<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

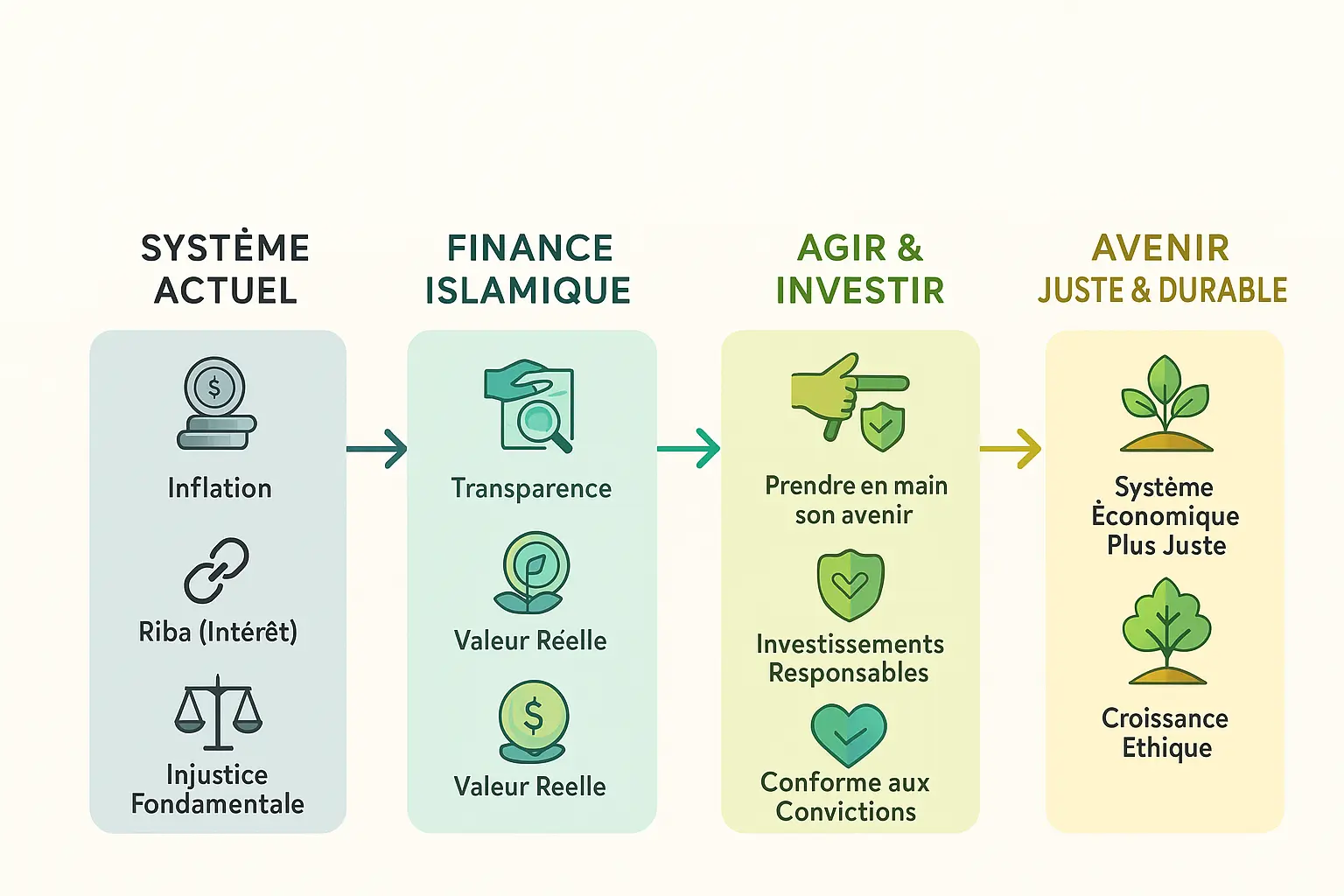

Key points to remember: Inflation, the "tax of the poor", stems from the riba-based system. Islamic finance offers a fair alternative by linking money to assets (gold, real estate) to preserve wealth. By avoiding riba and investing in accordance with Shari'a law, you can counter the erosion of purchasing power while aligning your finances with your ethical values.

