<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

Key points to remember: Investing in real estate without riba is possible, but "hidden riba" requires vigilance. Practices such as Tawarruq or exposure to the banking system create risks. Understanding Islamic contracts (Murabaha, Ijara) and asking the right questions remains essential. According to Mufti Taqi Usmani, some debt-backed Sukuk resemble bonds. Islamic ethics demand that the substance of transactions be verified.

Financement immobilier islamiques Les banques offrent-elles vraiment un financement immobilier sans riba, ou existe-t-il des pratiques qui y ressemblent étrangement ? Derrière des contrats comme la Murabaha ou l’Ijara, certains mécanismes cachent parfois une logique de prêt déguisé, où la banque évite le partage des risques ou multiplie les frais injustifiés. Comprendre ces subtilités, c’est protéger votre investissement d’un engagement haram et cultiver une confiance éclairée dans des actifs réels, comme un bien physique ou un projet partagé. Lisez cet article pour distinguer les promesses des réalités, et investir en alignement avec vos valeurs.

Contents

Investir dans l’immobilier islamique sans riba : un rêve accessible ou un piège caché ?

The dream of home ownership is shared by many Muslims. Real estate, a tangible and secure asset, embodies a promise of stability and growth. For those seeking to respect Sharia principles, it seems an ethical way to preserve their capital.

Yet one question still haunts people's minds: is Islamic bank real estate financing really riba-free? Behind Murabaha and Ijara-type contracts, certain practices bear a striking resemblance to conventional loans. This resemblance raises legitimate doubts about the possible presence of hidden riba.

This article is your guide to transparency. We'll break down the mechanisms authorized by Islamic finance, identify the risks of drift, and explain why interpretations vary from country to country. Thanks to concrete examples and the teachings of Dr. Mohammed Talal Lahlou, you'll understand how to avoid pitfalls and invest in line with your values. Our aim? To give you the keys to making an informed choice, without unnecessary judgment or complexity.

Riba, a fundamental prohibition at the heart of Islamic finance

What is riba and why is it forbidden?

Riba, an Arabic word meaning "increase", refers to any unjustified gain on money without creating value. There are two main forms of riba:

- Riba al-Nasi'ah: Interest linked to the duration of a loan. Borrowing 100 euros to repay 110 a year later, simply because of time, is forbidden.

- Riba al-Fadl: Unequal exchange of identical goods (e.g. 1kg of wheat for 1.2kg). Forbidden for six specific goods (gold, silver, cereals...), as it violates equity. According to a Hadith, these exchanges must be equal and immediate.

The prohibition of riba is clear in the Koran (suras Al-Baqarah 2:275-279 and Aal Imran 3:130), which denounces its perverse effects: concentration of wealth and excessive indebtedness. Imam Nawawi classifies it among the "great sins", underlining its impact on social inequalities.

Alternative pillars: risk-sharing and tangible assets

Islamic finance offers an ethical model based on two pillars:

Real assets: Every transaction must be based on a real asset. Example: in a murabaha contract, the bank physically buys an asset before reselling it. This principle eliminates speculation and empty contracts.

Profit/loss sharing (PPP): Investor and borrower form a partnership. Example: in moudaraba, the bank finances a project and shares the profits or losses. This mechanism builds confidence and prudence, avoiding the abuses of fixed-rate systems.

These principles aim to replace usury with a model where money serves the real economy, aligning ethics and shared responsibility.

Murabaha, Ijara: how does Islamic finance finance real estate?

Murabaha: a sale with a transparent margin

Le financement par Murabaha repose sur un contrat commercial où la banque achète le bien immobilier pour le revendre au client avec une marge bénéficiaire fixe. Contrairement à un prêt traditionnel, la banque devient propriétaire temporaire du bien avant de le céder, évitant ainsi le riba.

Le client rembourse le prix échelonné sur une période allant jusqu’à 25 ans, avec un apport personnel requis (15-30 %). Ce système respecte les principes islamiques, la banque partageant le risque de possession et étant rémunérée par une marge claire, non par des intérêts.

