 230, 2019) shows its ability to assess decentralized technologies. For cryptocurrencies, it has preferred caution, deferring a final decision to analyze the economic and legal implications. This thoughtful approach ensures that innovation remains rooted in Islamic principles, avoiding the pitfalls of haste.

Ecology and khilafah: fiqh at the service of the planet

The concept of khilafah (stewardship) and mizan (balance) places the Majma' in the vanguard of an "ecological fiqh". Its earlier resolutions on toxic waste (resolution no. 19, 1986) laid the foundations for collective environmental responsibility. In the future, its role will be to transform these principles into concrete action: regulating resource exploitation, promoting virtuous policies and integrating Islamic ethics into climate agreements. This spiritual and practical framework responds to the Koranic call to preserve creation.

Lighthouse of moderation: uniting Muslims in diversity

In a fragmented world, the Majma' embodies a beacon of moderation, reconciling legal schools and counteracting extremism. Its inclusive vision, based on dialogue and consensus, inspires initiatives such as Namlora, an Islamic investment platform that combines profitability and values. By standardizing fatwas and valuing the diversity of approaches, the Academy strengthens the cohesion of the Ummah, proving that fiqh remains a lever for responsible adaptation.

Le Majma‘ al-Fiqh al-Islami incarne la synergie entre Charia et Fiqh, guidant les musulmans via l’Ijtihad Jama’i. Ses résolutions en finance islamique (avec l’AAOIFI) et bioéthique montrent son impact. Face à l’IA et au climat, il reste un phare de la modération, inspirant une finance responsable, comme chez Namlora, alliant foi et khilafah (gérance) dans un mizan (équilibre divin).

FAQ

What is fiqh and why is it essential for a modern Muslim?

Imagine a legal code of conduct as a reliable guide to investing in projects that respect your values. Fiqh is this "golden rule": the human interpretation of divine Sharia principles, adapted to today's realities. It transforms the teachings of the Koran and Sunna into practical decisions, whether it's a financial contract or an ethical dilemma. Without fiqh, faith would remain a distant star, whereas it is a compass for navigating contemporary challenges.

What is Malikite fiqh and why is the Maghreb so attached to it?

Malikite fiqh, which originated in 8th-century Medina, is the equivalent of a diversified investment portfolio: it favors custom (urf) and the public good (maslaha), like a shrewd manager. The Maghreb has adopted it because its foundations align with its social traditions, rather like a local investment fund that fully understands the terrain. This school, founded by the jurist Malik ibn Anas, remains a pillar for millions of Muslims, combining rigor and pragmatism.

Where can you learn fiqh for everyday use?

Like all financial knowledge, fiqh is acquired through structured study. The universities of Al-Azhar in Egypt and those of the Gulf States offer academic training. But for today's curious, the Majma' al-Fiqh al-Islami also offers online resources, conferences and publications. It's a bit like taking a MOOC with experts, but with a spiritual and collective dimension: the Academy brings together scholars from all over the world to decipher modern issues together.

What is the International Academy of Islamic Fiqh?

Created in 1984 under the aegis of the OIC, the Academy is the "board of directors" for worldwide religious advice. Imagine a board of financial experts, but for Islamic issues: 57 member countries sit on it, along with jurists, doctors and economists. Their strength? Collective Ijtihad, a collaborative method for meeting the challenges of our time, from blockchain to renewable energies. It is a guarantor of moderation, like a common fund that avoids extremes.

What is Uṣūl al-fiqh, the method behind rulings?

The Uṣūl al-fiqh is the "toolbox" of jurists, like accounting principles for an auditor. It brings together the rules of interpretation: the Qur'an and Sunnah, of course, but also deduction (qiyas), legal preference (istihsan) or the higher aims of the Sharia (maqasid). These tools enablemodern fatwas to be aligned with the spirit of the texts, while adapting to realities, like an investment algorithm that adjusts to the markets.

What's the difference between Sharia and fiqh?

Sharia is the road laid out by God, as immutable as the fundamental laws of a state. Fiqh is the human GPS that makes it accessible, by integrating the context. Sharia is an absolute moral code, fiqh an evolving practice. For example, Sharia prohibits interest (riba), but fiqh develops the rules of takaful or Islamic sukuk. It's like distinguishing between a constitution and an implementing decree: one sets the principles, the other gives them concrete form.

Why does the Maghreb follow the Malikite school?

The Maghreb chose Malikism like an investor chooses a historical fund: by inheritance and efficiency. The teachings of Malik ibn Anas, disseminated as early as the 9th century by the Almoravids and Almohads, found a natural echo in Berber and Arab societies. This fiqh, rooted in daily life, reflects the balance of the region, rather like a localized economic model that favors social harmony and adaptation to local realities.

Why study fiqh in a changing world?

Fiqh is the life insurance of faith: it enables you to remain anchored in your convictions while navigating a constantly changing world. Whether you want to invest in a Shariah-compliant start-up or manage an inheritance according to Islamic rules, fiqh offers concrete answers. Learning fiqh provides a guide to combining faith and modernity, like a diversified portfolio that adapts to the markets without betraying its principles.

What are the 4 major legal schools of Islam?

Les quatre écoles, comme autant de stratégies d’investissement, offrent des approches complémentaires :

Hanafite (Asie du Sud, Turquie) : ouverte à la raison et aux coutumes.

Malikite (Maghreb, Afrique de l’Ouest) : ancrée dans les pratiques de Médine et le bien commun.

Shafi’ite (Asie du Sud-Est, Afrique de l’Est) : équilibre entre tradition et débats.

Hanbalite (Arabie Saoudite) : rigoureuse dans l’application des textes.

Le Majma‘ al-Fiqh al-Islami, lui, transcende ces écoles en réunissant leurs représentants pour un Ijtihad collectif, comme un conseil de sages veillant à l’unité de la Oumma.