<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Halal palladium: a little-known opportunity to invest in line with your values? In the face of market volatility and the challenges of traditional finance, palladium stands out: a precious metal that is both tangible and strategic, used in automobiles (catalytic converters), electronics and medical equipment, it combines growth and compliance. With a return of +20-25% in 2025, this rare metal, certified Shariah-compliant via physical products, back-to-back ETCs or Murabaha structures, offers responsible diversification. Find out how it protects your capital, avoids pitfalls such as derivative contracts, and embodies sustainable finance rooted in Islamic values.

Contents

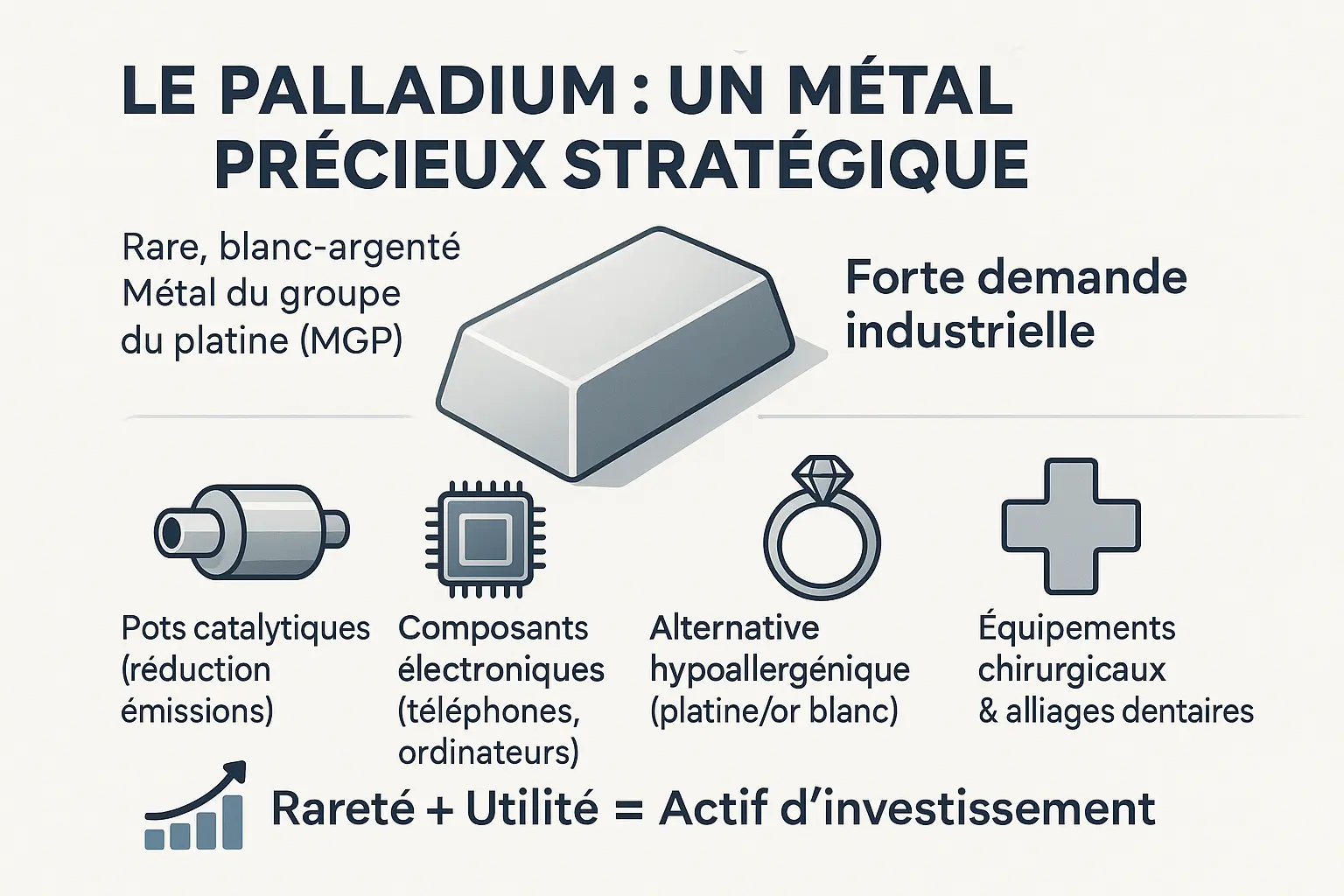

Palladium, a little-known but strategic precious metal

Did you know that this silvery-white metal, often sidelined in favor of gold or platinum, has an industrial demand 3 times greater than that of jewelry?

