<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: AAOIFI sets technical standards to harmonize Islamic finance, while Majmaʿ al-Fiqh proposes general resolutions on financial ethics. This complementarity enables investors to reconcile accounting rigor with Shariah compliance. For example, an AAOIFI standard on the Murabaha contract guides its practical implementation, while a Majmaʿ resolution assesses its fundamental legitimacy.

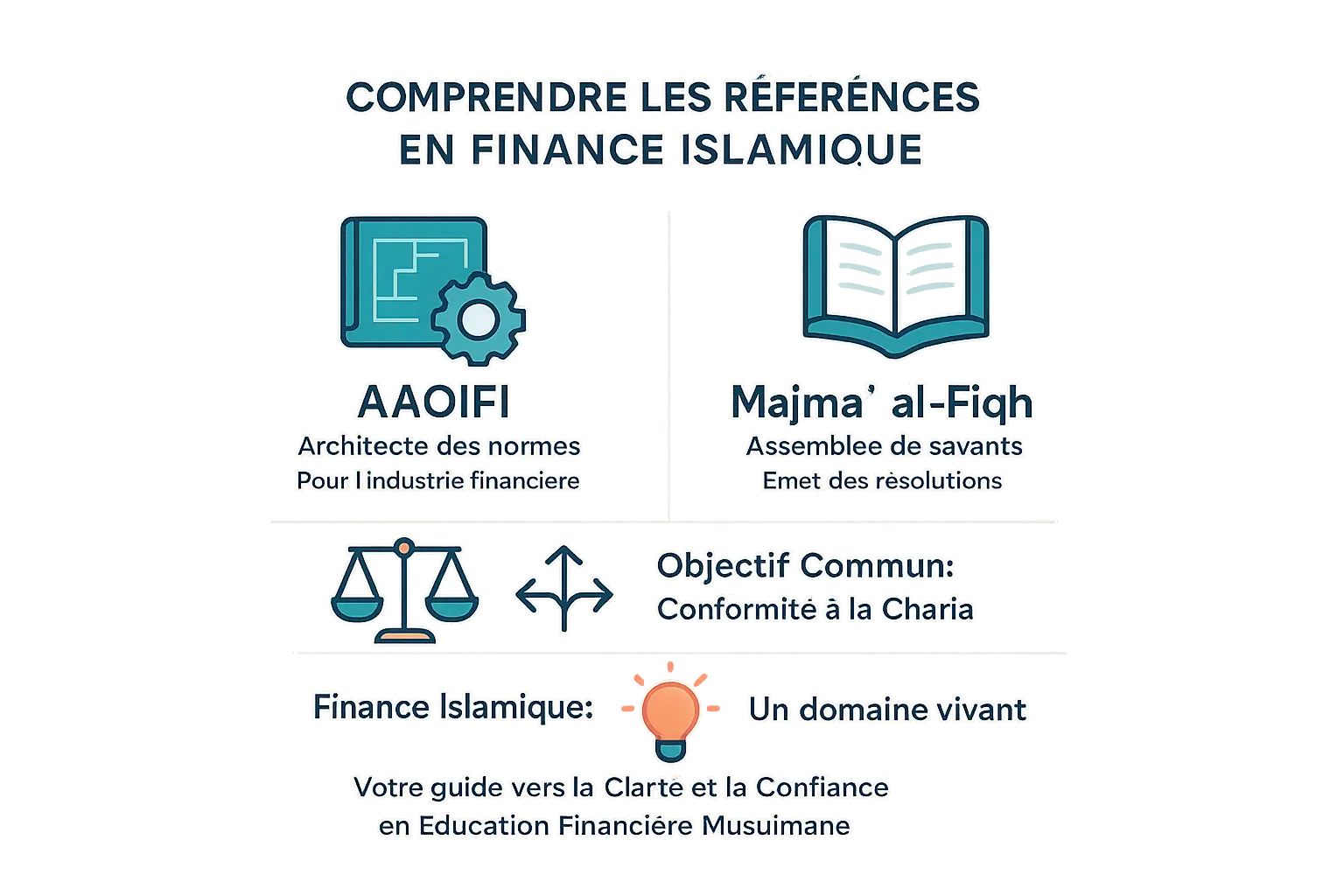

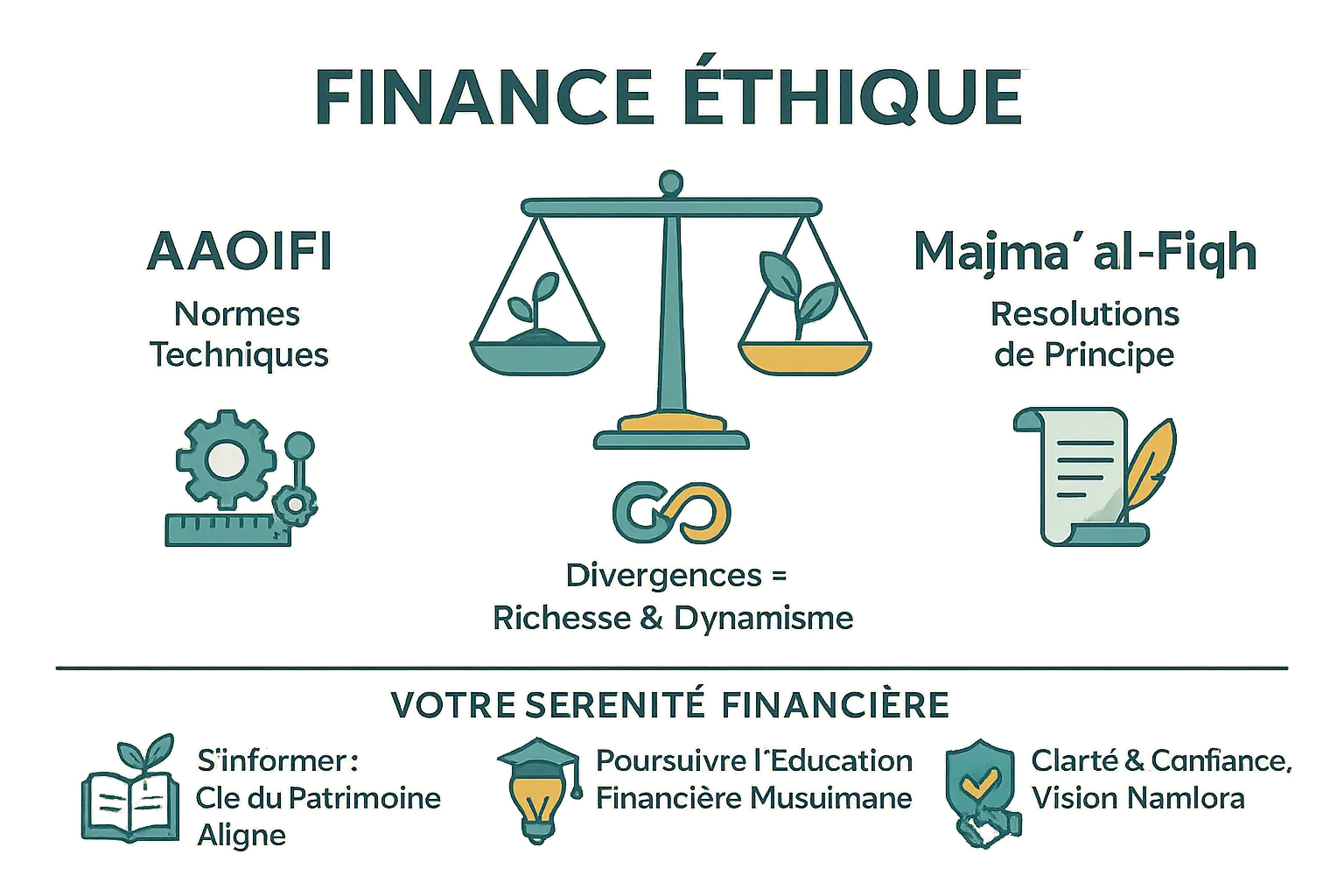

Vous vous sentez perdu face aux avis divergents de l’AAOIFI vs Majmaʿ al-Fiqh en finance islamique ? Vous n’êtes pas seul. Ces deux institutions, bien que partageant le même objectif de conformité charia, utilisent des méthodes distinctes qui peuvent sembler complexes pour un débutant. Dans cet article, nous démêlons avec clé la différence entre ces références incontournables, leurs approches (normes techniques vs résolutions savantes) et vous offrons une méthode simple pour lire leurs avis sans jargon. Finie la confusion : découvrez comment ces divergences, loin d’être un obstacle, enrichissent votre compréhension pour investir sans riba, en alignement avec vos convictions.