Is your purchasing power eroding without you understanding why? Inflation, described as the "tax of the poor", is the direct result of the modern financial system based on riba (interest), a mechanism condemned by Islamic finance. Think of your savings as black coffee: each printed bill dilutes its value, impoverishing those who don't invest. Discover how the ban on riba not only targets usury, but fights the root of a system that generates inflation and inequality. By exploring halal solutions, such as investing in gold or real estate, you'll learn how to protect your wealth while aligning your choices with the values of fairness and sustainability.

Contents

Riba inflation: understanding the link and Islamic finance solutions

Your purchasing power is declining? Islamic finance has an explanation

Since 2020, increases of 12% for bread, 8% for rents and 25% for energy have concretely translated the loss in value of your banknotes.

Inflation is not trivial. It is the result of a monetary system based on virtually unlimited banknote printing and widespread debt. Islamic finance, by prohibiting riba (interest), has been anticipating this risk for 1400 years.

Money is like a cake: each printed bill mechanically dilutes everyone's share. This process, an "invisible tax", penalizes savers and widens inequalities, especially for low-income households.

Namlora embodies this vision by promoting halal businesses and fostering the solidarity economy. Its ecosystem replaces profit at all costs with human and spiritual values, by attacking the very source of monetary devaluation: the interest system.

This article will help you understand:

- Why inflation acts as a hidden tax on savings

- How riba feeds the inflationary cycle through systemic indebtedness

- What solutions does Islamic finance offer to protect your assets and promote fair development?

Understanding these mechanisms is the first step towards a fairer future, in line with your convictions.

Inflation: an invisible tax that silently impoverishes

The mechanism of currency devaluation: how your money loses its value

Imagine concentrated black coffee. Its strength symbolizes the value of your money. Add water: debt dilutes its strength. As the coffee clears, your purchasing power erodes.

Inflation is explicitly described as the "poor man's tax", a mechanism that insidiously transfers wealth from savers to money creators.

