<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

To cut to the chase: real estate is halal if the financing avoids riba (interest), favoring contracts such as Murabaha or Musharaka. These solutions align your investment with Islamic principles, ensuring transparency and risk-sharing. Some platforms, such as Dubai's Stake, offer up to 10.1% halal yield from as little as $150.

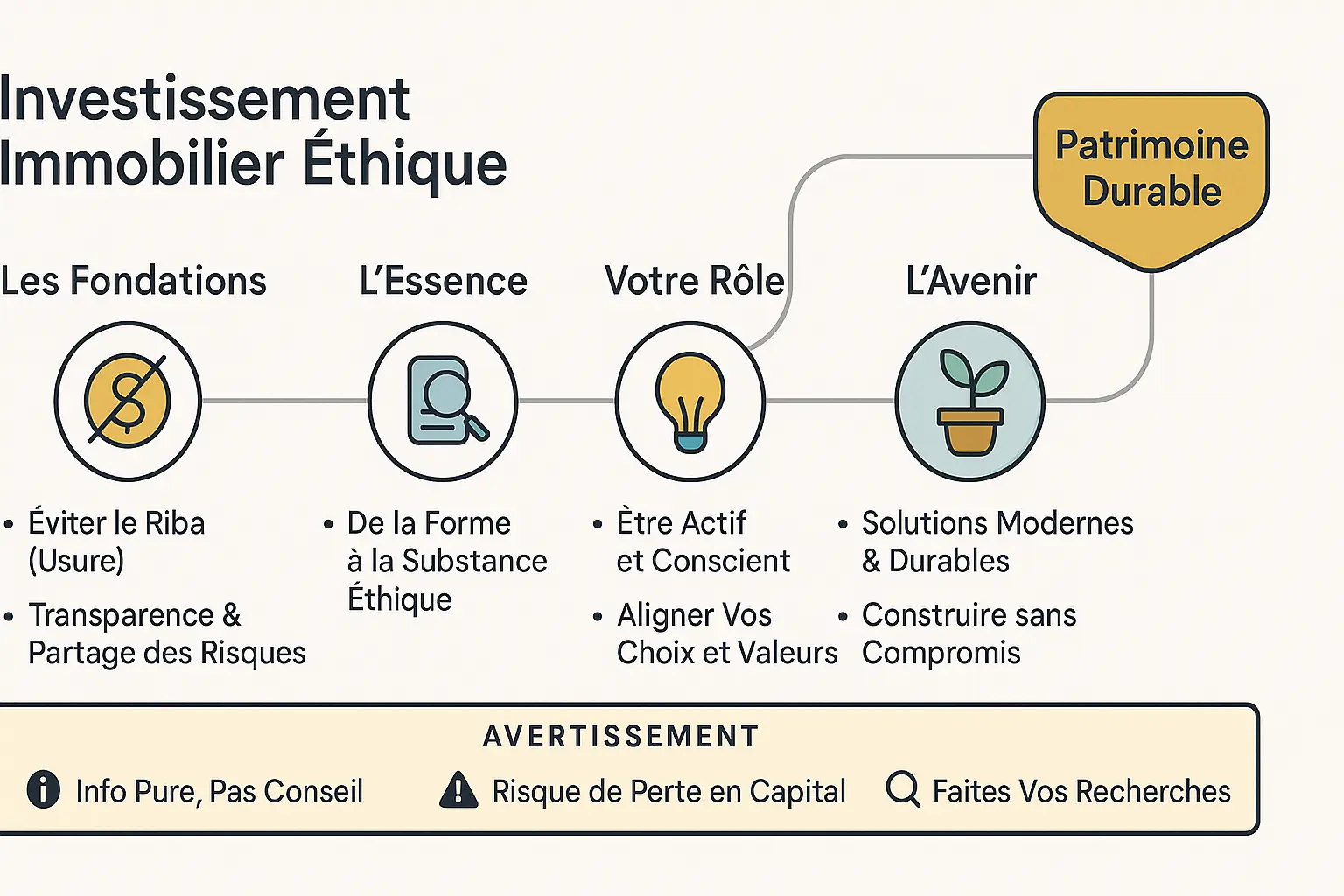

Halal or haram? Many Muslims hesitate to invest in modern real estate to reconcile faith and return. The asset is lawful, but the financing decides whether it is compliant: riba is forbidden, whereas solutions such as interest-free plans or contracts (Murabaha, Ijara) offer ethical and structured alternatives. Thanks to AAOIFI standards and Dr. Lahlou's analyses, explore how to avoid the pitfalls of "hollow forms" and "haram-washing". Concrete models, such as Muslimmobilier, illustrate the path to sustainable investment, rooted in the Islamic principles of justice, transparency and risk-sharing.