Discovered in 1803, palladium is a rare precious metal with a number of industrial applications. Unlike gold, it's not just used for investments and jewelry. Its strength lies in its use in critical sectors.

- Automotive: It filters 90% of the toxic gases in catalytic converters, a key role in reducing pollution.

- Electronics: Found in capacitors and smartphone components, it is indispensable to modern technology.

- Jewelry: Lightweight and hypoallergenic, it is used for long-lasting wedding rings without the need for rhodium plating.

- Health: Used for surgical instruments and dental alloys, it combines precision and strength.

Extremely rare, its extraction is concentrated in Russia (40% of world production), South Africa and Canada. The war in Ukraine has pushed up its price to 3,000 USD per ounce by 2022, before a correction linked to the boom in electric vehicles.

This high industrial demand, coupled with unstable supply, makes it a volatile asset. Yet its physical value makes it a serious candidate for portfolio diversification, provided that Islamic principles are respected. But what are these criteria? Find out in the rest of this article...

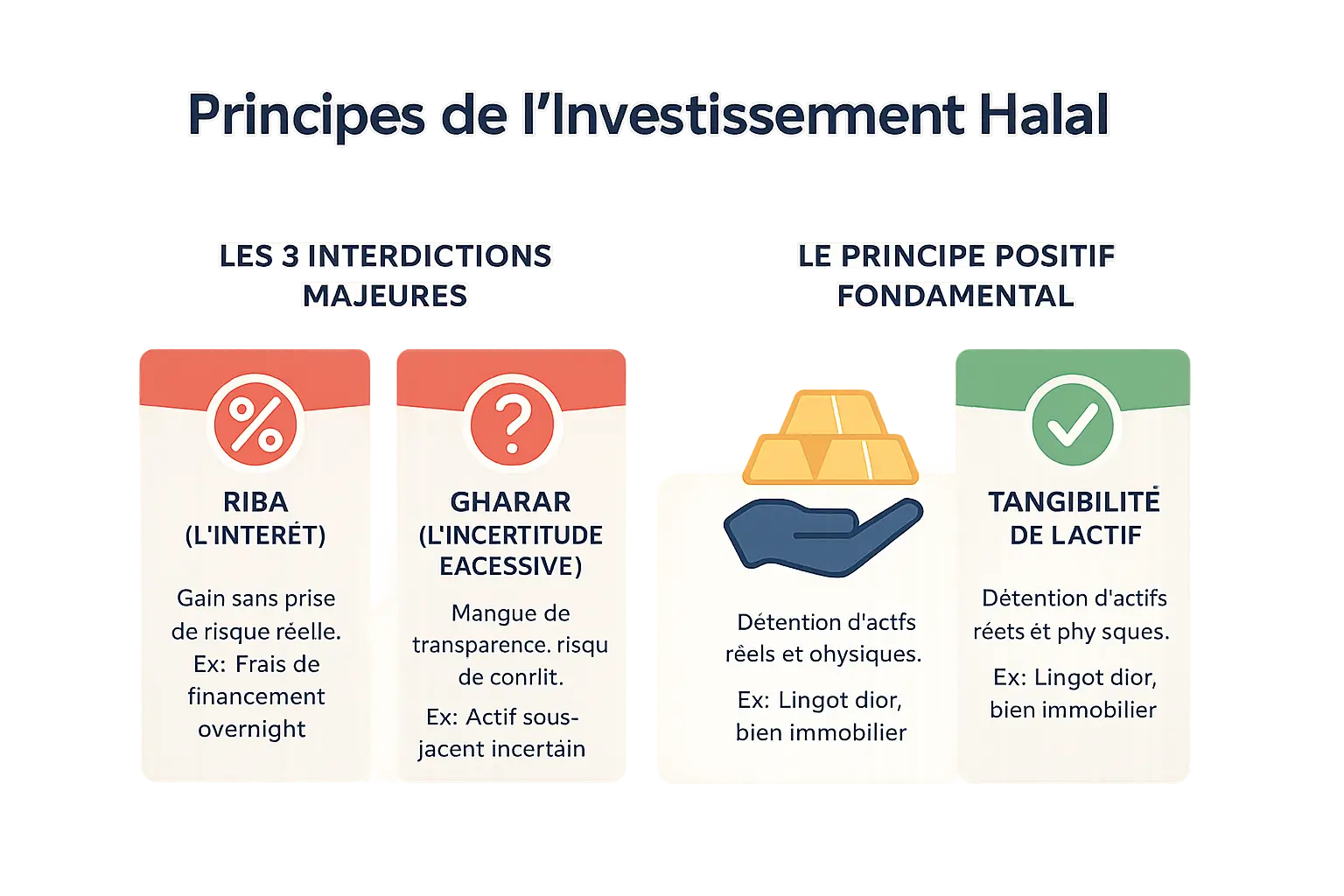

The pillars of halal investment applied to precious metals

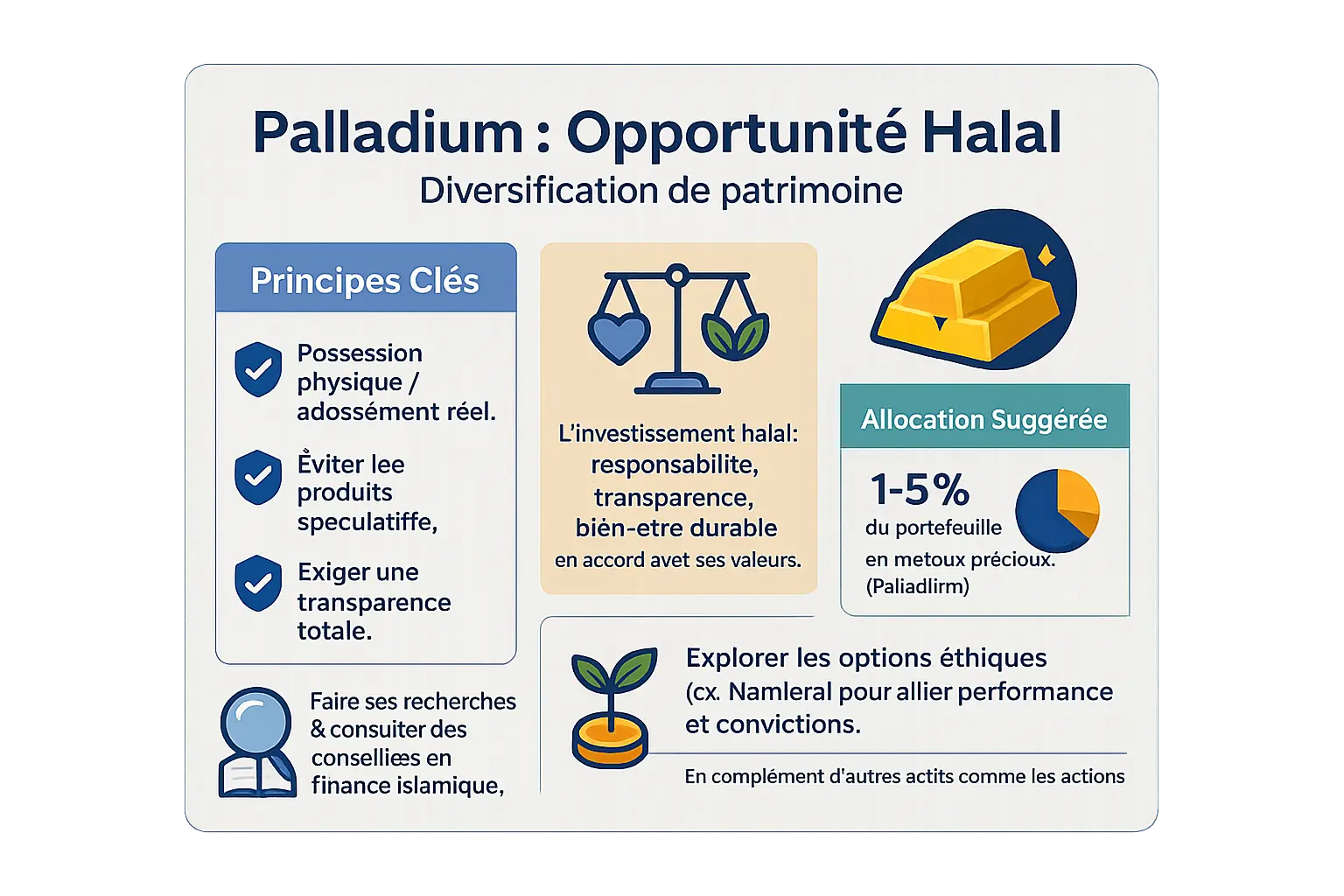

Investing in precious metals according to Islamic principles is based on three key rules. They protect your capital by aligning profit and responsibility, with transparency and ethics.