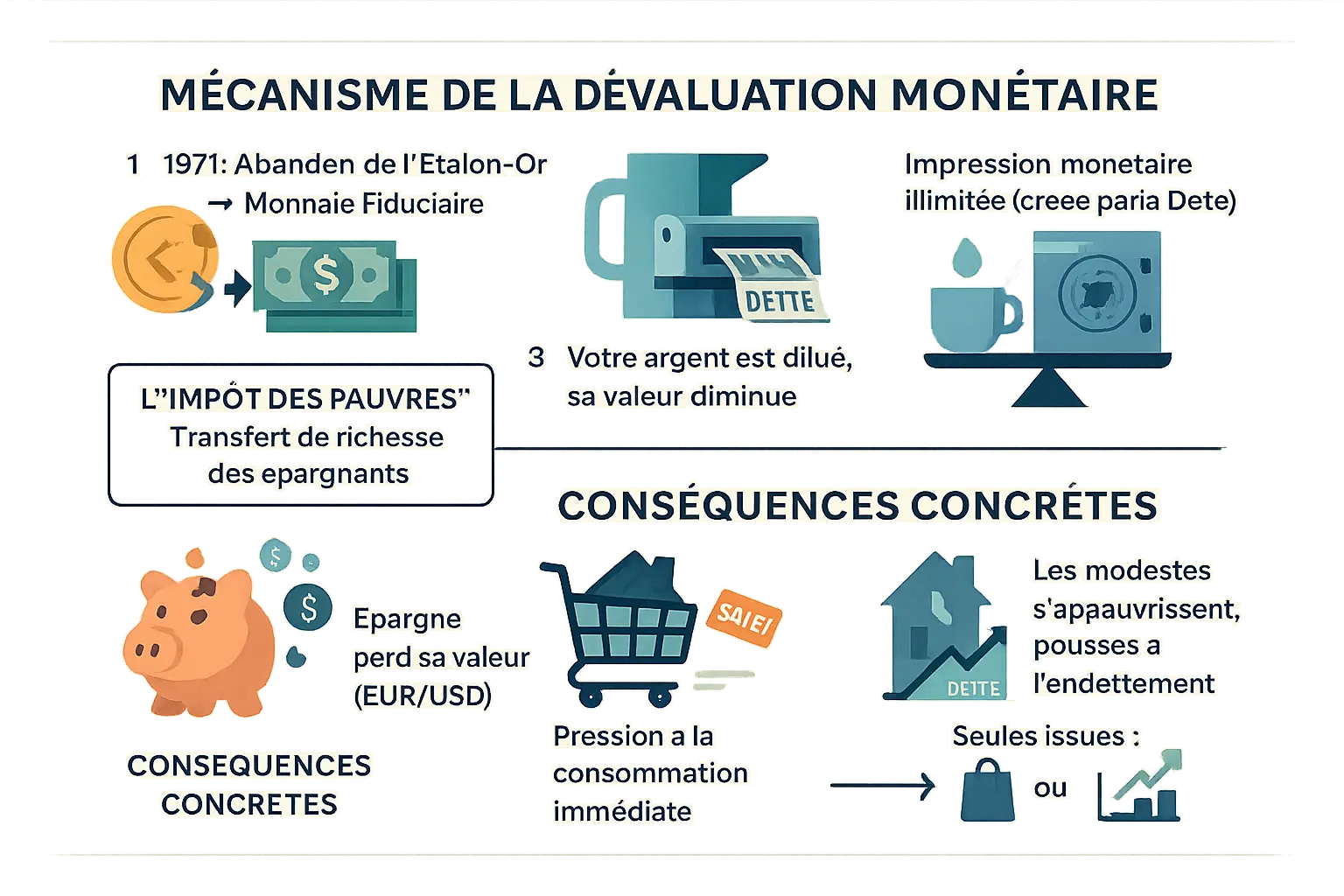

Until 1971, the world's monetary system was pegged to gold, limiting the printing of money. The United States broke this link, introducing fiat currency. Henceforth, governments could print without limit, fuelling a debt-dependent system.

Each new loan acts like water in coffee: the more we print, the more money loses its strength. An increase in the money supply without economic growth automatically leads to higher prices. This insidious phenomenon is inflation.

The concrete consequences: impoverishment of the masses

Inflation strikes silently at those who don ' t understand its workings:

- Loss of value of savings: Keeping your money in a current account or Livret A savings account (1.7% in 2025) devalues it. Banks use these funds for leverage, generating more debt. A saver loses 8% of purchasing power in 5 years, with inflation at 1.6% a year.

- Spending pressure: when a loss of value is anticipated, people prefer to consume now. In 2022, France's 5.2% inflation pushed households to spend more, discouraging savings.

- Those with the least are the biggest losers: The system penalizes the non-indebted. An employee earning €2,500 in 2020 will lose 10% of his or her purchasing power in 5 years. There are still two ways out: spend fast or invest in protective assets (gold, real estate, equities).

Riba: the fundamental prohibition at the heart of Islamic finance

The foundations of Islamic finance rest on an inescapable principle: the prohibition of riba. This term, deeply rooted in sacred texts, embodies an economic and moral vision that goes far beyond traditional financial boundaries to touch on the very essence of social justice and equity between human beings.

