<meta name="google-site-verification" content="0S72xkYcSqqt100ZuIzn_Zif1zL8vIvcXUmc5Tjo10o" />

The bottom line: Investing in gold is halal if the method complies with Islamic principles. The Wakala contract, used by platforms such as Inaia, guarantees real ownership, total transparency and the absence of riba. Rated 4.9/5 on Trustpilot, these modern solutions combine security, compliance and simplicity for ethical and sustainable investment.

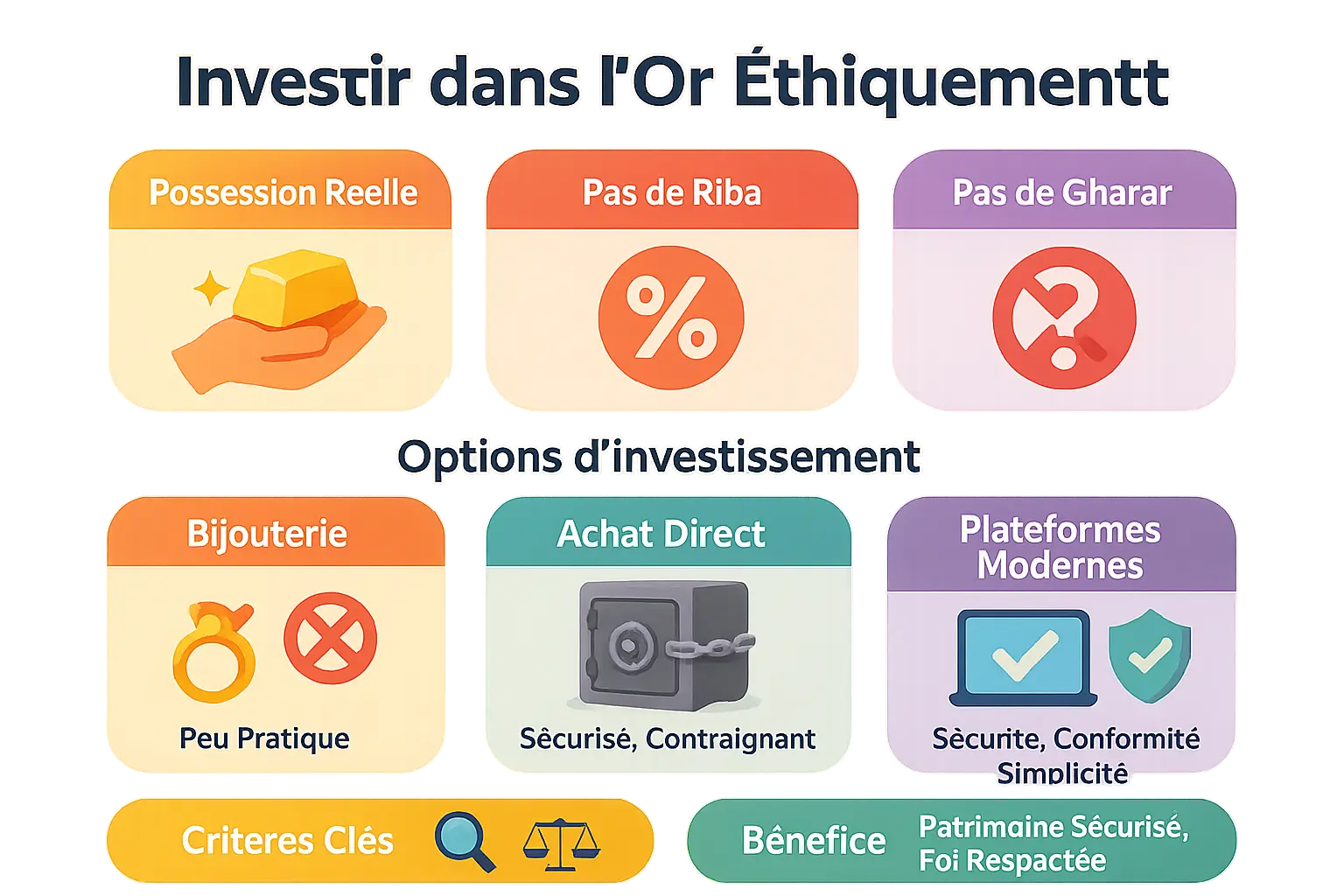

Investing in gold in Islam - is it halal? Behind this legitimate question lies a complex reality: how can you preserve your wealth without compromising your values? This article looks at the 3 ways to invest in gold, from traditional jewelry shops to modern platforms like Inaia, guaranteeing Islamic compliance and security. Find out why gold jewelry hides high costs, why bullion requires rigorous storage management, and how Inaia's Wakala contract eliminates riba, gharar and speculation. A modern solution that combines simplicity, transparency and respect for ethical principles, for asset diversification in physical gold, accessible from as little as a few hundred euros.