Prohibition of riba (hidden interest)

Riba refers to gain without sharing risk. For example, custody fees or "swaps" in a bank account may conceal disguised interest. These practices make money passive, contrary to Islamic principles. Prefer physical (bullion) or Sharia-certified products, such as Source-approved physical palladium ETCs. These structures, like installment sales (Murabaha), link the return to a tangible asset, eliminating any risk of riba.

Rejection of gharar (extreme uncertainty)

Buying palladium bullion without checking its storage is gharar. This uncertainty exposes investors to abuses such as fictitious certificates or funds without real metal. Futures contracts or funds with no underlying assets are common examples. Demand proof of physical possession (verifiable certificates) and storage in recognized locations (e.g. Swiss Central Bank). The Shari'a requires every transaction to be linked to a real asset.

Rejection of maysir (speculation)

Betting on palladium without owning it is maysir, forbidden by the Shari'a. This practice is tantamount to gambling. Give preference to certified physical ETCs or directly owned bullion. Like Aghaz, a specialist in halal investments, which limits exposure to palladium to 2% of portfolios combined with other tangible assets (e.g. Sukuk, ethical equities).

These pillars provide a transparent framework for your savings, aligning your choices with the teachings of Shari'a. Let's take a look at how to apply them to palladium.

Investing in palladium: conditions for compliance with Muslim ethics

Palladium, a strategic metal for the automotive industry, is attracting investors. Find out how to integrate it into a halal portfolio.