Ijara: a rental that leads to ownership

Ijara follows a hire-purchase model: the bank buys the property and rents it to the customer, with transfer of ownership at the end of the contract. During the term of the lease, the bank remains the owner and assumes the risks (depreciation, major works), while the customer pays fixed rents. At the end of the lease, the customer becomes the owner.

This mechanism differs from Murabaha in its intermediate stage: ownership is transferred only after the rental period. Both systems aim to avoid riba, but their structure and risk management vary.

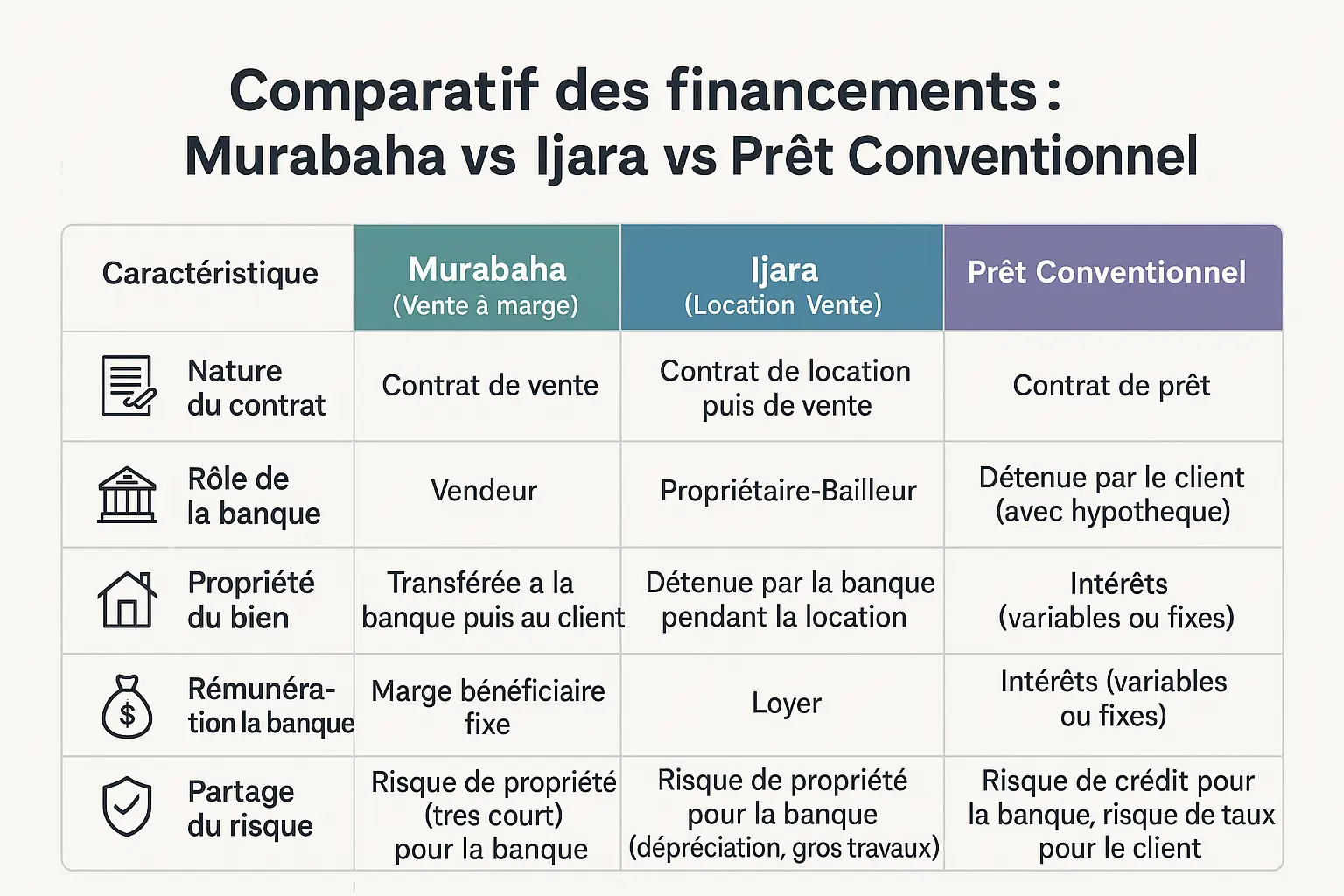

| Features | Murabaha (Margin sale) | Ijara (Rental-Sales) | Conventional loan |

|---|---|---|---|

| Type of contract | Sales contract | Rental and sales contracts | Loan contract |