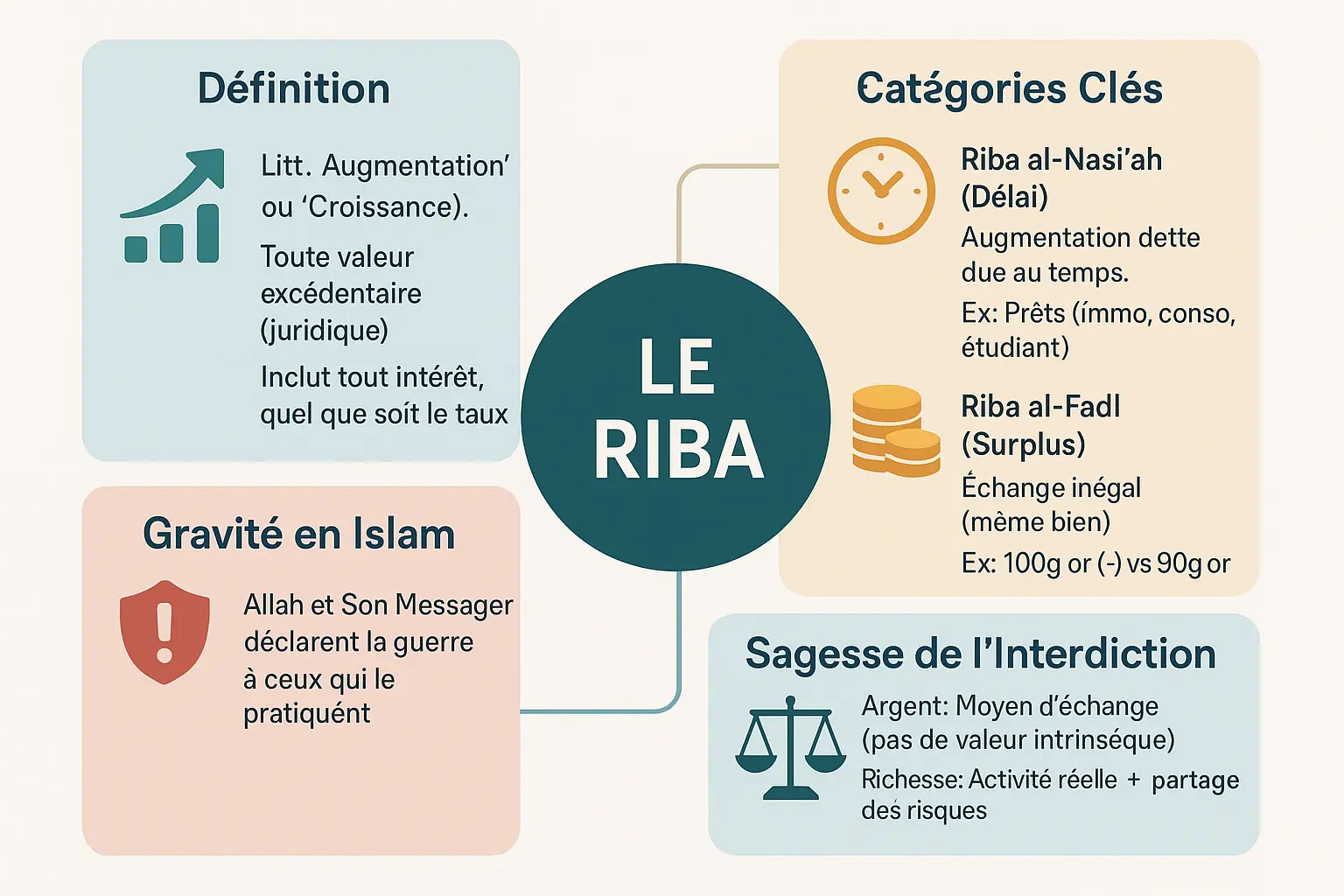

Definition and severity of riba: much more than usury

The Arabic word riba literally means "increase" or "growth". Legally, it refers to any excess value in certain transactions, going far beyond the simple notion of usury. As Investopedia reminds us, this prohibition applies to all interest, whatever the rate, and not just to excessive rates.

| Type of Riba | Definition | A concrete example |

|---|---|---|

| Riba al-Nasi'ah (Riba of delay) | Increase in the amount of a debt due to the simple passage of time | Home loans, student loans, consumer credit |

| Riba al-Fadl (Riba of the surplus) | Immediate exchange of unequal quantities of the same basic commodity (gold, silver, grain). | Exchange 100g of lower-quality gold for 90g of higher-quality gold |

Riba is considered such a serious threat that it is the only thing in the Koran for which Allah and His Messenger declare war on those who practice it.

The wisdom behind prohibition: justice, risk and real value

In Islam, money has no intrinsic value. It is merely a medium of exchange, a tool that must be used to create wealth by legitimate means. Islamic finance demands that this wealth be generated through legitimate trade, investment in tangible assets and the sharing of risks and profits.

Contrary to these virtuous models, riba represents a guaranteed gain with no real counterparty and no risk-taking. This mechanism, which disconnects money from the real economy, is considered unfair because it allows the lender to enrich himself without effort or sharing.

As the distinction between productive investment and speculation explains, Islamic finance values models in which all players share gains and losses. This ethical principle is part of a broader vision of social equity and collective responsibility.