Contents

Introduction: why several references in Islamic finance?

- AAOIFI: The architect of standards for the Islamic financial industry.

- Majmaʿ al-Fiqh: The assembly of scholars that issues resolutions on contemporary issues.

- What they have in common: a shared goal of Sharia compliance.

- Their difference: Distinct methods and audiences, sometimes leading to different approaches.

- The promise: This article gives you a simple, jargon-free way to read their reviews.

Vous vous lancez dans l’investissement halal et entendez parler de l’AAOIFI et du Majmaʿ al-Fiqh, sans vraiment savoir qui fait quoi ? C’est parfaitement normal.

La finance islamique est un domaine vivant, en pleine croissance, qui s’appuie sur une tradition juridique riche de 14 siècles. Il est donc naturel que plusieurs institutions de référence coexistent pour guider les pratiques. Ces différences ne sont pas des obstacles mais une richesse, reflétant l’adaptation continue de principes anciens à des contextes modernes.

Cet article vise à éclairer votre chemin avec simplicité. Vous découvrirez qui se cache derrière ces acronymes, comment ils travaillent, et surtout comment repérer l’essentiel dans leurs avis, sans vous perdre dans des détails techniques. Pas de conseils d’investissement ici, juste une éducation financière musulmane claire, pour vous donner confiance dans vos choix.

Who are AAOIFI and Majmaʿ al-Fiqh?

AAOIFI: the financial industry's standard-setter

AAOIFI is like the architect of Islamic finance. Founded in 1991, this institution sets technical standards to ensure that Islamic banks and funds operate consistently and transparently.

Its standards cover accounting, auditing, governance and Sharia-compliant ethics. They guide professionals in the creation of interest-free financial products.

These standards have been adopted as mandatory benchmarks in several countries. They serve as a basis for regulators to provide a framework for the sector. Professionals rely on these standards to guarantee compliance and transparency.

The Majmaʿ al-Fiqh: the council of sages for the community

The Majmaʿ al-Fiqh, established in 1981, acts as a council of Islamic jurists. It responds to modern legal issues, including finance, based on a collective work of legal reflection (ijtihâd).

Its resolutions aim to guide Muslims in their daily and professional lives. It is not limited to finance, but deals with all Islamic legal issues.

Its opinions are aimed at a wide audience: individuals, governments, religious and legal institutions. They shed light on moral and legal debates without going into the technical details of implementation.

A clear overview

| Institution | Main role | Notification type | Target audience | Official link |

|---|---|---|---|---|

| AAOIFI | Industry standardization | Shari'ah (technical) standards | Banks, financial institutions, products | aaoifi.com |

| Majmaʿ al-Fiqh (IIFA) | Collective case law | Resolutions (guiding principles) | General public, scientists, regulators | iifa-aifi.org |