| The bank's role | Sales | Owner-lessor | Lender |

| Property ownership | Transferred to the bank and then to the customer | Held by the bank during the lease | Customer-owned (with mortgage) |

| Bank remuneration | Fixed profit margin | Rent | Interest (variable or fixed) |

| Risk sharing | Ownership risk (very short) for the bank | Ownership risk for the bank (depreciation, major works) | Credit risk for the bank, interest rate risk for the customer |

Although different, Murabaha and Ijara offer alternatives to the usury prohibited by Sharia law. The former grants rapid access to property with a short risk for the bank, while the latter favors a broad sharing of responsibilities, reinforcing ethical compliance while respecting the needs of home ownership.

When practice departs from theory: the 4 faces of hidden riba

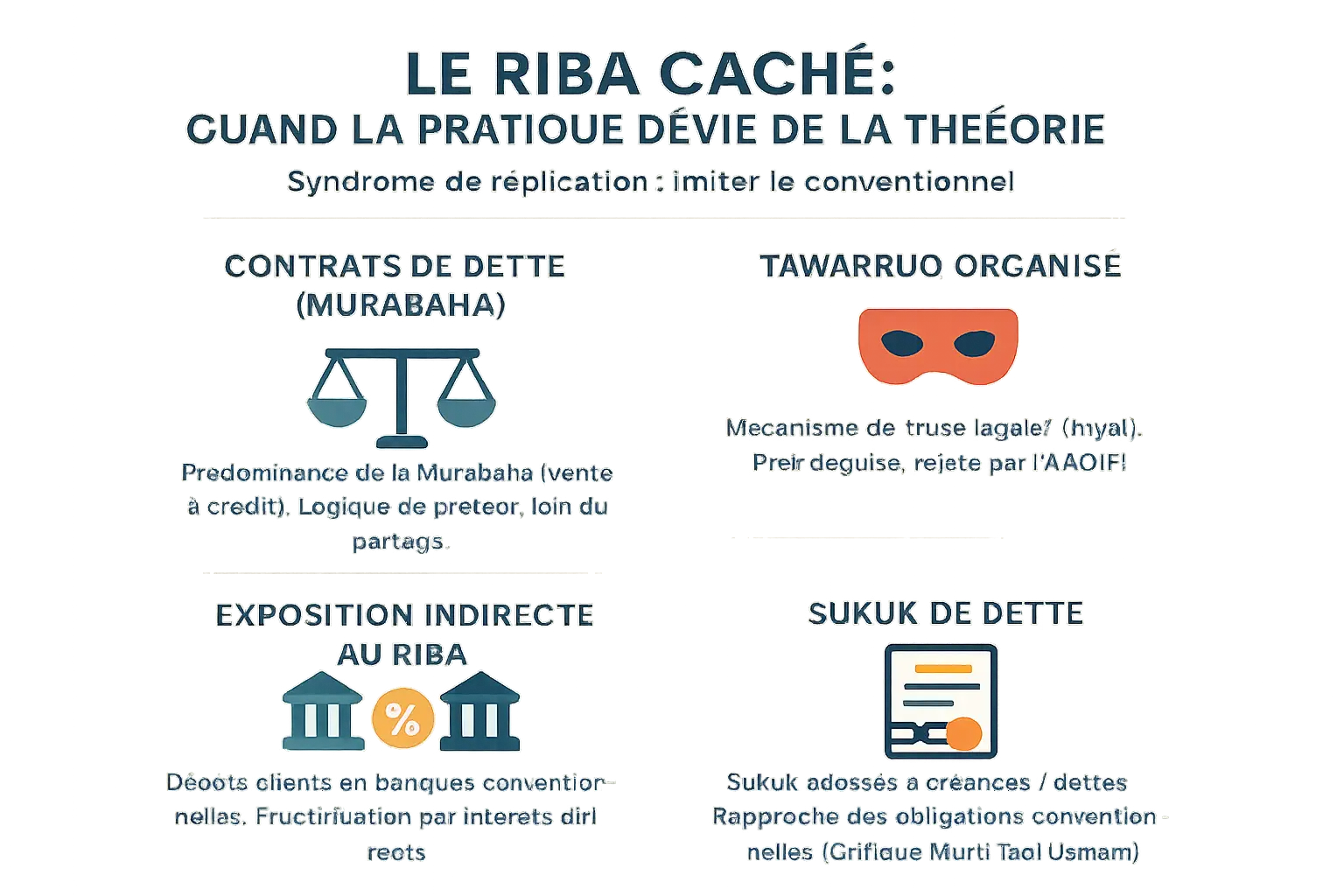

Islamic banks rely on contracts that are legally compliant with Sharia law, but certain practical mechanisms can erode their ethical spirit. As Dr. Mohammed Talal Lahlou points out in his thesis, Islamic financial engineering is often trapped in the "replication syndrome", where the same causes lead to the same effects as conventional products

. This opens the door to disguised forms of riba, between formal conformity and economic drift.

- 1. The predominance of debt-type contracts: Although Musharaka (partnership) ideally embodies Islamic finance, 80% of financing is based on Murabaha (sale on credit). This choice reduces risk for banks, bringing them closer to a conventional lender model. In Malaysia, this trend can be explained by the simplicity of execution, but undermines the participatory ideal of the Islamic economy.