Contents

Investing in real estate in Islam: a guide to aligning your project with your values

Real estate is much more than just a dream of ownership. For many Muslims, it's a secure investment and an opportunity to build wealth. Yet a crucial question remains: does real estate investment necessarily rhyme with halal or haram?

The answer lies not in the stone itself, but in the way it is accessed. The act of buying or renting a property is lawful, but the riba (usurious interest) that often accompanies conventional bank loans makes the operation non-compliant with Islamic principles.

This article will guide you through the process. Drawing on the expertise of Dr. Mohammed Talal Lahlou, the standards of the AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) and the opinions of the Majmaʿ al-Fiqh al-Islami (International Academy of Islamic Fiqh), we will detail alternative financing and its subtleties. Our aim? To enable you toinvest in real estate while remaining aligned with your convictions.

Because that's what it's all about: reconciling profitability and ethics, financial security and religious compliance.

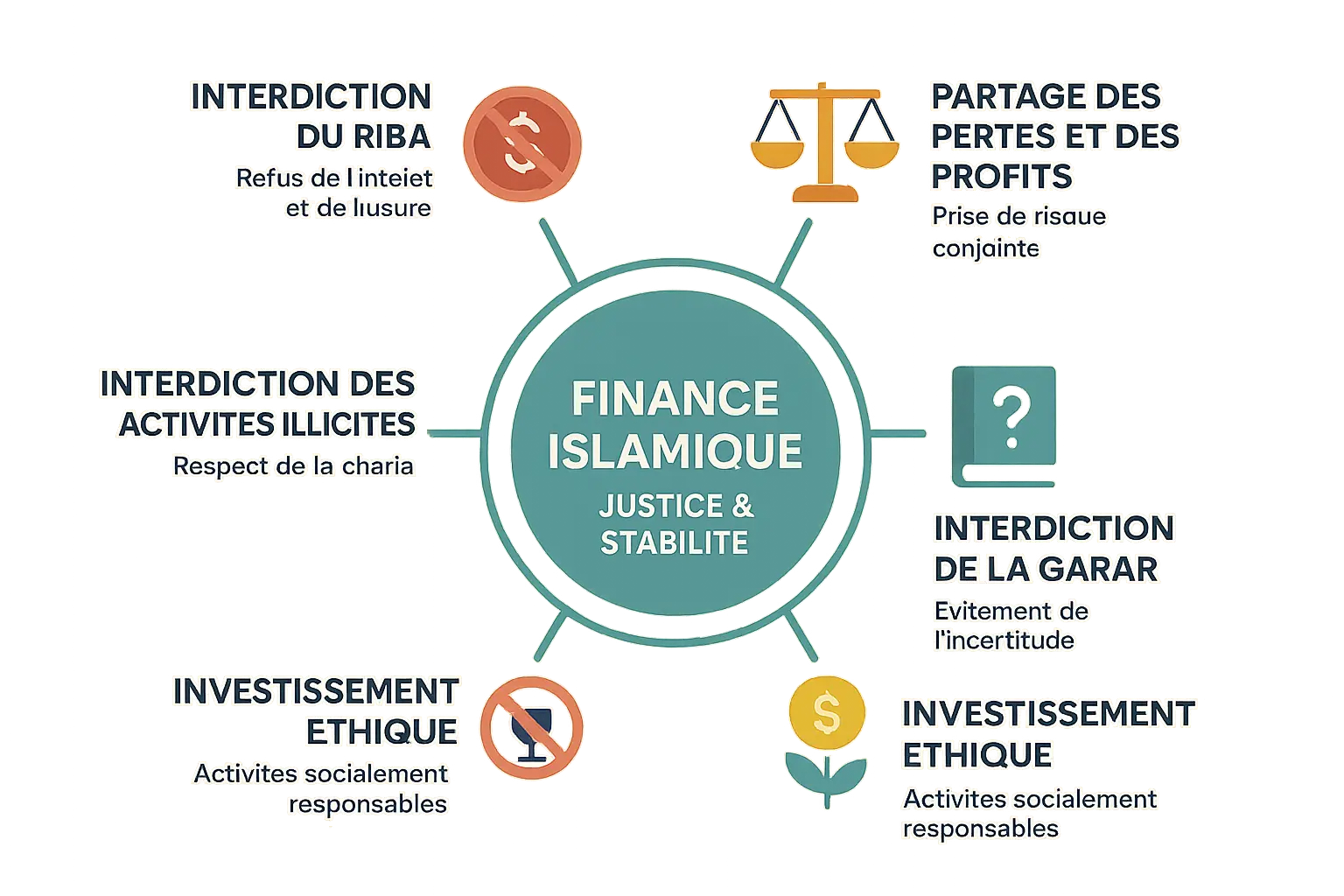

The 5 pillars of ethical investment in Islamic finance

Islamic finance is based on five ethical pillars, guaranteeing a fair and stable economic system, where transactions generate value without exploiting the weaknesses of others.