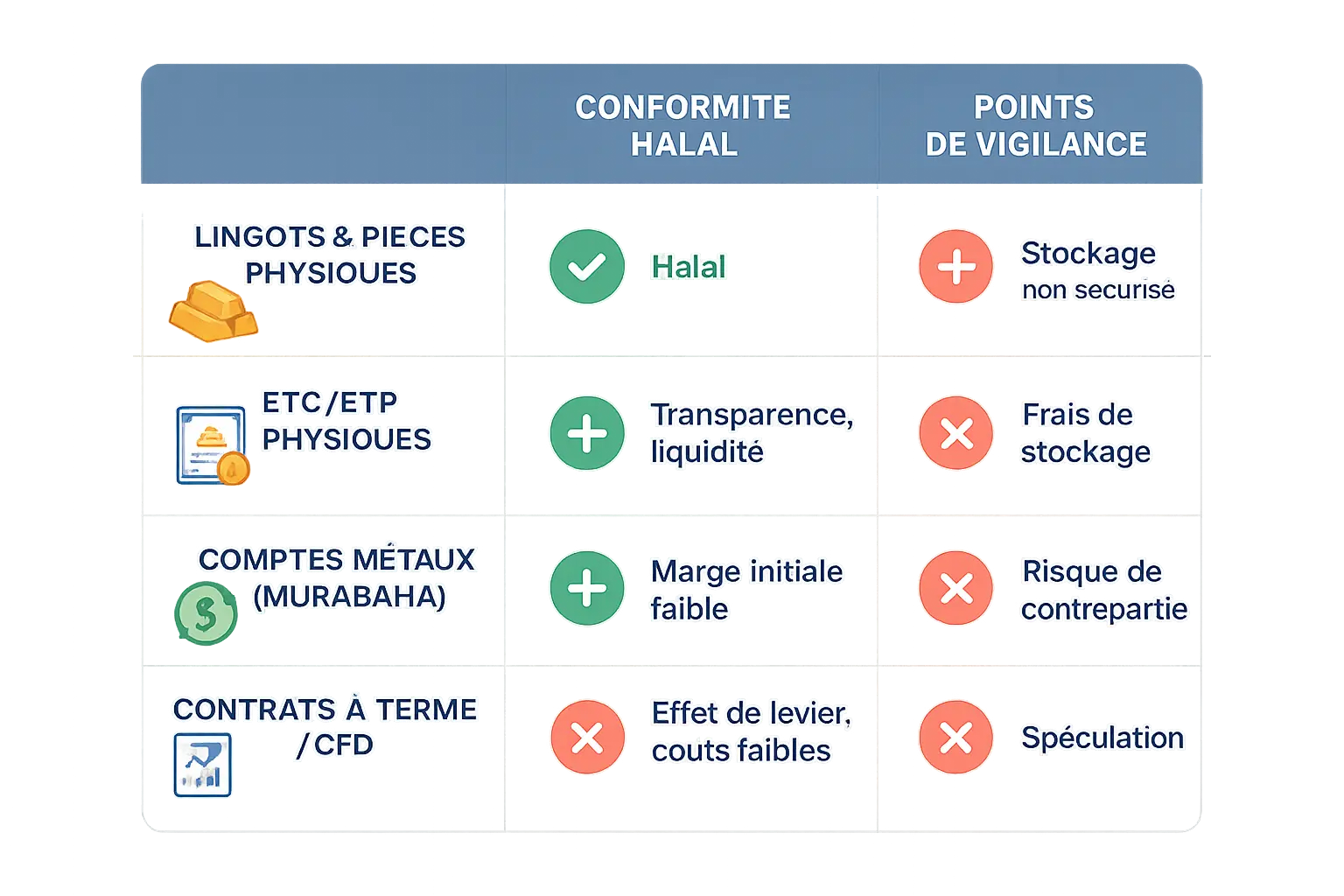

Physical possession: total control, but vigilance required

Buying bullion guarantees maximum compliance, as the asset is tangible. However, there are two major challenges:

- Storage and insurance costs, up to 8.30% to 33% of the metal price

- Reduced liquidity compared to financial products

Advantage: elimination of derivative risks. Ideal for purists, provided you opt for certified safe-deposit boxes.

Physically-backed products (ETC/ETP): liquidity with certification

ETCs likeETF Securities'ETFS Physical Palladium offer an intermediate solution. Each unit is backed by physical palladium stored in London.

Two essential conditions:

- Verify Shariah certification by a recognized committee

- Confirming our physical presence

Up to 2% of the portfolio can be allocated to this type of asset, according to Aghaz Investment, for balanced ethical diversification.

Metal accounts via Murabaha: riba-free structure

The Murabaha offered by Islamic banks enables you toacquire palladium interest-free. The bank buys the metal and then sells it back to you at an agreed margin.

- Legal framework in line with profit-sharing principles

- Easy access for novices

Check the margin applied and demand fee transparency.

Comparison of palladium investment methods

| Investment method | Halal compliance (Potential) | Benefits | Points to watch |

|---|---|---|---|

| Ingots/Physical parts | Very high | Total control, tangible assets | Storage costs, limited liquidity |

| FTE/FTE Physically supported | High (if certified) | High liquidity, mutualized costs | Check Shariah certification |

| Metal accounts (Murabaha) | High | No interest, secure setting | Bank margin, contract transparency |

| Forward contracts / CFDs | Non-conforming (Haram) | No | Speculation, lack of possession |

Why expert consultation is essential

Despite its recent performance (+20-25% in 2025), palladium remains volatile. Storage costs (8.1% VAT in Switzerland) and legal intricacies require specialized expertise.

Ask an Islamic finance advisor to identify certified solutions. In short: reconcile ethics and returns through real ownership, transparency and expert guidance. An approach that protects your faith and your capital.