Contents

Gold, a timeless refuge for Muslim savers

Faced with economic uncertainty and galloping inflation, many people are looking to preserve their savings. Gold, the age-old symbol of stability, is making a strong comeback in investment strategies. In 2025, its price exceeded 3,500 dollars an ounce, testifying to its resilience in the face of geopolitical and monetary turbulence. But for a believer concerned with respecting Islamic principles, the question arises: is buying gold compatible with halal finance?

The answer is yes, provided that certain rules are observed. Gold, a universally recognized noble material, is both a safe haven and a tangible asset. Yet its status as a ribawi - one of the six goods subject to specific rules in Sharia law - demands special treatment: immediate delivery, physical possession, and rejection of excessive speculation. These requirements are designed to preserve the ethics of the investment and eliminate any ambiguity in the transaction.

This article explains why gold remains a relevant option for the Muslim saver, while detailing the lawful methods for acquiring it. We will guide you through :

- The fundamental principles of Islamic finance as applied to gold - why this precious metal has always had a place in Muslim economic exchanges

- The different ways to invest (bullion, coins, halal ETFs, Sukuk gold) - solutions for every profile

- The advantages and limitations of each approach - making the right choice

- Innovative solutions like Inaia, guaranteeing compliance and security - how technology facilitates access to physical gold

The basics of halal investment: the golden rules to follow

Protecting your wealth according to Islamic principles requires mastery of the rules governing gold, the ribawi commodity that governs trade. Gold is not just a metal: it's an ancient economic pillar, but its conformity depends on a balance between tradition and modernity.