Cause and effect: how riba feeds the inflation machine

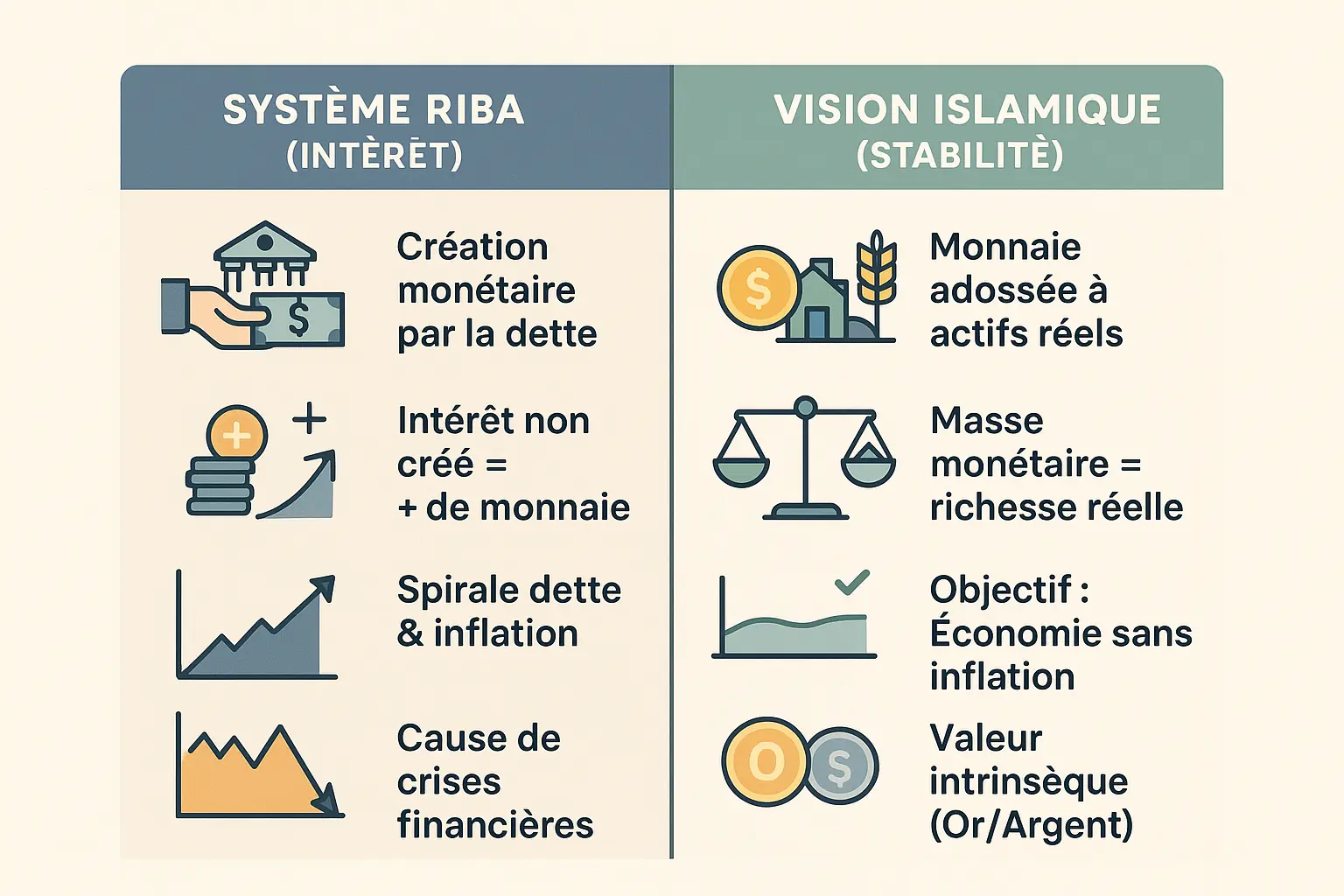

Riba as the driving force behind money creation and inflation

The riba-based financial system generates an inevitable debt spiral. When banks grant loans, they create money "ex nihilo" by simple accounting entries. But they only issue the capital, never the interest to be repaid. This mechanism forces them to print ever more money to cover the interest on previous debts, diluting the value of each monetary unit like water added to black coffee.