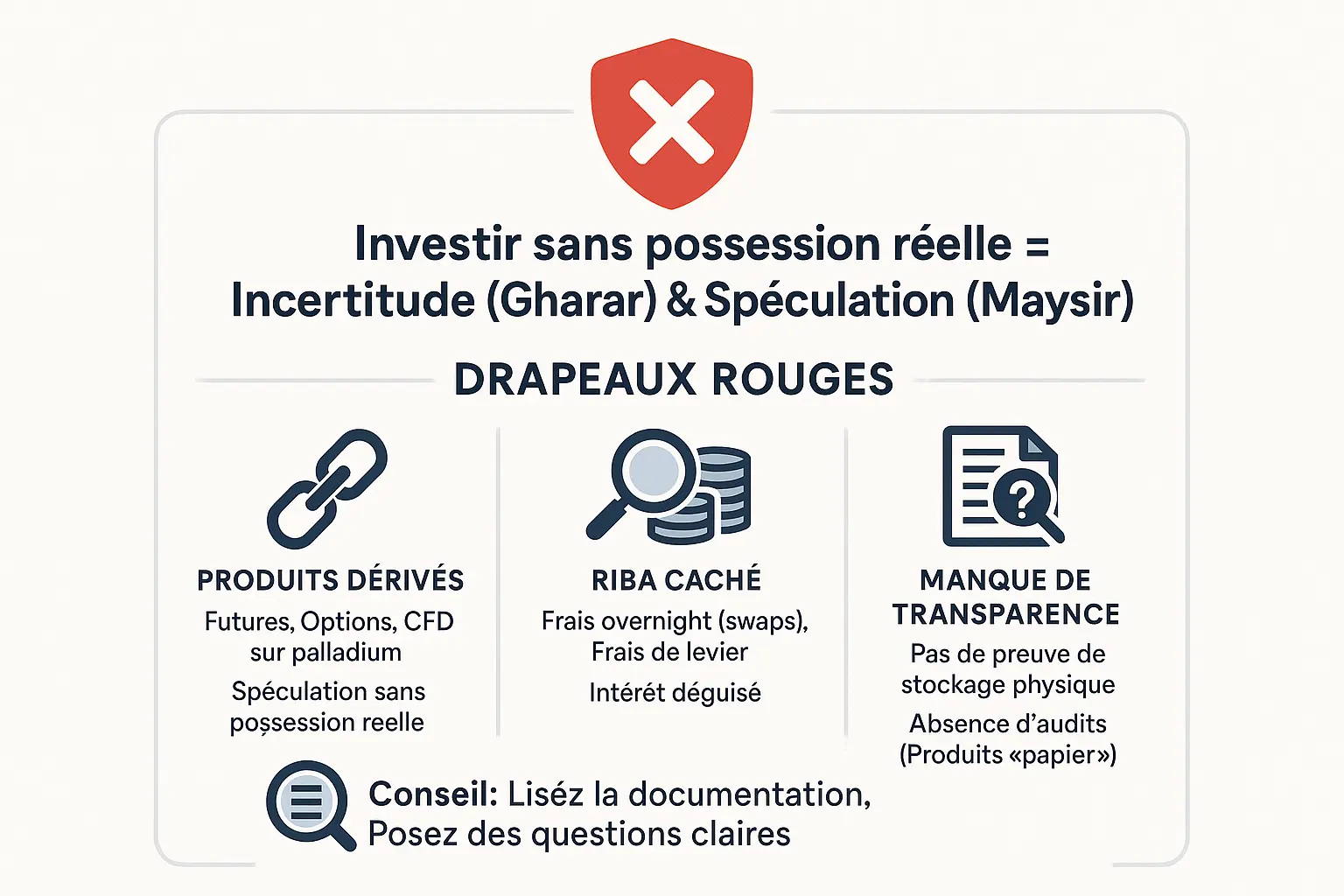

Points to watch: how to avoid the pitfalls of non-halal investment

The precious metals market is full of complex financial products. Not all of them respect Islamic principles. Investing without physical possession exposes you to non-compliant practices. Islamic finance requires transparency and tangible assets to avoid spiritual and financial risks.

"Investing without actual possession of the metal means venturing into the territory of uncertainty (Gharar) and speculation (Maysir), two practices to be avoided in Islamic finance."

Here are the three major perils to identify before investing in palladium:

Derivative products

Les CFD, contrats à terme et options constituent des formes de spéculation. Aucun ne donne droit au métal physique. La majorité des savants les interdisent pour cause de gharar (incertitude excessive) et de maysir (jeu de hasard). Le levier associé amplifie les risques, contraire au partage équitable des pertes et profits. Par exemple, un CFD sur palladium reste un simple pari sur sa valeur future, sans lien matériel avec le métal.

The hidden Riba

Overnight financing fees (swaps) or leverage costs can conceal riba. An Islamic product should only generate income from tangible assets. Some providers apply overnight open position fees, equivalent to disguised interest. Compare this to an interest-bearing loan, which is strictly prohibited. Check financing policies to avoid these practices.

Lack of transparency

Demand proof of physical possession (audit certificates, storage reports). Mere paper without a guarantee of the metal violates Islamic principles. Prefer Shariah-certified physical ETCs, such as those from Source, guaranteeing traceability and secure storage of palladium. A lack of transparency can lead to misappropriation or investment in non-compliant assets, compromising both your ethics and your return.

Ask for a detailed explanation of the product's structure. If in doubt, consult an expert in Islamic finance before subscribing. A rigorous approach preserves your ethics and your capital. By checking every detail, you build a sustainable portfolio, aligned with your values and financial objectives.