Methodology, not technique: two approaches for the same goal

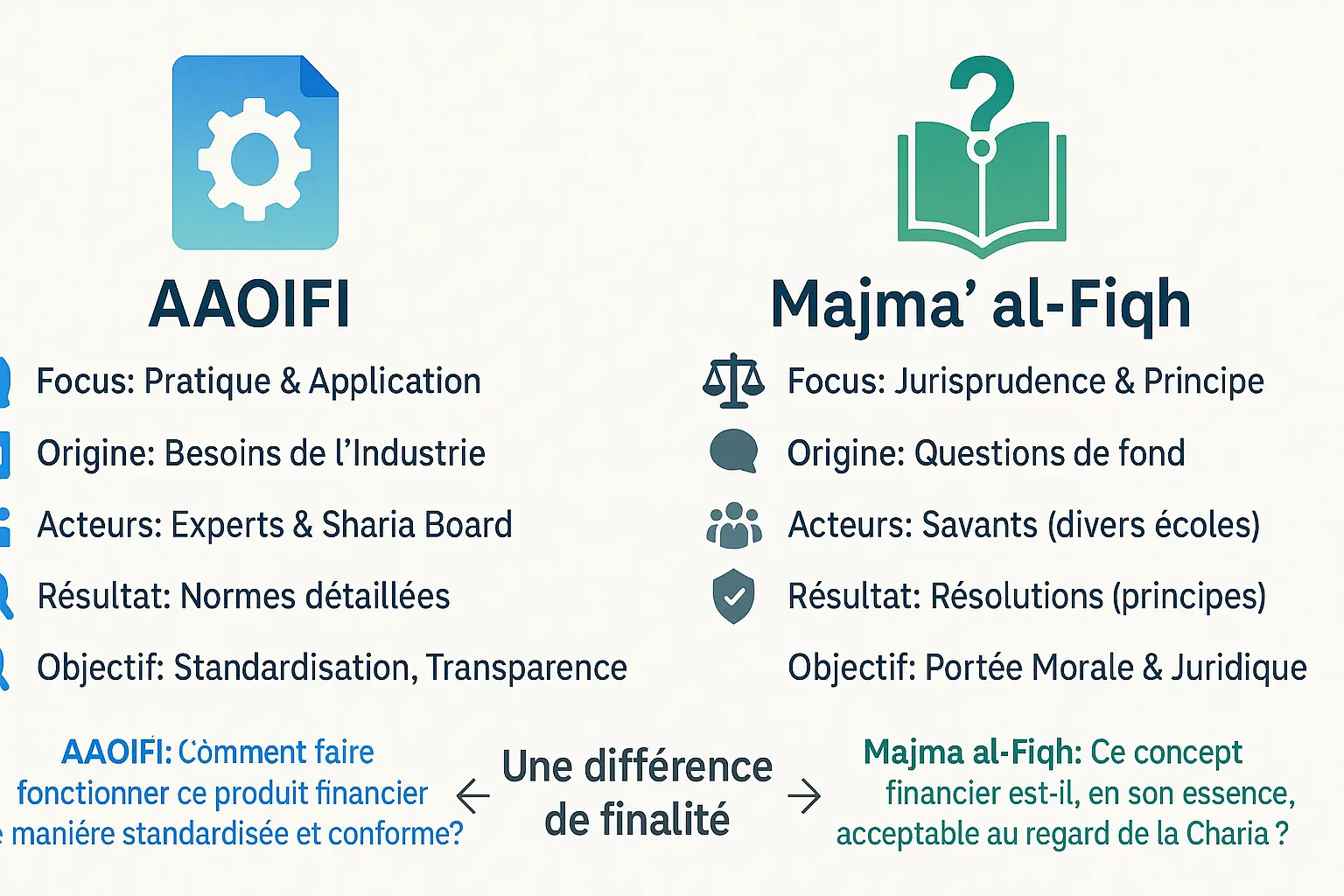

AAOIFI: the standardization process for industry

AAOIFI acts as a technical guide for the Islamic financial industry. Its work begins with consultations with accounting, legal and Shariah experts. These exchanges result in detailed standards for use by Islamic banks worldwide.

Imagine a standardized menu in an international restaurant: each branch serves the same dish, but adapted to local ingredients. In the same way, AAOIFI standards can be adapted to local contexts while maintaining a common base. This guarantees consistency and transparency.

The process includes public hearings and ongoing reviews. This open approach reinforces AAOIFI's authority, becoming the mandatory reference for many countries such as Bahrain and Qatar.

Majmaʿ al-Fiqh: collective ijtihâd in the service of the Ummah

The Majmaʿ al-Fiqh resembles a great council of sages. Bringing together jurists from all Muslim legal schools, it debates fundamental issues. Its aim: to establish general principles applicable to all aspects of life, including finance.

Take the example of a new form of Islamic insurance. The Majmaʿ brings together specialists over a period of weeks, confronts points of view, and delivers an opinion based on the Koran and Sunna. It is not an instruction manual, but a moral compass.