This inflationary dynamic is confirmed by a study in the Journal of Islamic Monetary Economics and Finance, which demonstrates that the interest-based system mechanically pushes up prices. Interest rates built into production costs are passed on to consumers, while low-rate policies stimulate consumer credit, fuelling excess demand.

A just economy: the Islamic vision of a stable currency

Islamic economics proposes a radical alternative: a currency backed by concrete productive assets. In prophetic times, the dinar (gold) and dirham (silver) had an intrinsic value, inseparable from their metallurgical utility. This physical anchorage prevented artificial money creation and ensured the stability of the money supply.

This model, explained in the Springer study, is based on profit and risk sharing (PLS). Unlike guaranteed interest systems, it links financial remuneration to productive investment in tangible goods. This approach limits speculative bubbles and stabilizes prices by anchoring them in the real economy.

Mechanisms such as mudarabah (risk-sharing partnership) or musharakah (joint venture) avoid the inflationary drift associated with interest. By requiring that profits be derived from genuine economic activities, this system reduces parasitic money creation while promoting equity. According to the World Bank, this logic could even mitigate the concentration of wealth observed in conventional systems.

How to protect yourself? Halal investment strategies in the face of inflation

The challenge of "indirect riba" and the importance of purification (tazkiyah)

Investing in a globalized financial system exposes Muslims to "indirect riba", a concept recognized by the AAOIFI (Accounting and Auditing Organization for Islamic Finance). This phenomenon arises when halal institutions, obliged to deposit funds with conventional banks, unwittingly participate in an interest-based system.

To counter this perverse effect, the scholars instituted purification (Tazkiyah). This practice consists of :

- Identify the portion of income generated by non-compliant sources, such as minimal interest from bank accounts or impure profits from partially compliant businesses.

- Calculate this amount precisely, often as a percentage of total income.

- Donate this sum to charity, without expecting any tax recognition or immediate spiritual reward.

This practice is becoming essential for those wishing to invest in the stock market in an Islamic way, guaranteeing capital protected from the contaminations of the current system.

Investing to preserve wealth: ethical alternatives

Faced with the erosion of purchasing power, halal investment is emerging as the fairest solution. Unlike debt-based systems, these strategies value tangible assets and share risks and rewards.

Here are the pillars of a resilient portfolio:

- Gold, a reservoir of historic value. Discover how to invest in gold without transgressing Islamic principles, by favoring physical forms (ingots, dinaars) over derivatives.

- Real estate, a tangible asset whose rents and value generally follow inflation. Opt for halal SCPIs or direct investments in line with scholarly opinion.

- Shares in virtuous companies, selected according to strict criteria: less than 5% prohibited income, debt limited to 33% of market capitalization, and economic activities aligned with Islamic values.

- Ethical participatory financing, where every dirham invested becomes capital in a concrete project, strengthening the link between capital and social impact.

Diversification between these assets provides real protection against inflation, while respecting Islamic ethics. Unlike riba-based systems, where savers lose money by letting their funds sit idle, these alternatives turn every investment into a lever for spiritual and material growth.

Building a fair and sustainable financial future

Inflation is not neutral: it reflects a system based on riba, impoverishing the masses. The Islamic ban on riba is not simply dogma, but an economic ethic aimed at restoring justice.

Islamic finance offers an alternative based on risk-sharing and the creation of real value. Namlora embodies this vision, combining spirituality, transparency and sustainable prosperity.

There is an urgent need to take our financial future into our own hands, by becoming part of a fairer economic system. Each responsible investment choice builds a world where trust and responsibility guide exchanges.

Inflation, the result of a system based on riba, is not inevitable. Islamic finance offers a fair and sustainable alternative based on real value and risk sharing. With responsible investments, preserve your purchasing power and contribute to a fair economic system. Take control of your financial future with Namlora, and invest according to your values.

FAQ

How to get rid of riba money?

To purify yourself of riba money, the recognized solution in Islamic finance is monetary purification (Tazkiyah). This involves identifying the illegal portion of your money, calculating it precisely and then donating it to charity, without expecting any spiritual reward or tax deduction. This practice is not simply a religious obligation, but an ethical act aimed at cleansing one's wealth and breaking the cycle of financial injustice. The aim is to ensure that this effortless, risk-sharing gain doesn't stay in your pocket, but benefits those who really need it.