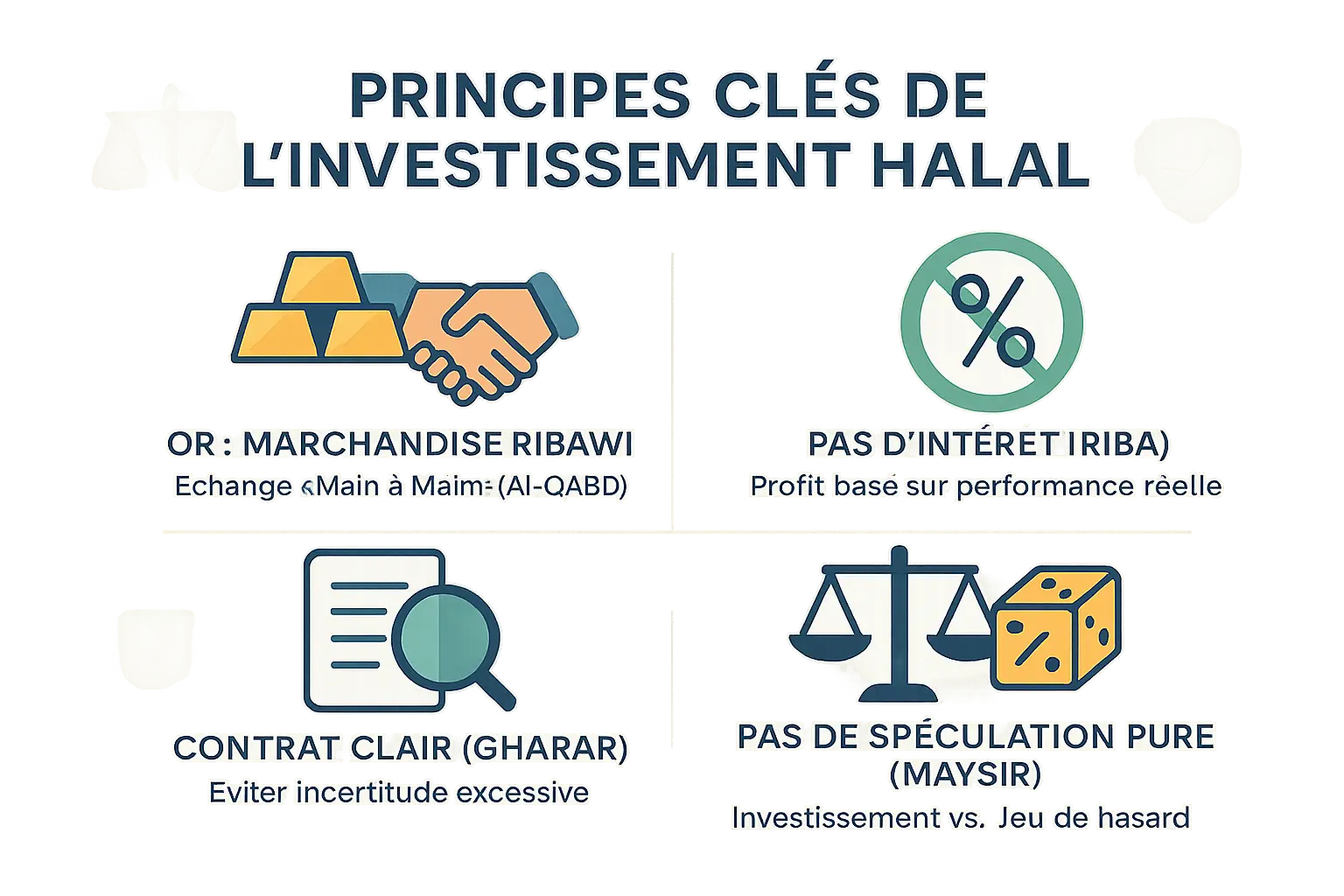

The three pillars of halal transactions

- Prohibition of Riba (interest): Any guaranteed gain without risk is prohibited. Halal profit arises from real performance, as emphasized in a Senate study. Forms of riba (surplus or delay in exchange) nullify the validity of a contract.

- Prohibition of Gharar (excessive uncertainty): The contract must clearly describe quality, quantity and delivery. Derivatives without physical possession, such as speculative contracts, violate this principle, according to Ifpo research.

- Prohibition of Maysir (pure speculation): Profits without effort or value creation are prohibited. Halal investment requires active participation, such as the acquisition of physical gold or Sukuk backed by real assets. The Koran condemns such speculation in Sura Al-Ma'ida (5:90).

"Protecting one's wealth is a legitimate quest, but to do so while straying from principles of justice and transparency such as the prohibition of Riba and Gharar is to risk losing one's serenity."

The key role of the Qabd: immediate possession

Gold, as a ribawi commodity, requires immediate transfer (Qabd). Two forms of possession are valid: physical or constructive via contract. Deferred exchange or unclear storage runs the risk of riba, invalidating Islamic compliance.

Modern practices in line with Sharia law

Innovative solutions such as the Wakala contract combine tradition and modernity. This mandate entrusts a third party (such as Inaia) with the management of the gold, while retaining ownership. A sharia committee validates each transaction, guaranteeing the absence of riba, gharar or speculation. Investors can request physical delivery at any time, further enhancing security.

The 3 ways to buy gold: which is truly halal and practical?