- The prohibition of Riba (interest): Verse 2:275 of Sura Al-Baqara condemns riba as an unfair mechanism. This prohibition is based on the idea that money should result from real economic activities. A conventional loan where interest is charged without any link to the results of the project violates this principle.

- Prohibition of Gharar (excessive uncertainty): Contracts must be clear. In Murabaha financing, the price, margin and terms are unambiguously defined.

- Ban on Maysir (excessive speculation): It is forbidden to buy properties on a "vente en état futur d'achèvement" basis without a guarantee of delivery. These transactions are based on random gains with no value creation.

- Backed by a tangible asset: Tangible assets, such as real estate, generate concrete income through rental or resale, unlike abstract investments.

- Profit and loss sharing (PPP): Musharaka shares risks equally. Example: a bank and an investor own 50% of a property, with equal sharing of rents and losses.

These principles, overseen by AAOIFI and Majmaʿ al-Fiqh al-Islami, ensure religious conformity and economic stability, guaranteeing sustainable and equitable development.

Classic rental property: why bank loans are a problem

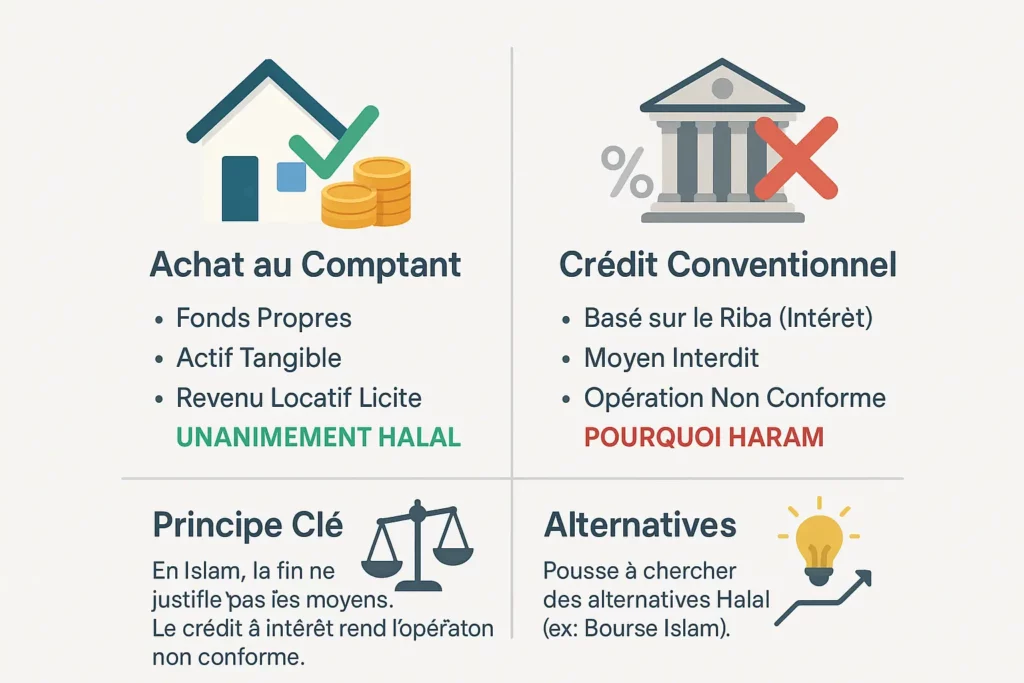

The simple case: cash purchase

Real estate investment using one's own funds is unanimously considered halal. The asset is tangible, the rents received are lawful, and the transaction complies with Islamic principles. No legal ambiguities remain, as the transaction is based on tangible ownership and ethical use of resources.