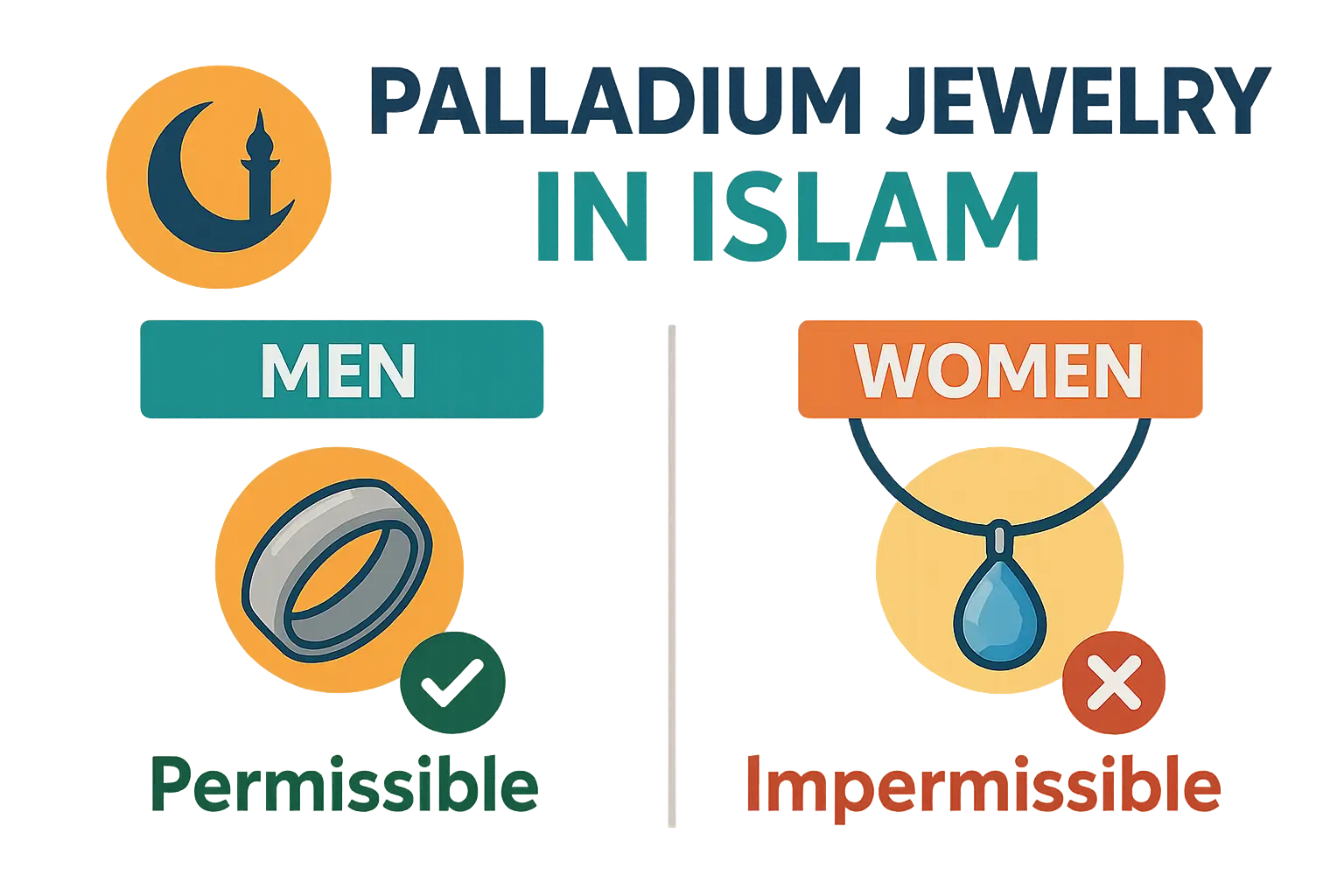

Beyond investment: is wearing palladium jewelry permissible in Islam?

If gold remains forbidden to Muslim men for clear reasons stemming from the sunna, what about palladium?

The hadith reported by Al-Tirmidhi explicitly states: " Wearing silk and gold is forbidden to the men of my nation". This prohibition is specifically aimed at gold, a metal symbolizing ostentation. Palladium, a precious but chemically distinct metal, is never mentioned in sacred texts.

Platinum, sometimes confused with white gold, is a good illustration of this nuance. Absent from the Prophetic era, its halal status is still debated. Some equate it with gold as a precaution, while others allow it. Palladium, though precious, follows the same logic: there is no explicit prohibition against it.

For men, there are alternatives: silver remains the benchmark, as shown by the use of prophetic rings. Stainless steel and tungsten offer modern, durable and compliant options. Palladium adds to these possibilities, with the advantage of an aesthetic close to white gold without sharing its restrictions.

Aesthetics aside, this metal is a perfect illustration of the Islamic balance: making the most of material resources while respecting divine limits. As with real estate matters, it's always a good idea to refer to the opinions of scholars.

Palladium and Islamic finance: an opportunity to be seized with caution

Investing in palladium can be in line with the principles of Islamic finance, provided that strict criteria are met. This precious metal, used in industry and electronics, represents a tangible alternative for diversifying wealth while remaining Shari'a-compliant.