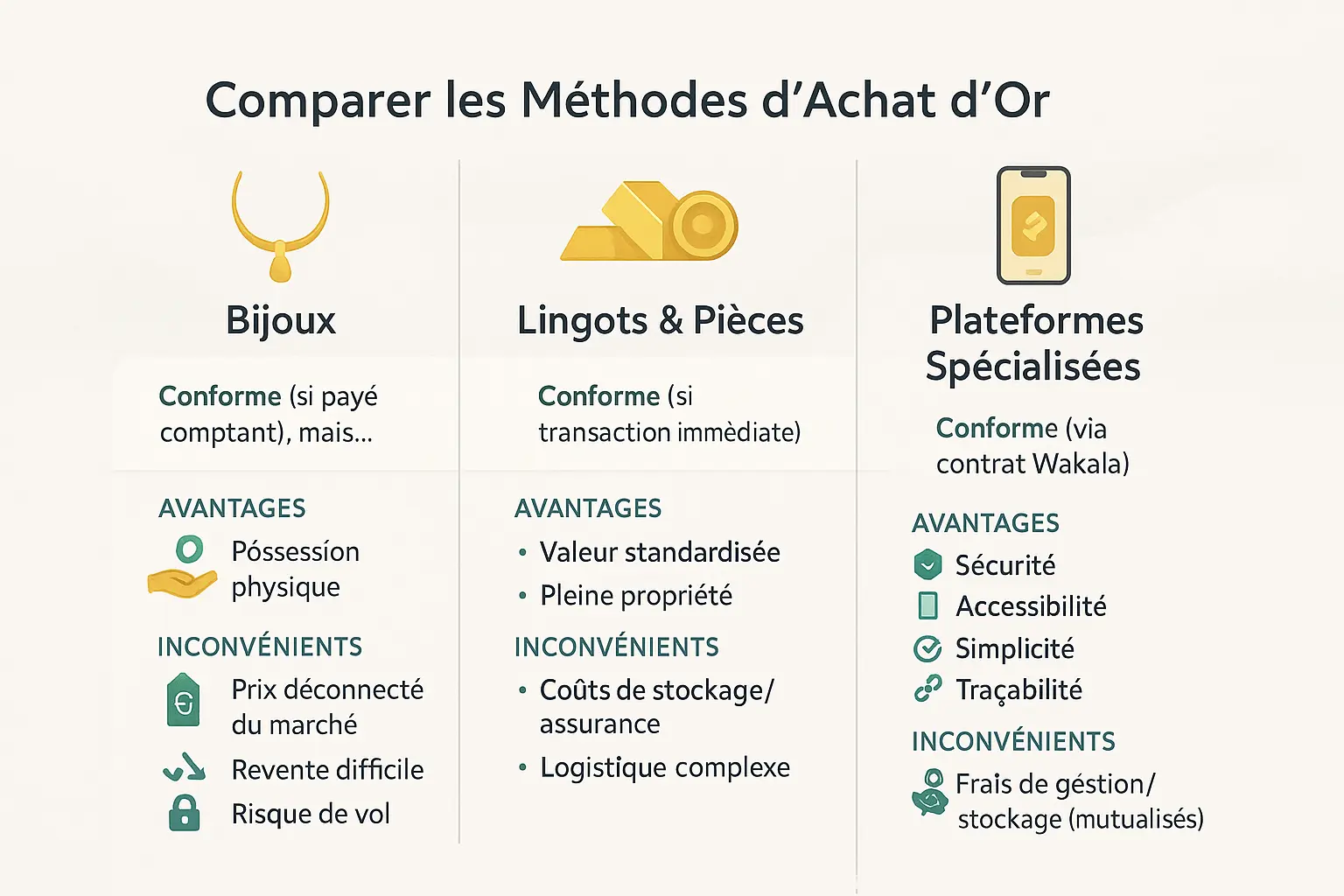

1. The traditional method: gold jewelry

Buying gold jewelry is still a traditional practice. You physically own the metal, but this method has its drawbacks. The price includes a substantial processing margin, often between 10 and 30% above the value of the pure metal. Resale often entails a 15-25% discount, penalizing your savings. Finally, the risk of theft or loss is real, with no guarantee of recovery in the event of a claim. This approach remains symbolic, but hardly optimal for a strategic investment.

2. Direct purchase: gold bars and coins

Certified ingots and coins offer standardized value thanks to their purity (usually 99.99%). You become the owner of a tangible asset, but storage poses challenges:

- Safe-deposit box fees (€50 to €200/year depending on size)

- Cost of theft insurance (up to 1% of value)

- Verification of the broker's compliance with Islamic rules

- Complex logistics for large-scale transactions

LBMA (London Bullion Market Association) ingots guarantee maximum liquidity, but require constant vigilance. Smaller units (1g to 10g) enable a modest start, but increase unit costs. Larger quantities reduce the price per gram, while complicating security. Verification of broker certification is crucialto avoid the pitfalls of speculation or hidden fees.

3. Modern, compliant solutions: specialized platforms

Platforms like Inaia are transforming gold investing. They enable you to buy physical gold stored in secure vaults, via a Wakala contract. This Islamic mandate eliminates riba, gharar and excessive speculation, validated by a committee of Shariah experts. You benefit from total transparency, digital monitoring and access from as little as a few hundred euros. The Wakala contract ensures traceability and compliance, with mutualized costs far lower than individual storage costs.

| Method | Islamic compliance | Benefits | Disadvantages |

|---|---|---|---|

| Jewelry | Compliant if paid in cash | Immediate physical possession | Price not in line with market, difficult to resell, risk of theft |

| Ingots/pieces direct | Compliant if immediate transaction | Standardized value, full ownership | Storage/insurance costs, complex logistics |

| Specialized platform | Compliant via Wakala contract | Safety, accessibility, traceability | Mutualized management fees |

Reviews of Inaia show a high level of satisfaction (4.9/5 on Trustpilot). Users highlight the company's impeccable ethics, responsive customer service and the possibility of requesting physical delivery within 7 working days. Options such as the monthly savings plan make it possible to acquire gold gradually, without suffering short-term fluctuations. For Muslim savers, these platforms modernize investment while respecting Islamic principles.