The complex case: conventional credit financing

The use of a conventional mortgage poses a major problem: it involves riba, forbidden by all Islamic legal schools. Even if the property acquired is licit, the use of a haram tool (interest) renders the operation non-compliant with the Shari'ah. As the fatwa reminds us:

"In Islam, the end does not justify the means. Even with a laudable intention, using a forbidden tool like interest-bearing credit to invest makes the operation non-compliant."

This prohibition is prompting many Muslims to explore halal alternatives, such as financing based on cost-plus sales (Murabaha) or hire-purchase (Ijara). However, these solutions require extra vigilance to avoid the abuses reported by AAOIFI. As with halal stock market investing, due diligence remains paramount. Bourse islam : Halal stock selection in 3 steps underlines the importance of checking the conformity of instruments before any commitment.

Halal financing solutions for your real estate project

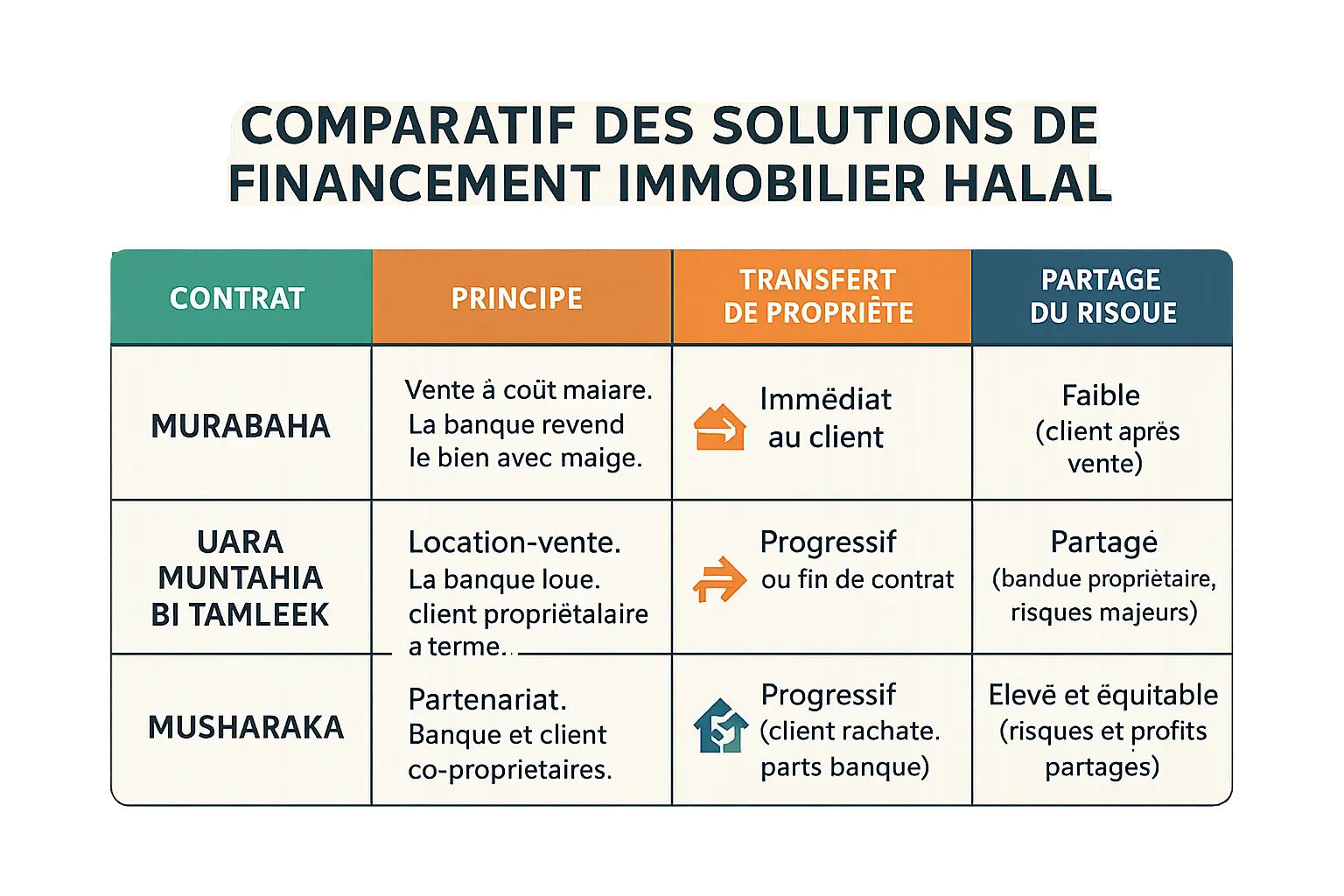

Islamic finance offers three main mechanisms for riba-free real estate: Murabaha (fixed-margin sale),Ijara (progressive rental) and Musharaka (degressive co-ownership). These models comply with AAOIFI standards and Majmaʿ al-Fiqh al-Islami opinions.

Murabaha: transparent sales

Murabaha is the most common mechanism. The bank buys the asset and then sells it back to the customer with an agreed profit margin. Payment is made in fixed installments, without interest.

- Contract of sale, not loan

- AAOIFI bans contract rollover

- Customer bears risk after acquisition

Ijara: towards step-by-step ownership

Ijara Muntahia bi Tamleek combines leasing and gradual buyback. The bank buys the property and makes it available to the customer. Part of the payments is used to buy back the bank's shares.

- Compliance with future AAOIFI 62 standards

- Risk sharing: the bank assumes major risks

Musharaka: ethical partnership

Musharaka embodies the participatory ideal. Bank and customer become co-owners of the property. The customer rents the bank's share while gradually buying back his or her own shares.

This solution shares risks and benefits equally, but remains underdeveloped in practice.

| Contract | Principle | Transfer of ownership | Risk sharing |

|---|---|---|---|

| Murabaha | Interest-free fixed-margin sales | Immediate | Low |

| Ijara | Rent to own | Progressive | Shared |

| Musharaka | Degressive partnership | Scaled | High |

Current issues

Dr. Lahlou highlights the "substance gap": some Islamic structures imitate conventional models. AAOIFI combats this tendency by requiring actual property transfers and prohibiting organized Tawarruq when it circumvents riba.

AAOIFI standards guide practices. Tazkiyah purifies income generated indirectly by conventional systems.