Majmaʿ resolutions directly influence AAOIFI. Like a tree whose roots (principles) nourish its branches (technical standards), these opinions guide concrete decisions.

A difference in purpose

AAOIFI asks, "How can this financial product be made to work in a standardized and compliant way?", while Majmaʿ al-Fiqh asks, "Is this financial concept, in its essence, acceptable with regard to Sharia?"

These two complementary approaches form the backbone of Islamic finance. AAOIFI provides the practical structure, the Majmaʿ establishes the legal foundations. Together, they ensure that halal investment remains true to principles while adapting to economic realities.

Where and why do opinions differ?

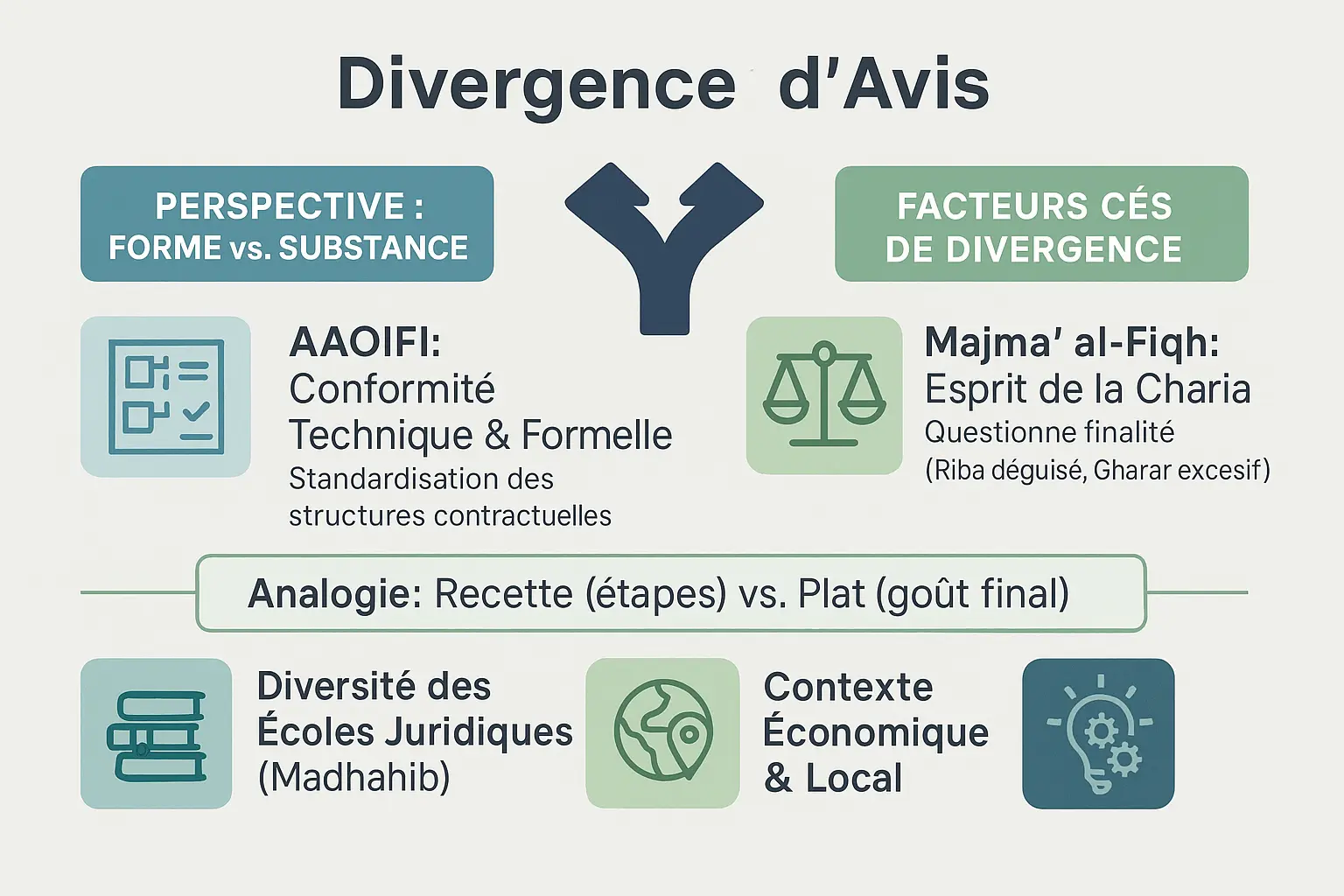

Form vs. substance: a question of perspective

Imagine a dish cooked with care following a recipe to the letter, but which fails to satisfy the guests. That's the difference in approach between AAOIFI and Majmaʿ al-Fiqh.