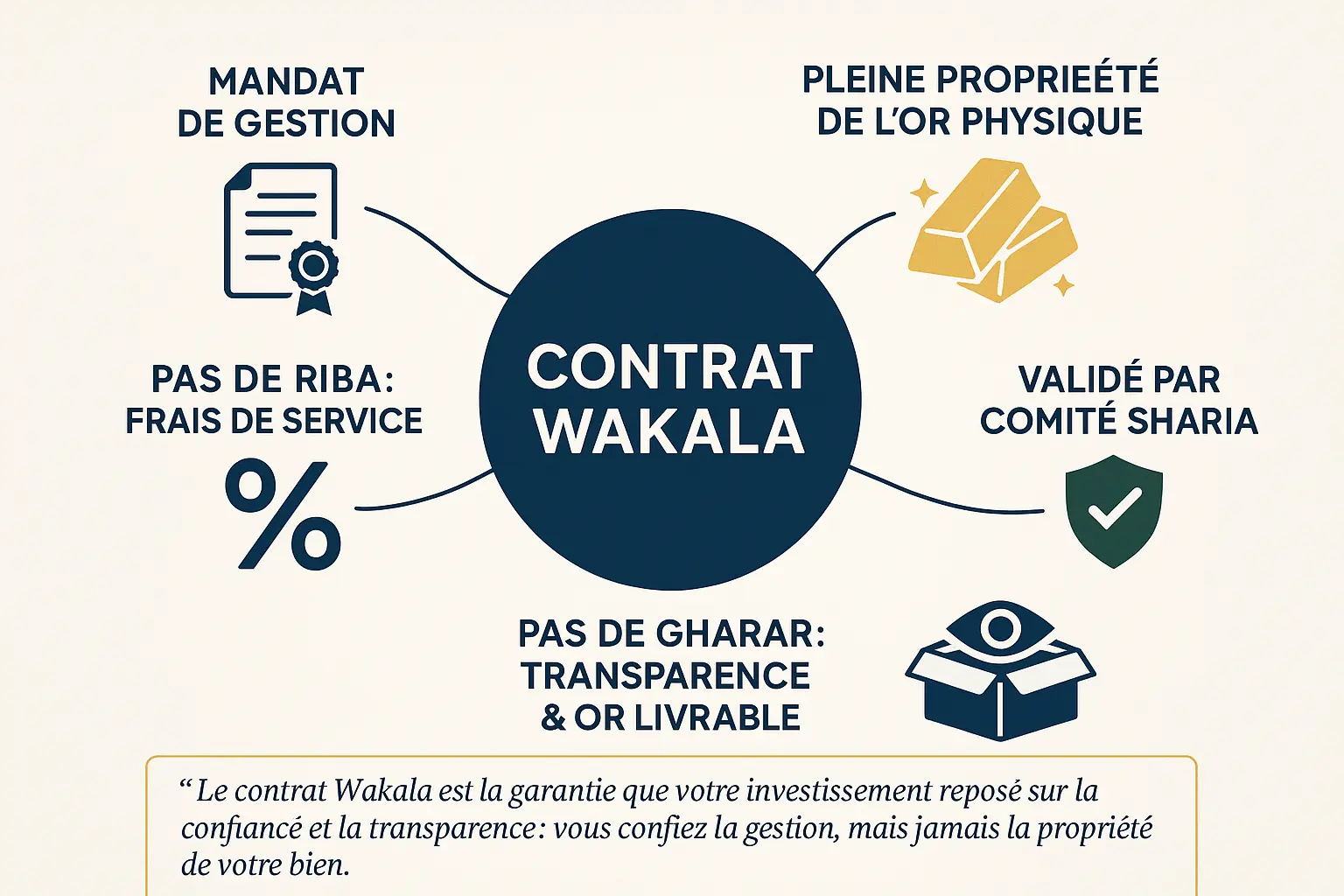

The Wakala contract: the key to a secure, compliant gold investment

The Wakala contract is a pillar of Islamic finance, enabling the purchase and management of physical gold in compliance with Sharia principles. What does it involve? It's a mandate whereby the investor (muwakkil) entrusts a third party (wakeel), in this case a platform like Inaia, with the responsibility of acquiring, storing and managing his gold. The gold remains the exclusive property of the investor, even if it is held by the wakeel.

No riba, no gharar: the guarantee of impeccable compliance. Wakala's structure eliminates two major prohibitions. The management fees charged by the platform do not represent interest (riba), but remuneration for a service rendered. What's more, transparency is total: investors know the quantity, quality and location of their gold at all times, eliminating any risk of uncertainty (gharar). As an expert in Islamic finance points out

The Wakala contract guarantees that your investment is based on trust and transparency: you entrust the management, but never the ownership, of your property.

Modern platforms like Inaia reinforce this security by involving a committee of independent Shariah experts. These jurists certify that each stage of the process - purchase, storage, resale - complies with Islamic principles. In this way, investors benefit from a double guarantee: a compliant system and rigorous monitoring.