- 2. Organized Tawarruq: This mechanism transforms a sale into a disguised lender. Example: the bank buys metal from the customer, who immediately sells it to a third party for cash. AAOIFI prohibits it, but the practice persists in the Gulf, denounced as a legal ruse (hiyal) to circumvent the riba prohibition. When goods are not physically delivered, the contract is reduced to a simple cash transaction.

- 3. Indirect exposure to riba: In Europe, Islamic banks sometimes deposit funds in conventional interest-bearing banks. Although customers do not benefit directly from these gains, this exposure runs counter to the ideal of a halal economy. In France, Tazkiyah (purification) offsets these illicit ancillary profits, remaining a palliative solution in the face of an inadequate overall regulatory framework.

- 4. Securitization and debt Sukuk: Some Sukuk, which are supposed to represent real assets, actually back claims. According to Mufti Taqi Usmani, 85% of Sukuk in 2008 did not comply with this rule, making them similar to conventional bonds. The absence of any concrete link with the physical asset transforms these instruments into speculative tools, far removed from their ethical purpose.

Face à ces défis, des solutions comme la Tazkiyah ou la révision des normes de l’AAOIFI tentent de réaligner théorie et réalité. Pourtant, la vigilance reste cruciale pour préserver la crédibilité de la finance islamique. Des réformes récentes en Malaisie et une approche stricte au Soudan montrent qu’une économie halal peut s’émanciper des modèles classiques en renforçant l’indépendance éthique de ses outils.