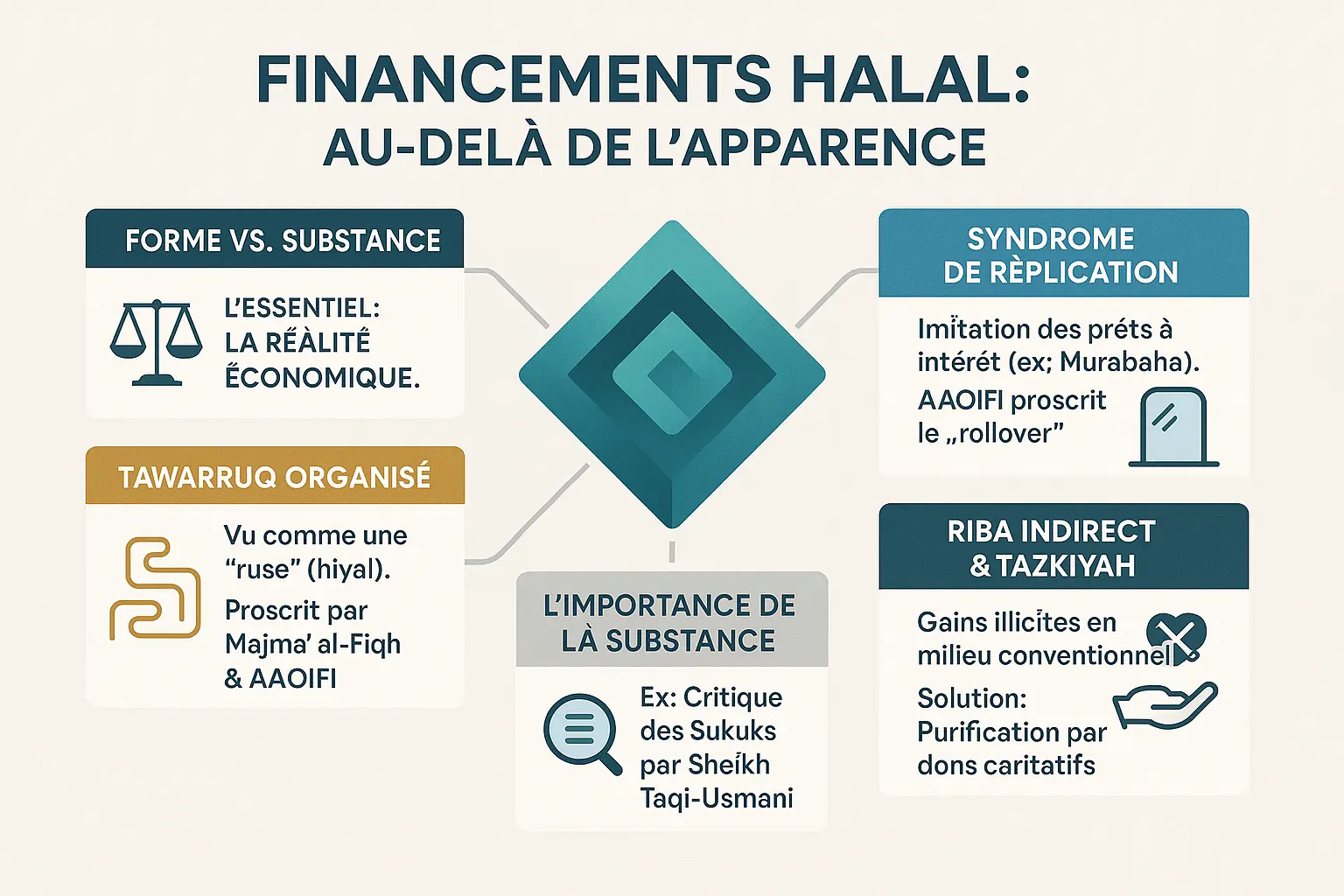

Beyond appearances: the nuances and criticisms of "halal" financing

When it comes to investing in real estate according to Islamic principles, true conformity lies in the economic substance, not in the legal form of the contract. Dr. Mohammed Talal Lahlou and AAOIFI highlight this risk of "formal deviance" in current products, where certain mechanisms, while legal, betray the spirit of Islamic finance by imitating conventional tools. This tension between form and substance is central to ethical investment.

Replication syndrome

Dr. Lahlou criticizes the "replication syndrome", where products like Murabaha mimic interest-bearing loans despite their legality. The AAOIFI has outlawed this practice via its Shari'ah standard n°59, prohibiting the "rollover" of Murabaha contracts deemed too similar to conventional loans. This model, although legally valid, departs from the spirit of Islamic finance, which is based on risk sharing. For example, "rollover" consists of renewing sales contracts to defer payments, artificially creating an interest flow disguised as a commercial margin. AAOIFI reiterates that Murabaha must remain a single, transparent sale, with no deferral mechanisms that turn it into a disguised loan.

The organized Tawarruq controversy

Tawarruq, a mechanism for obtaining cash via successive sales, is proscribed by AAOIFI and Majmaʿ al-Fiqh al-Islami. Considered a "ruse"(hiyal), it circumvents the prohibition of riba by masking a loan of money at implicit interest. A concrete example: an investor buys a property on credit from an Islamic bank, then immediately sells it to a third party to obtain cash. This arrangement, while theoretically legal, is denounced for its economic purpose, which is identical to a conventional loan. The Majmaʿ al-Fiqh al-Islami rejected this practice in its resolution n°14/2 (1999), believing that it creates an "appearance of legitimacy" concealing a prohibited system.

The problem of indirect riba

In contexts such as France, where the banking infrastructure remains predominantly conventional, an additional challenge arises: indirect riba. Even if an investor uses a halal account, his funds are often deposited in traditional interest-bearing banks. The recommended solution is Tazkiyah: to identify incidental illicit income (capped at 5% according to AAOIFI) and transfer it to alms-giving without personal profit. For example, if a Muslim holds an Islamic investment account in Europe, he or she must check whether the interest generated by banking partners is purified. This process, though complex, embodies a responsible approach to aligning financial practices and spiritual values.

For more on these issues, see Sheik Taqi-Usmani's analysis of sukuks, which illustrates the importance of substance in Islamic financing. As he points out, even instruments such asIjara can drift when they guarantee a fixed return, transforming a rental contract into a disguised loan. Vigilance therefore remains the watchword for any player involved in the Islamic economy.