Unlike gold jewelry, which is often expensive to buy and difficult to resell, Wakala offers a seamless solution. Gold is standardized (certified ingots or coins), stored in secure vaults, and accessible for as little as a few hundred euros. If required, physical delivery is possible at any time, guaranteeing real possession.

In short, the Wakala contract reconciles tradition and modernity. It allows you to invest in a tangible asset, without compromising your values. For those who wish to delve deeper, our detailed analysis of the Inaia platform explores its practical and ethical advantages.

Investment or speculation: can gold be "traded" in Islam?

Investing in gold is an ancient practice, but how do you distinguish it from speculation?

Investment vs. speculation: a clear dividing line

Halal investing is based on owning a tangible asset, such as physical bullion. It's a long-term approach to preserving value. Speculation, on the other hand, involves betting on short-term price variations without actually owning gold. It falls under the heading of gharar (uncertainty) and maysir (excessive speculation), and is therefore forbidden in Islam.

Conditions for Sharia-compliant gold trading

For gold trading to remain halal, two rules are crucial:

- Qabd: immediate delivery of gold after purchase, guaranteeing actual possession.

- Separate transactions: each sale is a single deed with immediate transfer of ownership.

Financial instruments to avoid

Some modern tools are haram:

- CFDs: based on gharar and riba, with no real assets.

- Binary options: an all-or-nothing model similar to maysir.

- Futures: speculative, without physical possession.

The role of modern platforms like Inaia

Inaia offers a Wakala contract: you retain ownership of your vaulted gold. This system eliminates riba, gharar and speculation thanks to transparent management.

Why gold remains an ethical choice

Gold preserves capital without riba and supports the real economy. By choosing compliant methods, you protect your wealth while honoring your convictions.

Contact Rabia d'Inaia via this link for a secure halal investment.