Contrasting landscapes: Islamic finance around the world

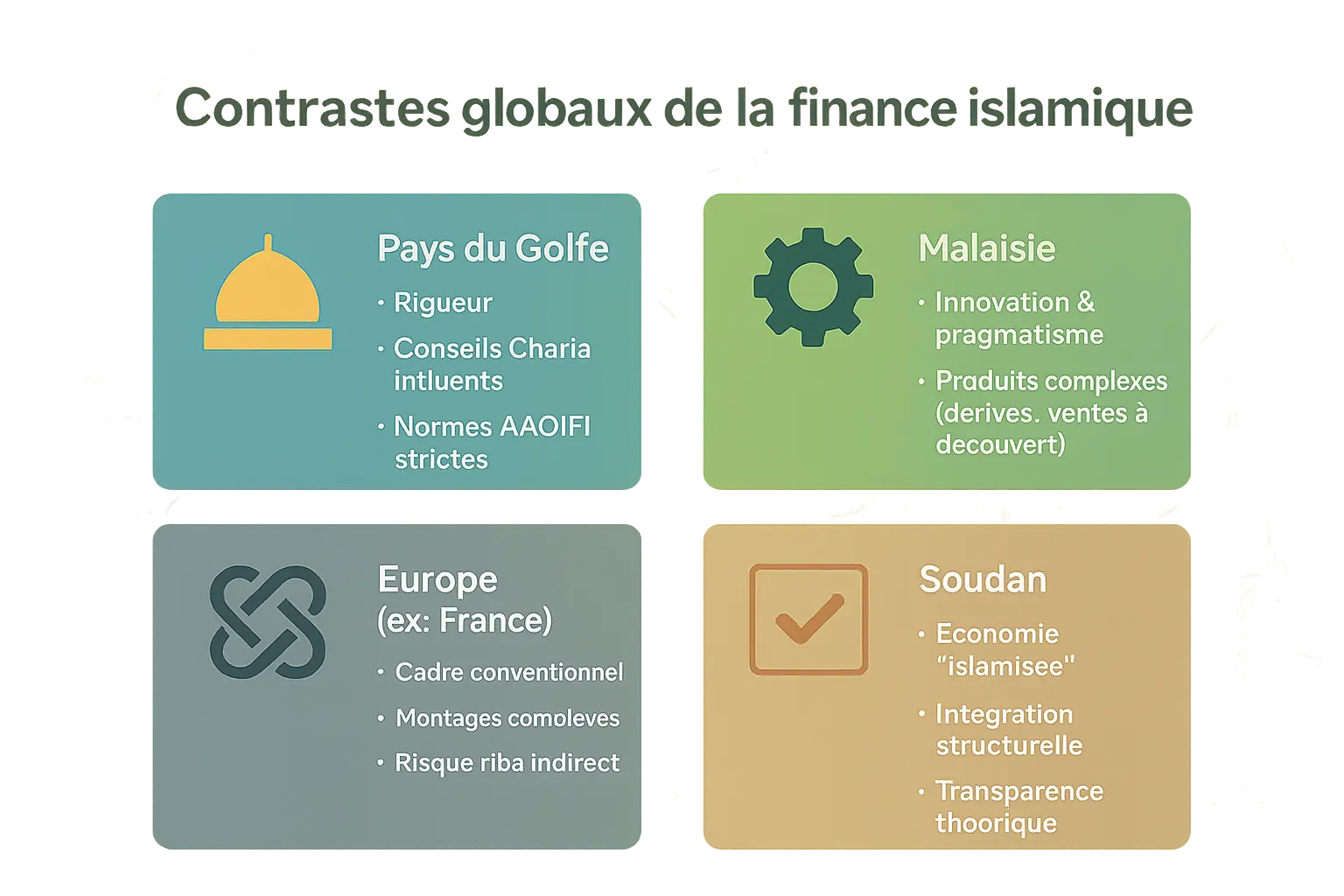

Islamic finance is applied differently in different regions. From the Gulf States to Europe, via Malaysia and Sudan, practices vary according to legal interpretations, regulatory frameworks and local economic realities.

- Pays du Golfe : Des standards élevés Grâce à des Sharia boards indépendants, les monarchies du Golfe appliquent rigoureusement les normes de l’AAOIFI. Les contrats respectent l’esprit de la Charia, avec des vérifications régulières.

- Malaysia: innovation under control A first in creativity, Malaysia allows products such as Islamic short selling. As Dr. Lahlou points out, this approach risks bringing certain contracts closer to speculation. The balance between attractiveness and compliance remains delicate.