AAOIFI checks that every ingredient (every clause in a contract) complies with technical standards. If everything is measured and compliant, the dish is declared "halal".

The Majmaʿ al-Fiqh, on the other hand, tastes the final dish. He makes sure that the whole corresponds to the spirit of Islamic principles, even if the ingredients are just right.

This discrepancy often arises in cases such as complex financial contracts. The AAOIFI validates the contractual structure if it complies with technical standards, while the Majmaʿ al-Fiqh may question whether the actual effect contradicts the spirit of the Shariah, such as disguised riba.

Factors influencing opinions

There are a number of reasons why experts' views differ. Here are the main ones:

- The diversity of legal schools (Madhahib): Scholars rely on different interpretations of the four major Sunni schools, offering varied solutions to the same problem.

- Economic and local context: Opinions may vary depending on whether Islamic finance is dominant (as in Malaysia or the Gulf States) or in the minority, which influences the rigor of interpretations.

- Financial innovation (Ijtihad): Faced with new products, scholars must interpret the texts to respond to new situations. This can lead to different conclusions before a consensus is reached.

Beginner's guide: 5 steps to reading a compliance notice

Understanding a Shariah compliance opinion is not just for scholars. With a simple method, you can grasp the essence of an opinion, whether it comes from the AAOIFI or the Majmaʿ al-Fiqh, without getting lost in the technical details. The aim here is to guide you step by step, remaining within an educational and non-advisory framework.

- Identify the source: Is it an AAOIFI standard (financial standardization) or a Majmaʿ resolution (learned assembly)? Knowing who is speaking gives 80% of the context. AAOIFI publishes standards for banks, structuring products such as Sukuk (Islamic bonds), while the Majmaʿ issues general opinions on lawfulness, sometimes touching on topics such as ethical savings or green investments.

- Find the main conclusion: get to the point: does the opinion authorize, prohibit or set conditions? A quick read of the conclusion will suffice. In AAOIFI standards, the answer is often found in the "Shariʿah compliance" chapters. For Majmaʿ resolutions, check the "final resolution" or "collective opinion" sections. A notice mentioning "total prohibition" or "subject to conditions" immediately clarifies its position.

- Identify key principles: Look for words like riba (interest), gharar (uncertainty), or maysir (speculation). These concepts structure the opinions. To invest in gold in Islam, the rules of cash exchange avoid riba. A Murabaha contract (purchase-resale with margin) must respect the rules of gharar, avoiding vague clauses on delivery or terms.

- Understanding the scope: Is it an opinion targeting a specific contract (e.g. AAOIFI Murabaha) or a general principle (e.g. Majmaʿ gharar)? An AAOIFI standard on Sukuk concerns banks, while a Majmaʿ resolution on ethics applies to everyone, including individuals. For example, an opinion on cryptocurrencies could be issued by the Majmaʿ with an ethical angle, while AAOIFI would focus on their integration into conventional financing frameworks.

- Adopt a cautious stance: If opinions differ on an innovative product, take a step back. In Islamic finance, it's better to understand before acting. Consult educational summaries, independent experts or community platforms such as Namlora to compare opinions and avoid pitfalls. When in doubt, always err on the side of caution.

FAQ: your questions about AAOIFI and Majmaʿ al-Fiqh

Understanding the institutions of Islamic finance avoids many misunderstandings. Here are some clear answers.