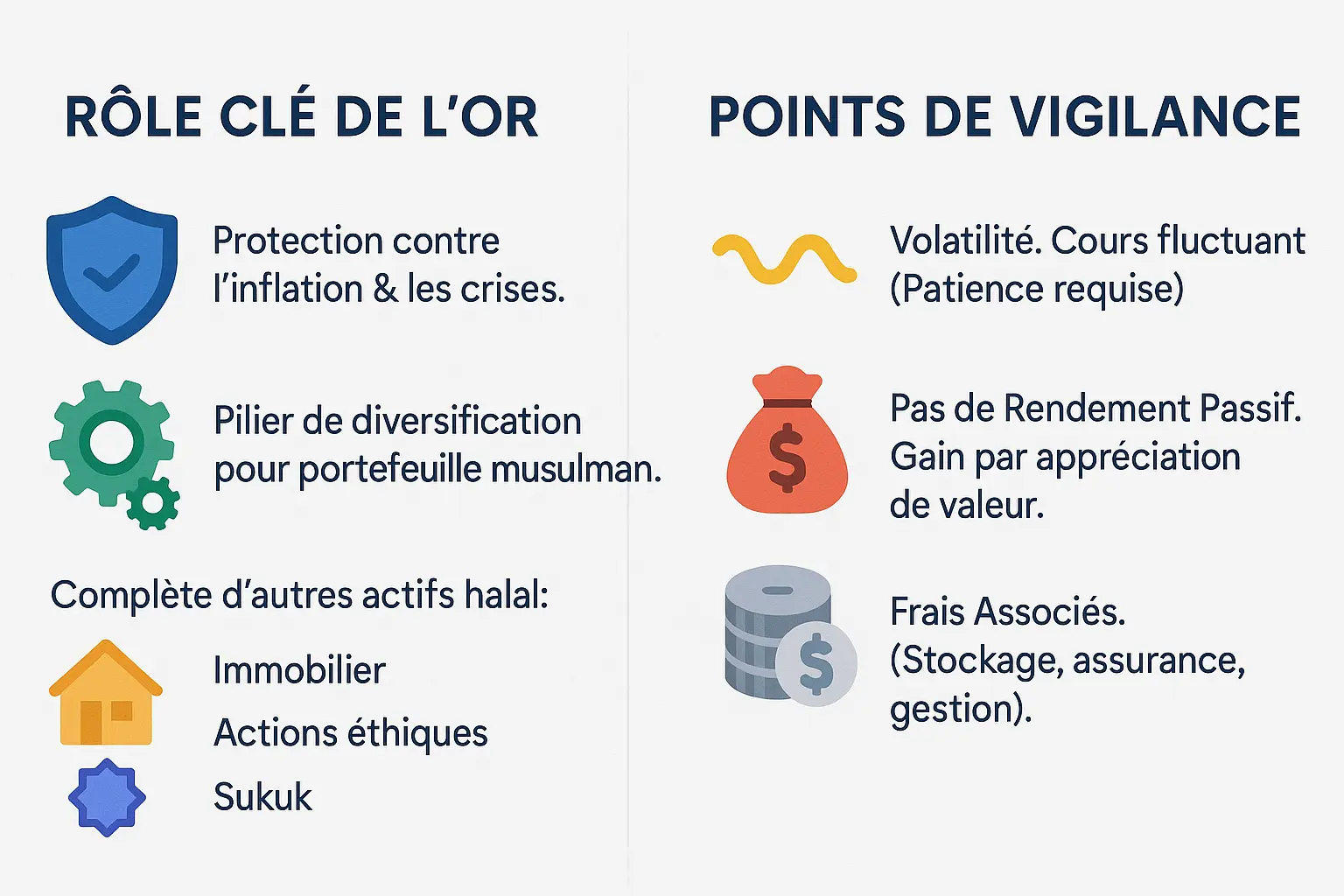

Gold in your estate: diversification and points to watch out for

Gold has stood the test of time as a symbol of value and stability. In a Muslim wealth strategy, it finds its natural place alongside other compliant assets such as real estate or Sukuk. This precious metal embodies a tangible form of protection against economic turbulence and inflation, while respecting the ethical principles of Islamic finance.

In the age of digital assets, gold retains its ancestral role as a guarantor of value. Unlike conventional investments, it is not tied to conventional financial systems that might incorporate elements of riba or gharar. It is this ethical purity that makes it a relevant choice for balancing a halal investment portfolio.

- Volatility: Its price can fluctuate unpredictably in the short term. A long-term view is needed to take full advantage.

- Lack of passive yield: Unlike real estate, which generates rental income, gold does not generate income on its own. Its value lies in preserving purchasing power.

- Associated costs: Whether for storage, insurance or management, these costs need to be factored into the asset equation.

When you choose gold for your savings, you're opting for a pillar of security. Sukuk gold and other modern formulas provide access to this precious metal while respecting the teachings of Sharia law. As popular wisdom has it, "sleeping wealth is better than running debt" - and gold, in its golden inertia, embodies the peace of mind that every Muslim saver dreams of.

Making the right choice for a sound, ethical gold investment

Investing in gold is an essential decision for preserving your wealth. By respecting Islamic rules, this practice becomes lawful and in line with strong values of justice and trust.

Physical gold, whether in the form of jewelry, bullion or certified coins, guarantees real possession, but has its limitations. Gold jewelry often has hidden costs, while buying bullion requires logistical precautions. Platforms like Inaia offer a balanced solution, combining transparency and convenience.

Modern platforms, based on the Wakala contract, eliminate the risk of riba and gharar. They ensure traceability, security and democratic access. Why deprive yourself of an opportunity that respects your convictions and your peace of mind?

By opting for Sharia-audited structures, you protect your assets and support a fair business model. Namlora offers an ecosystem for investing in harmony with your values. Discovering an ethical investment ecosystem guides you towards a spiritual and responsible financial future.

Every choice counts. Ethics and performance complement each other: your savings can become a lever for a fairer world. Gold, a symbol of durability, becomes an act of faith in a responsible society.

Investing in gold according to Islamic principles is possible and crucial to preserving one's heritage. By respecting actual possession and the prohibitions of riba, gharar and maysir, in particular via the Wakala contract, everyone can reconciling safety and compliance. Gold, a symbol of stability, offers a serene, virtuous investment.

FAQ

Is gold an authorized investment in Islam?

From an Islamic point of view, investing in gold is not only permitted, but historically valued. Gold has been used as a store of value since ancient times, and is an integral part of prophetic teachings, including the setting of zakat thresholds. However, its legality depends on the method of investment. The physical gold you fully own - jewelry, bullion or via a Wakala contract - is considered halal provided it complies with the principles of Islamic finance: immediate exchange (qabd), absence of riba (interest) and avoidance of excessive speculation (gharar). Speculative forms such as CFDs and futures contracts, on the other hand, remain prohibited.

Is gold trading Sharia-compliant?

Gold trading can be halal, but under strict conditions. It is permitted only if you buy physical gold that you actually own, and each buy/sell transaction is distinct with immediate transfer of ownership. By contrast, modern tools such as CFDs (Contracts for Difference), binary options or futures contracts are clearly haram, as they are based on speculation (maysir) and excessive uncertainty (gharar). Active trading also requires solid expertise and rigorous monitoring, which explains why long-term investment in physical gold is often more suitable for the compliance-conscious investor.