- Europe: Coexistence with the conventional system In France and Germany, Islamic banks operate within a conventional framework. Tools such as tazkiyah purify incidental income. Transparency is crucial to avoid hidden risks, despite a complex regulatory environment.

- Sudan: an integrated but fragile model While the Sudanese economy is not entirely Islamic, microfinance projects such as those run by the Bank of Khartoum demonstrate the potential of mudaraba or salam contracts to empower communities. However, political instability limits transparency, a major issue.

Each region adapts Islamic finance to its own reality. As the AAOIFI standards and Dr. Lahlou's work remind us, innovation must always respect the spirit of risk-sharing and ethics inherent in Islamic finance.

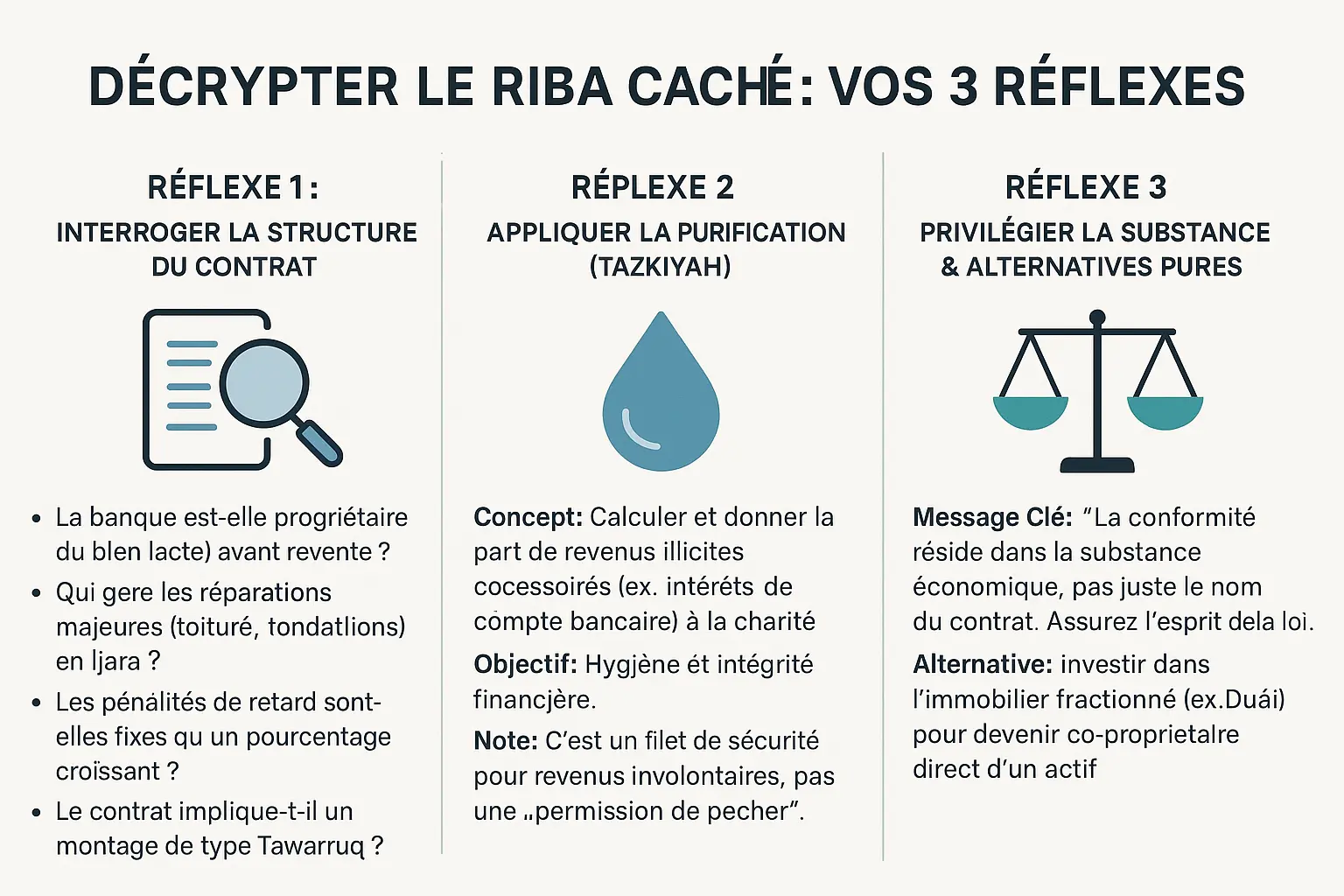

Become an informed investor: 3 reflexes to detect hidden riba

Key questions to ask your banker

Active verification protects against hidden risks. Here are the key points to address.

- Proof of ownership: Ask for deeds showing that the bank actually owned the property before resale. According to Dr. Lahlou, this guarantees the spirit of Murabaha, where the bank bears the risks. Demand copies of land registry or purchase invoices.

- Owner's responsibilities: Who pays for major repairs? A serious institution assumes these costs in accordance with AAOIFI standards. A complete transfer of risk to the customer evokes a façade Ijara. Ask for concrete examples of repairs covered by the bank.

- Pénalités de retard : Les frais doivent être fixes (ex : 10€ par relance) et non un pourcentage croissant. Ce dernier cas rappelle l’intérêt usuraire, dénoncé par le Majma’ al-Fiqhi en 2010. Vérifiez si ces pénalités sont versées à des œuvres caritatives.

- Tawarruq set-up: This mechanism, whereby the bank buys metal and then sells it to pay out money, is strictly forbidden by AAOIFI standards. This arrangement is subject to a binding religious ruling. Ask about successive sales of goods.

Serious institutions provide clear answers to these questions. Their transparency is a criterion of trust. For added security, consult a Sharia-compliant financial advisor.

Understanding purification (Tazkiyah): a solution to indirect exposure

Even in a rigorous system, certain frictions may arise. The Tazkiyah acts as an ethical filter.