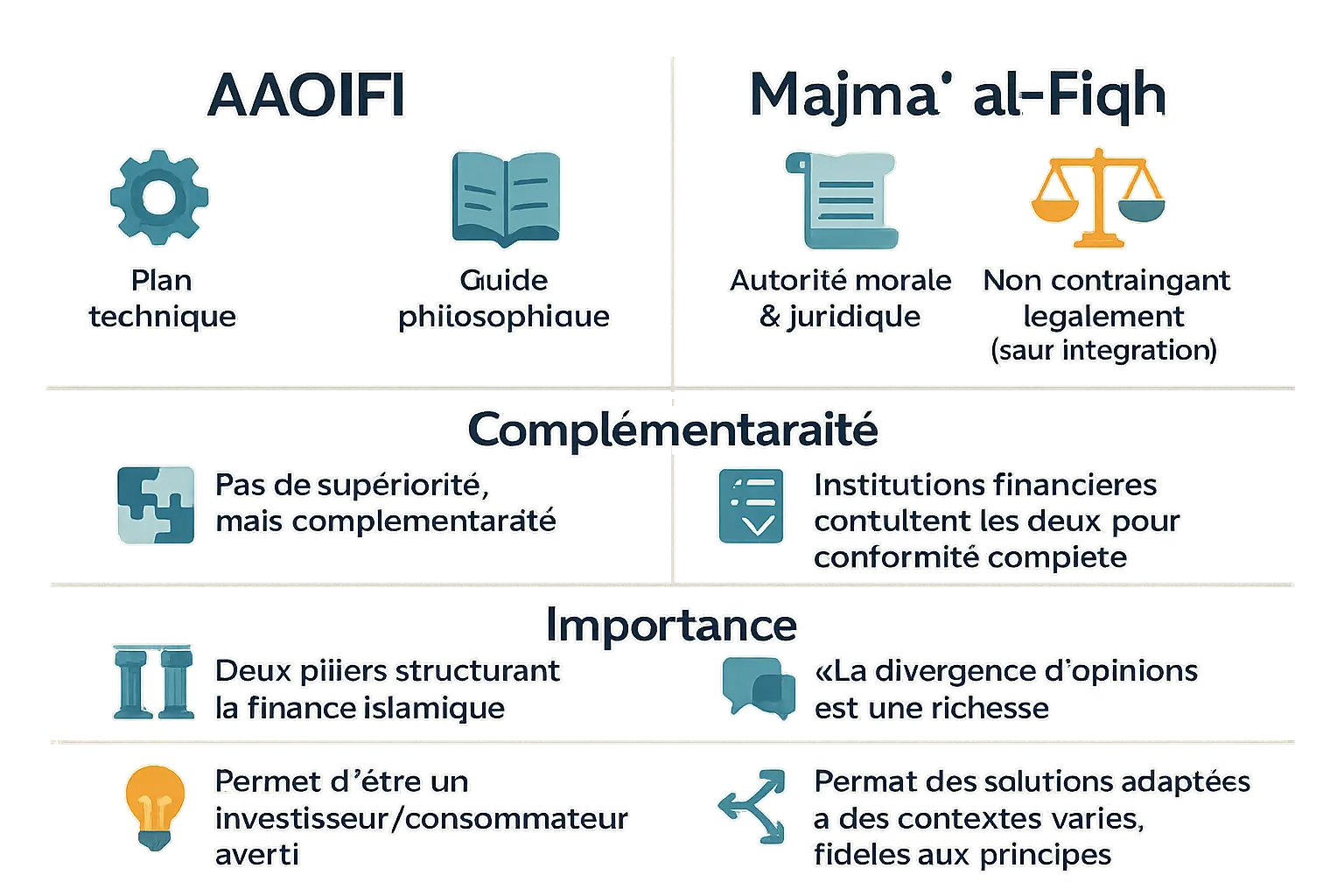

Is one opinion superior to the other?

AAOIFI and Majmaʿ al-Fiqh are complementary. AAOIFI establishes technical standards for financial operations. The Majmaʿ offers legal guidance based on fiqh. Both guide Islamic banks towards sound compliance.

Are their opinions binding?

AAOIFI standards are mandatory in several countries (Bahrain, Qatar...). Those of the Majmaʿ have moral authority, becoming binding only if integrated into national legislation. Their religious legitimacy remains strong.

Why get to know them?