What are the recommended halal investments?

In Islamic finance, a halal investment can be recognized by three essential criteria: it must be tangible (real possession), free of riba (interest) and gharar (excessive uncertainty). Physical gold, rental property, Sukuk (Islamic bonds) or shares in ethical companies (excluding prohibited sectors such as alcohol or tobacco) are among the preferred options. Platforms such as Inaia even offer an innovative approach with the Wakala contract, a Sharia-compliant investment mandate that allows you to buy gold stored in a safe deposit box while retaining full ownership. The key is to focus on tangible assets and transparent business models.

Is gold lending permitted under Islamic principles?

Lending gold is a delicate subject in Islamic finance. According to Islamic principles, since gold is a "ribawi commodity", any loan of gold with interest (riba) is strictly forbidden. Even without interest, the lending of gold poses challenges: in the event of restitution, the exact quantity must be returned, which can lead to confusion. On the other hand, a compliant approach would be to use gold as collateral (rahn) for a currency loan, provided the contract complies with Sharia rules. For savers, solutions such as Inaia's Wakala contract offer a modern alternative: you retain ownership of your gold, and the platform manages its safekeeping without speculating or lending your asset, guaranteeing total compliance.

What investments are considered haram?

Haram investments in Islam can be identified by three major prohibitions: riba (interest), gharar (excessive uncertainty) and maysir (speculation). In practice, this excludes interest-bearing accounts, loans with usury, derivatives such as CFDs or binary options, as well as prohibited sectors (alcohol, tobacco, gambling). Even gold can become haram if bought via usurious credit or speculated on non-compliant markets. Unclear contracts, with no traceability of the asset or based on chance, should also be avoided. On the other hand, physical gold or gold managed via a Wakala contract, Sukuk or shares in ethical companies remain pillars of a responsible Muslim portfolio.

What sources of income are considered haram in Islam?

In Islam, money becomes haram when it comes fromforbidden activities or non-compliant practices. This includes income from alcohol, tobacco, gambling, armaments, or adulterous entertainment industries. Income generated by riba (interest), such as conventional savings accounts or loans with usury, is also haram. Finally, gains obtained through deception, fraud or excessive speculation (maysir) are to be avoided. Even in investment, assets such as CFDs, futures contracts or shares in unethical companies fall under these prohibitions. On the other hand, physical gold, Sukuk or investments in ethical projects (such as solar energy) are examples of income considered halal.

Is investing in gold via a digital platform Sharia-compliant?

Yes, provided the platform uses a compliant mechanism, such as the Wakala contract. This model, inspired by the Islamic mandate, enables you to buy physical gold stored in a vault while retaining ownership of it. Inaia, for example, uses this contract to guarantee total transparency: no riba, no gharar, and no speculation. You can request delivery of your bullion at any time, or sell part of your gold without constraint. This method combines the security of physical possession with the simplicity of digital technology, with shared storage costs. For a Muslim investor, it's a modern alternative to expensive jewelry or self-managed bullion.

What forms of trading comply with the principles of Islamic finance?

Le trading halal se limite aux actifs réels que vous possédez pleinement, sans effet de levier ni spéculation. Par exemple, acheter de l’or physique pour le revendre plus tard, ou trader des actions d’entreprises éthiques (excluant les secteurs haram) sans emprunter. Le contrat Wakala permet même de trader de l’or de manière conforme, puisqu’il repose sur la possession constructive validée par les savants islamiques.

En revanche, le trading à terme, les CFD ou les ventes à découvert (short-selling) sont inacceptables car ils impliquent de vendre ce que vous ne possédez pas ou des paris risqués. Le day trading reste débattu : certains érudits l’acceptent si l’action est détenue légalement (après règlement T+1) et sans levier, mais d’autres préfèrent des approches plus conservatrices.

Can Muslims invest in the stock market in the right way?

Oui, à deux conditions : privilégier les actions d’entreprises éthiques (hors secteurs haram) et éviter l’effet de levier. Le trading à la journée (day trading) reste controversé, car il dépend de la possession légitime de l’action au moment de la vente (T+1). En revanche, le swing trading ou l’investissement à long terme sont plus sûrs, car les transactions sont généralement réglées avant la revente.

Des fonds islamiques ou des robo-conseillers spécialisés filtrent les actions conformes à la charia, excluant les entreprises avec des ratios d’endettement élevés ou des revenus illicites. Pour simplifier, des ETF Sukuk ou des portefeuilles diversifiés permettent d’allier conformité et performance. Comme toujours, la clé est la transparence et la vérification préalable de la conformité des actifs.