Compliance lies not just in the name of the contract, but in the economic substance of the transaction. Your role is to ensure that the spirit of the law is respected.

This process consists of redistributing incidentally illicit income (e.g. 0.01% bank interest) to charity. According to Dr. Lahlou, this is "a self-regulating mechanism for the externalities of a mixed system". Calculations are based on ratios determined by Sharia supervisory committees.

In France, Tazkiyah is applied to guarantee financial integrity. It is inspired by the Zakat in breaking the excessive attachment to wealth. Some banks disclose the purified amount annually.

If you want to go further, look for structured alternatives. For example, Stake offers a fractional real estate model where you become co-owner of a tangible asset in Dubai. This model, similar to Musharaka, eliminates the excesses of "hidden riba" by restoring confidence in the materiality of assets.

Building on sound foundations: towards fair and transparent real estate investment

Synthesis: between a theoretical ideal and a practice to be monitored

Islamic finance is based on a clear foundation: the prohibition of riba, the tangibility of assets and the sharing of risks. In theory, contracts such as Murabaha or Ijara keep speculative practices at bay. But the reality of the market reveals a number of challenges.

Certain mechanisms, such as organized Tawarruq or badly structured Sukuk, run the risk of concealing logics close to self-interest. Even Tazkiyah, while virtuous, must not become a mere palliative for dubious practices. Vigilance remains essential.

Your power as an investor

You have the power to redefine standards. By demanding transparency on the economic substance of contracts, questioning practices that mimic conventional finance, and favoring committed players, you become an agent of change.

This approach is part of a broader vision of value-driven investment. As Namlora illustrates, it's about building an ecosystem where economic growth doesn't come at the expense of ethics, justice or faith. Every choice counts.

Investing in real estate without riba is possible, but requires informed vigilance. While the foundations of Islamic finance are solid, the risk of hidden riba persists in certain practices. By asking the right questions and focusing on transparency, you become a player in an ethical investment ecosystem, aligned with your values and your future.

FAQ

Which bank is riba-free?