What are the three types of inflation?

Inflation, the gradual loss of purchasing power of your money, comes in three main forms: demand-side inflation, caused by excessive demand for goods and services in relation to supply; cost-side inflation, fuelled by rising prices for raw materials or wages; and finally, imported inflation, due to currency depreciation or rising world prices. Each type of this "invisible tax" affects your daily life differently, but particularly affects those who don't have the tools to counter it, such as savers. This is why Islamic finance, by prohibiting the riba at the root of much inflation, offers concrete alternatives to protect your purchasing power.

What is riba?

Riba, an Arabic word literally meaning "increase" or "growth", represents any excess value in specific transactions prohibited by Islamic sacred law. Contrary to popular belief, it is not limited to excessive usury, but encompasses all interest, whatever the rate. Two main forms exist: Riba al-Nasi'ah, which is interest on loans (such as mortgages or student loans), and Riba al-Fadl, which concerns the unequal exchange of identical goods such as gold or silver. In Islam, riba is one of the few transgressions for which Allah and His Messenger declare war on those who practice it, as it undermines economic justice and impoverishes the masses through monetary devaluation.

How can I save without riba?

Saving without riba is not only possible, but necessary to protect your money from the "invisible tax" of inflation. Several solutions are available: investing in tangible assets such as gold, real estate or precious metals, which retain their intrinsic value; Islamic savings accounts, which use profit-sharing models (mudaraba) instead of offering a fixed interest rate; or solidarity funds that invest in the real economy, such as agricultural or industrial projects. The principle is simple: your money must participate in the creation of real value, with risk and profit sharing, as advocated by Islamic finance. It's an ethical choice, but also an intelligent one to safeguard your financial future.

What to do with the money earned through riba?

Money earned through riba, even indirectly, must be purified in accordance with the principles of Islamic finance. The solution is to identify the exact amount of illicit income, calculate it carefully and then donate it in full to charitable causes. This sum cannot be deducted for tax purposes, nor can it be considered as an act of charity (sadaqa) for which you are seeking a spiritual reward. It is an act of purification (tazkiyah) that aims to cleanse your wealth, not to derive personal benefit from it. Even if you have not chosen to receive this money (as in some conventional bank accounts), it is your moral and religious responsibility to dispose of it in this way, to remain true to the values of fairness and transparency of Islamic investment.

What are the positive effects of inflation?

Although inflation is often compared to a "poor man's tax" for its inequitable impact, it can have positive effects in certain contexts. Moderate inflation (around 2%) can stimulate the economy by encouraging companies to invest and hire, as the cost of capital is lower. It also facilitates the functioning of the labor market by allowing wages to adjust gradually, and reduces the real value of debts, which can relieve indebted households. However, these benefits are limited to moderate rates. Beyond that, inflation becomes a double-edged sword, penalizing savers, destabilizing the economy and widening inequalities. By aiming for a fairer monetary system, Islamic finance seeks to reduce these distortions while protecting the most vulnerable.

Who is responsible for inflation in France?

Inflation in France, as elsewhere, is the result of a number of economic factors. The European Central Bank (ECB) has a major responsibility for money creation, but it is above all government budget policies, market movements and external shocks (such as energy crises) that influence its level. Yet the heart of the problem lies in the current banking system, which enables money printing via riba. Every euro created to feed loans dilutes the value of your money, like water added to black coffee. It's a mechanism that benefits those who control money creation, to the detriment of savers. Islamic finance, by prohibiting riba, proposes an alternative model where money creation is directly linked to the real economy, not to debt.

Where is inflation highest?

Inflation varies widely around the world, but is generally highest in countries with high levels of public debt, limited local production and weak currencies. Currently, countries such as Venezuela, Sudan and Zimbabwe are going through periods of hyperinflation, with their currencies losing value day after day. Even in developed economies, periods of excessive growth in the money supply result in high inflation. In France, as elsewhere, this "invisible tax" hits modest households hardest, as they lack the tools to counter it through investment. This is why Islamic finance, by proposing a monetary system anchored in economic reality and not in debt, is a long-term solution for stabilizing prices and protecting everyone's purchasing power.