Make sure you have physical possession of the metal or a real backing. Avoid speculative products such as derivative contracts, which are often equated with gharar. Demand full transparency on the metal's origin and associated costs. These key steps guarantee the legitimacy of your investment.

Experts recommendallocating 1-5% of your portfolio to precious metals. This proportion provides protection against inflation without overloading your strategy. As the Aghaz organization explains, this approach is part of a balanced diversification with assets such as halal equities or Sukuk.

"Halal investment is not just a list of rules, but embodies an approach to responsibility, transparency and the pursuit of sustainable well-being, in line with its values."

Before making any decisions, consult specialists in Islamic finance. Their expertise verifies the compliance of funds like the Sprott Physical Platinum and Palladium Trust (SPPP), whose physical structure is audited by Sharia committees. This avoids the pitfalls of hidden riba or non-compliant fees.

To deepen your knowledge, explore ethical investment options on Namlora. This platform brings together opportunities aligned with your convictions, complementing other assets such as halal equities.

In conclusion, palladium stands out as a strategic metal for halal investment, combining rarity and industrial utility. By respecting Islamic principles - physical possession, avoidance of Riba and Gharar - via certified ingots or ETCs, it enables ethical diversification. An opportunity to reconcile performance and values, as proposed by Namlora.

FAQ

Can Muslims wear palladium jewelry?

Yes, Muslims can wear palladium jewelry. Unlike gold, which is strictly forbidden for men in Islam, palladium is a distinct precious metal that does not fall under this restriction. It is appreciated for its strength, lightness and silvery color, ideal for men's wedding rings. As a physical asset, it embodies both a symbol of value and an ethical choice, without conflict with Islamic principles.

Is it permissible for a man to wear platinum in Islam?

Platinum, like palladium, is approved for use by men. Although there is some debate, most scholars agree that it is not subject to the same restrictions as gold. Its use in jewelry or investment remains compliant, provided it is held physically or via Shariah-certified products, avoiding speculation and hidden riba. It's a discreet but precious alternative.

How can I check that a palladium investment product is halal?

For a product to be halal, there are three key criteria: physical possession (bullion, coins) or real backing (certified ETCs), absence of speculation (avoid CFDs, futures), and total transparency (no fees linked to interest rates). Prefer structures such as Murabaha or Shariah-approved physical ETCs, like those from Source or ETF Securities, for guaranteed compliance.

What is palladium-plated brass?

Palladium-plated brass is a base material (brass) coated with a thin layer of palladium. Although aesthetically pleasing, its investment appeal is limited, as the real value lies in the small amount of palladium present. For a halal investment, prefer tangible assets in pure palladium, such as certified ingots, which respect the principles of the Shariʿah while offering lasting value.

Who can wear Palladium shoes?

The term "Palladium" in the shoes refers to a brand name, not the metal. As such, these shoes are approved for everyone, men and women, without religious reservation. It's a reminder that palladium, as a metal, is an asset in its own right, while its use in a product name is a matter of naming, not religious conformity.

Why is palladium so expensive?

Palladium is expensive due to its dual scarcity: it is 30 times rarer than gold and is mined mainly in Russia and South Africa, regions subject to geopolitical tensions. Its price is also driven by massive industrial demand (90% for catalytic converters) and its supply-related volatility. In 2025, its performance of +20-25% underlines its attractiveness in times of crisis, provided you opt for tangible, compliant investments.

Which stones are recommended in Islam?

Islam does not specifically prohibit stones, but encourages sobriety. Stones such as agate (aqeeq) are praised in hadiths for their spiritual virtues. However, the key is to avoid superstitious practices or those associated with other beliefs. When investing, favour tangible assets such as precious metals, which combine material value with ethical compliance.

Which metal is mentioned as "descended" in the Koran?

The Qur'an refers to iron as a metal "sent" by Allah: "And We sent down iron, in it damage and benefits" (Sura Al-Hadid, 25). No verse specifically mentions gold, silver or palladium. This reminder underlines the importance of iron's usefulness, but also the need to choose useful and tangible investments, such as palladium, whose industrial demand reinforces its value.

Is white gold haram for men?

Yes, white gold is haram for men. Although it has a silvery hue, it contains gold mixed with other metals (such as palladium). The ban on gold therefore extends to its alloys. Pure palladium, on the other hand, is permitted. To invest without compromise, opt for clear-cut products: physical bullion, certified ETCs or Murabaha structures, for diversification in line with both Islamic finance and market realities.