They structure Islamic finance. Distinguishing between them enables you to judge financial products with discernment, becoming an informed consumer, autonomous in aligning your choices with your values.

Isn't a difference of opinion a problem?

Difference of opinion, based on sound methodologies and mutual respect, is a richness and a sign of vitality in Islamic jurisprudence, not a weakness.

These differences reflect our ability to adapt to different contexts without betraying our principles. They offer practical solutions while preserving ethics.

Disclaimer: Namlora is not an investment advisor. This content is educational. Everyone remains responsible for their own decisions. AAOIFI | Majmaʿ al-Fiqh

What you need to know to invest with confidence

AAOIFI and Majmaʿ al-Fiqh share a common goal: to frame ethical finance, but their methods differ. The AAOIFI proposes technical standards for institutions, while the Majmaʿ al-Fiqh formulates moral resolutions for the general public. These divergences reflect the richness of a constantly adapting legal tradition, with no real opposition.

Congratulations on your enlightened approach! Understanding these distinctions is the first step towards investing in line with your values. To deepen your Muslim financial education, explore Namlora's ethical investment ecosystemdesigned to simplify access to transparent and sustainable finance.

⚠️ Disclaimer : Namlora n’est pas un conseiller en investissement. Ce contenu est éducatif et communautaire. Chacun reste responsable de ses décisions.

L’harmonie entre AAOIFI (normes techniques) et le Majmaʿ al-Fiqh (principes éthiques) réside dans leur complémentarité. Leur diversité est une force pour une finance islamique dynamique. En les comprenant, vous éclairez vos investissements alignés à vos valeurs. ⚠️ Disclaimer : Namlora n’est pas un conseiller en investissement. Contenu éducatif. Chacun reste responsable de ses choix.

FAQ

Quelle est la règle des 5 % dans AAOIFI ?

La règle des 5 % dans les normes AAOIFI est un seuil technique utilisé principalement dans les contrats de financement islamique, comme le Mourabaha, pour encadrer la prise de risque. Elle signifie que l’institution financière doit détenir une part minimale de 5 % du bien financé pour garantir une véritable implication économique. C’est un peu comme si vous achetiez une maison en vous assurant de posséder une petite part de terrain : cela renforce la solidité du contrat et évite les abus. Cette règle illustre comment les normes AAOIFI traduisent les principes de la finance islamique en pratiques concrètes et vérifiables.

What are the AAOIFI standards?

Les normes AAOIFI sont des référentiels techniques qui guident le fonctionnement des institutions financières islamiques. Elles couvrent la comptabilité, l’audit, la gouvernance et la conformité à la Shariah. Imaginez-les comme un manuel d’utilisateur pour les banques : elles détaillent comment structurer des produits comme le Ijara (leasing) ou le Mudaraba (partenariat), tout en évitant les interdits comme le riba (intérêt). Ces normes visent à harmoniser les pratiques mondialement, pour une transparence et une confiance accrues dans le secteur.

Quels sont les principes fondamentaux de la finance islamique ?

La finance islamique repose sur trois piliers simples : 1. Interdiction du riba (intérêt) : Les gains doivent découler d’un vrai partage de risque, pas d’un taux fixe. 2. Refus du gharar (incertitude excessive) : Les contrats doivent être clairs et équitables pour toutes les parties. 3. Légitimité des activités : Les investissements doivent respecter les valeurs éthiques (pas d’armes, d’alcool, etc.). C’est comme cultiver un jardin : si les graines (les principes) sont saines, la récolte (les profits) est durable et bénéfique pour tous.

What is AAOIFI?

L’AAOIFI (Organisation comptable et d’audit pour institutions financières islamiques) est une institution qui établit des normes techniques pour les banques et fonds islamiques. Son rôle ? Permettre à ces institutions de fonctionner de manière transparente et conforme à la Shariah, en fixant des règles précises pour les contrats, les audits ou la gouvernance. C’est un peu l’ingénieur de la finance islamique : il fournit les plans pour que chaque produit soit solide, éthique et comparable à l’échelle mondiale. Ses normes sont adoptées par de nombreux pays, comme le Qatar ou le Bahreïn, pour encadrer l’industrie.