Your practical guide to truly halal real estate investment

Investing in halal real estate is more than just checking the surface area of a property or the amount of rent. The key lies in the substance of the transaction itself. As Dr. Mohammed Talal Lahlou, a specialist in Islamic financial markets, points out,

"An investment is not halal simply because it is labelled as such. Diligence and the quest for transparency are the duties of every ethically-minded investor."

This vigilance is all the more necessary as AAOIFI, in its Shari'ah standard no. 59, prohibits "rollover" practices in Murabaha contracts, deemed to be too close to conventional mechanisms.

Here's your checklist for avoiding "haram-washing" in your real estate projects.

- Ask for the detailed contract: Demand the full text of the Murabaha, Ijara or Musharaka contract. Check that it's a real sale or a true sharing of risk. Clauses relating to gharar (uncertainty) must be clear: how are responsibilities defined in the event of a dispute?

- Ask about risk-sharing: Ask the question: "If the asset is destroyed, who bears the loss? In a compliant arrangement, risks are shared, as in a true Ijara or Musharaka partnership. For example, in the event of a major loss, the bank bears the loss if it holds legal title to the asset.

- Check the independence of the Sharia Board: Identify the members of the Compliance Committee. Is their curriculum vitae public? Is their opinion on the product accessible? Also check whether they sit on other competing institutions, which could create conflicts of interest. A reputable institution publishes this information.

- Stay alert to the substance: Favor participatory models like Musharaka where you become a co-owner. This is often a sign of greater compliance with the spirit of Islamic finance, as the Majmaʿ al-Fiqh al-Islami emphasizes in its resolutions.

When evaluating opportunities, modern platforms such as Stake in Dubai allow you to invest from as little as US$150 with returns of 10.1%. And don't forget the Tazkiyah: illicit ancillary income must be purified by donating it to charity, in accordance with AAOIFI standards.

Building a future on sound foundations: the path of ethical real estate

Halal real estate is achievable by avoiding riba and complying with AAOIFI standards. According to Dr. Mohammed Talal Lahlou, Islamic finance is based on tangible assets and risk sharing, embodied in contracts such as Murabaha orIjara.

Substance takes precedence over form: a contract imitating a conventional loan betrays the spirit of the Shari'ah. Ethics require rigorous partners and purification of income(Tazkiyah), as recommended by the Majmaʿ al-Fiqh al-Islami.

Platforms like Namlora are revolutionizing the approach, aligning investors and entrepreneurs around human and sustainable values.

Due diligence remains crucial. Check the structure of the contract and the solidity of the model before making any commitment. Real estate, a symbol of faith, is built stone by stone, with rigor and pure intention.

This article is for information purposes only and does not constitute investment advice. Any investment involves risk. Consult Islamic finance experts before making any decision.

Investing in halal real estate is possible by avoiding riba and favoring structures like Musharaka. Prioritize the substance of contracts. Modern solutions such as Namlora make this objective accessible. This article is not intended as advice: get informed.

FAQ

Is it haram to invest in real estate?

Real estate investment in itself is halal, as it is based on a tangible asset, a source of lawful income (such as rent). On the other hand, the method of financing may render the operation haram. For example, a cash purchase or a purchase via a halal (interest-free) plan is permissible. On the other hand, a conventional bank loan involving riba (interest) is unanimously rejected by scholars. So, the key lies in the structure of the financing: give preference to interest-free solutions, such as direct plans with the developer or platforms specialized in Islamic finance.

Is a real estate agent halal or haram?

The profession of real estate agent is halal, provided it complies with Islamic principles. As an intermediary, his remuneration is lawful if it stems from a clear and ethical contract. However, it becomes haram if it facilitates non-compliant transactions (such as interest-bearing loans) or fails to mention gharar (uncertain) or maysir (speculative) practices. A good agent must guide towards transparent solutions, avoiding artificial arrangements. For example, an agent working with platforms such as Muslimmobilier, which validates its operations via a Sharia board, is acting within the framework of ethical practice.

What are the riba-free real estate investments?

Les solutions sans riba se multiplient, alignées sur les principes islamiques. Voici les principales options :

– Les plans de paiement directs avec le promoteur, jusqu’à 10 ans, sans intérêt.