Islamic banks, when respecting their principles, avoid riba by using contracts such as Murabaha (sale with margin) or Ijara (hire-purchase). However, certain practices, such as "rollover" (contract renewal), can resemble conventional loans. In France, Islamic banks sometimes have to integrate the traditional banking system, which exposes customers to "hidden riba". To avoid this, favour institutions that apply tazkiyah (purification of incidental illicit income) and verify their compliance via recognized Shariah committees.

How do Muslims go about buying a house?

Muslims can purchase property via halal mechanisms such as Murabaha or Ijara. With Murabaha, the bank buys the property, then resells it at a fixed margin, repaid in monthly installments. With Ijara, the bank leases the asset before transferring it to the customer. These systems exclude interest, but require the bank to take temporary possession of the asset (risk of ownership). In Europe, check that contracts respect these principles and do not conceal practices akin to riba, such as penalties calculated over time.

What is the interest rate of an Islamic bank?

Islamic banks do not charge interest rates, as riba is forbidden. Their remuneration comes from a profit margin (Murabaha) or rents (Ijara), defined from the outset. For example, if a property costs €200,000, the bank can resell it for €240,000, to be repaid over 15 years. This amount is fixed, with no contingencies, unlike conventional loans. However, some structures resemble fixed-rate loans, raising debate about their conformity with the spirit of Shari'ah.

Why can't Muslims borrow from banks?

In Islam, riba (interest) is strictly forbidden, as money should not generate wealth "effortlessly". This includes conventional loans, where the borrower pays more than the initial capital. Islamic finance offers alternatives such as risk-sharing contracts (Musharaka) or real transactions (Murabaha). These models link financing to a tangible asset (real estate, commodity) and eliminate the idea of a "guaranteed gain". However, practices such as organized Tawarruq, where successive sales create a loan effect, remain controversial and proscribed by AAOIFI.

What's the best bank for Muslims in France?

In France, options are limited, as Islamic banks have to fit into a predominantly conventional system. Establishments such as Banque Al Barid (via partnerships) or specialized branches of major groups (e.g. Crédit Agricole) offer halal products. To avoid "hidden riba", check that the bank applies tazkiyah (donation of a share of incidental illicit income) and uses real contracts (e.g. Murabaha with transfer of ownership). Choose transparent institutions, with independent Shariah committees and regular audits.

How can I avoid riba?

To avoid riba, favor Islamic products structured around real assets (real estate, commodities) and risk-sharing. When a contract resembles a loan (e.g. a renewed Murabaha), ask key questions: did the bank own the property? Are penalties fixed (to cover costs) or calculated on delay? Finally, if you use a traditional bank, allocate a portion of your income to tazkiyah to purify unintended gains linked to the conventional banking system.

What are the opinions on 570Easi?

570Easi, a real estate investment platform in France, is not explicitly mentioned in the available data. If it offers halal financing, check that it uses contracts such as Ijara or Musharaka, with a real transfer of ownership. Avoid models where income is guaranteed without risk sharing, or those that resemble disguised loans (e.g. "real estate annuity" with no liability on the part of the lessor). Consult independent Shariah experts to validate the economic substance of the product.

What are the alternatives to mortgages for Muslims?

Alternatives include collective savings (e.g. tontines between families), participatory financing platforms (e.g. investment in compliant Sukuk), or partnerships (Musharaka) with Islamic social landlords. In France, structures such as the "Investir dans l'immobilier halal" scheme make it possible to acquire property via fractional ownership shares, thus avoiding debt contracts. Although less widespread, these models respect the spirit of Shari'ah by linking finance to real assets and risk-sharing.

How can I become a homeowner without credit?

To become a homeowner without credit, you'll need to build up a sufficient capital contribution through strict savings or partnerships (e.g. with relatives in Musharaka). Other solutions include life leases (Istisna), where you build a property by paying instalments, or fractional ownership platforms, where you gradually buy shares. In Europe, some Islamic associations support interest-free social housing projects. Finally, patience and moderation in your needs (e.g., buying a smaller property) can often help you avoid debt, by aligning your investment with the values of justice and simplicity.