– La Murabaha : la banque achète le bien puis le revend à prix fixe (hors intérêt).

– L’Ijara (location-vente) : la banque loue le bien, une partie des loyers sert à racheter l’actif.

– La Musharaka (partenariat) : co-propriété avec la banque, partage des risques et des bénéfices.

Ces modèles, validés par des institutions comme l’AAOIFI, évitent l’usure tout en restant accessibles, notamment via des plateformes comme Muslimmobilier, actives en France, Dubaï ou au Maroc.

Is a mortgage halal or haram?

Un prêt immobilier classique, avec intérêt, est haram. L’islam interdit catégoriquement le riba, même pour un bien licite comme un logement. En revanche, des alternatives halal existent :

– Les contrats Murabaha ou Ijara, où la banque agit en partenaire (pas en prêteur).

– Les financements participatifs, comme la Musharaka, où le risque est mutualisé.

Le défi est de vérifier la substance des contrats : certains produits « halal » imitent en apparence le prêt conventionnel, ce que l’AAOIFI dénonce comme un substance gap. Privilégiez les modèles transparents, comme ceux validés par un Sharia board indépendant.

Which investment is haram?

Sont haram les investissements fondés sur :

– Le riba (intérêts), comme les prêts bancaires classiques.

– Le gharar (incertitude excessive), par exemple des contrats opaques ou spéculatifs.

– Le maysir (jeu de hasard), comme les placements à risque abusif sans création de valeur.

Exemples concrets :

– Acheter un bien via un crédit à taux variable.

– Investir dans des projets immobiliers spéculatifs (résidence virtuelle, sans actif tangible).

Pour rester conforme, optez pour des actifs tangibles (immobilier locatif) et des financements transparents, comme les plans sans intérêt de Muslimmobilier.

Where not to invest in real estate?

Évitez les marchés ou pratiques à risques élevés, non conformes aux principes islamiques :

– Les zones spéculatives : marchés en surchauffe (ex : certaines villes où les prix flambent sans fondement économique), risquant de tomber dans le maysir.

– Les investissements indirects : fonds immobiliers ou REITs (Real Estate Investment Trusts) non contrôlés par un Sharia board.

– Les transactions non transparentes : contrats avec clauses ambiguës ou recours à des hiyal (ruses) pour contourner le riba.

Privilégiez des marchés stables et des actifs tangibles, comme le locatif en France (marché mûr) ou à Dubaï (rendement élevé mais à évaluer avec soin).

Why is the banking profession considered haram?

Conventional banking is often perceived as haram, as it relies on riba (interest), which is forbidden in Islam. Conventional banks generate profits through interest-bearing loans, which contradicts Koranic teachings (Sura Al-Baqara 2:275). However, Islamic bankers play a halal role if they use contracts such as Murabaha orIjara, avoiding hiyal (artifice). Their challenge is to respectadâb al-mu'âmalât (transaction ethics), sharing risks and promoting economic justice.

How to buy property in Islam

Pour acheter un bien de manière halal, suivez ces étapes :

1. Évitez le riba : préférez l’achat au comptant ou des financements participatifs (ex : Murabaha, Ijara).

2. Vérifiez la conformité : choisissez des institutions avec un Sharia board reconnu (comme l’AAOIFI).

3. Privilégiez la transparence : lisez les contrats pour vous assurer qu’il n’y a pas de gharar (incertitude) ou de clauses injustes.

4. Investissez dans des actifs tangibles : privilégiez l’immobilier locatif (résidentiel, commercial) à des placements abstraits.

Des plateformes comme Muslimmobilier ou des banques islamiques en France offrent des solutions testées et approuvées.

What are the risks of being a real estate agent?

Les risques d’un agent immobilier résident dans son éthique professionnelle et sa conformité religieuse :

– Risques financiers : un agent mal informé pourrait orienter vers des marchés instables (ex : Dubaï, où les rendements sont élevés mais le marché jeune).

– Risques juridiques : contrats mal rédigés ou abus de gharar (ex : promesse de rendement garanti).

– Risques spirituels : faciliter des transactions haram (comme un crédit à intérêt) ou taire des alternatives halal.

Pour vous protéger, collaborez avec des agents certifiés halal, comme ceux de plateformes éthiques, et vérifiez toujours la part de riba dans le financement. La diligence est un devoir islamique avant tout investissement.